Randy Shropshire/Getty Images Entertainment

Elon Musk has put in a bid on Twitter, Inc. (NYSE:TWTR), and, frankly, it’s almost the perfect bid at $54.20 per share. Seeing as it is 4/20 on the calendar now, let’s talk about it.

Twitter is a social media platform that has the potential to morph into an entertainment, news, gaming, and subscription publishing platform. The only reasons I can see that it hasn’t already is that management has been crummy.

Jack Dorsey, co-founder and the former two-time CEO, has ripped the Board of Directors for being dysfunctional. Of course, he was CEO for years, so he might be deflecting a bit at why Twitter hasn’t taken off as many have expected.

Musk’s bid comes in at a time when the market is weak, and he might be Twitter’s biggest star attraction. His bid makes sense in a lot of ways and is probably about the right price or maybe just a bit shy.

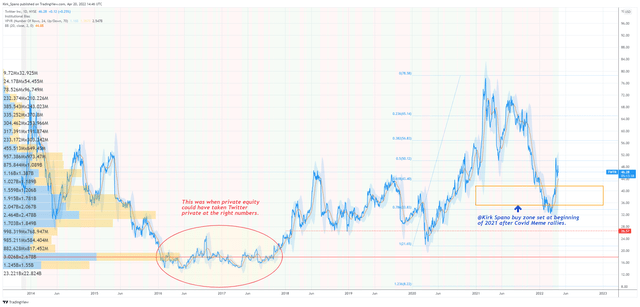

At middle $40s prices, I am a buyer of Twitter shares and a seller of cash-secured puts on dips. Given that volatility has been high, I have accumulated a full 3-4% position in the stock.

Musk Is Twitter’s White Knight

Upon making a bid for Twitter, many analysts suggested that there would be a competing “White Knight” bid at a higher price for Twitter. Unless it is Alphabet (GOOG) (GOOGL), Microsoft (MSFT), or Salesforce (CRM), I don’t know that I see another bidder.

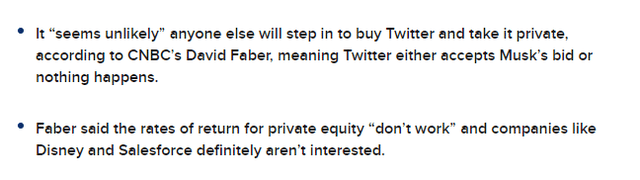

As David Faber at CNBC has pointed out, the numbers for private equity to take Twitter private just aren’t there.

The time for private equity to take Twitter private would have been during 2016-17, after Twitter shares cratered after the IPO hype.

I think that brings us to why I think Musk is Twitter’s actual White Knight.

Dorsey and the Board of Directors have failed to grow Twitter into a cash flow machine, which is what it should be – more on that below.

Musk is Twitter’s biggest star tweeter. Without Musk, I’m frankly not sure what happens to Twitter. He’s like having Howard Stern at Sirius (SIRI) (LSXMK) – a reason why millions come.

That Musk, Twitter’s biggest star, is making a bid for the company, I think is the perfect offer. They need him. He needs them to a degree and he at least says he has aspirations for the platform.

We would see of course if Musk just talks his own book, or actually grows Twitter. I think he would grow it. Regardless, without Musk, Josh Brown could likely be right that Twitter is a melting iceberg.

What Is Twitter Now?

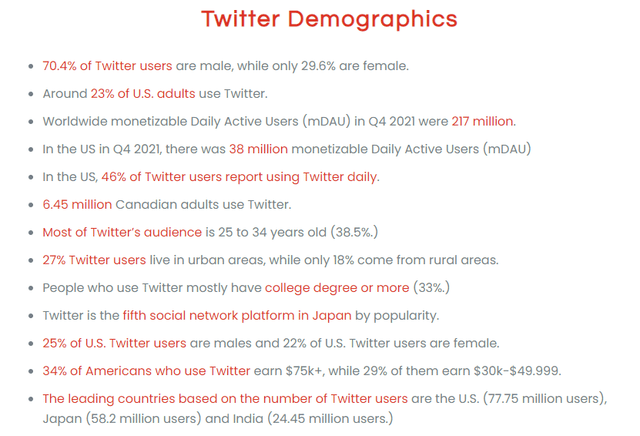

Currently, according to advertising agency Omnicore, there are over 200 million daily global users of Twitter. It could easily be in the billions if Facebook (FB) is any measure.

Twitter Demographics (Omnicore)

Notice that Japan and India are already big users. Given India’s clean energy aspirations and Musk’s street cred there, you’d think there’s some opportunity to expand into the 1.4b population of India.

This is where I think we can project what Musk can bring to the table for Twitter besides the money bags. Musk is an iconic figure. I also think he’s a little weird, but so what.

What Musk Could Bring To Twitter & The World

Musk, in discussing Twitter, but also his M.O. for a long time, is pushing ideas like freedom and sustainability. That’s a pretty wide tent to speak to.

Let’s talk freedom. People who have a measure of freedom want to protect it. People who don’t have the freedom they want are trying to get it.

A platform based on freedom, not just freedom of speech which is misidentified legally and ethically by propagandists and ignoramuses, would be a good thing.

Freedom, in all its many forms, needs a new diversified voice. Twitter could be it. Twitter could promote the freedoms we all seek. Freedoms of speech, association, press, religion, movement, education, marriage, our bodies, our data, entrepreneurship… it’s a long list. That would be a great global business model.

Then there’s sustainability. There’s some talking his book there for sure, but with around 70% of the people on the planet believing climate change is a problem, could Twitter be the platform that brings the grass roots support for sustainability policy over special interests, deregulation, and tax breaks for polluters? I think it could. And, my guess is that there are some very nervous fossil fuel execs about Musk owning Twitter.

Twitter’s Omnichannel Potential

There are hundreds of top authors on Twitter, but that has gone to waste. One need only look at Substack or even Seeking Alpha to see the viability of paid content platforms.

One of Twitter’s founders, Evan Williams, currently runs Medium, a content publishing platform. He was among those who support a politically neutral platform that allows anyone to publish without censorship. That seems to be very in line with Musk’s views. Musk could bring Williams and Medium into the fold to be the long-form content provider, probably by buying it outright with Twitter shares.

Twitter has already cut deals with the NFL, NCAA, MLB, NHL and MLS. These have proven to be popular, and engagement has been growing as fans interact in game. Add in the significant potential of gambling as a revenue driver and you can see opportunities.

If Twitter can add sports, why not a weather widget that has forecasts, history, documentary, and other content? I’m sure Byron Allen would take that phone call.

Twitter could further expand it’s news offerings via a subscription platform similar to Apple’s without being tied to a particular hardware. They could have the free news in the sidebar with an option to add paid content via a basket or single provider subscriptions that carry out to individual apps as well. They would be a sort of Roku (ROKU) for the news.

And, why not directly compete with Roku. Twitter conversations with the masses or dedicated groups overlaying what your watching is already happening with the sports as mentioned above. Why not offer single sign-on for your streaming services with your Twitter ID. The tech is there.

Twitter is trying to get into gaming more. It has authors. Its Periscope technology makes it possible to compete with Twitch, but alas, management killed it too. That’s a gigantic market to poo-poo. Why not give GameStop’s (GME) Ryan Cohen a call and see if there’s some synergy there.

At one time, Twitter had a short-form video platform called Vine. Management killed it. And then, TikTok and Instragram took over a now booming space that has evolved to marketing revenues. Why did Twitter leave? Who cares, it was flat out stupid.

It’s time for Twitter to undo a lot of mistakes and head into a free and sustainable future. I think Musk is the guy to push the needed changes as Chairman and majority owner – but not CEO, he needs to hire out for that. And, if Musk does succeed in his bid, he needs to have a large minority of board members be independent and capable of challenging him. It seems Musk likes a challenge.

Investment Quick Thought

I think I’ve laid out the so-far missed potential of Twitter and why Musk could be a great fit as majority owner and Chairman Of The Board. Here’s my investment approach.

- I have taken a full position (3-4% of portfolio) in Twitter common stock with a cost basis of $46.

- I have also sold the $41 June puts (cash-secured puts) for $2.14 on the volatility. My clients are actually a significant portion of the outstanding. If put to me, my position would grow by 2/3 to more than a full position and it would give me a net cost under $39 for the shares which is around where Elon was buying and I think is significant support. Right now you can sell those puts for closer to $2.50.

- I have also sold $55 June calls (covered calls) for $2 on the volatility against half of my Twitter shares. Right now those calls are below $2. If you want to generate some income against a long TWTR stock position, I’d set the GTC at $2 or above and see if it gets executed. My guess is that it would be.

While I believe that Twitter has big potential, there is risk. I think Twitter is most likely to reach near its potential with Musk as Chairman and majority owner. If Twitter stays independent, I don’t have enough faith in management to steer this company. Here are my stock ownership scenarios.

- If Musk’s bid fails because Twitter stays independent, I’d have to reconsider my Twitter long position.

- If Musk’s bid fails because he is outbid, I’ll take the money and run.

- If Musk succeeds in becoming majority owner and Chairman Of the Board, I guess I take the money because I have to most likely.

- What I’d love to see is Musk become majority owner and Chairman, but about 30-40% of the company remain publicly traded. In that case, I’d hold a long time. This also is the most likely way for Musk to make money because the share price would rise. I hope he cares about that.

Be the first to comment