Fritz Jorgensen/iStock via Getty Images

Welcome to the March 2022 edition of Electric Vehicle [EV] company news. March reported very strong February 2022 global electric car sales even if February is typically a slow month. The standout again was China sales, led by BYD Co.

In EV market news we are seeing increasing moves by Western governments to help support the sector and the supply chain. We saw this just last week with President Biden invoking the Defense Production Act to boost the EV supply chain, especially at the mining level.

In EV companies news we continue to see BYD and Tesla lead, but the ICE companies are now making much greater efforts to catch up. The smaller EV juniors continue to be a mixed bag, some doing great and others not doing so well.

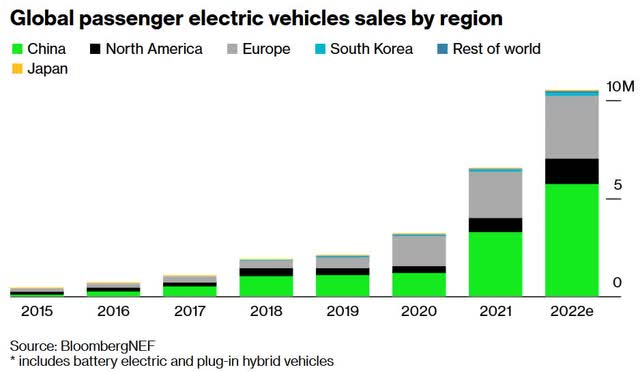

Global electric car sales as of end February 2022

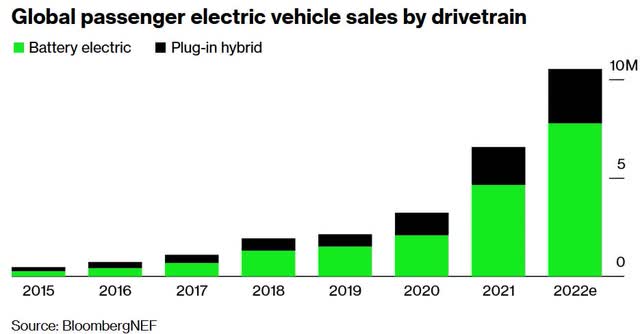

Global electric car sales finished February 2022 with 541,000 sales for the month, up 99% on February 2021, with market share of 9.3% for February 2022, and ~9.5% YTD.

Note: 70% of electric car sales YTD were 100% battery electric vehicles (BEVs), the balance being hybrids.

China electric car sales were 291,000 in February 2022, up 176% on February 2021 sales. Electric car market share in China for February was 20%, and 17% YTD.

Europe electric car sales were 160,000 in February 2022, up 38% YoY, reaching 20% market share and 19% YTD. Germany reached 25% share, France 20%, and Netherlands 28% share in February 2022.

US electric car sales were not available.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and charts below.

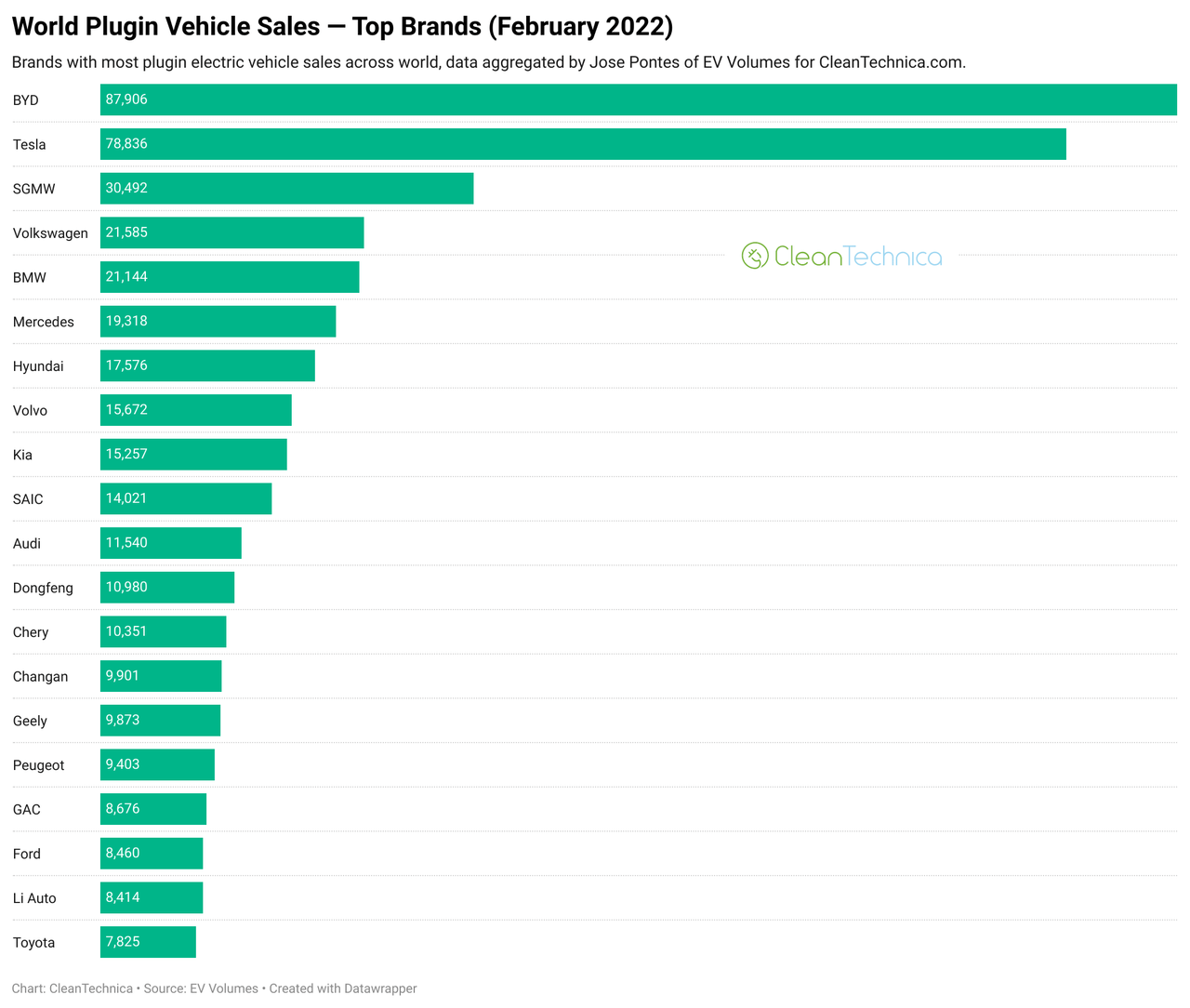

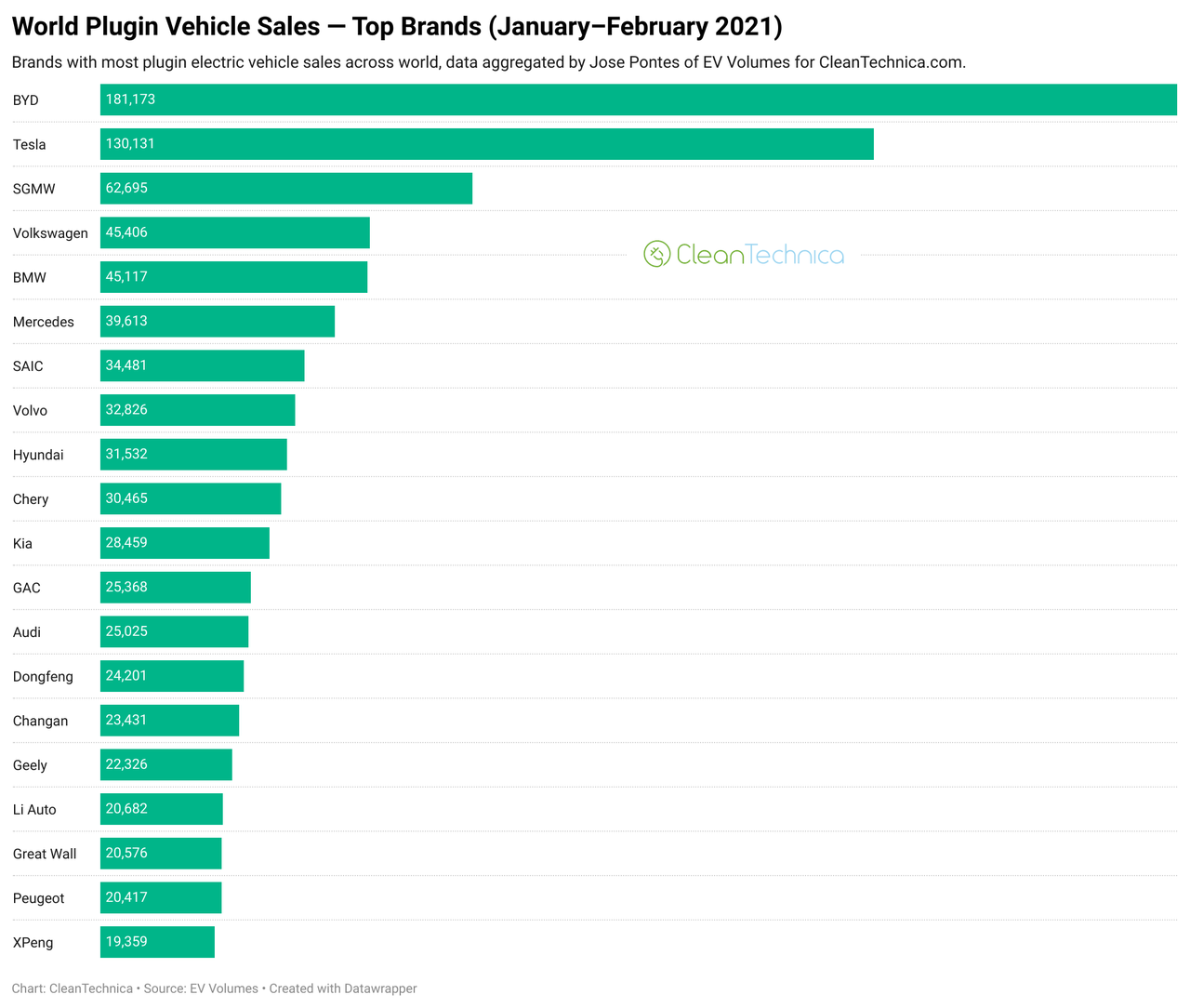

Global plugin electric car sales by brand for February 2022

Global plugin electric car sales by brand YTD in 2022

CleanTechnica

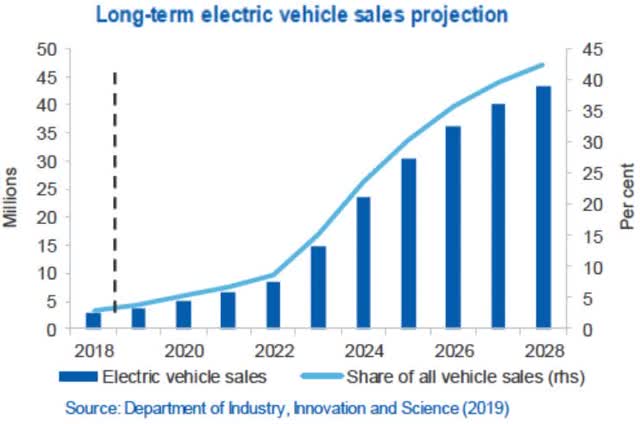

EV sales forecast to really take off from 2022 as affordability kicks in

The chart below aligns with my research that electric car sales will really take-off after 2022. It now looks like electric car sales already took off in 2021 with ~6.5m sales and 9% market share.

Mining.com Bloomberg Hyperdrive Bloomberg Hyperdrive

EV market news

On March 4 Electrek reported:

UK reaches new record electric car market share as Tesla Model Y debuts. The United Kingdom has reached new record electric car market share with 17% last month as Tesla debuted the popular Model Y in the market.

On March 7 Seeking Alpha reported: “Cathie Wood doubles down, calls top in oil as EVs set to “destroy” demand.”

On March 8 Seeking Alpha reported:

Electric vehicle stocks rip gains as oil battle rages on. News that the Biden Administration plans to ban Russian oil has sent a large part of the electric vehicle sector into a higher gear on Tuesday.

On March 9 CNBC reported:

Biden restores California’s ability to impose stricter auto pollution limits. The Biden administration is restoring California’s authority to set its own rules on greenhouse gas emissions from cars, pickups and SUVs… Seventeen states and the District of Columbia have adopted California’s tighter standards… The Biden administration’s decision will also help California move toward its goal of phasing out all new gas-powered passenger cars and trucks by 2035.

On March 10 InsideEVs reported:

Tesla reportedly sees 100% increase in orders in some areas of US. We predicted there would be a huge surge in EV sales as gas prices soar, and it appears to have already begun.

Note: Electrek also reported on March 10, 2022 – “Tesla (TSLA) order rate is surging in the US as gas prices are turning people toward electric cars.”

On March 11 BNN Bloomberg reported: “Senators urge Biden to invoke Defense Act for battery materials.”

On March 13 NPR reported:

How a handful of metals could determine the future of the electric car industry… Companies are betting hundreds of billions of dollars on electric cars and trucks. To make them, they’ll need a lot of batteries. And that means they need a lot of minerals, like lithium, cobalt and nickel, to be dug up out of the earth. These minerals aren’t particularly rare, but production needs to scale up massively – at an unprecedented pace – to meet the auto industry’s ambitions… Beijing controls about three-quarters of the market for the minerals that are essential for batteries… Demand for some mined products could scale up tenfold within a handful of years…

On March 18 CarSales.com.au reported:

Consumer interest in EVs at record high. CarSales search data reveals more and more people are considering an EV as their next car. Consumer interest in electric vehicles is at an all-time high as fuel prices continue to skyrocket, with EV searches at CarSales peaking at almost 20 per cent on March 13.

On March 19 CleanTechnica reported:

Germany gets on board with EU ICE ban… Politico reports that Germany has reluctantly and belatedly signed on to the 2035 ICE ban and will ditch plans to lobby for key exemptions to EU carbon dioxide emissions targets.

On March 21 Bloomberg Hyperdrive reported:

Two-minute battery changes propel India’s shift to E-Scooters… it costs just 50 rupees (67 cents) to swap out a single fully discharged battery, which is about half the price of 1 liter (¼ gallon) of gasoline.

On March 22 Electrek reported: “Electric cars are now three to six times cheaper to drive in the US as gas prices rise.”

On March 23 NPR reported: “Record high gas prices are driving demand for electric vehicles or EV.”

On March 25 Mining.com reported: “Morgan Stanley flags EV demand destruction as lithium price soars.”

On March 31 Seeking Alpha reported:

Biden invokes Defense Production Act to boost EV battery production… the Biden administration officially said Thursday it will use the Defense Production Act to boost domestic production of critical materials for batteries needed to power electric vehicles and the transition to renewable energy. The decision adds lithium, nickel, cobalt, graphite and manganese to a list of covered items, which could help mining companies access $750M under the Act’s Title III fund.

EV company news

BYD Co. [SHE: 002594] [HK:1211] (OTCPK:BYDDY) (OTCPK:BYDDF)

BYD is currently ranked the number 1 globally with 15.8% market share YTD. BYD is ranked number 1 in China with ~27.1% market share YTD.

On February 22 InsideEVs reported: “BYD sales in 2022 might reach 1.5 million plug-in cars.”

On March 23 Pandaily reported:

BYD invests in lithium developer Chengxin Lithium – Pandaily. Upon this issuance, it is expected that Shenzhen-based automaker BYD will hold more than 5% of the company’s shares. They will jointly develop and acquire lithium resources, and BYD will step up the procurement of lithium products for supply stability and cost advantages.

On March 24 Seeking Alpha reported:

“BYD, Shell forge charging partnership. The partnership, which will initially kick-off in China and Europe, will help enhance the charging experience for BYD’s pure electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) customers.

- BYD customers will have access to membership services encompassing over 275,000 charging terminals on Shell’s network.

- The partners also plan to jointly develop fleet solutions and exclusive charging services for BYD’s customers in key European markets.

- Furthermore, a joint venture will be established to develop an EV charging network in China. The JV is expected to operate over 10,000 EV charging terminals in Shenzhen, with plans to expand to other cities in China in the future.

- In addition to this, BYD and Shell plan to collaborate on global R&D in the areas of battery performance and charging…

- Shell entered into a similar partnership with NIO (NIO) – BYD’s local counterpart – last year.”

On March 26 CarNewsChina reported:

BYD to supply Blade Batteries to NIO and Xiaomi. Together with NIO, Xiaomi also signed a cooperation agreement with Fudi Battery…

On March 28 BYD reported: “São Paulo Metro Line 17 SkyRail vehicle rolls off production line.”

On March 30 CNEVPOST reported:

BYD’s order backlog reportedly reaches 400,000 units. BYD conservatively expects to sell 1.5 million vehicles in 2022, or 2 million if supply chain conditions improve.

On April 1 CarNewsChina reported:

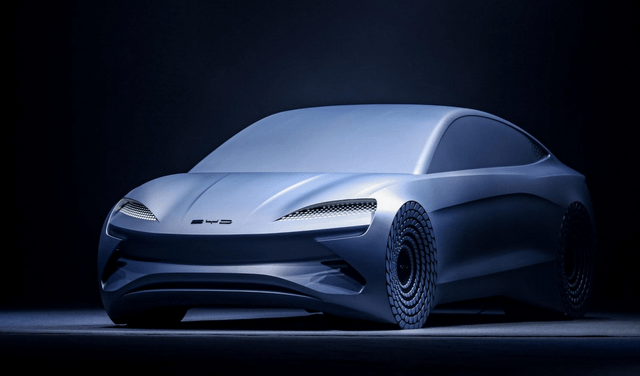

Official images of BYD Seal released. Model 3 competitor starts at 35,000 USD… The pure electric cruising range of the Seal is 700km with an 800V high-voltage platform. The Seal will be manufactured at BYD’s Changzhou base with a planned annual production capacity of 60,000 units and an expected monthly sales of 5,000 units… and designed based on BYD’s “Ocean X” concept car… it confirmed BYD Seal would launch in Australia branded as BYD Atto 4.

The BYD Seal is taken from the BYD Ocean X concept car

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked the number 2 globally YTD with 11.4% global market share. Tesla is number 3 in China with 6.4% market share YTD. Tesla is ranked 9th in Europe due to a slow January. Tesla is still the number 1 electric car seller in the US by far.

On March 4 Teslarati reported: “Tesla formally wins final environmental approval to open Gigafactory Berlin.”

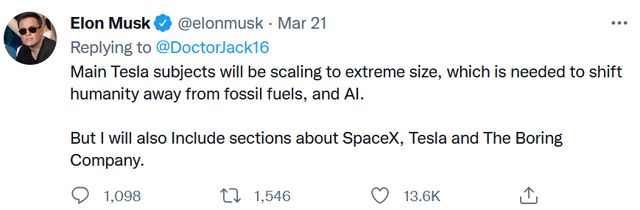

On March 17 Teslarati reported: “Tesla’s Elon Musk hints that he’s working on a “Master Plan Part 3″.”

On March 20 The Driven reported: “Tesla to open UK Superchargers to other EVs “within weeks or months”.”

On March 21 Teslaxnews reported: “Musk reveals plan to scale Tesla to ‘extreme size’.”

Source: Twitter @elonmusk

On March 22 Electrek reported: “Tesla Megapack selected for big new 300 MWh energy storage project to help renewable energy in Australia.”

On March 22 CNBC reported:

Elon Musk breaks out the dance moves as he opens new Tesla factory in Germany… Tesla sees the Berlin factory producing up to 500,000 vehicles annually… Troy Teslike, an independent Tesla researcher, tweeted that the firm is then hoping that vehicle output will hit 1,000 per week at the six week-mark following the start of commercial production, and then 5,000 per week by the end of 2022.

On March 22 Teslarati reported:

Tesla Giga Fest at Gigafactory Texas gains ultimate approval, ticketing likely to follow soon… Giga Fest will show Tesla fans and attendees a tour of the interior of its new factory, which began producing the Model Y crossover earlier this year. Tesla plans to hold the event on April 7.

On March 28 Seeking Alpha reported:

Tesla stock up as it plans for a stock split… Shares holders will vote on the measure at its upcoming 2022 Annual Meeting of Stockholders.

On March 30 Mining.com reported:

Tesla inks secret multi-year nickel supply deal with Vale… The yet to be disclosed agreement, reported by Bloomberg News, will see the Brazilian miner supply nickel produced in Canada to the EV maker…

Note: The Bloomberg report states: ” “People don’t realize how far ahead Tesla is when it comes to securing the supply chain for raw materials and an integrated approach to battery materials,” said Todd Malan, a spokesman for Talon Metals.”

Investors can read my June 2019 Blog post: “Tesla – A Look At The Positives And The Negatives”, where I rated the stock a buy. It was trading at USD 196.80 (post 5:1 stock split is equivalent to USD 39.36). Or my most recent Tesla article on Trend Investing – “A Brief Update On Tesla And What Is A Fair Valuation Today Plus My PTs For The Years Ahead.”

Wuling Automobile JV (SAIC 51%, GM 44%, Guangxi 5.9%), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus), Beijing Automotive Group Co. (BAIC) (includes Arcfox) [HK:1958) (OTC:BCCMY)

SGMW (SAIC-GM-Wuling Automobile) is number 3 globally with 8.5% market share year to date. SAIC (includes SAIC’s share of the SAIC/GM/Wulin JV (SGMW)) is 2nd in China with 13.7% share.

On March 3 GM Authority reported: “GM’s all-new Wuling MINI EV GameBoy edition revealed.”

On March 10 Electrive reported:

SAIC-GM-Wuling aims to double NEV sales. SAIC-GM-Wuling is aiming for annual sales of one million new energy vehicles [NEVs] as early as 2023. To achieve this, the Chinese joint venture also wants to invest heavily in development and also its own battery plant in China… The new sales target of one million NEVs in 2023 would thus correspond to more than a doubling compared to 2021.

On March 14 SAIC reported:

SAIC Motor reports 30.6% growth in Feb… According to official data, sales of SAIC Motor’s self-owned brands doubled in February… Sales of NEVs continued to soar, with more than 45,000 vehicles sold in February, increasing by 48.4 percent year-on-year. SAIC Motor continued to occupy an absolute dominant position in the domestic NEV market. SAIC-GM-Wuling’s Hongguang MINI EV also maintained sharp growth in sales…

You can read my Trend Investing article: “SAIC Motor Looks To Be A Good Buy Near The 5 Year Low”.

Volkswagen Group [Xetra:VOW] (OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda/ Bentley

‘Volkswagen Group’ is currently ranked the number 4 top-selling global electric car manufacturer with 8.3% market share YTD, and 1st in Europe with 18.7% market share YTD.

On March 3 Volkswagen reported: “Volkswagen stops production of vehicles in Russia and suspends export.”

On March 4 Volkswagen reported:

Go-ahead for new Trinity plant: Milestone for the future of the Wolfsburg production location… Supervisory Board approves new manufacturing site in Wolfsburg-Warmenau close to the main plant. Some €2 billion to be invested in production of the ground-breaking Trinity electric model. Production of Trinity from 2026 will be net carbon-neutral and will set new standards in autonomous driving, electrification and the digitalization of mobility…

On March 9 Volkswagen reported: “A Bulli for the all-electric future: World premiere of the new ID. Buzz.” Highlights include:

- “Design: The ID. Buzz transfers seven decades of Bulli know-how into the era of software and digitalisation.

- Software: Latest version brings state-of-the-art assist systems such as ‘Travel Assist with swarm data’ and automated parking to the range.

- Charging: ‘Plug & Charge’ technology enables the ID. Buzz to be easily charged while out and about with up to 170 kW.

- Energy storage: Bidirectional charging (Vehicle-to-Home) enables the integration of ID. Buzz into the home energy system.

- Interior space: The ID. Buzz provides space for five persons and 1,121 litres of luggage – and, as the Cargo, for two euro pallets.

- Market launch: This autumn in Europe. Advance orders can already be placed in some countries in May.”

The new ID. Buzz

Voklswagen website

On March 14 Volkswagen reported:

Volkswagen and Ford expand collaboration on MEB electric platform… “Ford to build another electric model based on the MEB platform. MEB volume to be doubled to 1.2 million units over lifecycle.

On March 18 Financial Times reported:

Porsche accelerates shift to electric after unexpected EV success. Brand’s first purpose-built electric car, the Taycan, was launched in 2020 and outsold the 911 in 2021. “In 2030, the share of all new vehicles with an all-electric drive should be more than 80 per cent,” said Oliver Blume, chief executive, who added that the transition was “running faster [than Porsche] planned years ago”.

On March 19 CarNews China reported: “Volkswagen to Unveil ID.Aero concept car on Beijing Auto Show.”

On March 22 Reuters reported:

VW targets $7.1 billion for North America, could build ID.Buzz there -executive. Volkswagen AG plans to invest at least $7.1 billion over the next five years in North America and add 25 new electric vehicles there by 2030.

On March 23, Volkswagen reported: “Volkswagen Group and SEAT reveal electrification plan for Spain.”

On March 24 Reuters reported:

VW plans to open Spanish battery plant near Valencia in 2026… Investment depends on securing government funds… Volkswagen said it would invest, with suppliers, over 7 billion euros ($7.7 billion) in the plant and in starting EV production at two Spanish factories… Volkswagen aims to build six large battery factories across Europe by 2030. The first plant by Northvolt in Sweden, in which Volkswagen holds a 20% stake, will begin production in 2022. A second in Germany will be built by 2025 with China’s Gotion High-Tech (002074.SZ), in which Volkswagen owns 26%.

On March 31 Reuters reported: “Giga-casting and robots: How Volkswagen’s Trinity aims to catch up with Tesla.

- Volkswagen finalising production plans for new EV factory

- Large die casting and more automation on the cards

- Aims to match Tesla with 10-hour car production time.”

Geely Automobile Holdings Ltd (OTCPK:GELYY, HK:0175), Volvo Cars, Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus,

Geely/Volvo is currently ranked number 5 in the global electric car manufacturer’s sales ranking with 6.3% global market share.

On March 2 Volvo Cars reported:

Volvo Cars reports sales of 42,067 cars in February, share of electrified cars increased to 33%… Sales of fully electric cars increased by 229.5 per cent compared with the same month last year and made up 7.9 per cent of total sales.

On March 22 Volvo Cars reported: “Volvo Cars expects reduced production due to temporary worsened semiconductor situation.”

On March 24 Lotus reported: “Lotus restarts Hethel factory tours after £100 million upgrade.”

On March 29 Lotus reported: “Lotus Eletre: the world’s first electric Hyper-SUV… Manufacturing at all-new hi-tech facility in China to start later this year.”

Lotus Eletre

Lotus website

Hyundai (OTC:HYMTF), Kia (OTC:KIMTF)

Hyundai-Kia Group is currently ranked number 6 in the global electric car manufacturer’s sales ranking with ~5% market share (not updated). Hyundai-Kia Group is ranked 3rd in Europe with 12.3% market share YTD.

On March 2 Hyundai reported: “Hyundai Motor accelerates electrification strategy, targeting 7% of global EV market by 2030.” Highlights include:

- “Hyundai Motor CEO Jaehoon Chang unveiled the company’s electrification roadmap and strategies at the 2022 CEO Investor Day forum today.

- Hyundai targets to sell 1.87 million BEVs annually by 2030 by strengthening line-up to introduce 17 new BEV models by 2030; 11 for Hyundai models and six for Genesis luxury brand

- To boost BEV production capability centered on high-demand regions. Company is considering adding a new dedicated BEV production facility.

- To maximize efficiency of lithium-ion batteries; to develop technologies for next-generation batteries as part of company’s comprehensive battery strategy…”

On March 17 Hyundai reported: “Record sales of EVs make Hyundai Motor one of the most electrified manufacturers in Europe.”

On March 21 Kia reported: “Kia EV6 triumphs in 2022 Red Dot Design Awards.”

Stellantis N.V. (NYSE:STLA) (merger Fiat Chrysler Group (FCA) and the Peugeot Group (PSA)) Ferrari

Stellantis Group is currently ranked the number 7 in the global electric car manufacturer’s sales with ~5% global market share. Stellantis is ranked 2nd in Europe with 15.9% market share YTD.

On March 16 Stellantis N.V. reported:

Stellantis Ventures launches with €300 million fund to propel innovation uptake. The fund will initially invest €300 million in early and later-stage startup companies developing innovative, customer-centric technologies that could be deployed within the automotive and mobility sector.

On March 23 Stellantis N.V. reported: “Stellantis affirms commitment to Italy with Automotive Cells Company’s [ACC] Planned Battery Plant Investment.” Highlights include:

- “ACC intends to build a third production site at the Stellantis facility in Termoli, Italy.

- Partners to accelerate ACC development with an objective of at least 120 gigawatt hours of cell capacity by 2030.”

On March 23 Stellantis N.V. reported: “Stellantis and LG Energy Solution to invest over $5 billion CAD in Joint Venture for first large scale lithium-ion battery production plant in Canada.” Highlights include:

- “Joint venture company to become first large scale, domestic, electric vehicle battery manufacturing facility in Canada.

- Facility to have an annual production capacity in excess of 45 gigawatt hours.

- Plant targeted to be operational in 2024 and create an estimated 2,500 new jobs.”

BMW (OTCPK:BMWYY), Mini, Rolls-Royce

BMW Group is currently ranked the number 8 global electric car manufacturer with ~3.9% global market share. BMW Group is ranked 4th in Europe with 11.9% market share YTD.

On March 3 BMW Blog reported: “BMW investing $200 million in new press shop At Spartanburg factory…”

On March 9 BMW Group reported: “Renewed success in meeting CO2 targets: BMW Group continues to pursue its consistent path of emission reduction in 2021.”

On March 16 BMW Group reported: “Transformation and responsibility: BMW Group steps up technological change for sustainable future.” Highlights include:

- “…E-mobility ramp-up: 15 BEV models in production.

- Electromobility: Neue Klasse will speed up market penetration – BEV share of 50 percent could be reached earlier.

- Neue Klasse brings technological advances in next-generation battery cells, automated driving, circularity and digitalisation.

- Lean, green, digital: Neue Klasse ushers in production of the future.

- Strong free cash flow for Automotive Segment in 2022.

- Share repurchase authorisation proposed.

- Zipse: “2021 provides evidence of successful transformation”.”

On March 16 BMW Blog reported: “BMW Neue Klasse EVs to be built in Munich From 2026.”

On March 25 BMW Blog reported: “BMW suspends production at two Chinese factories due to COVID-19.”

On March 25 BMW Blog reported:

BMW wants to build five battery gigafactories with partners… In the meantime, BMW says it will be teaming up with partners to build five battery gigafactories around the world. They’ll be strategically positioned where the company is making EVs in order to cut logistics costs…

Daimler-Mercedes (OTCPK:DDAIF, OTCPK:DDAIY) (Smart – 50% JV between Daimler & Geely) (NB: A proposal to rename Daimler to Mercedes Benz)

Daimler-Mercedes is ranked number 9 globally with 3.5% market share. Daimler-Mercedes is ranked 5th in Europe with 10.8% market share.

On March 3 Mercedes Blog reported: “Mercedes-Benz halts exports to Russia. The premium manufacturer will also cease manufacturing there until further notice…”

On March 11 Mercedes-Benz Group reported: “Mercedes-Benz establishes sustainable battery recycling: Own recycling plant to start in 2023.”

On March 15 Mercedes-Benz Group reported:

Mercedes-Benz EV ramp-up: new battery plant sets stage for EQS SUV production in the U.S. Mercedes-Benz opens a new battery plant in Bibb County, Alabama, a few months ahead of the start of production of all-electric Mercedes-EQ vehicles in the United States (U.S.).

Li-Auto (LI)

Li-Auto is currently ranked number 17 in the global electric car manufacturer’s sales ranking with 1.8% market share.

On March 1 Li-Auto reported:

Li Auto Inc. February 2022 delivery update… the Company delivered 8,414 Li ONEs in February 2022, up 265.8% year over year. The cumulative deliveries of Li ONE reached 144,770 since the vehicle’s market debut…

On March 14 Li-Auto reported:

Li Auto announces inclusion of its shares in the Shenzhen-Hong Kong Stock Connect Program…

On April 1 Seeking Alpha reported:

Li Auto delivers 125% increase in March deliveries. Li Auto delivered 11,034 Li ONEs in March 2022, an increase of 125.2% Y/Y, taking the Q1 deliveries to 31,716 (+152.1% Y/Y).

Great Wall Motors [HK:2333] (OTCPK:GWLLF) (OTCPK:GWLLY) [Ora]

GWM is currently ranked number 18 in the global electric car manufacturer’s sales ranking with 1.8% market share.

On March 30 Great Wall Motors reported:

GWM unveiling 6 models of NEVs, at 43th Bangkok International Motor Show… HAVAL H6 HEV, HAVAL H6 PHEV, HAVAL JOLION HEV and ORA GOODCAT were all on display. Among these models, ORA GOODCAT GT and TANK 300 HEV Concept Car was unveiled for the first time in Thailand and have received much attention.

GWM Making Appearance at 43th Bangkok International Motor Show

Great Wall Motors website

XPeng Inc. (Xiaopeng Motors) (XPEV) [HK:9868]

XPeng is currently ranked number 20 in the global electric car manufacturer’s sales ranking with 1.7% market share.

On March 1 XPeng reported: “XPeng announces vehicle delivery results for February 2022.” Highlights include:

- “6,225 vehicles delivered in February 2022, a 180% increase year-over-year.

- Technology upgrade for Zhaoqing plant completed to accelerate future deliveries.”

On March 10 XPeng reported: “XPeng kicks off P5 smart EV sedan reservation in 4 European markets and opens XPeng experience store in the Netherlands.”

On March 23 XPeng reported:

Xpeng P7 100,000th car rolls off production line… The 100,000th P7 rolled off the production line 695 days after its official launch on April 27, 2020, setting a record for pure electric vehicles from emerging auto brands in China. This accomplishment reflects customers’ recognition of the P7’s quality and smart functionality, as well as the efficiency of XPENG’s production, supply chain management, and sales and service network.

The 100,000th XPENG P7 rolls off the production line

XPeng website

On March 28 XPeng reported: “XPeng reports fourth quarter and fiscal year 2021 unaudited financial results.” Highlights include:

- “Quarterly vehicle deliveries reached 41,751, a 222% increase year-over-year.

- Quarterly total revenues reached RMB8,556.0 million, a 200.1% increase year-over-year.

- Quarterly gross margin reached 12.0%, an increase of 4.6 percentage points year-over-year.

- Full year deliveries were 98,155 vehicles, a 263% increase year-over-year.

- Full year total revenues reached RMB20,988.1 million.

- Full year gross margin reached 12.5%, an increase of 7.9 percentage points year-over-year.”

On April 1 Seeking Alpha reported:

XPeng reports Q1 deliveries ahead of estimates, March numbers surge 202%. XPeng… March deliveries at 15,414 Smart EVs (+202% Y/Y, +148% M/M); monthly delivery of the P7 smart sports sedan exceeded 9K for first time peaking to 9,183.

NIO Inc. (NIO)

On March 1 NIO Inc. reported: “NIO Inc. provides February 2022 delivery update.” Highlights include:

- “NIO delivered 6,131 vehicles in February 2022, increasing by 9.9% year-over-year.

- NIO delivered 15,783 vehicles in 2022 in total, increasing by 23.3% year-over-year.

- Cumulative deliveries of the ES8, ES6 and EC6 as of February 28, 2022 reached 182,853.”

On March 24 NIO Inc. reported:

NIO Inc. reports unaudited fourth quarter and full year 2021 financial results. Quarterly total revenues reached RMB9,900.7 million (US$1,553.6 million)…Full year total revenues reached RMB36,136.4 million (US$5,670.6 million). Full year deliveries of the ES8, the ES6 and the EC6 were 91,429 vehicles.

On April 1 Seeking Alpha reported:

NIO makes record deliveries in Q1. The company delivered 9,985 vehicles during the month and a record 25,768 units (+28.5% Y/Y) in the first quarter of 2022.

Renault [FR:RNO] (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

On March 14 Mitsubishi reported:

Mitsubishi Motors Krama Yudha Sales Indonesia signs MoU with Pos Indonesia, Haleoya Power, Gojek and DHL Supply Chain Indonesia to do a pilot study on commercial usage of electric vehicles…

On March 23 Renault reported: “Renault industrial activities in Russia are suspended.”

Ford (NYSE:F)

On March 2 Ford reported: “Ford accelerating transformation: Forming distinct auto units to scale EVs, strengthen operations, unlock value.” Highlights include:

- “Creates distinct electric vehicle and internal combustion businesses poised to compete and win against both new EV competitors and established automakers…

- Ford Blue will build out company’s iconic portfolio of ICE vehicles to drive growth and profitability – relentlessly attacking costs, simplifying operations and improving quality; will provide world-class hardware engineering and manufacturing capabilities for all of Ford.

- Ford Model e will accelerate innovation and delivery of breakthrough electric vehicles at scale, and develop software and connected vehicle technologies and services for all of Ford.

- Ford Blue and Ford Model e will operate as distinct businesses, but share relevant technology and best practices to leverage scale and drive operating improvements; along with Ford Pro, all three businesses are expected to have discrete P&Ls by 2023.

- Accelerates Ford+ plan to unlock growth and create value for Ford’s shareholders: total company adjusted EBIT margin of 10% and annual production of more than 2 million EVs by 2026; expect EVs to represent half of global volume by 2030.”

On March 14 Bloomberg Hyperdrive reported:

Ford steps up Europe EV push with seven all-electric models. Carmaker targets more than 600,000 electric car sales by 2026. Ford to invest $2 billion in EVs, batteries at Cologne plant… The U.S. carmaker is also doubling to $2 billion its planned investment at its key European production site in Cologne, Germany, to make electric vehicles as well as a battery assembly facility starting in 2024, Ford said Monday. The push is part of the automaker’s global plan to reach more than 2 million in EV sales.

On March 14 Ford reported: “Ford, SK and Koç set to create a Joint Venture to accelerate Ford’s electrification revolution in Europe.”

On March 15 Bloomberg Quint reported:

Ford plans giant EV battery plant in Turkey with SK, Koc… Ford’s Turkish partner will join forces with the U.S. automaker’s battery venture to build one of the world’s largest battery plants by 2025.

General Motors/Chevrolet (NYSE:GM)

On March 7 General Motors reported:

GM expands its North America-focused EV Supply Chain with POSCO Chemical in Canada. GM and POSCO Chemical to process cathode active material at new joint venture plant in Quebec. General Motors Co. and POSCO Chemical announced that they are working with the governments of Canada and Quebec to build a new facility in Bécancour, Quebec, estimated at $400 million (C$500 million). The new facility will produce cathode active material [CAM] for GM’s Ultium batteries, which will power electric vehicles such as the Chevrolet Silverado EV, GMC HUMMER EV and Cadillac LYRIQ.

On March 15 CNBC reported:

GM will begin production next week on the Cadillac Lyriq, the brand’s first EV model… The Lyriq, starting at $59,990, is the first of a new lineup of electric cars and SUVs for the brand as it plans to exclusively make all-electric vehicles by 2030. Rory Harvey, vice president of Cadillac, said it has seen “massive” interest in the Lyriq, citing more than 220,000 “hand raisers,” or people who have asked for additional information on the vehicle.

On March 21 General Motors reported: “Cadillac celebrates launch of LYRIQ at Spring Hill, Tennessee, Assembly Plant.” Highlights include:

- “LYRIQ sets the standard for the future of Cadillac.

- Launch marks another milestone in GM’s commitment to all-electric future.”

2023 Cadillac LYRIQ production begins

General Motors website

Toyota (NYSE:TM)/ Lexus

On February 28 Toyota reported: “Accelerating bus electrification toward achieving carbon neutrality.” Highlights include:

- “Isuzu and Hino to begin production of BEV Flat-floor Route Buses in FY2024.

- Isuzu, Hino, and Toyota to begin study for planning and development of next-generation FCEV Route Bus.”

Rivian Automotive (RIVN)

On March 10 The New York Times reported:

Rivian pares delivery targets for 2022, citing supply problems. The company said it expected to produce only 25,000 electric vehicles this year, adding a new cloud to its outlook only months after a hot I.P.O.

On March 10 Electrek reported:

Rivian announces Q4 results: loses $2.4 billion… Rivian confirmed that it produced only 1,410 vehicles so far in 2022, which is barely more than they did in 2021.

Lucid Group (LCID)

On February 28 Lucid Group reported: “Electric vehicle manufacturer Lucid Group gearing up for first international plant in Saudi Arabia after signing agreements with multiple agencies.”

On March 1 Teslarati reported:

Lucid Group lowers 2022 production forecast by around 30 percent. Lucid said on its Q4 2021 Earnings Shareholder Deck that it would be revising its 2022 targets, reducing them by around more than 20 percent. Lucid will aim for 12,000 to 14,000 units, citing supply chain constraints and “a continued focus on quality.”

On March 24 Lucid Group reported:

Lucid expands presence in Canada with Toronto Studio opening; Expects Canadian deliveries in Spring 2022; Collaborates with Electrify Canada.

Polestar Automotive Holding UK Limited (PSNY) via SPAC Gores Guggenheim Inc. (GGPI)

No news for the month.

Tata Motors (TTM) group (Jaguar, Land Rover)

On March 7 Tata Motors reported: “Tata Motors bags an order for 65 EVs from Kerala State Electricity Board.”

On March 15 Tata Motors reported: “Tata Motors receives an order for 250 EVs from Aurangabad Mission Green Mobility.”

GreenPower Motor Company Inc. [TSXV:GPV] (GP)

On March 1 GreenPower Motor Company Inc. reported:

Workhorse and GreenPower sign supply agreement for delivery of 1,500 GreenPower EV Star Cab and Chassis for Workhorse W750 Step Vans.

On March 23 GreenPower Motor Company Inc. reported: “GreenPower launches the Nano BEAST, a purpose-built, zero-emission, all-electric, Type A School Bus.”

GreenPower’s Zero-Emission Nano BEAST Type A School Bus

GreenPower Motor Company Inc. website

On March 24 GreenPower Motor Company Inc. reported: “GreenPower’s battery-electric vehicles eligible for up to $375,000 in California HVIP funds.”

Investors can also read my Trend Investing article on GreenPower here.

Workhorse Group Inc. (WKHS)

On March 1 Workhorse Group Inc. reported:

Workhorse Group reports fourth quarter and full year 2021 results. Sales, net of returns and allowances, for the full year 2021 were recorded at $(0.9) million compared to $1.4 million in 2020. The decrease in sales was primarily due to an increase in sales returns and allowances in connection with the recall of C-1000 vehicles announced in the third quarter of 2021…

Electric Last Mile Solutions Inc. (“ELMS”) (ELMS)

No news for the month.

Lion Electric (LEV)

On March 9 Lion Electric reported: “Lion electric announces partnerships with leading upfitters and new truck applications at NTEA Work Truck Week 2022.”

On March 23 Lion Electric reported:

Lion Electric hosts Federal and State Officials, Key Stakeholders at its upcoming Illinois Manufacturing Facility… The event showcased the advancement of Lion’s state-of-the-art manufacturing facility in Joliet, Ill. and highlighted how the recently passed Infrastructure Investment and Jobs Act [IIJA] will bolster clean manufacturing in the United States… The IIJA sets aside $5 billion in funding for the adoption of clean school buses to be administered by the EPA…

Nikola Corporation (NKLA)

On March 23 Nikola Corporation reported: “Alta Equipment Group expands Nikola Dealer Network to Arizona.”

On March 24 Reuters reported: “Nikola says started production of electric trucks on March 21.”

On March 29 Nikola Corporation reported: “Nikola and ENGS Commercial Finance Co. sign agreement to provide financing for zero-emission semi-truck sales.”

Near term potential EV producing companies

Faraday Future Intelligent Electric Inc. (FFIE)

On March 15 Faraday Future reported:

Faraday Future receives Nasdaq acceptance of plan to regain listing compliance… Nasdaq has granted the Company an extension until May 6, 2022 to file its Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 (the “Q3 Form 10-Q”). The extension also covers the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 (the “Form 10-K”).

Lordstown Motors (RIDE)

On February 28 Lordstown Motors reported: “Lordstown Motors reports fourth quarter and fiscal year 2021 financial results.” Highlights include:

- “Ended 2021 with a cash balance of $244 million, $79 million above the midpoint of the previously issued outlook on disciplined spending, favorable working capital, additional equity issuances and a deferral of certain investments into 2022.

- Executed the asset purchase agreement with Foxconn to initiate the Company’s strategic shift to a less capital-intensive business model focused on developing, engineering, testing and industrializing vehicles in partnership with Foxconn, with Foxconn manufacturing the Endurance in the Lordstown facility.

- Raised $182 million in capital, comprised primarily of $100 million in down payments by Foxconn for sale of the Lordstown facility, $50 million from the sale of common stock to Foxconn and $30 million in other equity issuances; an additional $50 million down payment from Foxconn was received on January 28, 2022.

- Began building and testing Endurance pre-production vehicles for validation and homologation.

- Strengthened the senior leadership team and managed a challenging operating environment throughout 2021, including the impacts of COVID-19 and supply chain disruptions.”

Outlook

- “Reaffirm third quarter 2022 target for commercial production and sales of the Endurance.

- Expect commercial production and sales of the Endurance of approximately 500 units in 2022 growing to as many as 2,500 units in 2023…”

Arrival (ARVL)

On March 3 Fleet Owner reported:

Arrival details 2022 sales targets, more than doubles backlog. The electric vehicle maker’s leaders are forecasting that 2022 capex will grow by about a quarter to roughly $400 million.

On March 7 Fleet News reported:

UPS alliance helps Arrival solve electric van riddle. Electric vehicle start-up specialist Arrival believes its collaboration with global delivery giant UPS will give it an edge when its first vehicle, a 3.5-tonne full electric van, goes into full production later this year. UPS, which has already placed an order for 10,000 vans, the first of which will be delivered this quarter, has helped to fine tune and evolve the design, technology and key features to maximise the vans’ usefulness, reliability and durability, after running trials for the past couple of years.

Hyliion Holdings (HYLN)

On February 28 Businesswire reported: “Hyliion Hypertruck Innovation Council Member GreenPath Logistics orders 50 Hypertruck ERX™ units.”

On March 22 Businesswire reported: “Mone Transport converts previous Hypertruck ERX™ reservation to 20-unit order.”

Fisker Inc. (FSR)

On March 16 Fisker Inc reported: “Fisker brings world’s most sustainable vehicle, the all-electric Fisker Ocean SUV, to Berlin.”

On March 29 Fisker Inc reported: “Fisker establishes environmental policy in advance of all-electric Fisker Ocean’s November 2022 start of production.”

Note: A 2020 Reuters article quoted: “Fisker is targeting initial sales of 8,000 SUVs in 2022, 51,000 in 2023 and 175,000 in 2024.”

You can read my Trend Investing article on Fisker Inc. here, or the European reveal of Fisker Ocean video here.

Canoo Holdings (GOEV)

On February 28 Canoo Holdings reported: “Canoo Inc. announces fourth quarter and fiscal year 2021 results.” Highlights include:

- “Finalized purchase agreement for 1,000 vehicles with the State of Oklahoma.

- Governor Stitt awarded $15M from the Quick Action Closing Fund to support Oklahoma job creation and economic development

- Finalized and announced our Advanced Manufacturing Facility in Bentonville, Arkansas.”

Proterra (PTRA)

On March 22 Proterra reported: “Proterra Announces multi-year battery supply agreement with the Shyft Group for Blue Arc Electric Delivery Vans and EV Chassis.”

Mahindra & Mahindra (OTC:MAHDY)

On March 22 Mahindra & Mahindra reported: “Quiklyz ties up with BluSmart to provide 500 EVs on leasing.”

On March 27 Rush Lanes reported: “Mahindra KUV100 Electric launch in 2022 – Before Tata Punch EV.”

EV fleet purchasing & financing

Ideanomics Inc. (IDEX)

On March 7 Ideanomics, Inc. reported: “Ideanomics secures threshold in Energica Motor Company SpA Voluntary Tender Offer.”

On March 28 Ideanomics, Inc. reported: “Ideanomics finalizes Energica Motor Company deal, acquiring 70 percent ownership stake in pioneering high-performance all-electric motorcycle company.”

Three wheel EV companies

Arcimoto Inc. (FUV)

On March 2 GlobeNewswire reported: “Arcimoto and Directed Technologies Launch Pilot Program to introduce ultra-efficient electric delivery vehicles into Australia.”

Electrameccanica Vehicles Corp. (SOLO)

No news for the month.

Electric Vehicle ETFs

- The Amplify Lithium & Battery Technology ETF (BATT) is a broad based EV related fund worth considering. It is currently a trading on a PE of 22.0. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles.

Other EV or EV related companies

Other EV companies I am following include Envirotech Vehicles (OTCQB:EVTV) (formerly ADOMANI Inc., Atlis Motors, Ayro, Inc. (AYRO), Blue Bird Corporation (BLBD), Blink Charging (BLNK), Byton (private), China Evergrande New Energy Vehicle Group [HK:3333], Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Guangzhou Automobile Group Co., Honda [TYO:7267] (HMC) (OTCPK:HNDAF), Mazda (OTCPK:MZDAY), Niu Technologies (NIU), Qiantu Motor, Sono Group N.V (SEV), (Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), WM Motor, and Zhi Dou (private).

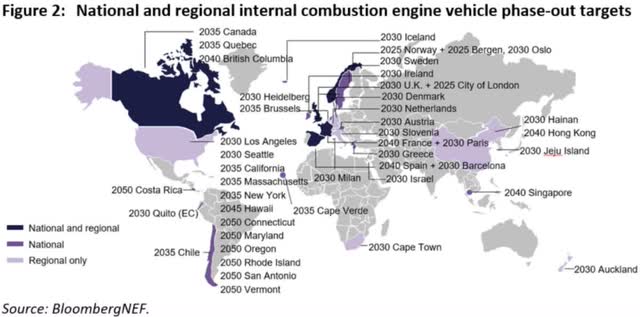

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least:

- Norway (2025); UK, Netherlands, Denmark, Sweden, Iceland, Greece, Ireland, Israel (2030); Scotland (2032); Hong Kong (2030-40); EU, Germany, Japan, Canada (2035); France, Spain, Egypt, Taiwan, Singapore, India, New Zealand and Poland (2040).

- Rome (2024); Athens, Paris, London, Stuttgart, Mexico City, Madrid (2025); Amsterdam, Brussels, Hainan (2030); California, New York, Quebec Province (2035); Sao Paolo, Seoul (2040).

Note: Wikipedia has an excellent list showing the phase out of fossil fuels in various cities and countries.

ICE vehicle phase-out target dates

Autonomous Driving/Connectivity/Onboard entertainment/Ride sharing [TaaS]/ EV leasing/renting

On March 30 Automotive News Europe reported:

Why the industry is considering a leap ahead to Level 4 autonomy. Why the industry is considering a leap ahead to Level 4, and skipping Level 3, on the road to fully autonomous cars.

On March 30 CNBC released an interesting article:

‘A ghost is driving the car’ – my peaceful and productive experience in a Waymo self-driving van… For me, riding in a self-driving van with no one behind the wheel truly highlighted the potential of autonomous vehicles, which some believe will be a multitrillion-dollar market for investors.

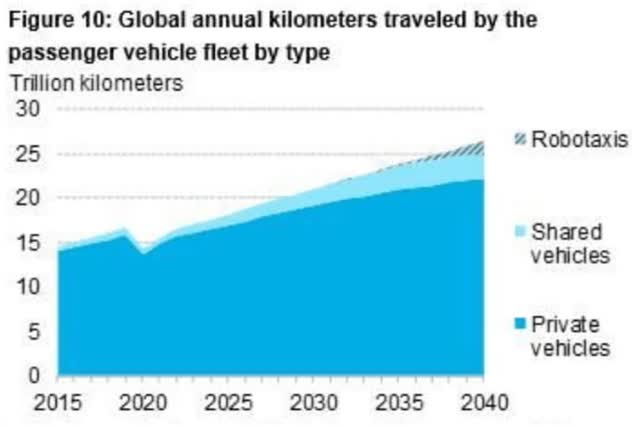

BNEF 2020 forecasts by fleet type

Conclusion

February 2022 global electric car sales were up 99% YoY and reached 9.3% global market share; 20% share in China, 20% in Europe, and no figures for the USA.

Highlights for the month were:

- UK reaches new record electric car market share of 17% in February.

- Cathie Wood doubles down, calls top in oil as EVs set to “destroy” demand.

- Electric vehicle stocks rip gains as oil battle rages on.

- Biden restores California’s ability to impose stricter auto pollution limits.

- Senators urge Biden to invoke Defense Act for battery materials.

- A handful of EV metals could determine the future of the car industry.

- Germany gets on board with EU ICE ban by 2035.

- Australia – Consumer interest in EVs at record high.

- Electric cars are now three to six times cheaper to drive in the US as gas prices rise.

- Record high gas prices are driving demand for electric vehicles or EV.

- Biden invokes Defense Production Act to boost EV battery production.

- BYD, Shell forge charging partnership. BYD to supply Blade Batteries to NIO & Xiaomi. BYD’s order backlog 400,000 units, expects to sell 1.5m vehicles in 2022, or 2 million if supply chain conditions improve.

- Tesla – Elon Musk breaks out the dance moves as he opens new Tesla factory in Germany. Tesla Giga Fest at Gigafactory Texas set for April 7. Musk reveals plan to scale Tesla to ‘extreme size’ in Master Plan 3. Tesla stock up as it plans for a stock split.

- SAIC-GM-Wuling aims to double NEV sales by 2023, new Wuling MINI EV GameBoy.

- Volkswagen AG plans to invest at least $7.1 billion over the next five years in North America and add 25 new electric vehicles there by 2030. Porsche – “The share of all new vehicles with an all-electric drive should be more than 80 per cent.”

- Geely – Lotus Eletre announced the world’s first electric Hyper-SUV, Lotus Eletre.

- Stellantis, LG announce $5.1-billion EV battery plant in Windsor, Ontario.

- BMW Group – E-mobility ramp-up: 15 BEV models in production.

- GWM unveiling 6 models of NEVs, at 43th Bangkok Motor Show.

- XPeng P7 100,000th car rolls off production line… XPeng reported March deliveries at 15,414 Smart EVs (+202% Y/Y, +148% M/M).

- Ford steps up Europe EV push with seven all-electric models, creates distinct electric vehicle and internal combustion businesses, plans giant EV battery plant in Turkey with SK, Koc.

- GM begins production on the Cadillac Lyriq.

- Lucid Group gearing up for first international plant in Saudi Arabia. Lucid lowers 2022 production forecast by ~30% due to supply chain issues.

- GreenPower launches the Nano BEAST, an all-electric school bus.

- Nikola says started production of electric trucks on March 21.

- CNBC report on autonomous driving experience – ‘A ghost is driving the car’.

As usual, all comments are welcome.

Be the first to comment