Khanchit Khirisutchalual

Investment thesis

Ecovyst (NYSE:ECVT) share prices have decreased by around 35% from all-time highs of $14.49 in March 2021 as a result of a recent stabilization of sales, little growth expectations for 2023, and fears of a potential recession that could impact the company’s operations. But despite this, Ecovyst’s operations have remained intact since its restructuring process and the company’s gross profit and EBITDA margins are very high, which allows for vast amounts of cash generation.

The level of debt has steadily decreased over the years and has given way to the establishment of a very ambitious share buyback plan, which will represent the way in which the management rewards shareholders for holding the company’s shares in the long term. In the following article, I will explain why I believe the current share buyback plan is destined to succeed and why Ecovyst is a company worth owning.

A brief overview of the company

Ecovyst, whose name was changed from PQ Group Holdings Inc. in August 2021, is a leading provider of specialty catalysts and services. The company was incorporated in August 2015 as a result of the business combination with Eco Services Operations LLC and the IPO was completed in October 2017, but the business has its roots back in 1831. Since 2019, the company has transformed its operations by divesting two major business segments and exclusively becoming a provider of products and solutions aimed to improve the sustainability profile of the operations of refineries and plastic manufacturing processes around the world.

The company’s products represent environmentally friendlier alternative products to meet the environmental standards of the company’s customers, and its operations are divided into two main segments: Ecoservices and Catalyst Technologies.

Under the Ecoservices segment, the company provides sulfuric acid recycling and end-to-end logistics to North American refineries for the production of alkylate, a gasoline blending component required for meeting gasoline specifications and for the production of premium-grade fuel. The company also provides on-purpose virgin sulfuric acid for water treatment, mining, and industrial applications.

Under the Catalyst Technologies segment, the company provides silica-based catalyst products and process solutions to leading producers and licensors of polyethylene and methyl methacrylate for the manufacturing process of high-strength and high-stiffness plastics used in packaging films, bottles, containers, and other molded applications. Under this segment, the company also manufactures zeolite-based emission control catalysts used for the removal of nitrogen oxides from diesel engine emissions, as well as sulfur dioxide from fuels during the refining process, which is essential for refining, petrochemicals, and emission control systems for both on-road and non-road diesel engines.

The purpose of the company is to capitalize on the growing need to opt for the use of low-carbon technologies for the preservation of the environment, helping producers to comply with environmental standards. The company counts on long-standing relationships with blue-chip customers, which ensures continuous revenue streams.

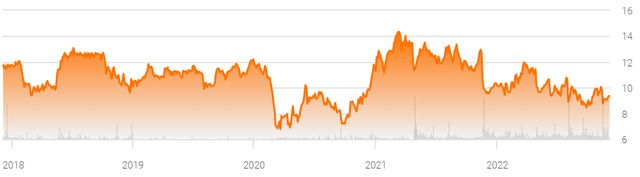

Ecovyst share price (Seeking Alpha)

Currently, shares are trading at $9.36, which represents a 35.40% decline from all-time highs of $14.49 on March 11, 2021. This decline has taken place despite the completion of what we could call a successful restructuring process, and this is due to a stabilization of sales after a period of growth in 2021 and in the first half of 2022, as well as increasing fears of a potential recession impacting the U.S. economy due to rising interest rates.

The restructuring process has been finished

Since 2019, the company has divested a large part of its businesses, thus becoming a major provider of specialty catalysts and sulfuric acid products and services, and reducing its debt pile with the cash obtained through the sales of said businesses.

In August 2019, the company sold a non-core product line of the Performance Chemicals segment for $28 million. More than a year later, in December 2020, the company also completed the sale of its Performance Materials business to Potters Buyer, an affiliate of The Jordan Company, for $650 million.

In March 2021, the company acquired Chem32, a high-margin leading supplier of catalyst pre-activation services used in the production of traditional and renewable fuels, for $44 million. And later, in August 2021, the company finally sold its Performance Chemicals business for $1.1 billion with the intention to reduce its debt pile by around $525 million and return cash to shareholders with a special cash dividend of $3.20 per share.

The remaining business is what we know today as Ecovyst, whose evolution is so far positive in terms of sales and cash from operations. As of this moment, the company has entered a new stage that should be marked by the reduction of its remaining debt pile, the distribution of cash from operations to shareholders, mostly in form of share buybacks, and potential acquisitions in line with the current business model of the company.

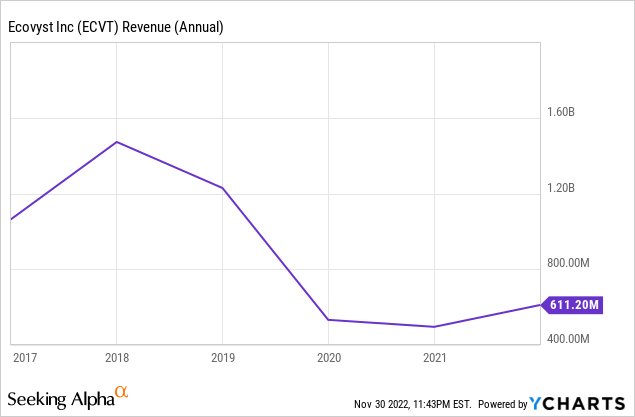

Revenue has stabilized and is showing signs of growth

As a consequence of the divestments of the businesses mentioned, sales have fallen over the years. This major decline was to be expected and, in fact, necessary since the company had a huge debt, but sales somewhat stabilized in 2020 with a decline of 6.91% and increased by 23.25% in 2021 to $611.20 million. Furthermore, revenues are expected to reach $826.31 million in 2022, which will represent a 35.19% increase compared to 2021. This feat is in fact more than feasible considering the current trailing twelve months’ sales of $807.6 million, and after that, revenue is expected to stabilize at $829.81 million in 2023, which represents a further 2.75% increase compared to 2022.

If we look at the most recent evolution of sales, they increased by 41.93% year over year during the first quarter of 2022, by 53.23% during the second quarter, and by 38.89% during the third quarter, delivering all together a year-to-date increase of around 45%. These increases are boosted by tighter fuel standards in the United States, increasing demand for premium gasoline, higher demand for petrochemical applications, and higher global polyethylene demand.

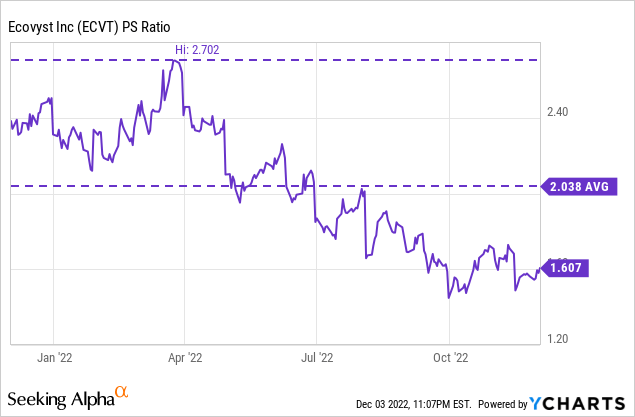

Using 2021 as a reference, only ~6.5% of the company’s sales take place in foreign countries, whereas 93.5% take place in the United States. The recent decline in the share price has caused a price-to-sales ratio decline to 1.607. In this sense, and although it is true that the company has operations internationally, geographic diversification is very limited, which increases the risk profile for investors as the company’s operations essentially depend on the environmental laws of the United States. But the current decline in the share price is not directly linked to this factor, but rather to the stabilization of sales and the instability that the current macroeconomic scenario implies for future revenue and profit margins.

A 1.604 PS ratio means that the company generates revenues of $0.62 for each dollar held in shares by investors, annually. The current ratio is 21.15% lower than the past year’s average of 2.038, and 40.53% lower than the highest peak of 2.702, and this means that investors are giving a lower value to the company’s sales because, on the one hand, they are showing signs of stabilization as a very slight rise is expected for 2023 and, on the other hand, as a consequence of the risks that the current macroeconomic landscape, mostly a potential recession, poses for the company.

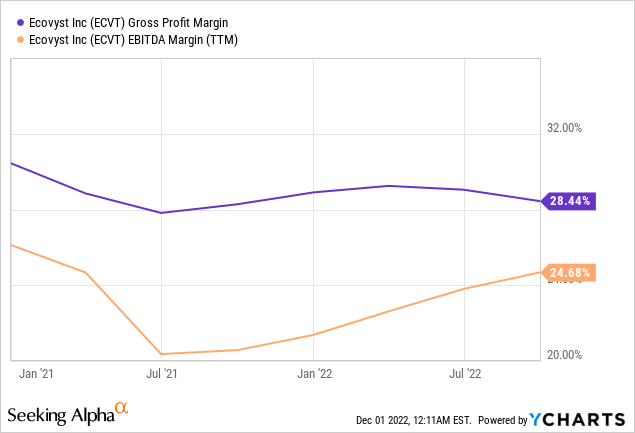

The company is highly profitable

The company is currently navigating a very complex terrain as it faces labor shortages, inflationary pressures, increased prices for raw materials, and increased energy costs. And to all this, we must add the current risk of the US economy entering a relatively deep recession.

But despite all these headwinds impacting virtually all the economies (and companies) around the globe, the resulting business after the divestitures of the Performance Materials and the Performance Chemicals segments is delivering gross profit margins of ~30% and EBITDA margins of over 20%, which means the company is highly profitable.

These high margins are possible thanks to the company’s ability to pass increasing production costs to customers, and thanks to maintaining a very high level of profitability the company is generating vast (and increasing) amounts of cash from operations, which is essential to continue reducing its debt pile and continue with its current share repurchase program.

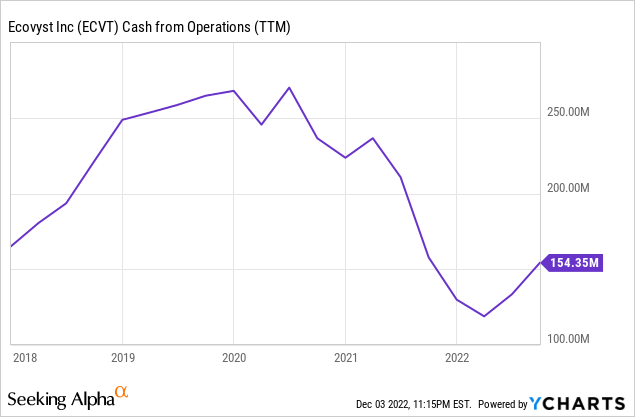

In this sense, trailing twelve months’ cash from operations currently stands at $154.35 million despite an increase of $1.6 million in inventory and $25.9 million in accounts receivable during the same period while accounts payable have only increased by $2.8 million. In short, the company in its current state is generating enough cash from operations to make its level of debt very manageable and its share repurchase program viable.

The company’s debt is widely manageable

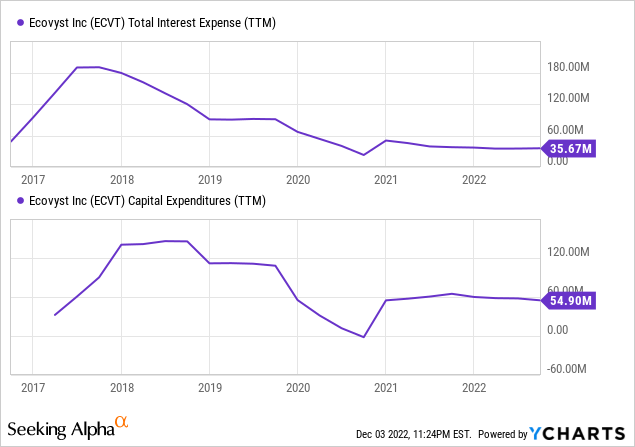

This high cash from operations is more than enough to cover current annual interest expenses of $35.67 million and capital expenditures of $54.90 million, which makes the company’s debt load highly manageable. Currently, this debt load does not pose an excessive risk to the company’s operations and future.

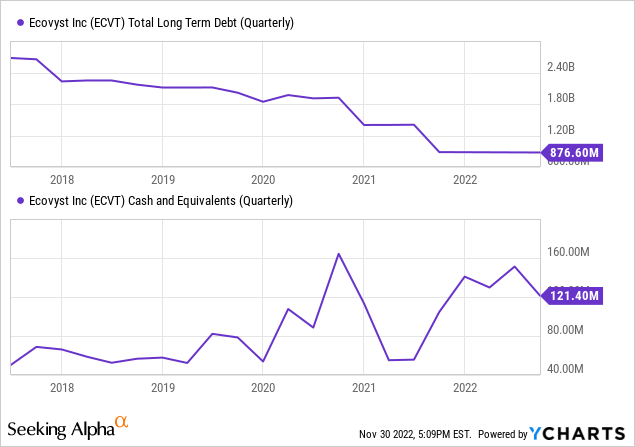

Since the company went public, its debt pile has decreased very steadily in part thanks to the two major divestments of 2020 and 2021. Actually, it could have done so at a much higher rate but has distributed part of the proceeds to shareholders through a special dividend of $1.80 per share after the divestment of the Performance Materials business segment in 2021, which represented an expense of $243.75 million, and a special dividend of $3.20 per share after the divestment of the Performance Chemicals business segment in 2021, which represented an expense of $435.59 million. Also, the company started to buy back its own shares in 2022 under its recent massive share repurchase plan.

This low-risk profile is the result of the fact that the interest expenses of $35.67 million represent only 23% of the current trailing twelve months’ cash from operations of $154.35 million, and this is despite the fact that I have not taken into account the increase in inventories and accounts receivable during the same period. Furthermore, the company has $121.40 million of cash on hand, with which it is prepared to go ahead with its plans even if it has to face a short to medium term setback.

Share repurchases will increase investors’ positions over time

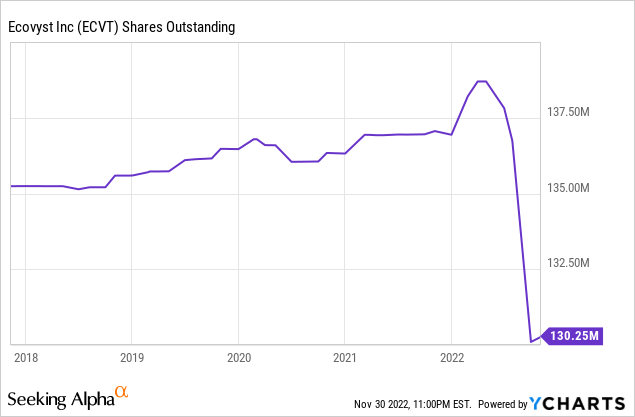

After the completion of the company’s restructuring process, the management has been inclined to reward shareholders via share buybacks in an aggressive way. So far, the total number of shares outstanding has decreased by 4.88% year to date.

More specifically, in April 2022, the company announced a $450 million share repurchase plan over the next four years, which, although very ambitious (remember that the current market cap stands at $1.22 billion), is actually quite feasible to a great extent thanks to high cash on hand and cash from operations despite the essential risk of not being fully applied due to current macroeconomic headwinds and uncertainties. The current 4.88% decline in the total number of shares outstanding is the result of the announcement of a share repurchase of 6.5 million shares in August 2022, and the management has already announced another share repurchase of 8 million shares with cash on hand and cash from operations in November 2022, with which the total number of shares outstanding should decrease by another ~6%.

This means that each share represents an increasing portion of the company, thus improving per-share metrics. Share buybacks are an indirect way to reward shareholders in the long run as their positions will grow over the years, and this should boost shareholders’ capital gains, in the long run, should operations remain healthy.

Risks worth mentioning

In general, the company’s risk profile is not high since its profitability is very high and its products respond to an imperative trend for the preservation of the environment. But despite this, there are some risks that are very important to take into consideration for an investor determined to invest in Ecovyst shares.

- The current level of debt is highly manageable as the company covers current interest expenses and capital expenditures with ease. But despite this, it is still a relatively high level of debt that could become problematic if cash from operations decreases in the short and/or medium term. In this sense, a potential recession, a decrease in volumes as a result of a new headwind, or a deterioration in profit margins could mean that said cash from operations would not cover interest expenses so easily.

- The company has a very high exposure to the US market, which makes its operations very sensitive to legislative and economic changes in the country.

- The irruption of electric vehicles in the automotive market could have a negative impact on the demand for some of the company’s products since Ecovyst is focused on combustion engine cars. In the long term, the company may find it necessary to look for new markets to expand in order to compensate for a possible loss of volumes in the industry, which may not be achieved successfully.

- The current share buyback program may not be fully completed if the company’s operations weaken in the short and medium term. While this is always a risk to consider when dealing with massive share buyback programs, it is an event I consider highly unlikely. It is important to consider that the company is currently generating a trailing twelve months’ cash from operations of $154.35 million, a trailing twelve months’ increase of $1.6 million in inventories, and $25.9 million in accounts receivable. Even if we subtract the increase of $2.8 million in accounts payable, we still get $179.05 million, and the company has to face only ~$90.5 million of interest expenses and capital expenditures annually. At the current cash generation rate, the company could cover the entire share buyback program and still have over $100 million excess cash left in four years to reduce its debt pile or make a minor acquisition. In addition, the company has $121.40 million of cash on hand, which gives it even more leeway.

Conclusion

I consider that the current share price decline represents a good opportunity for long-term investors. Ecovyst is poised to deliver juicy returns to investors over the years thanks to the high-profit margins of its business model, and at the moment the management has decided to do it through a massive share repurchase program that is poised to be fully completed successfully over the next four years.

Long-term debt has steadily declined over the past few years and current cash from operations widely cover interest expenses and capital expenditures. Furthermore, the products that the company offers respond to an increasing need for the preservation of the environment, and customers need Ecovyst products to improve the environmental profile of their operations and to comply with the laws, which gives Ecovyst an edge.

Be the first to comment