Plyushkin/iStock via Getty Images

Investment Thesis

A recent PTAB ruling consolidated Editas Medicine, Inc.’s (NASDAQ:EDIT) power over foundational CRISPR patents, at least for now. Despite initial market excitement, which saw EDIT rise 9%, the ruling had a detrimental effect on the ticker as it highlighted the binary nature of the dispute’s outcomes: “Winner Takes All.” UC Berkley, University of Vienna, and Emmanuelle Charpentier, known collectively as “CVC,” announced intentions to appeal the verdict. Investors should expect a volatile ticker until the court sorts this issue permanently.

Market Position

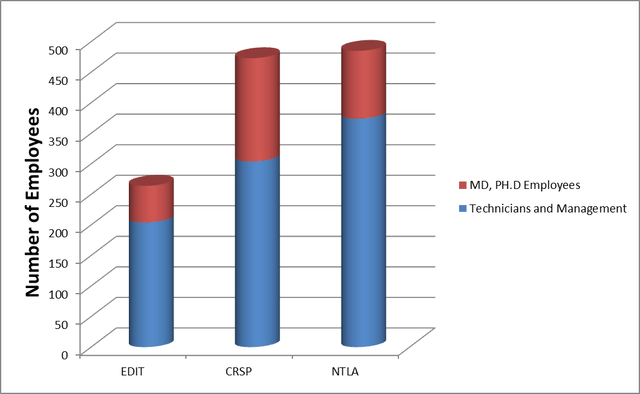

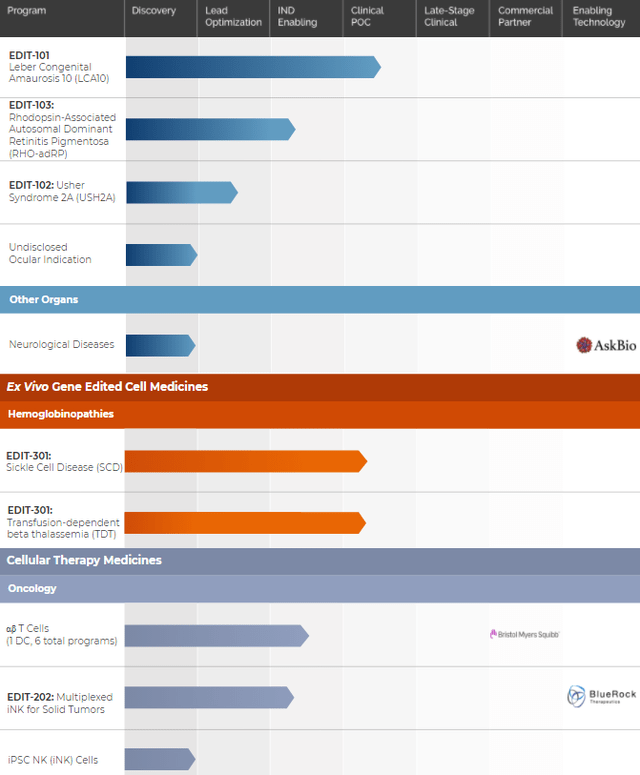

EDIT is smaller than its peers, with fewer scientists, clinical programs, and scientific progress. It has chosen a more trodden path than its peers, Intellia Therapeutics Inc. (NTLA) and CRISPR Therapeutics AG (CRSP), focusing on diseases with higher chances of clinical success than commercial appeal.

Editas Medicine, Intellia Therapeutics and CRISPR Therapeutics

Its clinical data has also been disappointing, mainly due to inconclusive results, partially from a poorly organized trial. Two Chief Medical Officers (“CMO”) resigned in less than a year, a major red flag for an early-stage biotech.

Its most advanced clinical program, EDIT-101, has low commercial prospects, and despite being touted as a “proof of concept,” its narrow technological moat is evident by similar therapies on the market. For example, Spark Therapeutics- now part of Bristol Myers Squibb (BMY) first introduced Luxturna in 2018, the first in-vivo, AVV, gene-editing drug targeting Leber congenital amaurosis “LCA.” The only major difference between EDIT-101 and Luxturna is that the former uses CRISPR in an AVV instead of a cDNA. The technological contribution of EDIT-101 is thus limited, given that neither CRISPR nor the delivery method AVV for subretinal injections is its own invention. EDIT-101’s primary advantages over Luxturna are inherent in the compactibility of CRISPR/Cas12 rather than any technological moat or know-how on EDIT.

EDIT also lags in the hemoglobinopathies space, a popular field among gene editing biotechs due to ease of delivery, clarity of biomarkers, and established literature. NTLA and CRSP are preparing to submit a BLA, while EDIT is screening patients to start the trial, placing it far behind in the race. EDIT’s B-Thal and Sickle Cell Disease “SCD” program uses the same strategy as CRSP and NTLA; suppressing a specific gene to achieve a biological balance of functional hemoglobin.

Commercial Prospects

Below is a commercial review of EDIT’s two programs in the clinical stage:

Ocular Diseases

EDIT-101:

EDIT’s investigational drug for LCA10 posted inconclusive results last September. Part of the problem was a disorganized and poorly managed clinical trial that is too small to draw a conclusion, especially when efficiency is less than 100%. Nonetheless, EDIT’s troubles pale against its peer, ProQR (PRQR), whose “puzzling” stage 2/3 clinical trial, as described by Citi analyst, failed to demonstrate the efficacy of its therapy, giving EDIT a second fighting chance in the race to develop a cure for LCA10 blindness. There is still a chance for EDIT-101 to demonstrate efficacy. Given the Orphan Drug designation, the FDA will be more lenient when assessing the risk/reward balance than it would if LCA10 patients had an alternative option.

There are around 2 thousand patients with LCA10 in developed countries, constituting a small market, making it hard to commercialize EDIT-101. LUXTURNA, which targets LCA RPE65, generated disappointing sales, despite pricing the drug at $850,000 per injection ($1.7 million for both eyes), casting uncertainty over EDIT-101 commercial prospects.

EDIT management stresses that its EDIT-101 program was a proof-of-concept that will now allow it to expand into other more lucrative markets, but it seems that investors’ patience has run out. Despite having a more robust market, EDIT-103, its second-most advanced ocular disease program, remains in the pre-clinical stage. PRQR estimates that 1 in 4000 individuals suffers from Retinitis Pigmentosa. Out of these, 30-40% are inherited autosomal-dominant RP. 25% of the remaining patients suffer from a mutation in the rhodopsin gene, the specific target of EDIT-103. The population of Europe and North America is 777 million. Back-of-the-envelope calculation puts the market size between 14,500 – 19,500 patients, more than LCA10, but still small, given that not all of these have the means to pay for the therapy.

For this reason, I believe that, although EDIT can leverage parts of its ocular in-vivo platform into other eye diseases, this will be a long process, with no clear path to profitability, or at least sizable revenue that compensates for the risks.

Hemoglobinopathies

EDIT-301

EDIT-301 is one of EDIT’s two programs in the clinical stage. It is a “2-in-1” drug targeting B-Thal and SCD, creating a sizable market, increasing chances of commercial success. However, this is a crowded market, with all CRISPR companies having the same program using the same strategy: increasing fetal hemoglobin levels.

EDIT Hemoglobinopathies program also lags behind its peers. CRSP is preparing for a BLA for its SCD and B-thal drug, the final step before marketing, while EDIT had only begun screening patients. The FDA often limits the label of new medicines to the worst cases that don’t respond to standard of care therapies, such as bone marrow transplants. By the time EDIT gains marketing approval, NTLA and CRSP medicines would have shrunk the patient pool manifested in this case in transfusion-dependent patients.

Financial Position

EDIT ended 2021 with $620 million in Cash and Marketable Securities, enough for a couple of years, depending on how fast it progresses its programs. Generally speaking, the more advanced a clinical trial, the higher the expenses. The company has $123 million in operational debt, consisting of accounts payable, accrued expenses, and deferred collaboration revenue, but no financial debt, given that early-stage biotechs are non-bankable, mirroring the speculative nature of the ticker.

Regarding the patent win, EDIT now has a non-exclusive license from the Broad Institute. However, if other CRISPR companies wish to cross-license patents across the Atlantic, this arrangement must come from the CVC and the Broad rather than CRISPR biotechs. Thus, I don’t see significant monetary benefits from the patent win beyond the US commercial rights of the key CRISPR patents used in EDIT’s pipeline.

Given its lagging programs, EDIT will most likely raise additional capital at some point, and the recent ticker slump will translate into more shareholder dilution. Moreover, EDIT has fewer partners than its peers, leaving it alone in lifting the development and commercialization burden.

Summary

Clinical success doesn’t always translate to commercial success in the biotech world. EDIT focuses on rare genetic eye diseases that have proven challenging to commercialize. Although 2 million individuals worldwide suffer from inherited eye blindness, the market is fragmented, with several hundreds of gene mutations underlying these ailments. Thus, hopes of a blockbuster therapy from one program are slim.

Two of EDIT’s CMOs resigned in less than twelve months. This is a significant red flag, mirroring the lagging status of its pipeline compared to peers. EDIT will most likely trade at a discounted valuation compared to its peers, NTLA and CRSP, despite the patent win, which only covers the US region and excludes a critical market for rare diseases in Europe, where CVC has the legal upper hand. The Broad is calling for a truce with CVC, citing benefits for the medical and scientific community, which, in my view, would incorporate cross-licensing across both sides of the Atlantic.

I maintain shares in EDIT as a speculative trade. In my view, the CRISPR underdog is the ripest for an M&A, especially in light of the recent patent win.

Be the first to comment