marchmeena29/iStock via Getty Images

eGain Corporation (NASDAQ:EGAN) is a promising stock, representing a share in a next-gen digital service provider, that I believe is a buy for investors. The post-Covid shift towards digitization and changing dynamics puts EGAN at the forefront of this change, positioning the company to be an industry leader in the near-term future. Its impressive ROCE calculations further reinforce its attractiveness from an investment standpoint. EGAN’s inclusion into any portfolio is likely to boost both growth as well as return on capital.

Company Overview

eGain Corporation is a company that operates in the domain of customer service infrastructure. It particularly focuses on cloud-based software solutions and professional services, based in California. It holds a presence in various markets spanning North America, Europe, the Middle East, and the Asia Pacific.

EGAN’s primary strategy rests on delivering solutions that ensure the automation of customer engagement mechanisms, along with its augmentation and orchestration. Its business model is sales-based, as well as subscription-based, whilst simultaneously offering professional services such as consultancy to its clients. As a result of E-Gain’s expertise, the nature of its services falls into multiple sub-sectors such as healthcare, telecommunications, financial services, retail, government projects, and others.

Gaining Foresight by Looking Behind: EGAN’s Price Trajectory

Looking back at the shifts in EGAN’s price, we can gain useful insight as to how the market has priced the stock, especially amidst global shockwaves and disruptions. In the last five years, EGAN price ballooned by a degree of seven times, whilst trading at $11.58 as of early April 2022. However, this ride has not been smooth, and the growth trend had frequently taken hits from external disruptions, yet has consistently managed to overcome these shocks. Where the growth from April 2017 to April 2022 amounts to 600%, the growth in the first 15 months of this timeframe was close to 1000%, which saw EGAN climb from $1.65 to nearly $18.

When the Covid-19 pandemic had hit the globe, industries faced shutdowns and global supply chains had seen serious disruption. However, for EGAN, this phase denoted tremendous opportunity, growth, and demand for its services. Businesses and organizations saw a shift to remote models, which brought about a surge in digital solutions offering online experiences to the business. Customer service had been extensively prioritized throughout this period.

The shifting market dynamics prioritized different areas that had been prioritized in customer service, such as phone wait times. EGAN was quick to recognize this and offer services that minimized phone wait durations. As a result, EGAN prices ballooned by over three times from March 2020 to November 2020, rising steadily from $5.81 to $18.33.

EGAN’s Covid-linked growth spurt was followed by a hard plummet following the release of its earnings report for fiscal Q1 2021. The company topped earnings estimates but missed expectations on revenue. Moreover, its financial outlook for the second was substantially below the expectations of Wall Street, leading to investors dumping the stock.

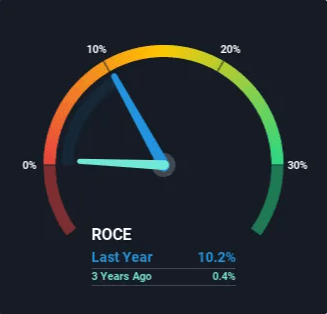

From then onwards, the price of EGAN rose and fell, eventually stabilizing at its present price of $11.59. Amidst the rises and dips of March 2022, EGAN had managed to gain 8.8% in its price. The earnings Q2 release from February 2022 gave EGAN a substantial boost upwards of 32%. By surpassing analysts’ expectations of an EPS of $0.03 per share, EGAN had managed to deliver an EPS figure of $0.10 per share. Due to this impressive financial performance and growth, the company’s return on capital employed (ROCE) climbed up from 0.4% to a staggering 10.2% in a mere 3-year timespan. This brings us to an in-depth discussion regarding the company’s ROCE.

Simply Wall St

The EGAN Comeback Story Links Closely to its ROCE Improvement

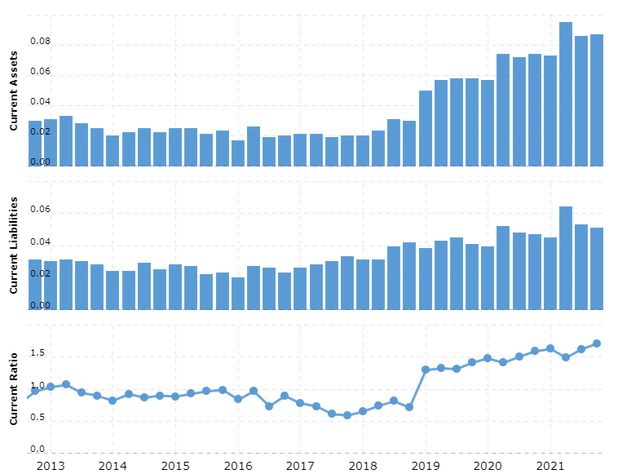

While in 2017 the company was reporting consistent losses, its ROCE figure of 10.2% indicates a turnaround for EGAN’s path from a capital burner to one adding value to its investor’s financial resources. This comeback also relates heavily to its capital utilization, which is 300% higher than where it stood in 2017. The company has grown in size and has improved in capturing opportunities. Furthermore, this increased ROCE and capital utilization has coincided with a 50% decrease in its current ratio, indicating that EGAN has grown robustly and sustainably instead of a pure debt-based growth surge.

EGAN’s balance sheet indicates it is standing in a far better position in paying off its current obligations than it was before. It comes as no surprise, therefore, that investors associate the improvement with a significant degree of risk reduction.

eGain Taking Customer Service to the Future

Just as the outbreak of the Covid-19 pandemic demonstrated, the nature of eGain holds immense potential in a time of crisis, the company has made a mark as a service provider of the future. The Covid-19 age has initiated several trends that relate to digital customer service and cloud-based solutions, which continue to influence the path the industry has taken as a whole. EGAN is increasingly proving to be a company looking to the future, and addressing upcoming challenges.

In March 2022, the company participated in the Mobile World Congress in Barcelona, where it announced the success story of its client firm from the telecommunications sector, BT Consumer. As a result of employing eGain solutions, BT Consumer completely restructured its customer service portal serving 20 million customers. Through the use of AI-based processes, it had managed to substantially improve both customer engagement, as well as retention. Most impressive, however, was the sheer cost-cutting that BT Consumers managed to implement as a result of eGain services, which saw optimization through the elimination of tens of thousands of customer service agents and store associates.

Moreover, research has indicated that the post-Covid shift to digitization has most significantly impacted customer experiences, along with employee management and operations. E-Gain’s focus has always been on enhancing customer experience, by ensuring a more personal experience achieved through emotional engagement. Through the use of AI tools and data analytics, E-Gain allows its clients to better understand its customers, and ensure value creation by shifting offerings based on these insights.

E-Gain corporation is, in many ways a torchbearer for progress in the world of digital services realm. Through its innovative use of artificial intelligence, investors hold grounds to anticipate future growth. As the global customer service industries shift to the digital space, eGain’s potential market capture continues to enhance. With its knowledge management approach developed during the Covid-era, eGain has redefined customer service through subcategorizing queries into informational, transactional, and situational divisions. In light of these developments, the company claims to be at the forefront of next-generation customer service, whilst “leaving competitors in the dust.”

Company Insiders Transactions: Risks and Prospects

To gain confirmation of the market prospects about EGAN, looking to insider transactions could prove highly insightful, given the information advantage company higher-ups have over the market. In early February, director Christine Russel’s option of 20,000 shares, vested in 2018, was exercised. This option worth $1.8 offered a substantial earnings premium over the then-market price of $12.21. Following the exercise of this option, Russell had sold all 20,000 of the newly acquired shares, given the sheer long-term appreciation brought about, as a result of EGAN’s growth. This could point to a potential risk for market shareholders. However, the director’s total ownership of 56,250 shares remained unaffected as a result of the transaction.

However, looking towards more positive insider transaction news, a new update had come about in late February 2022. In another option being vested, the CEO of eGain, Ashutosh Roy, gained 200,000 shares at the exercise price of $5.28. However, unlike the director Russell, the CEO decided to hold on to these newly added shares, pushing his total ownership up to 8,767,050 EGAN shares.

Although the newly exercised options remained minuscule compared to total ownership, the CEO chose to hold on to them, despite a potential sale profit of $1.25 million, and proceeds of $2.3 million, without impacting net ownership. This is a clear indication that the company’s higher-ups are of the view that holding on to their stocks will result in higher profitability than the present opportunity. It is clear that growth and profitability are anticipated by insiders, given their information advantage.

Remarks and Conclusion

EGAN is a stock that has its sights set high. However, unlike most companies that do, it has the financial performance to prove it as being upon this ambitious path of transformational growth. Looking at these factors holistically points to eGain stock being a clear buy for market participants.

The Covid-19 outbreak in 2020, whilst a crisis for global industry, proved to be an opportunistic shift for the company. Demand for digital customer service surged to an unprecedented degree. The company successfully grabbed on to this opportunity, and this was reflected in the explosive growth in its ROCE figures. This is, in large part, due to E-Gain’s innovative approach, and the use of AI-based processes that cut down costs substantially and enhance both customer engagement and retention, across several industries. Company insiders anticipate further profitability and growth realization yet to come.

Be the first to comment