JHVEPhoto

Enbridge Inc. (NYSE:ENB) announced just a few days ago that it would be investing $1.5 billion in a new LNG project in British Columbia. The company, as a midstream company, has seen a more volatile share price. As we’ll see throughout this article, the company’s impressive share price will enable massive shareholder returns.

Enbridge Understands The Future

The world is changing and midstream companies are struggling to adjust.

Enbridge Investor Presentation

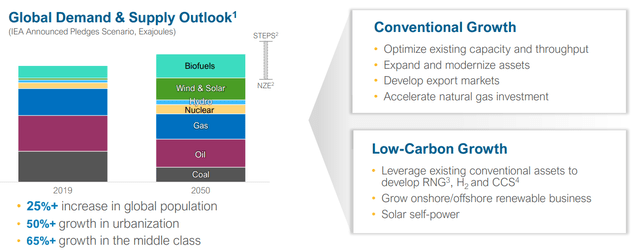

From 2019 to 2050 global population is expected to increase by more than 25%. However, more significantly, urbanization is expected to increase by more than 50% with a more than 65% growth in the middle class. That’s expected to lead to a substantial increase in fuel demand. Wind and solar especially are expected to see demand increase massively.

That massive increase will mainly come from a rapid decline in coal demand as emissions decrease. Natural gas demand is expected to increase slightly while oil demand and supply decreases slightly. The decline rate means that the company’s existing assets won’t go down, but it does mean that the company needs to readjust.

Enbridge Business Performance

The company has continued to execute on its business operations, which will enable increased opportunity.

Enbridge Investor Presentation

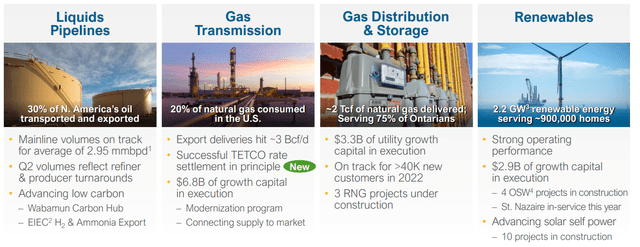

Among the most important of the company’s assets is the Mainline pipeline which is on track for volumes to average almost 3 million barrels / day. The company transports 30% of North America’s oil through its liquid pipelines, and it’s continuing to perform well despite refiner and producer turnarounds. The company is also advancing a low carbon portfolio.

The company’s gas transmission includes 20% of consumed natural gas with export deliveries hitting ~3 Bcf/day. The company has a massive $6.8 billion in growth capital execution here across a multi-decade time period. The company’s assets are integrated. The company is on track for >40K new customers in 2022 and serves 75% of Ontarians.

Lastly is renewables. The company has 2.2 gigawatt in renewable energy serving ~900 thousand homes and is spending billions in growth. This is a smaller segment but one that other companies aren’t investing in as heavily, giving the company substantial growth potential.

Enbridge Woodfibre LNG

North America LNG exports are going to be one of the fastest sectors of fossil fuel growth globally, and Enbridge is beginning to enter that. Natural gas demand is expected to remain strong as an alternative fuel for coal, and Europe is working to move off of reliance on Russian natural gas. North American natural gas represents a great way to do that.

Enbridge Investor Presentation

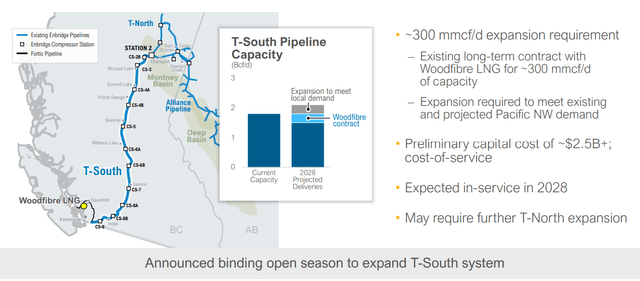

The company made a massive investment in Woodfibre LNG and it has the ability to outperform as a result. The company is expanding pipeline capacity to support the project, and T-South Pipeline capacity is expected to increase by a double-digit % with a 300 million cubic feet / day expansion requirement. The pipeline is expected to be in-service in 2028.

At the same time, the company is also looking at potential expansion opportunities in the market. The company now has a 30% preferred equity interest in Woodfibre LNG. The company’s investment is $1.5 billion although $600 million will be project financing. The project is 70% contracted and will have 2.1 mtpa in production.

To Asia, where LNG demand is massive, the shipping costs are 50% lower than from the United States Gulf Coast.

Enbridge Continued Growth

Enbridge isn’t a company to skimp on growth, and the company is continuing to invest heavily.

Enbridge Investor Presentation

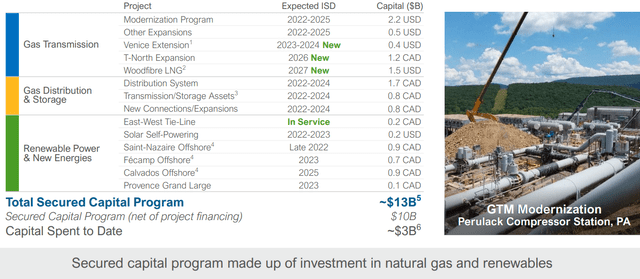

The company’s total secured capital program is a massive $10 billion USD. Long term, the company has $5-6 billion in annual investment capacity, of which it sees $3-4 billion as ratable organic growth. The company has started several new projects and the company’s projects are expected to be in service from this year until 2027.

Out of this, the company is spending roughly 25% of its capital program on renewable power and new energies. That will enable additional and reliable long-term growth.

Enbridge Shareholder Returns

ExxonMobil has generated strong financial returns and has the ability to generate massive shareholder returns.

Enbridge Investor Presentation

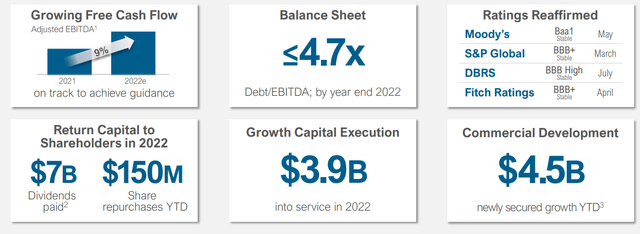

Enbridge is growing its free cash flow (“FCF”). The company’s debt to EBITDA ratio is massive at roughly $70 billion in long-term debt, which costs the company billions in annual interest expenditures. However, that spending has supported continued growth for the company and its impressive assets. The company’s discounted cash flow (“DCF”) has consistently increased by mid-to-high single digits.

The company’s commitment to both growth and direct shareholder returns makes it a valuable investment.

Thesis Risk

The company has reliable cash flow, meaning that its thesis has much lower risk than other companies. The company has a diversified portfolio of assets and it’s continuing to invest in a changing market which will position it better for the future. However, the company has substantial debt and is investing heavily, which makes it susceptible to a market downturn.

Conclusion

Enbridge is one of our favorite companies in the midstream sector. The company has a dividend yield of 6%, which costs it $5.4 billion annually and is something that the company can comfortably afford. Outside of that, the company is also investing massively in growth capital and is looking at other forms of shareholder rewards.

The company also has a share buyback program worth more than $1 billion. The company’s DCF yield is expected at 12%, and, however the company spends the money, we expect substantial shareholder returns. This makes the company a valuable investment for any portfolio. Let us know what you think in the comments below.

Be the first to comment