redtea

Article Thesis

Enbridge (NYSE:ENB) is a high-quality energy infrastructure player with attractive growth potential in different areas, including renewables, CO2 pipelines, and so on. The company reported strong results for its most recent quarter and has also increased its dividend, and yet, shares have pulled back over the last couple of weeks. With a starting dividend yield of 7%, Enbridge looks attractively priced right here.

Strong Results And A Compelling Growth Outlook

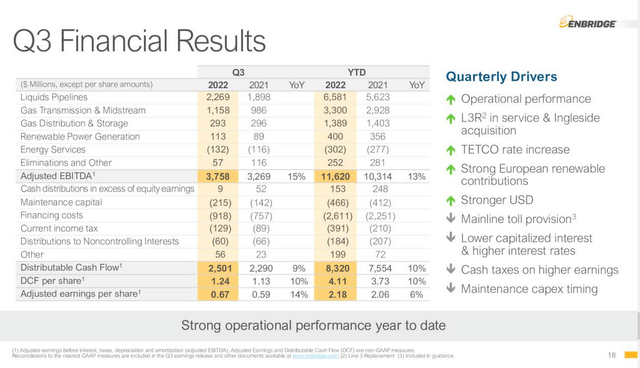

Enbridge reported its most recent quarterly results in November. During its most recent quarter, the company recorded a small revenue increase in Canadian Dollars, as its top line hit C$11.6 billion. More importantly, however, is the company’s profitability performance:

The company was able to grow its EBITDA by a very compelling 15% year over year, which was slightly better than the year-to-date average of 13% — which was pretty strong as well. This was possible thanks to cost reductions that allowed ENB to grow its EBITDA meaningfully despite a minor revenue increase.

Infrastructure players such as Enbridge pay their dividends with what is called distributable cash flow, which is calculated by subtracting maintenance capital expenditures from the company’s operating cash flow. This metric totaled C$2.5 billion during Enbridge’s most recent quarter, while the year-to-date total suggests that this year’s DCF will total around C$11 billion. If the company were to forego all growth projects and if it decided not to pay down any debt, the DCF result is what Enbridge could theoretically pay out per year without hurting its balance sheet in the long run. Since Enbridge is currently trading with a market capitalization of C$105 billion, this suggests that the company could pay a dividend yielding 10% or slightly more than that if it wanted to.

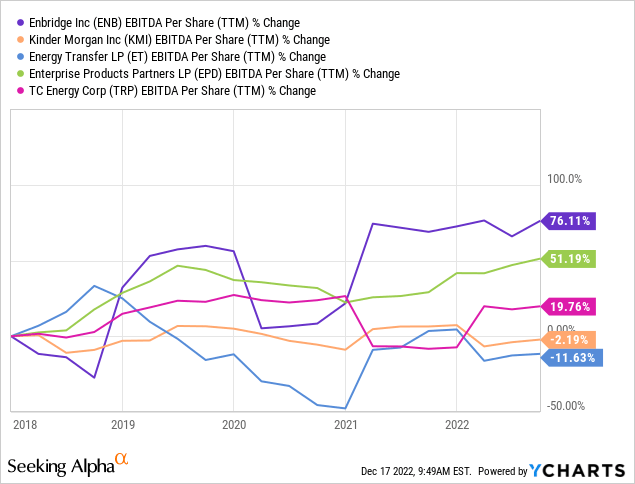

Enbridge does not pursue a strategy of returning 100% of DCF to its owners, which is in line with the strategies of many other midstream players. Instead, Enbridge decides to use some of its distributable cash flow to finance growth projects (or, more precisely, the equity portion of these projects as they are usually partially financed with debt). Other ways to use retained cash flows include debt reduction and buybacks, but Enbridge is focused on pursuing accretive growth projects for now. Looking at the company’s compelling growth track record, that makes sense:

Enbridge has a peer-group leading EBITDA per share growth rate over the last five years. That’s a more important metric compared to overall EBITDA growth, as EBITDA growth can be partially offset by an increasing share count. Some midstream companies have issued a lot of shares in the past, which is why EBITDA per share growth was negative for companies such as Kinder Morgan (KMI) over the last couple of years. Enbridge has performed very well when it comes to EBITDA per share growth, however, as the 5-year growth rate stands at an impressive 12%.

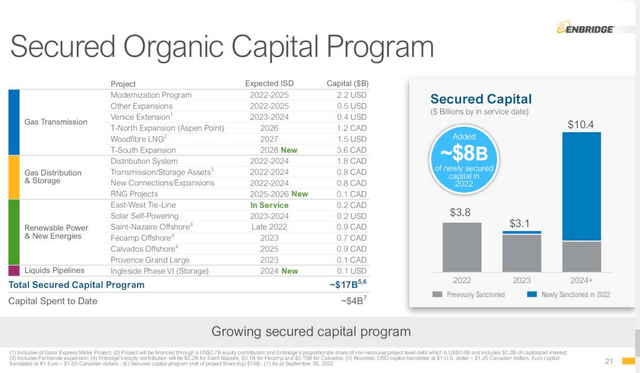

With a track record this strong, I believe that the company rightfully pursues further growth via organic and inorganic investments. While many midstream or energy infrastructure players have reduced their growth spending in order to focus on deleveraging, dividends, and share repurchases, Enbridge has one of the largest backlogs in the midstream space. The company’s current growth program can be seen here:

With C$17 billion of future projects, Enbridge will grow its asset base very meaningfully over the next couple of years. The dates for when these projects will come on line differ, but are mostly in the 2022 to 2025 range, with some outliers in 2026 and 2027. Woodfibre LNG is one such project that will start up in 2027 if everything goes according to plan. That can be explained by the fact that LNG projects take years to develop, but due to the ongoing global energy market shifts, this could be a highly lucrative project for Enbridge. With Europe seeking to be independent from Russian natural gas deliveries in the future, global demand for LNG will grow significantly going forward. Add coal-to-gas switching due to the better CO2 emissions profile of natural gas versus coal, and there is massive potential for LNG exporters over the next decade and beyond. Enbridge will capitalize on that via its own LNG project, but all of its natural gas pipelines could also benefit from higher natural gas exports out of North America — even when other companies operate LNG projects, someone has to move the natural gas to the export facilities, after all.

As we can see in the above slide, Enbridge is also pursuing a wide range of renewable energy projects. This includes offshore wind parks such as the Saint-Nazaire project on the French Atlantic coast, but also some solar power projects where Enbridge sees potential. This should help Enbridge’s ESG score over time, but more importantly, it will also position Enbridge to generate profits from a global megatrend. While I do believe that oil and natural gas will be needed for decades, it’s good to see that Enbridge is already positioning itself in future growth areas on top of continuing to earn money from its existing cash cow businesses.

Analysts are currently predicting that Enbridge will grow its EBITDA by 5% next year. I believe that this should be easily achievable, between the start-up of new projects and due to rate increases on existing pipelines — due to the ongoing energy shortage, Enbridge is in a good negotiating position when it comes to new contracts, as producers and end markets want high transportion volumes. On top of that, some contracts are CPI-linked, which naturally should be advantageous for Enbridge in the current environment.

Beyond 2023, analysts are currently predicting a long-term profit growth rate of 6%. While that does not necessarily translate into a comparable cash flow growth rate, I do believe that a mid-single-digits cash flow growth rate should be achievable. Rate increases alone should allow for a low-single-digit growth rate, and with some growth projects and buybacks added, a 5%+ long-term growth rate seems like a realistic goal. The fact that the company has proven its ability to deliver even higher growth in the past is also reassuring — the business model and strategy work.

The Dividend Yield Makes Shares Attractive

A 5%+ annual growth rate does not make shares attractive by itself. Amazon (AMZN) will almost certainly grow faster in the long run, and yet its shares seem pricy, due to a pretty elevated valuation. But Enbridge is not expensive, and if a 5% annual growth rate is achieved, returns should be compelling.

Enbridge currently offers a dividend yield of 7%. If 5% annual cash flow growth is achieved, and if the dividend payout ratio is held constant, which would mean annual dividend growth of 5% as well, then annual returns in the double-digits are pretty likely. At constant valuations, this scenario would result in a 12% annual total return.

Even if Enbridge does not manage to grow its cash flow by 5% or more per year, total returns could still be very solid. If annual cash flow growth comes in at just 2% per year, in line with the long-term inflation target, which would be well below current estimates and the past performance, then annual returns would likely still be in the 9% range.

When we consider that Enbridge has below-average volatility (its beta is 0.8), and that a large portion of Enbridge’s future return will come from dividends, which are independent of market movements, then Enbridge seems like a compelling pick, both from an absolute returns perspective, and from a risk-reward perspective.

Takeaway

With an enterprise value to EBITDA multiple of 12, Enbridge is not the cheapest energy midstream player. But its track record is excellent, its growth outlook is compelling, and the company’s 7% dividend yield is well-covered and offers a hefty income yield.

I do believe that there is a high likelihood that investors will see 10%+ annual returns going forward (my estimate is 12% in the long run), but even if Enbridge underperforms current estimates widely, high-single-digit returns should be achievable. Overall, Enbridge is a compelling investment at current prices, having pulled back 10% from recent highs.

Be the first to comment