mikkelwilliam/E+ via Getty Images

I don’t sleep well at night. Mind you, that has nothing to do with my investment portfolio. It has to do with the fact that I have three children under the age of five. That’s not to say that my investment portfolio doesn’t worry me. Of course it does, as I don’t want to lose any money, and an investment in common stocks exposes me to that risk.

My worries have been building lately as it relates to Enthusiast Gaming Holdings Inc. (NASDAQ:EGLX). It is by far my largest holding. While their financial results have been exceptional as measured by growth in revenue and expansion in gross margin, their increase in operating expenses has outpaced that growth.

Of course, 100% sales growth means little if it is offset by 100% growth in expenses. My intent with today’s article is not to explain away my fears or see if I can resolve them, but rather, to value EGLX as if all my fears came true. If shares are trading at levels now that will yield me a 12% return even if expense problems persist, then there is less to worry about.

Bottom line up front: even if EGLX continues to see significant increase in expenses and growth slows, it is still trading at levels that can suggest a 12% return, my required rate. Shares are still a buy.

Hakuna Matata?

Those who often read my work know that I often talk about how large numbers become increasing difficult to compound at identical rates. While EGLX grew revenue by 130% last year, maintaining that is a practical impossibility, and my worry is that growth will slow. But what IS very achievable is growing by identical dollar amounts. More on that in a moment.

Looking at total revenue growth alone isn’t sufficient in this instance. EGLX drives sales from segments that have exceptionally different margin profiles. I therefore found it necessary to separate out direct sales and programmatic sales and model their growth individually. Using historical results and management commentary allows for them – after plugging in margins and combining the resulting dollars into a gross profit from which we can take out operating expenses. This provides a picture for net income looking years into the future. Let’s get into the numbers.

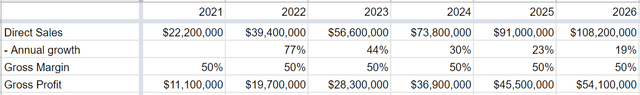

Direct Sales

My whole premise is that EGLX will only be able to grow next year by the exact same dollar amounts as they did last year. In terms of direct sales, they went from $5 million in 2020 to $22.2 million in 2021, growth of $17.2 million. Repeating that in 2022 means a total of $39.4 million in that year, $56.6 in 2023, and so on.

In the recent earnings conference call, management was asked about what kind of margins direct sales carry. Here is the conversation:

Derek Soderberg, Colliers Securities

…. I am wondering if you could share where gross margins are for direct sales today and maybe where they can be long term? And then can you share to what degree the direct sales contribute to gross margin expansion either sequentially or year-over-year?

Alex Macdonald

So I’ll tell you where they’re at and then I think that in fact I will answer the second part of the question through there. They still are coming in around a 50% margin. There’s a bit of an array. Of course, we have higher touch, things like live activations or even digital live activations with studios and presenters and anchors and all sorts of things. Those are right now the lower and then the digital media and some of the other sponsorship areas are higher. They’re still averaging about 50%.

As we scale them, there will be economies of scale to the margin as well. …. our live entertainment or digital entertainment properties…. can support additional sponsorships which will raise the overall margin of the sponsorships against them. So I think that number increases. But right now it’s coming in around 50%.

Using that 50% as our base-line assumption, here is what the direct sales segment looks like through 2026:

Notice how growth on a percentage basis slows significantly every year. That is the worry, and that is what we are building into the model.

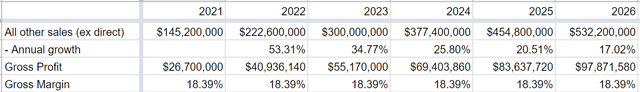

Programmatic Sales

We can run an identical exercise with the lower margin programmatic ad sales. While EGLX has segment revenue from other sources, they aren’t huge, so I find it appropriate to wrap those up here. Let’s call it “all other sales”. From 2020 to 2021, all other sales ex-direct grew from $67.8 million to $145.2 million, growth of $77.4 million. We will apply that same dollar amount to every year.

As for margin, gross in this segment was 18.39% in 2021. We use that going forward. Here is the table:

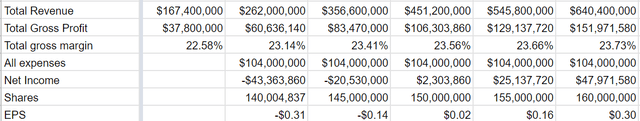

Totals

Adding together gross profit from these segments and then taking out operating expenses gives us a good idea of where net income will be. Before we get to that grand reveal, I have some more worries to get off my chest.

The first is OPEX, which went from $35.5 million to $85.5 million year over year, an increase of 140%! This significantly outpaced revenue growing 130% and gross profit growing 102%. There are assurances that OPEX would level out from here. Again from the conference call Q&A:

Jeff Fan, Scotiabank

Most of my questions were answered, just a couple of follow ups or clarifications. One is on the OpEx. I know you’ve explained a number of reasons why that number has ramped up through this past year but it sounds like, what you’re saying is, you’re at scale. So am I to interpret that at the $17 million, $18 million (per quarter, excluding executive compensation and D&A) where you’re today is the right jump off point for 2022?

Alex Macdonald

Hey, Jeff. This is Alex. And just pardon me for my shortest answer ever. But, yes, that’s your kickoff point for the next year. I think that’s a good basis point and I think you have it right.

But up to this point, EGLX hasn’t proved their ability to scale without significantly growing OPEX. To assuage this worry, I am going to add share-based compensation and depreciation/amortization back to OPEX such that it amounts to $26 million a quarter, or $104 million a year.

The other matter I worry about is the fact that EGLX has only $22 million in cash on the balance sheet and they burned $23 million in cash from operations last year. If they burn cash at a similar rate and/or try to fit in more acquisitions, they are going to need to raise capital. To model in this worry, for my per share calculations I assume that total diluted shares outstanding expand by 5 million every year through 2026 as they might issue shares to raise money.

And now the moment you have all been waiting for:

By 2026, EGLX could very feasibly have $0.30 in EPS. At a very conservative multiple of 16, that would be a stock price of $4.80. Discounted back to the present at my 12% required rate of return is $2.72. In US dollars, that translates to a stock price of $2.18 being the level at which or below EGLX can be bought to receive the 12% annual return at least. EGLX is currently trading for ~$2.50.

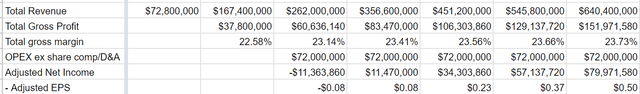

But remember that the OPEX numbers shown above includes both stock compensation expense and depreciation/amortization, neither of which are cash charges. Taking those out of the equation results in an adjusted EPS of $0.50. At the same multiple of 16 and translated into US dollars is a stock price of $4.54. Using that number, shares are currently 46% undervalued.

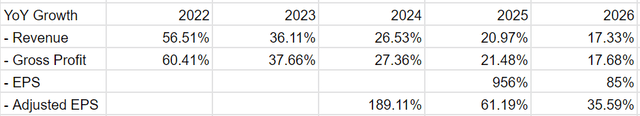

Here is another table showing the growth rates from year to year in the metrics we have used.

The big bullish question to be asked is what company growing revenue, gross profits, and EPS at those rates is going to get a multiple of only 16? There is lot’s of worry and pessimism baked into different layers of my assumptions. But even in those scenarios EGLX looks attractive.

Upside Surprises

The above model is my base-line. There are several things that could go right that would juice results fantastically.

The first is the fact that if the first quarter of this year is any indication, direct sales are going to grow much more this year on a dollar amount basis than last year. In spite of Q4 being the strongest season of the year for ad sales, the CEO of EGLX said in the conference call that Q1 direct sales are going to be well above Q4 of $8.8 million:

…. 42% of our almost $9 million in direct sales in 2021 coming from recurring customers. And I can tell you, with two days to go in the quarter that number will be substantially higher in Q1.

That is sequential growth in spite of moving from the strongest quarter of the year to the weakest.

On the topic of recurring customers, analysts have asked repeatedly about the stickiness of the EGLX business model. The concern is that businesses are just doing a taste test of the EGLX ad platform. But these repeat customer numbers alleviate that concern, as the customers not only come back but also spend more money. More on that topic from the CEO:

I’m particularly proud to say that in Q4 42% of direct sales revenue was from renewals, from partners we had previously worked with and further we are seeing deal size on average amongst renewals to be larger than new customers. That’s a very telling metric and bodes very well for our direct sales business line as again it is another proof point that our flywheel of services we offer brands is winning market share.

Some of these renewal partners include AB InBev, Activision, Best Buy, Bethesda, Disney, Elevation, FX Networks, G FUEL, HBO Max, Lego, Microsoft, Nintendo, Procter & Gamble, Square Enix, State Farm Insurance, TikTok, Tracfone, Truth Initiative, Universal Pictures and Warby Parker. And I think it goes without saying, but it bears repeating, that if you’re going to win multiple rounds of business with something like Disney Plus or HBO Max, it’s for one reason and one reason only: it’s because the solutions that we offer are converting subscribers for them.

Part of the driver here is a new push by EGLX into cinema to advertise for studios debuting new movies. The symbiosis here is apparent, since video games are often based off of movies (Star Wars titles, for example) and movies are often drawn from video games (World of Warcraft). The CEO of EGLX spoke to this point too:

We also noted in early 2021, that our direct sales team was going to commit itself to successfully unlock a new category for us in Hollywood Studio Films. This category proved to be one of our best in 2021 as we partnered with 17 film releases in the year compared to zero in the prior year. Some of the partners we work with include Amazon Originals, Disney, Elevation Pictures, Paramount Pictures, United Artists and Universal. This is one particular category we are very bullish on for 2022.

Another matter is the potential for margins to expand substantially beyond what my models indicated. In the tables above, the tiny expansion in total gross margin from year to year happened ONLY as a result of direct sales making up a steadily larger proportion of the revenue pie. I conservatively assumed that gross margin on the programmatic ad side would go no-where. But EGLX is working hard to improve the margin profile on that line too and has a history of successfully doing so.

Long-term, management has repeatedly mentioned operating margins north of 20%. If we take the revenue number from 2026 in my scenario above and apply a 20% operating margin to it, leaving everything else the same (shares outstanding, multiple, etc.), the stock price would be ~$13 five years from now. From current trading levels that is an almost 40% annualized return.

Risks

The biggest risk for EGLX that is often on my mind is that it feels like they are inclined to chase shiny objects, as it were. I worry that they are spreading themselves too thin, spending tremendous amounts of time and money on things that may not yield a good return.

The not all-inclusive list of initiatives includes working on getting more subscribers, expanding their direct sales team, improving margins on the programmatic side, sustaining an esports franchise, coordinating with influencers, building a social media site from the ground up, exploring opportunities in NFT’s, curating M&A options, creating original media and content, hosting live industry events and conferences, and so forth. It’s a lot. The execution risk is massive.

It seems like a growth at all costs mindset, and they even made comments along those lines during the conference call. From the CFO:

…. nothing is going to stop our growth. We aren’t — it’s not our style. We’re still going to pursue that. We’re proud of that. We’re not here for small wins. We’re here for a big win. …. we are not going to prioritize anything over growth. But nothing is going to stop us from growing. Nothing is going to get priority over that.

I can think of one thing that should stop ANY business from pursuing growth in a particular line: pet projects whose return doesn’t get over the cost of capital hurdle. I love to hear how enthusiastic they are, but also hope for discipline and restraint when needed. It’s fine to throw things against the wall to see if it sticks. But a focus on core lines is paramount. If the focus is on throwing things against the wall, all you get is a big mess.

A specific item in this realm is Project GG, the social media site for gamers they are trying to launch. Commentary on Project GG was completely absent from the prepared remarks, and they even deflected when asked about it:

GG is also a code word within our organization for innovation. Project GG is our sort of internal codeword for a number of innovative initiatives that we’re pursuing and very pleased with the progress so far.

I read this to mean, “the social media site isn’t progressing along as quickly as we would like.” And it may be a long-ways off until they get beyond the alpha launch for select persons:

We’re learning a lot in the alpha phase. And we also see an opportunity that we’re not going to take a misstep on. So I’m highly encouraged sometimes, even the geniuses at Google had Gmail in beta for…. roughly 10 years. So we’re not going to rush something until we know we got it right. But we’re learning a lot and we’re really pleased with the progress.

….we’re not going to put something out there to our gamer community where we haven’t fully tested that and it hasn’t been fully adopted by our community.

It’s too early to fault them for anything or label anything a failure. But it is worrisome. Project GG was a huge talking point and selling point for them not long ago.

The change in tone needs to be taken note of. Especially in context of the fact that the brain behind Project GG, Menashe Kestenbaum, who also happens to be the founder and (now former) president of Enthusiast Gaming, is leaving the company after ten years. For those wanting more detail he posted a video about his departure on YouTube (the short of it that he is much more interested in venture capital stage companies and is therefore launching a VC fund).

But this all can be added to the risk factor part of the investment thesis. I wouldn’t be surprised to hear of Project GG being abandoned. That would be bad, but it would also signal that they know when to call it quits on something that isn’t meeting benchmarks and won’t eventually help build the business. And, of course, the expenses associated with development of Project GG would fall off the income statement. We will see.

Conclusion

Successful investing requires a degree of optimism. Perma-bears never have the gumption to invest and therefore lose out on the fantastic compounding power of the stock market. It is optimism that compels people to take risks, a necessary part of growing wealth.

It is in that spirit that, in spite of my worries, I am optimistic about EGLX. But that optimism is informed optimism in that even if what I worry about comes to fruition, a lot of money can still be made by investing in EGLX at these levels. The biggest thing to watch for is management controlling expenses and showing good judgement on what to focus on and what to drop. If they can continue to execute at historic dollar amount growth while not letting expenses run away, a lot of money is there to be made in the next five years.

Be the first to comment