James Neal/iStock via Getty Images

Published on the Value Lab 12/16/22

This year has been difficult for hydropower, and EDP (OTCPK:EDPFY) has been caught wrongfooted in its hydro business. Thankfully, that business is smaller than it used to be after they sold Iberian assets a couple of years ago, and wind and solar are doing well on precipitous price increases. Finally, networks remains entirely resilient thanks to its regulated nature. EDP looks good, but its investments in renewables are growing its debt quickly, and while fixed rate debt dominates, pressure is being put on its net income growth. Dividend stays the same.

Q3 Breakdown

EDP has two broad businesses: regulated and generation. Within generation is solar and wind and then the hydro business. In terms of EBITDA, everything did well except the hydro business.

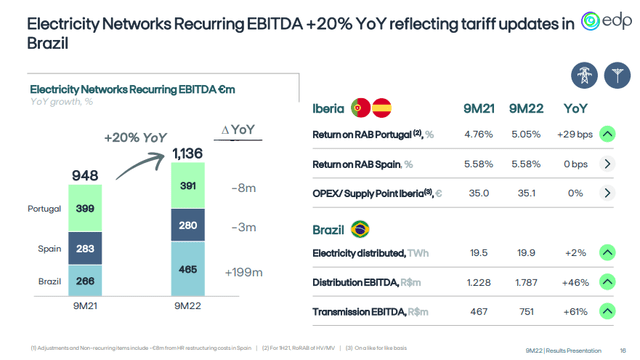

Networks (Q3 2022 Pres)

The regulated business saw growth driven by increases in tariffs for distribution and transmission in the Brazilian provinces in which EDP operates. Because of higher interest rates and inflation rates, the tariff was favourably increased, increasing remuneration of EDP for its regulated utility services. In other geographies, as is typical of a regulated utility, EBITDA was very flat, slightly pressured by inflation, but with RAB growth offsetting that inflation to increase their remunerating base.

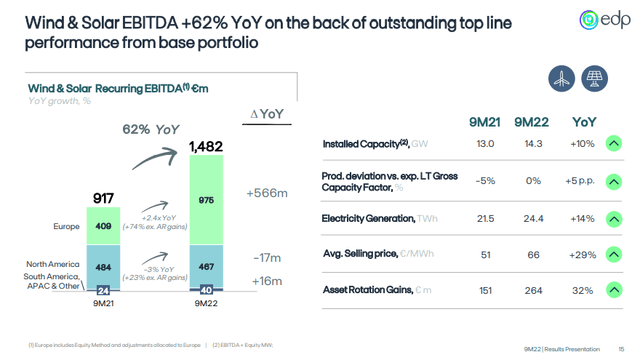

Wind and Solar Performance (Q3 2022 Pres)

Wind and solar generation were great. Selling prices in Europe grew massively and this drove the majority of gains. Assets are being fully utilised, and the growth in generation is accounted for by capacity generation growth and not utilisation growth. Some selling of developed assets explained about 25% of the EBITDA growth, a testament to EDP’s PE style model in a very hot infra and renewables private market.

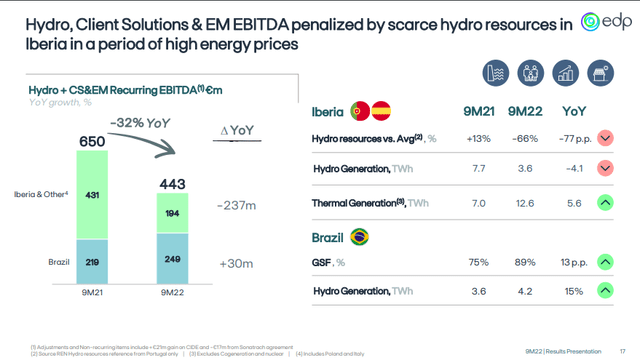

Hydropower Performance (Q3 2022 Pres)

Unimpressive were the hydro results. It was driven by pressure on reservoirs due to droughts. Generation halved, and thermal generation had to compensate to meet energy production needs and service PPAs with customers. This required inputs of either gas or coal, which is extraordinarily expensive right now. They were caught wrongfooted, much like Enel Chile (ENIC).

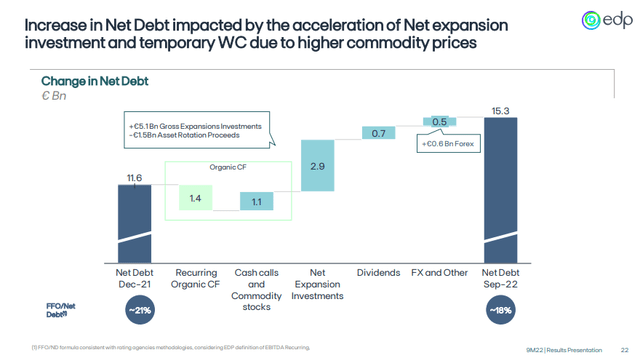

Net Debt (Q3 2022 Pres)

While capacity growth drives results, it required net debt to do. Capital raising occurred prior to the market shutdown, and the rates aren’t high at all between 1.7-3.3%. 69% of the debt is fixed too. But still, the net debt growth is a pressure on the bottom line. Net income was flat YoY despite strong operating performance.

Bottom Line

EDP remains a dividend cow. Its assets are valuable, and EDP is below points where in the past we have been buyers. Its PE is 20x, and dividend yield 4%, but its asset rotations show that it can flip its assets for great profits, and that is unlikely to change as they reap the benefits of renewable development. Moreover, they are rapidly growing assets in a technically sustainable way.

However, the market doesn’t seem to want to value EDP on a SoTP basis, based on private market multiples. In other words their PE-savvy model doesn’t get a lot of credit from markets. Also their net income growth is being stymied by higher capital costs. When they mature their model, we’ll see pretty meaningful deleveraging of their debt which is more than 5x FFO. We think there’s value here, and that among European utilities, EDP has the most vigorous strategy. Definitely for the watchlist.

Be the first to comment