powerofforever

Shares of Bally’s Corporation (NYSE:BALY) have lost about 60% of their value over the past year as concerns about a recession have led to questions about consumer spending on discretionary categories like gaming. Additionally, Bally’s has a very aggressive financial policy. If things go well, there is meaningful upside, but investors need to believe there will not be a downturn in results between now and 2026 as there is limited operational cushion.

I would begin by separating out operating results from financial policy as they are two separate things. Bally’s is operating well. In the company’s second quarter, revenue more than doubled to $552 million as the economy is now fully re-open. Income from operations (excluding leaseback losses) was essentially flat at $135 million as it increased advertising spending by $80 million to $181 million. Adjusted EBITDA rose to $141 million from $83 million, and EPS was $0.98. This advertising spend is partly discretionary as it tries to grow its online offerings, and it is having success doing so. North American interactive revenue more than tripled to $18 million, and its loss improved from $50 million to $24 million.

In 2020, the company struck a ten-year deal with Sinclair (SBGI) to rebrand the Fox Sports Regional Networks “Bally Sports” for just about $8.5 million per year, a low-cost way to meaningfully increase brand awareness for its sport betting platform. This was a shrewd and cost-effective way to build the brand to the target audience. The partnership has since deepened to include Bally-produced content during non-game windows to further increase awareness of its sports betting offerings.

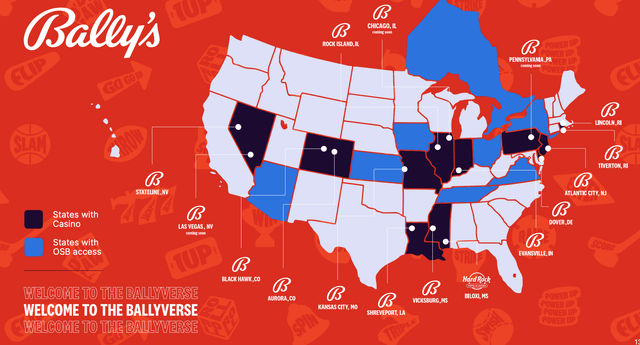

Because these are regional networks, it can customize its programming to tie-into local casinos it owns or its mobile app, creating an entire Bally’s ecosystem. As you can see blow, it currently owns and operates 15 casinos across 10 states, making it the third largest regional casino company.

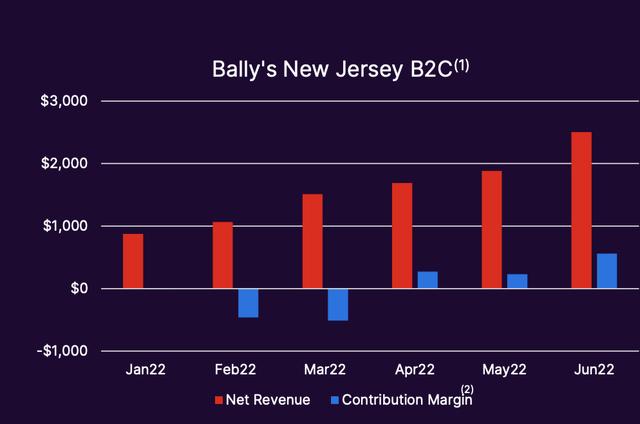

Alongside its physical presence, Bally’s has sports betting in 19 states with over 500k monthly customers. Its iCasino offers online gambling in Asia and the UK as well as New Jersey. As that regulation eases, potentially next in Michigan and Pennsylvania, there is greater upside to the interactive business. Its overseas business generates about $70 million of quarterly income, generating that scale and profitability in the US would be a game-changer to its financial performance. In New Jersey, Bally’s uses the physical casino to sign up customers to the iCasino platform, and it is already contributing to the bottom line. This will be a multiyear story that takes longer to play out nationally than sports betting, but it is a source of upside.

Aside from digital, Bally’s also has significant growth in physical casinos. Bally’s is taking control of the Tropicana Las Vegas, giving it a prime property on the Strip, and is planning a major new casino in Chicago, which will become its flagship property. It will have a temporary casino open next year for a three-year period until the permanent casino opens in 2026; there is also the potential for slots in the airport. Chicago will be run as an unrestricted subsidiary, 75% owned by Bally’s, with a total cost of $1.7 billion. In its first year fully running, it expects Chicago to generate $250 million of EBITDA.

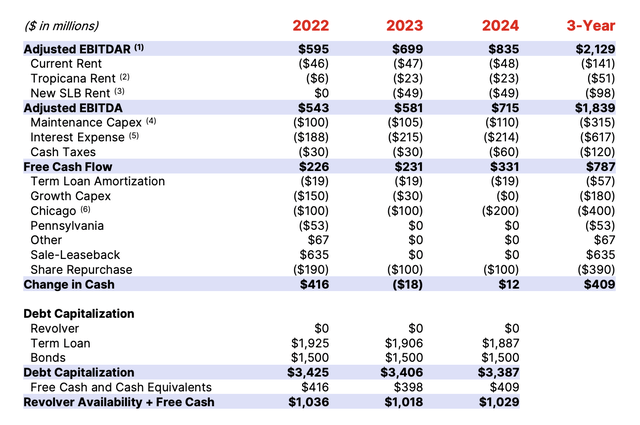

That is a significant contribution. After all, this year the company expects $2.2.-$2.3 billion in revenue and $535-$550 million in adjusted EBITDA. I tend to expect results to be at the low end of guidance given the stronger dollar, which will reduce the overseas interactive profit contribution. With this growth in the pipeline, its share price performance may be surprising. This gets into concerns over the financial policy, namely paying for all of this growth. Below, you can see management’s three-year cash flow forecast.

Now, management does not include growth cap-ex or Chicago in its free cash flow figures, but this is cash out the door, and in my view should be factored in. Including growth cap-ex but not Chicago, 2022 free cash flow will be $76 million, 2023 is $181 million, and 2024 is $319 million. That is about $1.28, $3.30, and $5.50 per share. Including its contributions to build out Chicago, free cash flow per share becomes -$0.28 this year, $1.47 next year, and $2.20 per share in 2024.

The company also carries a substantial amount of debt, about $3.4 billion, and $1.93 billion of this is floating rate. Debt/EBITDA in 2023 is expected to be about 5.9x; that is a high amount of leverage. Given higher interest rates, interest expense may also be another $20 million next year, bring free cash flow per share down to $1.05, giving shares about a 5% 2023 FCF yield.

As you can see, its combined growth and maintenance cap-ex peaks this year at $250 million and should start to fall by H2 2023. In order to finance these ambitions, Bally’s has done a sale-leaseback transaction for its Biloxi and Tiverton casinos, which is providing $635 million of liquidity.

Now, a sales leaseback is not free money as Bally’s now has higher rent costs of $49 million, and in some ways, this is likely taking on debt. When a company borrows money, it receives cash today and then pays interest. Here, it gives control of an asset, receives cash today and then pays rent. The implied interest rate is 7.7% based on the $49 million in rent and $635 million in proceed, so it is not cheap debt either. This adds to the company’s fixed costs.

I could understand raising liquidity to pay down floating rate debt or to finance its cap-ex and interactive advertising. In addition to this, management is using the proceeds to buy back stock. The company repurchased $103 million in stock via a tender offer in July. Because it used some of the proceeds to repurchase stock, it is essentially adding financial leverage, adding a debt-like instrument to its capital structure and taking out equity. Generally, I like buybacks, but at the moment, given Bally’s growth spending and elevated debt load, I believe balance sheet strength should be a greater priority.

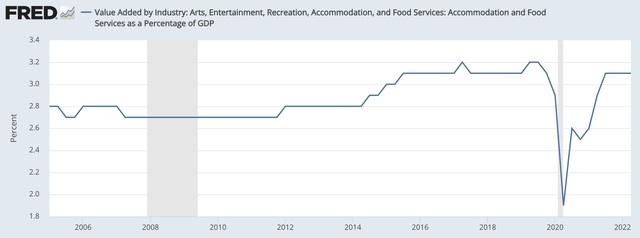

This is particularly true given the risk of recession, or at least consumers pulling back from discretionary spending in the face of high inflation. Bally’s has benefitted from the surge in travel and recreation spending as the economy reopened. However, as a share of GDP, this spending is back to normal levels. In other words, there is limited growth to recapture, and travel/casino spending is more likely to follow the path of the economy.

I do not know if there will be a recession next year, and generally think strong consumer balance sheets, can help insulate the US economy. But a company with a higher debt load is more exposed to a downturn as it needs to continue to pay interest no matter how its businesses perform. Combine that with Bally’s funding losses in its US digital business and Chicago buildout, and this company has significant cash flow needs. Even under its own estimates, its aim to repurchase $100 million in stock in 2023 and 2024 strike me as too aggressive. I estimate a ~4% miss in revenue vs expectations next year would leave the company free cash flow breakeven, an uncomfortable place to be given its debt load. In 2026 if all goes well, this could be a company with over $1 billion in EBITDA as Chicago starts contributing, and US interactive income turns positive. Using today’s Enterprise Value/EBITDA multiple of 7.5x, it could be a $7.5 billion business.

With $3.4 billion in debt and $1.3 billion in Chicago project debt, that would still leave $2.8 billion for Bally’s equity or $51 per share. That is a four-year return potential of over 25% annualized. It is just a matter of making it from here to there. By relying on so much debt financing, BALY exposes itself to a downturn where it may need to borrow at higher rates to fund growth if cash flow turns negative, scale back growth spending, or bring in equity partners. Given the return potential, shareholders would be best served with no further buybacks and a retention of cash to finances projects and pay down debt.

As it is not pursuing that, I view Bally’s as a highly speculative investment. If all goes according to plan, shares have tremendous upside potential, but it is only appropriate for investors who recognize the high level of volatility Bally’s is likely to exhibit and are comfortable with it. I would also only recommend it to investors who believe there will not be a material downturn in consumer discretionary spending, which would derail its cash flow projections. While there is tremendous upside, considering its vulnerabilities to downside risk, I view shares as a hold. Bally’s high return potential is held back by its high risk profile.

Be the first to comment