Scott Olson

The premise

On April 4, Elon Musk announced that he had purchased 9.2 per cent of Twitter’s shares for $2.64 billion. This made him the largest shareholder in Twitter (NYSE:TWTR). After refusing to join the board (he had initially accepted), Musk submitted an unsolicited, non-binding offer to buy the company for $43 billion, or $54.20 per share, and to privatize it.

The company responded the following day by announcing a “poison pill,” which would allow shareholders to purchase additional shares in a hostile takeover, making it significantly more costly for the initial buyer to control the company. On April 20, Musk informed the company that he had succeeded in obtaining a series of financings from several banks and financial institutions (The funding included $7 billion in senior secured bank loans; $6 billion in subordinated debt; $6.25 billion in bank loans to Musk personally, secured by $62.5 billion in Tesla stock; $20 billion in cash capital from Musk, to be provided through the sale of Tesla stock and other assets; and $7.1 billion in capital from 19 independent investors)On April 25, Twitter announced that it had entered into a definitive agreement to acquire and privatize the company.

What happened on Friday

On Friday, a lawyer for Elon Musk notified Twitter’s legal department in a letter of Musk’s decision to terminate the $44 billion acquisition of Twitter. This decision has significant legal consequences, as the two parties had agreed for Musk to pay a $1 billion penalty in the event of the termination of the agreements.

The letter in question reports that “Twitter failed to meet its contractual obligations”, which consisted of providing Musk with the relevant business information he requested. The contract is not public, so we cannot know if indeed Twitter had to provide certain information, but according to Musk’s attorney, Mr. Ringler,

Musk did not waive his right to review Twitter’s data and information […] he negotiated access and information rights under the Merger Agreement precisely so that he could review data and information relevant to Twitter’s business before funding and completing the transaction.

Among the contractual obligations being cited was to provide correct information about monetized daily active users (mDAUs) and how many of those were spam accounts. Musk and his lawyers challenged Twitter that the 5% estimate was false and that a correct figure should be around 20% instead. Twitter argues that it is impossible to calculate spam accounts based solely on public information.

Musk’s possible motivations

Musk’s initial choice to buy Twitter had come as a surprise to most analysts. The company has apparent problems turning its massive number of active users (229 million as of Q1 of 2022) into revenue. Moreover, if we look at the two years from Q4 of 2019 to Q4 of 2021, the ARPU of the rest of the world (all other countries excluding the U.S.) declined by 3%, from $13.64 to $13.25. To solve these problems, Musk warned his partner financial institutions that he planned to cut workers, invite influencers to create content, and introduce subscription services to improve Twitter’s profits.

Musk likely realized only after the bid was submitted that he had made a bad deal: perhaps he was genuinely unaware of how many spam accounts were on the platform, and at the same time, it was difficult to foresee the collapse of the tech sector that lowered the multiples of all companies in the industry.

What will happen now to Twitter?

Twitter board chairman Bret Taylor said the company is still committed to closing the deal at the agreed price and intends to take legal action to enforce the agreement.

The stock could continue to fall for some time. However, the acquisition had kept Twitter’s price steady while the rest of the market came down; this situation has now changed. Since Musk notified his concerns about the number of fake accounts in the past two months, the share price has fallen 25%, and we may only be at the beginning.

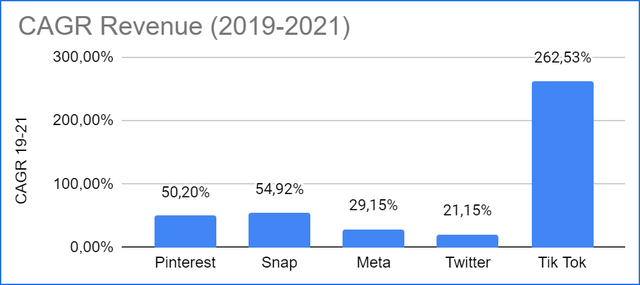

Twitter, in the two years from 2019 to 2021, was the company to grow its revenue the least compared to its main competitors: Snapchat (SNAP), Meta Platforms (META) and Pinterest (PINS).

CAGR revenue (Own Chart)

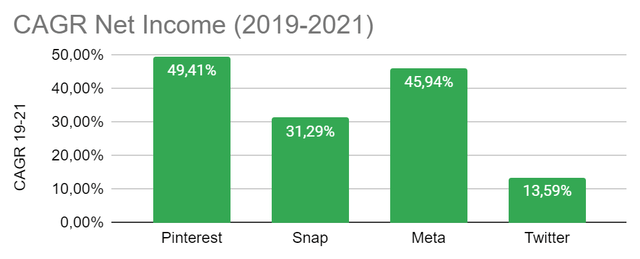

The company’s net income has also grown lower than its competitors. As with Snapchat and Meta, Twitter has also recently been affected by Apple’s changes to iOS 14’s privacy features.

Twitter net income (Own Chart)

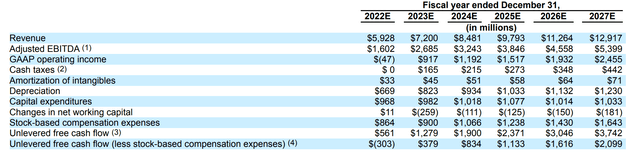

On May 17, Twitter filed a proxy statement providing detailed information about Musk’s acquisition. Inside is a section in which the company provided estimates for 2022-2027 should the acquisition not occur. Twitter assumes that it will grow its market share significantly over the next six years, from the “historical average” of 2.1% to 3.3%, a significant achievement in a highly competitive market.

Revenue forecast (Twitter)

The forecast is not particularly exciting, with a CAGR of just 13.86%, not far off from Meta’s CAGR of 13.2% predicted by analysts (between 2022 and 2026), which, however, trades at a PS of 3.7 versus Twitter’s PS of 4.5.

Conclusions

Twitter, to date, is one of the most widely used social networks in the world, with over 200 million daily active users. However, the company has always struggled to compete in advertising, failing to capitalize on its massive number of users.

Moreover, the estimates provided by the company on future growth are not exciting, especially compared to analysts’ forecasts for Meta. This company, along with Alphabet (GOOG), has a duopoly of the advertising market. Currently, Twitter appears slightly overvalued compared to its major competitors; however, recent news about the failed acquisition could bring the share price down significantly shortly, creating attractive opportunities for new investors.

Be the first to comment