Hammad Khan/iStock via Getty Images

Finding dependable candidates for long-term buy-and-hold on the portfolio is always a challenge. In this case, our attention will be centering on Encore Wire (NASDAQ:WIRE), a company with dependable profitability and an easy-to-understand business model.

Based in McKinney, Texas, Encore Wire designs and manufactures copper wire and cables which are used for indoor construction. With talk of infrastructure modernization, that could be a chance to increase sales, as a lot of wire and electrical systems may need to be replaced with new, and with increased profit margins, this could be a very good thing indeed for investors.

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Net Sales | $940m | $1.16b | $1.288b | $1.275b | $1.277b |

| Cost of Goods | $820m | $1.00b | $1.099b | $1.109b | $1.082b |

| Gross Profits | $120m | $156m | $189m | $166m | $194m |

| Op Income | $50m | $80m | $101m | $75m | $99m |

| Diluted EPS | $1.63 | $3.21 | $3.74 | $2.77 | $3.68 |

A five-year look at financials out of the 10-Ks shows a base line for how the company works, with a steady amount of profitability. It’s not a great value play at those levels for the $2 billion market cap it tends to float around. A unique niche company with a dependable model, it was still something some people really wanted in their portfolio.

Under normal circumstances this would be a fairly stable company and stock. The inputs and outputs are pretty dependable, as is demand. Increases in construction should increase general demand for wiring. The big variable has been cost of raw materials, which is basically copper prices. Then 2021 happened.

| 2020 | 2021 | |

| Net Sales | $1.277b | $2.592b |

| Cost of Goods | $1.082b | $1.724b |

| Gross Profits | $194m | $867m |

| Op Income | $99m | $699m |

| Diluted EPS | $3.68 | $26.22 |

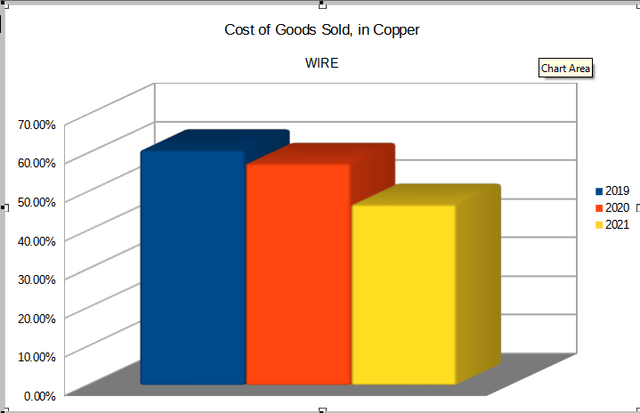

You’ll notice everything changed, and P/E multiples in the 30s are now in the high-value territory of single digits. This is better than anyone was expecting, but not that hard to understand. Products are all fairly simple manufactured equipment from mostly-automated processes. The big variable is cost of goods sold in the price of copper.

Copper drives costs and a 20% decrease in two years and an increase in net sales led to a big increase in the bottom line. WIRE’s existing capacity put them in a nice position to take advantage of the demand and the low cost.

Where to go from here?

Diluted EPS of $26.22 at an appealing margin. So what do they do for an encore? The most recent Q1 similarly showed growth in sales and strong margins. Analysts are estimating EPS going forward of $20.91 and $13.78. These are both nice multiples at current prices and seem to project WIRE as a good value play so long as it can be bought at these prices.

The question of return on investment is a little further out, as they are clearly in position to grow at these margins. WIRE does pay a tiny dividend right now, and if they’re making good money annually, they may want to consider dialing that up as a growth-dividend play to return value to investors.

It’s hard to predict the future of returning value to investors, but so long as the company is making money at this rate, they will have options, and that’s a very good thing.

Everything looks rosy right now, but we have to be realistic that things can change. An increase in copper prices could hurt the margins. That’s unlikely in my opinion, as the current global economy doesn’t support huge demand for copper.

The biggest danger at these margins would be someone else joining the market to take advantage of the pricing advantages. The expensive automation machinery would be a fairly high cost of entry to do that, however, and again is probably not likely unless the situation further improves or gets even better.

Be the first to comment