eyegelb

It’s been a mixed Q2 Earnings Season for the Gold Miners Index (GDX), and last week’s reports disappointed on balance. This was evidenced by guidance cuts, upwards revisions in costs, and a further capex blowout from IAMGOLD (IAG), with it at least being consistent in this department with its regularly scheduled Cote capex blowouts. In fact, the company has been so consistent with these upwards revisions that it’s carved out a sizeable ~$600 million funding gap, increasing the probability of significant share dilution.

However, amid these disappointments, Endeavour Mining (OTCQX:EDVMF) has been a rock, not only tracking well ahead of guidance but raising its planned FY2022 dividend (US$0.81 annualized) due to its solid performance and cost controls. In fact, the company reported industry-leading all-in sustaining costs in H1, helped by a portfolio that benefits from several strong assets and successful portfolio optimization. In a sector with too many underperformers to count, Endeavour remains a top-10 producer for investors looking for exposure to gold without the headaches, with a bonus of consistent dividend income.

Sabodala-Massawa Operations (Company Presentation)

Q2 Production

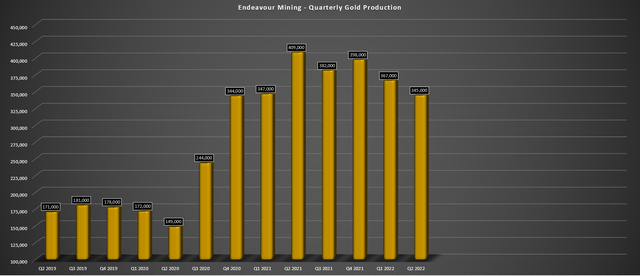

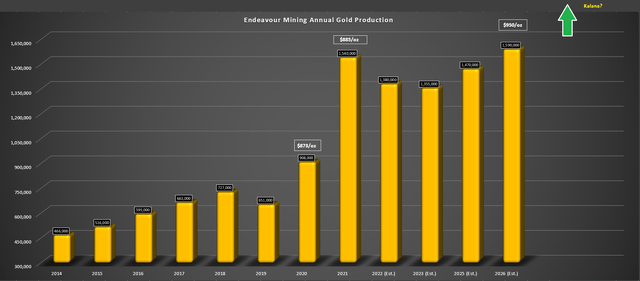

Endeavour Mining released its Q2 results last week, reporting quarterly production of ~345,000 ounces, pushing H1 2022 production to ~702,000 ounces. This was driven by solid quarters from Hounde, Ity, and Mana, offset by a much softer Q2 for its best asset, Sabodala-Massawa, plus Boungou and Wahgnion. Despite the softness from these three assets in the period, Endeavour is tracking very well against FY2022 guidance, on track to beat its guidance mid-point of ~1.36 million ounces of gold. Key updates to look forward to are an update on the Sabodala-Massawa Expansion (addition of a 1.2 million tonne per annum BIOX plant) and the Lafigue Feasibility Study due this quarter).

Endeavour Mining – Quarterly Gold Production (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Endeavour saw a decline in production on a year-over-year basis, with output sliding from 409,000 ounces to 345,000 ounces. This was a significant decline, but the company was up against difficult comps with a great quarter out of Wahgnion (41,000 ounces), a robust quarter from Sabodala-Massawa (~96,000 ounces), and a great quarter from Ity as well (~79,000 ounces).

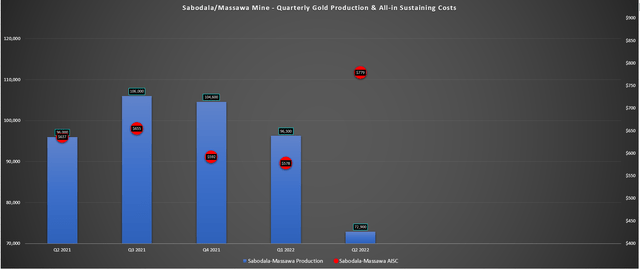

Sabodala-Massawa – Production & Costs (Company Filings, Author’s Chart)

While Ity did perform well in Q2, it struggled to lap the 79,000 ounces from last year (down 2%). Meanwhile, Endeavour’s star performer (Sabodala-Massawa) had a weaker quarter (~73,000 ounces vs. ~96,000 ounces) due to mine sequencing with a focus on waste extraction ahead of planned mining at Massawa North (higher grade pit than Sofia). This led to a sharp increase in all-in sustaining costs [AISC] per ounce at the asset, but this jump in costs still left the mine’s operating costs 40% below the industry average at $779/oz. Finally, among the larger assets, Hounde had a great quarter (~87,000 ounces) with lower grades offset by higher throughput and recovery rates.

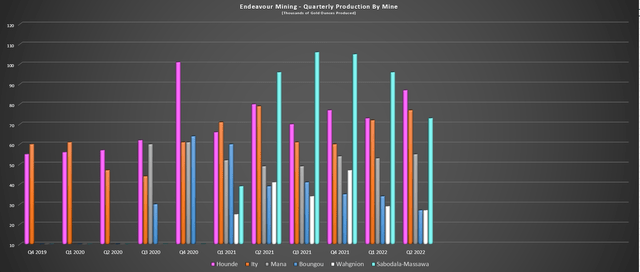

Endeavour Mining – Quarterly Production by Mine (Company Filings, Author’s Chart)

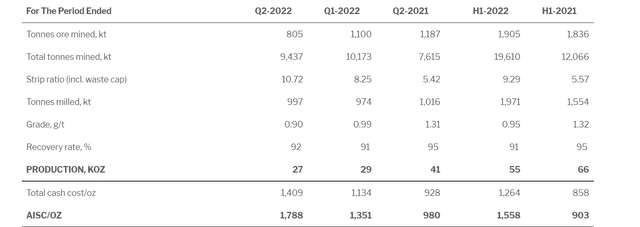

Moving over to the laggards within the portfolio, Wahgnion and Boungou stood out with much weaker performances. That said, while Boungou may have seen a sharp decline in production year-over-year related to reliance on the East Pit and lower-grade stockpiles for mill feed, the asset is still on track to do ~130,000 ounces this year at all-in sustaining costs of $950/oz to $1,000/oz. At Wahgnion, it was a very ugly quarter from a headline standpoint, with ~26,500 ounces produced at all-in sustaining costs of $1,788/oz, an alarming figure compared to ~47,700 ounces at $980/oz last year.

However, while these are certainly not figures we’ve come to expect from Endeavour’s mines, this was a very abnormal quarter. For starters, grades were well below the reserve grade at 0.90 grams per tonne of gold, related to the planned higher strip ratio at the Nogbele North and Fourkoura pits, and the mill relied on some low-grade stockpiles. Simultaneously, this was a much more expensive quarter than usual. Sustaining capital was up 300% vs. Q2 2021 due to mining fleet rebuilds and waste capitalization. If we combine this with fewer ounces sold, it’s no surprise that costs at the asset spiked in the period.

Wahgnion Operating Metrics (Company Filings, Author’s Chart)

Investors can take comfort in that while guidance is tracking towards below guidance on production at Wahgnion and cost guidance ($1,050/oz – $1,150), this asset should still push out 130,000 ounces at sub $1,240/oz costs, a respectable figure. So, while a guidance miss is unfortunate, it’s important to put it in context. If we compare this to other assets, Iamgold’s Rosebel is on track to beat guidance, but guidance is for ~168,000 ounces at $1,600/oz+ costs. As discussed by Endeavour, we should see a sharp increase in production as mining moves to the high-grade Samavogo pit during Q4.

To summarize, despite the much lower production at these three assets, Endeavour is still in great shape this year, on track to maintain a ~1.40 million-ounce production profile, with further growth in the tank from Lafigue and the Sabodala-Massawa Expansion. Plus, even with the higher costs at these three assets in Q2 combined with inflationary pressures (consumables, fuel), Endeavour reported sub $970/oz all-in sustaining costs. Let’s take a closer look at cost performance below:

Costs & Margins

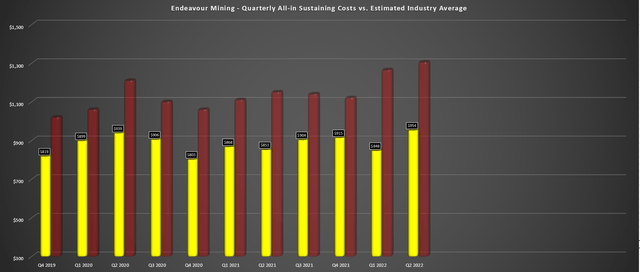

Looking at all-in sustaining costs below, Endeavour not only looks to have come in within the top-5 from a cost standpoint among gold producers, but its costs were well below the industry average. This is evidenced by Endeavour’s all-in sustaining costs (yellow bars) shown below vs. the steadily rising industry average (red bars). In fact, while the industry average costs have increased more than 20% since Q1 2020, Endeavour’s costs are up just 6% ($954/oz vs. $899/oz), partially benefiting from weakness in the Euro, but mostly due to its continued portfolio optimization. The latter refers to adding exceptional assets to the portfolio and divesting higher-cost assets.

Endeavour Mining – AISC vs. Industry Average (Company Filings, Author’s Chart)

One could argue that this is an artificial way to manage costs and that Endeavour shouldn’t receive as much praise for this progress, with this not being a fair comparison to operating portfolios that remained static in the same period. While Endeavour did shake up its portfolio, it purchased Semafo for a very reasonable price during the March 2020 crash (~$800 million vs. a peak market cap of $1.8 billion) and it got a decent price for Teranga, with its assets (ex-Golden Hill) having an After-Tax NPV (5%) of $2.0+ billion currently.

Notably, the Teranga deal gave Endeavour one of Africa’s best operating assets (400,000 ounces at sub $800/oz costs). Following this, the company divested two non-core assets in periods of gold price strength

So, while it may have partially engineered its way into seeing less cost creep than its peers due to key additions/divestments, this was accomplished through disciplined moves. This is far superior to the other deals we’ve seen in the sector over the past several years. The result is that Endeavour Mining enjoyed AISC margins of $878/oz in Q2 2022 and $972/oz year-to-date (~52% AISC margins), with a 3% increase in AISC margins in H2 2022 vs. H2 2021. Besides, while the addition of low-cost assets has helped, Endeavour has salaries locked in for three years; it’s working to improve pricing on some items, and managed to renegotiate haulage contracts to drive lower mining costs at its key asset, Sabodala-Massawa.

Given this solid performance, with AISC margins set to come in above $850/oz this year, Endeavour has increased its dividend plans to $200 million this year while also set up to return over $60 million to shareholders through share buybacks. So, while there was share dilution in Endeavour’s acquisitions that allowed it to nearly double production at sub $950/oz costs, I expect a good chunk of this dilution to be clawed back through repurchases, translating to meaningful growth in cash flow and production per share on deck. Let’s look at the financial results below:

Financial Results

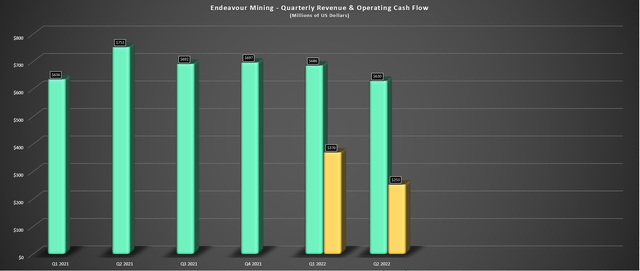

Finally, looking at the company’s financial results, Endeavour reported revenue of ~$630 million in Q2 2022, an 11% decline from the year-ago period. This was related to fewer ounces sold (~343,700 ounces vs. ~395,100 ounces), partially offset by a higher gold price. While this figure might be disappointing, this was largely due to softer quarters at two assets where output was abnormally low (Wahgnion, Boungou). As noted by the company, Wahgnion will see higher production in Q4 once the Samavogo pit is commissioned, and Boungou will have a better H2 as mill throughput increases.

Endeavour Mining – Quarterly Revenue & Operating Cash Flow (Company Filings, Author’s Chart)

From a cash flow standpoint, Endeavour reported Q2 operating cash flow of ~$253 million, translating to H1 2022 operating cash flow of ~$622 million. This was a more than 23% increase from the year-ago period and translated to $2.22 in cash flow per share (H1 2022: $2.12). The higher cash flow generation was related to fewer income taxes paid in the period and a higher gold price ($1,872/oz vs. $1,779). Assuming the gold price can hold above $1,750/oz, Endeavour is on track to generate more than $4.40 in operating cash flow in FY2022.

While these metrics might not appear all that exciting and are off their highs, it’s important to note that this was an abnormal quarter, especially with the company’s breadwinner also having its weakest quarter (Sabodala-Massawa). However, with a commitment to continue share buybacks, plans to grow production to near 1.6 million ounces by FY2026, and what should be a stronger gold price after a two-year consolidation for the metal, there is a clear path to $5.50+ in annual cash flow per share.

Endeavour Mining – Long-Term Potential (Company Filings, Author’s Chart)

This is far too cheap a figure for a business executing like Endeavour is. Plus, by the end of this decade, I don’t think a 1.85 million ounce annual run rate is a stretch from within the current portfolio or 2.0+ million ounces assuming a strategic acquisition, pointing to 25% to 35% production growth. Assuming the company can deliver on its next growth phase (1.56 – 1.60 million ounces), I would not be surprised to see the company increase its annual dividend to US$1.10 per share by Q4 2025, translating to a ~5.30% yield on cost for investors purchasing the stock below US$21.00 per share.

Valuation

Based on ~248 million shares and a share price of US$20.90, Endeavour Mining trades at a market cap of ~$5.18 billion. This is a very reasonable valuation for a ~1.40 million-ounce producer, especially one with a track of delivering on its promises and the discipline not simply to grow for the sake of growth. This is evidenced by its ability to acquire solid assets at attractive valuations while divesting its sub-par assets into periods of strength in the gold price. Based on conservative estimates and continued softness in the gold price in H2, Endeavour trades at less than 4.6x operating cash flow estimates ($4.55) and a discount to its estimated net asset value (~$6.8 billion).

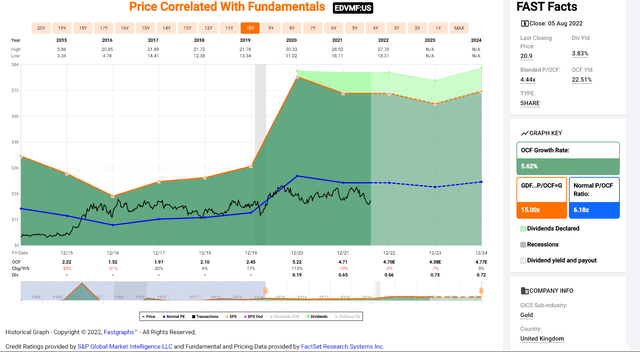

Endeavour Mining – Historical Cash Flow Multiple (FASTGraphs.com)

If we look at the chart above, we can see that the stock has historically traded at ~6.2x cash flow (10-year average), but I believe a premium to this multiple makes sense. This is because the company currently offers industry-leading capital returns, has a strong organic growth profile (Lafigue, Kalana + early-stage opportunities), and enjoys industry-leading margins, able to keep its costs down from portfolio optimization and strong cost controls, unlike some of its peers. Based on what I believe to be a fair multiple of 7.0X cash flow and FY2023 estimates of US$4.35, I see a fair value for the stock of US$30.45.

If we measure from a current share price of US$20.90, this represents a 46% upside from current levels, or closer to 50% from a total return standpoint when including dividends to be paid. Importantly, this assumes the gold price averages below $1,825/oz in 2023, which I believe is quite conservative. Hence, if we were to see the gold price recover and trade back near its highs ($2,000/oz+), Endeavour could hit new all-time highs above US$31.00 per share. So, for patient investors looking for consistent returns, I continue to see Endeavour as a top-10 name in the sector.

Summary

While Endeavour may not have the best jurisdictional profile, it has done a great job diversifying itself across West Africa (Senegal, Cote D’Ivoire, Burkina Faso), and it’s done a phenomenal job optimizing its portfolio. The result is a portfolio with several strong assets consistently producing at sub $1,000/oz all-in sustaining costs even in a highly inflationary environment. Investors are now reaping the benefits of this hard work, enjoying a 5.0%+ yield from share buybacks and annual dividends. Given Endeavour’s strong track record, solid organic growth profile, and industry-leading capital returns, I would view any pullbacks below US$20.00 as low-risk buying opportunities.

Be the first to comment