vm/E+ via Getty Images

Investment Thesis

From time to time the stock market throws up anomalous valuations, or periods of share price growth that extend beyond what is reasonable, and I believe this is what has happened recently with the share price performance of Indianapolis based Pharma Giant Eli Lilly.

Conversely, the market can also oversell a stock based on doubts over future performance that may be unfounded, and I would like to make the case that this is what has happened with Pfizer (NYSE:PFE), another member of the “Big 8” US Pharmaceutical companies – Johnson & Johnson (JNJ), Eli Lilly (NYSE:LLY), Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD).

The over-buying of Eli Lilly stock and over-selling of Pfizer stock has led to a surprising event – recently, Eli Lilly became a more valuable company than Pfizer by market cap. My suspicion is that the market has become carried away with Eli Lilly’s share price momentum, and that its overtaking Pfizer in terms of market cap valuation is a key inflection point that will finally bring an end to the bull run.

Meanwhile, thanks to its twin COVID drugs, Comirnaty the vaccine, and Paxlovid the antiviral, Pfizer was able to generate exceptional cash flow from operations of >$32bn last year, and will do so again this year. That has enabled the company to invest substantially in M&A, and turn an unexceptional product pipeline into an industry leading one.

As such, I expect that these two pharmas‘ market cap valuations will swap places again in the near future, with Pfizer’s stock price rising whilst Lilly’s falls. I believe this is the only sensible conclusion to be drawn after considering the two companies and their respective strengths and weaknesses, and the substantial difference in size – as I will explain over the course of this article.

Fundamentally Speaking, Pfizer Is In A Different League to Eli Lilly

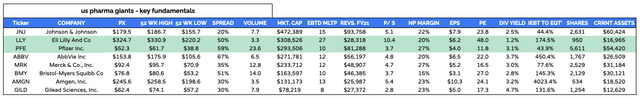

As we can see from the table below, by almost every fundamental measure, Pfizer ought to be substantially the more valuable company.

my table using data from Google Finance, TradingView

As we can see, however, Eli Lilly’s current market cap valuation is presently $308.5bn, whilst Pfizer’s is presently $293.5bn. To understand how surprising and anomalous this is, let’s consider some key measures of value.

- Pfizer’s dividend payment of $0.40 per quarter per share yields ~3.1% per annum, whilst Lilly’s dividend payout of $0.98 per quarter per share yields ~1.2%.

- Pfizer generated $81.3bn of revenue in FY21, whilst Eli Lilly generated $28.3bn – only 34% of Pfizer’s total.

- Pfizer delivered a price to sales ratio in FY21 of 2.7x, whilst Lilly delivered a P/S ratio of 10.4x, nearly 4x worse than Pfizer.

- Pfizer’s price to earning ratio in FY21 was 11.8x, whilst Lilly’s was 48x – >4x worse.

- Pfizer has current assets of ~$54.4bn, whilst Lilly has current assets of ~$17bn.

- Pfizer’s debt to equity ratio is superior to Lilly’s – 44%, versus 175%.

- In FY22, Pfizer is guiding for revenues of $98 – 102bn, up ~23% year-on-year, whilst Lilly is guiding for revenues of $28.8 – $29.3bn, up ~3.3% year-on-year.

Taking the above into account, it seems quite astonishing that it is Lilly that enjoys the higher market cap – second only to Johnson & Johnson (JNJ) within the US major pharmaceutical sector.

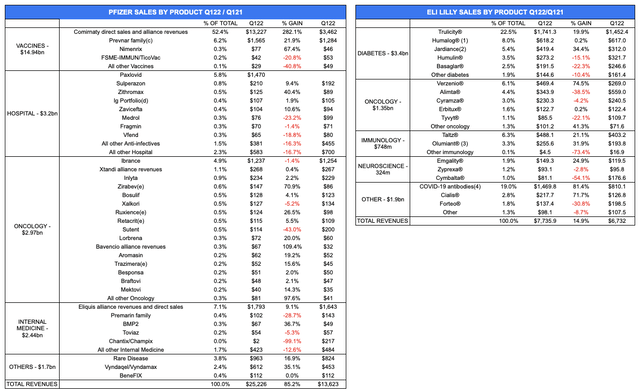

If we consider the company’s respective drug portfolios, we arrive at the same inescapable conclusion – Pfizer’s is worth substantially more than Lilly’s.

Pfizer vs El Lilly revenue by product Q122/Q121 (my table using company data)

Lilly might have the most valuable ex-COVID franchise – its Diabetes division generating ~$3.4bn in Q122 – but Pfizer’s Hospital, Oncology and Internal Medicine divisions are substantially more valuable than Lilly’s next 3 franchises, whilst its vaccines division, driven by Comirnaty, generated nearly 2x more revenue than Lilly’s entire portfolio in Q122, and if sales of Paxlovid grow as forecasted in quarters 2,3, and 4, the Hospitals division will likely do similar.

Lilly’s Unstoppable Stock Price Momentum Driven By Potential Of Two Pipeline Drugs – With 1 Subject To A Major Caveat

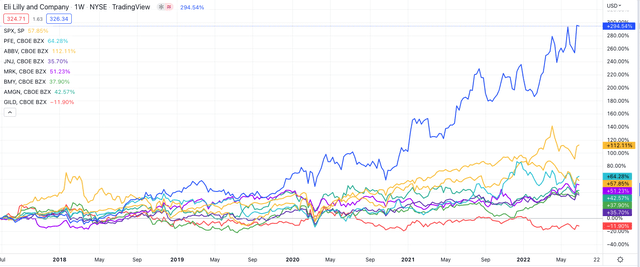

Next, let’s consider share price performance, firstly over a 5-year period.

US “Big 8” Pharma stock price performance (TradingView)

As we can see, Lilly is the runaway leader amongst the “Big 8” US Pharmaceuticals, up by nearly 300% across the past five years, whilst Pfizer has slightly outperformed the S&P 500, up 64% compared to the S&P’s 58% gain.

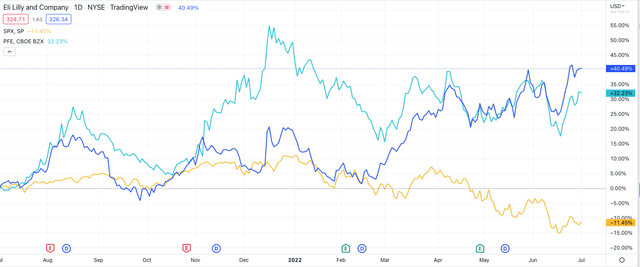

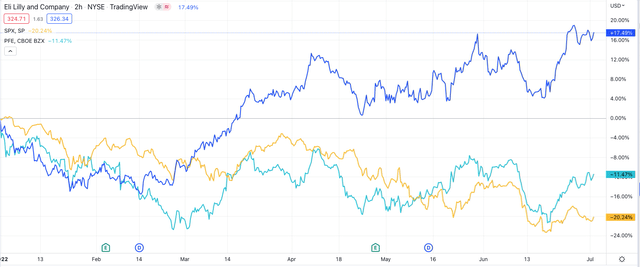

Pfizer vs. Eli Lilly – 12m share price performance (TradingView)

Over the past 12 months, we can see that there is little difference in overall share price performance – in fact, Pfizer had the greater momentum going into 2022, its stock up >50% – but across the past six months, Pfizer’s value has fallen whilst Lilly’s has continued to grow.

Pfizer vs Eli Lilly – 6m share price performance (TradingView)

You may ask, how does a major Pharmaceutical guiding for a 23% uplift in revenue generation in FY22 lose value, whilst another, guiding for a ~3% uplift in FY22 revenue, gain value, especially when the former is guiding for revenue >$100bn, and the latter for <$30bn?

The answer is that the US pharmaceutical sector is unique in terms of the value it attaches to the drugs a company may develop and bring to market next, rather than on sales of those that have already been developed and brought to market.

Investors have pinned their hopes on two Lilly drugs which are expected to become mega-blockbusters – i.e. generate sales potentially in excess of $10bn per annum. The first of these, Tirzepatide, has already won an approval – under the brand name Mounjaro and as a 6-injection regime – to treat patients with Type 2 diabetes.

In head to head trials, Mounjaro out-performed what is likely to be its biggest rival for market share – Novo Nordisk’s (NVO) Ozempic – whilst the drug will also likely win approval to treat obesity, having met its co-primary endpoint of at least 5% body weight reduction in a late stage clinical trial.

Analysts have predicted that Tirzepatide / Mounjaro could eventually generate peak sales >$20bn per annum, which is great news for Lilly, although it should be noted that the drug will take market share away from its own drugs such as its current best-selling drug Trulicity, which loses its patent protection in 2027 anyway (meaning generic competition will drive its price point and sales down, likely by >20% per annum), and possibly Jardiance too. These two drugs generated ~$8bn sales between them in FY21, a figure that is now likely to shrink.

The second drug that investors believe could generate >$10bn per annum is a much more controversial one. Donanemab is a drug designed to treat Alzheimer’s disease (“AD”) – a 5.8m patient market in the US alone, where only a single disease modifying drug has been approved in the past 20 years.

The problem is, that approved drug was Biogen’s (BIIB) Aduhelm. Granted authorisation by the FDA in June 2021, initially analysts felt that Aduhelm, launched with a price point of $56k, would be a >$10bn – $20bn selling asset. Instead, doubts about the drug’s efficacy and safety profile saw the Centers for Medicare and Medicaid (“CMS”) refuse to authorise reimbursement for the drug outside of clinical studies. Biogen has all but shelved Aduhelm, and the drug may never make another sale.

Lilly’s Donanemab has a similar mechanism of action (“MoA”) to Biogen’s Aduhelm – targeting the reduction of amyloid beta in the brain – and although Donanemab wowed investors – reducing cognitive decline in AD patients by 32% compared to placebo in a Phase 2 trial in early 2021 – Lilly no longer expects to secure a fast track approval for Donanemab much before Phase 3 study results are released in mid-2023. There is no guarantee either that the Phase 3 results will match the successful Phase 2 results, given a much larger patient population, or that the CMS will grant reimbursement even if they do.

Essentially, by attaching so much value to Tirzepatide and Donanemab, investors in Lilly are failing to acknowledge the high level of risks involved.

Tirzepatide ought to be a success, but sales across the rest of Lilly’s diabetes franchise will likely fall. Donanemab may not even be approved, and even if it is, the widespread scepticism around its MoA is likely to heavily impact its sales potential – just as it did with Aduhelm.

Pfizer Reaps Benefit Of ~$100bn Additional Revenue In FY21/22

In Pfizer’s case, most people will be aware that the pharma – together with partner BioNTech (BNTX) – developed the Comirnaty COVID-19 vaccine, which was approved in late 2020, scoring >95% efficacy in its pivotal study, and became the most-used vaccine in the Western world, earning Pfizer $36.8bn of revenue in 2021, which was split 50/50 with BioNTech.

In 2022, Comirnaty is forecast by Pfizer management to generate $32bn of revenue ($16bn for Pfizer) whilst the COVID anti-viral the pharma has also developed – Paxlovid – is forecast to generate $22bn. Should that happen – and there is little reason to believe otherwise – these two new drugs will become the #1 and #2 best-selling drugs in the world in 2022.

Granted, after 2022, as pandemic pressures ease, mass vaccinations end, and fewer patients require treatment for COVID, it seems inevitable that the revenues generated by Comirnaty and Paxlovid will fall substantially. The fact remains however that Pfizer was able to generate nearly $22bn of net income in FY21, and will likely generate an even larger sum in FY22 thanks to the additional contribution from Paxlovid.

A bird in the hand, as they say, is worth two in a bush, and Pfizer has been able to put its cash to very good use, making a series of acquisitions. First the company paid $2.2bn to acquire Trillium Therapeutics, developing two promising blood cancer drugs that target the CD47 “don’t eat me” signal used by cancer cells to avoid detection.

Next, Pfizer spent ~$6.7bn acquiring Arena Pharmaceuticals and its late stage auto-immune drug Etrasimod – an oral S1P receptor modulator whose late stage clinical trial data suggests it can rival Bristol Myers Squibb’s Zeposia’s best in class profile in Ulcerative Colitis, and possibly Multiple Sclerosis, meaning it could generate peak sales of up to $5bn.

In May, Pfizer announced that it would acquire Biohaven (BHVN) in an $11.6bn deal, obtaining the rights to market and sell migraine therapy Nurtec, which has been forecast to generate nearly $2bn in revenue by 2024 by analysts, whilst Pfizer itself believes it can develop a $6bn per annum migraine franchise. And most recently, Pfizer announced the acquisition of ReViral and its antiviral therapeutics targeting respiratory syncytial virus (“RSV”), in a $525m deal. The revenue opportunity here is likely >$1.5bn.

Thanks to Comirnaty and Paxlovid, the ~$21bn Pfizer has spent bolstering its commercial and clinical portfolio is small change for the company. Lilly, meanwhile, has benefitted from additional COVID revenues thanks to its antibodies Bamlanivimab, Etesevimab and more recently Bebtelovimab, which added $1.5bn to Lilly’s top line in Q122, versus $810m in Q120.

Once again, however, Lilly’s COVID revenues are not in the same ballpark as Pfizer’s, and as such there is less opportunity for the firm to make strategic acquisitions – Lilly’s last major M&A activity was the acquisition of LOXO oncology in 2019 for $8bn, and the $1bn acquisition of Prevail Therapeutics in late 2020.

Looking Ahead – Lilly Revenues Will Rise Whilst Pfizer’s Will Fall, But The Gap Will Remain A Chasm

Pfizer CEO Albert Bourla has outlined plans to drive $25bn of new revenues by 2030. When we consider Etrasimod, Nurtec and the migraine franchise, and other assets such as the JAK inhibitors Xeljanz and Ritlecitinib, targeting autoimmune indications, Lorbrena, a cancer therapy targeting non-small cell lung cancer (“NSCLC”) – the largest in oncology – a vaccine targeting Lyme disease, and a hemophilia drug with a pivotal data readout due in 2023, that goal does not look out of reach.

Lilly’s Tirzepatide is a once-in-a-generation molecule, and trumps anything that Pfizer may have in its pipeline, and then there are assets such as Olumiant – a JAK inhibitor already approved to treat alopecia (Pfizer’s Ritlecitinib has not yet reached that milestone) – Mirikizumab in Ulcerative Colitis. The oncology division, too, boasts Alimta, a blockbuster in NSCLC, and Verzenio, likely to take market share away from Pfizer’s blockbuster Ibrance as that drug is set to go off patent.

Despite its pipeline potential, it seems almost inevitable that Pfizer’s revenues will shrink in the coming years due to falling sales of Paxlovid and Comirnaty. My own calculations see revenues falling by ~12% between 2022 and 2023, then by 4% per annum, to ~$76bn in FY26, with Comirnaty and Paxlovid combined generating not much more than $10bn per annum for Pfizer.

Looking at Lilly’s forward revenues, even if we are highly optimistic and make Tirzepatide a ~$20bn peak seller, Donanemab a ~$10bn seller, and add an additional $5bn from other product launches, the extra $35bn generated – let’s say also by 2026 – results in top line revenues of <$65bn – still >$10bn less than Pfizer, and don’t forget Lilly is the less efficient company when it comes to profit margins – 27% for Pfizer, 20% for Lilly.

The point I am making is that, although investors feel that they are buying the potential of Eli Lilly, when paying a premium and pushing its market cap valuations up above Pfizer’s, they are failing to factor in the risk involved in drug development. Often, drugs fail to live up to their peak sales expectations.

Meanwhile, Pfizer – under the seemingly inspirational leadership of its CEO Albert Bourla – pioneered the first ever messenger-RNA vaccine, which will earn the company >$30bn of direct revenue by the end of 2022, and followed up with Comirnaty, which will earn the company a similar figure at the very least.

These revenues are either already realised, or virtually guaranteed to be earned in FY22, whereas Lilly can make no such guarantees about its two flagship pipeline assets – and certainly not in the case of Donanemab, which could be an expensive flop.

Conclusion – Lilly’s Promise Is Not Unlimited, Pfizer’s Strength Is Self-Evident – The Mis-Pricing Is Clear

No Matter how I draw up the discounted cash flow valuations, calculate the future earnings streams, or forecast the revenues lost to the end of the pandemic, I am left with the same conclusion. By almost any measure, Pfizer is a more valuable company than Eli Lilly.

In this post I first considered the fundamentals – e.g. Pfizer’s revenues in FY21 were 2.9x greater than Lilly’s, and in FY22, they will be >3.5x. I then looked at share price gains – Lilly’s near-300% gain over five years, against Pfizer’s 64% – nearly 5x less – over the same period.

I looked at the promise of Lilly that investors are seemingly desperate to buy into – what looks like a bona-fide >$15bn – $20bn per annum peak seller in Tirzepatide (albeit much of that revenue will be market share taken from other assets in Lilly’s diabetes franchise) and an asset in Donanemab that seems as likely to damage Lilly’s valuation than enhance it.

I have countered that the two COVID drugs Pfizer has developed in Comirnaty and Paxlovid may have short shelf lives (although this is not necessarily guaranteed – COVID cases remain high) – but have made Pfizer cash rich, and that Pfizer has spent that money wisely on M&A, whilst there is perhaps $30bn more funding coming due by the end of 2022, and potentially $25bn of near-term revenue within the near-term pipeline.

I have tried to look into the future to see if there is any way Lilly could challenge Pfizer from a top line revenue perspective, and concluded that it is not possible even in the most optimistic of scenarios.

As such, although it is by no means a bad company, I conclude that the Lilly bubble is close to bursting, and that its overtaking Pfizer in terms of market cap value ought to persuade even the most blinkered investor that a correction is due.

At the same time I believe sentiment around Pfizer focuses too much on a likely fall in sales of its two COVID assets, Paxlovid and Comirnaty. The money already generated by these two mega-blockbusters – has been collected, some of it is reinvested, and some of it allocated to pay down debt, and perhaps complete share buybacks or further raise the dividend.

It is rare – to my mind – to see such obvious indications that a mis-pricing of two stocks has occurred within the stock market. I believe investors can take advantage of this situation today, either by backing Pfizer, or selling Lilly.

That is not necessarily a reflection of weakness at Lilly, but a reminder that a hype cycle can run out of control. It is however a reflection of the strength that I see at Pfizer, a company whose golden run of new revenue generation may be coming to an end, but which has the cash and the newly acquired companies to show for its monumental efforts during the pandemic.

Be the first to comment