braclark

Co-produced with Treading Softly

Recession! Inflation! Interest Rates rising! All have been big headlines lately, sometimes all three in one title:

With the latest inflation numbers hitting the 9% range. The market is expecting the Federal Reserve to move again with another large rate hike. These hikes are designed to combat inflation but also are body blows to the economy.

The reason interest rate hikes reduce inflation is because they lower demand. They make it more expensive to borrow and therefore discourage spending. In other words, the Fed is trying to slow inflation by making consumers poorer. If the Fed goes too far, then a growing economy can tip into recession.

It’s a delicate balancing act.

Do I see a recession on the horizon? Definitely.

It is not a question of if there will be a recession, it is a question of when. Most recessions are not the level of the Great Financial Crisis. Most are a yawn for the market except a few sectors and once it’s over the market resumes its upward climb.

This means income investors with a long-term horizon should not reduce their exposure to the economy and market but should look for opportunities to expand it while others are selling out.

Do I see an economic calamity on the horizon? No.

I do see massive income investment opportunities all over the market due to the recency bias of investors who lived through the Great Financial Crisis. Many investors are selling without asking questions.

When the recession comes, what will it look like? Will it look like the Great Financial Crisis, where financials and real estate were pummeled while “Growth” stocks performed relatively well? Or will it look like the Dot-Com bust where Growth plummeted while financials, real estate, energy, and other “Value” sectors held up well?

The bottom line is we don’t see the credit excesses we saw in the mid-2000s. We don’t see companies leveraged to the hilt, consumers taking out mortgages at 120%+ LTVs, banks that are pushing the envelope, or other red flags that would indicate a financial crisis. Instead, we see more of a valuation crisis for those stocks that were bid up to nosebleed levels during COVID. We see spending growth below inflation levels but still growing. Across the economy, we see cutting back or slowing down, but we aren’t seeing collapse.

The market is dipping, and recession will come. Yet, any recession will likely be much milder than the market is fearing. As prices fall, we can take advantage of higher yields and buy a larger income.

Today, I want to present two picks that will give you a wide exposure to all aspects of the economy and market. An excellent way to cast a wide net and benefit from the opportunities presented before us.

Let’s dive in.

Pick #1: ECC – Yield 14%

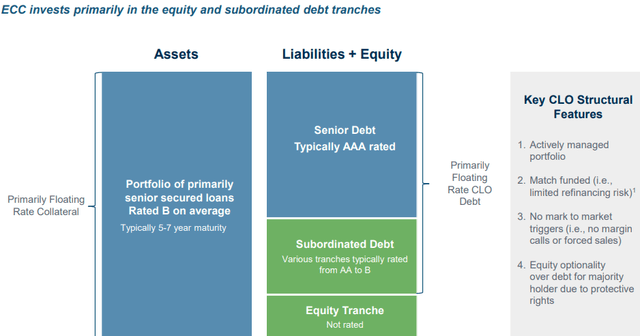

Eagle Point Credit Company Inc. (ECC) is a CEF (closed-end fund) that invests in CLO (collateralized loan obligations). We’ve talked about CLOs a lot, yet it is a sector that remains mysterious for many, thus many investors are very cautious about anything they find to be mysterious. I don’t blame them!

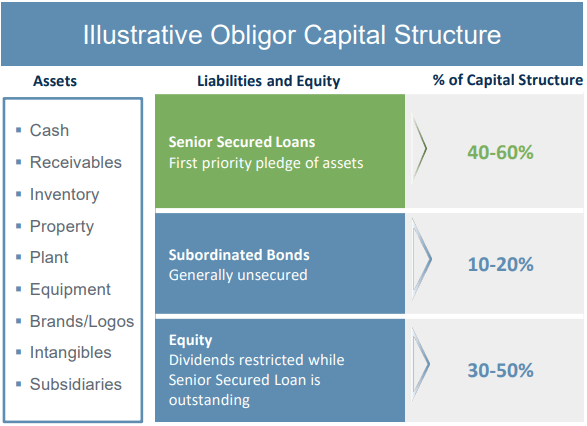

What is a CLO? It is a collection of bank loans. The CLO buys up bank loans and then leverages them up by taking on debt. Like all debt, the lender has the right to get paid first. Like all debt, there are various covenants and restrictions to protect the lender. In the CLO world, they are called senior and junior “debt tranches”, but are they really all that different from company XYZ taking out a first and second lien secured loan? No. Functionally, they are very similar.

Like all leverage, the loans that the CLO takes out work to increase the return to the equity. The same way that any other company takes out loans in order to improve returns per share for the equity. The terms are different, but the structure is fundamentally the same.

Here is a look at a CLO’s structure. (Source: ECC, Quarterly Update Q1 2022)

Note you have a portfolio of senior secured loans (bank loans aka “leveraged loans”) as the assets, and on the liabilities side, you have senior debt and subordinated (junior) debt, with the rest being equity.

Here is a look at the typical borrower’s capital structure:

ECC, Quarterly Update Q1 2022

Note, that they are fundamentally the same. Senior debt, subordinated debt, and then equity. Really, every company on the planet has a similar basic structure. Senior debt, subordinated debt, and equity. The percentages of each can vary, and you might have some complications like asset-based debt that has a senior claim to specific assets but no claim to others. You might have preferred equity, convertible debt, warrants, etc. But ultimately, it all goes back to the basic corporate structure where you have a few levels of debt and then equity.

When you are buying the stock for XYZ company, you are buying the equity. The bottom of the capital stack, the last in line. All those liabilities? They all have to be paid as agreed before your shares are entitled to a penny of earnings.

So what is a CLO? For all practical purposes, it is a company that is tasked with owning loans for investment purposes. The CLO buys loans, and like most companies, takes out debt to improve returns.

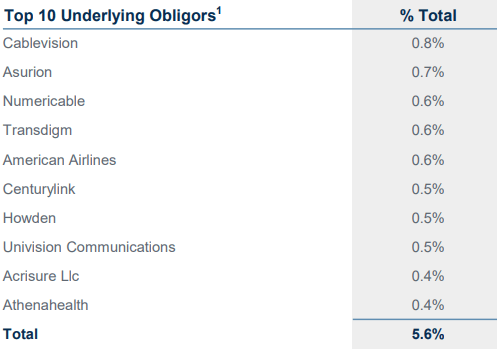

What does ECC do? It buys equity positions in CLOs. Through these positions, ECC has exposure to 1,852 unique borrowers. And these aren’t fly-by-night companies, all of them have public credit ratings and many of them are publicly traded.

ECC, Quarterly Update Q1 2022

What about industry diversification? ECC is invested in many industries such as Technology, Healthcare, and Publishing:

ECC, Quarterly Update Q1 2022

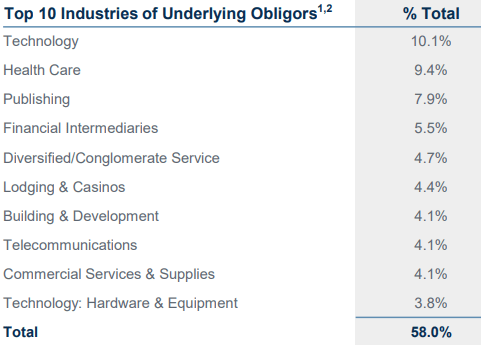

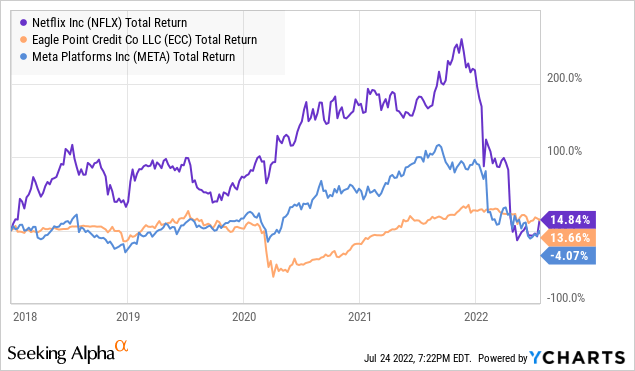

When you boil it all down, what is the bet that ECC is making? ECC is betting that these companies will pay their debt more often than not. It is a leveraged bet, which means that returns are magnified. As they say, “leverage cuts both ways”. Yet in the big picture, if returns are positive more than they are negative, leverage will lead to higher overall returns over the long run, this is what has happened to ECC. Here is a look at ECC, compared to Invesco Senior Loan ETF (BKLN), a fund that buys the very same kind of loans that CLOs hold without the leverage.

So in about 7 years, ECC has returned over 4 times as much. And the bulk of that return has come as dividends. If you invested $10,000 into ECC at IPO, you would have received over $8,200 in dividends. Plus, you’d still have the same number of shares producing even more income for you.

Some people will say that a high yield is “risky”. Yet with every dividend, you are realizing a tangible return. A dividend is cash that is going into your pocket, allowing you the opportunity to reassess the investment and decide to buy more, buy something different, or even remove your cash and spend it on whatever you need.

Unrealized gains are great… until they disappear.

A vastly superior unrealized gain can disappear in the blink of an eye.

Is ECC volatile? Yes. Especially when you compare it to owning bank loans directly. That volatility in price will go both ways. When the market panics it will go down more quickly, when the market is optimistic, it will go up more quickly.

At the end of the day, the question for ECC is whether companies will pay their loans. The price swings in the middle are dramatic but ultimately irrelevant. As CEO Tom Majewski said:

…every loan will either default or pay off at par, it’s a binary outcome. And for CLOs in every loan and every CLO has to mature before the CLO debt is due. So we’ve got the runway to see it through to the other side. And that option, in our opinion, is mispriced by the market. Some people get very focused on what’s the liquidation value. We don’t have to liquidate. And we’ve got the runway to hold these — every loan will do one or two things, and we can find out which one. And the vast majority of loans have a funny habit of paying off at par.

Oh, and did I mention that these are all floating-rate loans? So the interest that CLOs are collecting and passing along to ECC is increasing!

Pick #2: BGR – Yield 5.4%

Oil prices are high, which should be benefiting funds that invest in major oil companies like BlackRock Energy and Resources Trust (BGR).

The U.S. is dumping oil out of its Strategic Petroleum Reserve, bringing the SPR down to the lowest levels since 1987. The strategy has been a political talking point but has done little to reduce prices. It all boils down to supply and demand. There isn’t enough supply to meet demand, so prices climb until demand declines.

Yet despite the strength in oil prices, oil companies have sold off over the past month, with many down 20% or even more. Why? Probably because the market has become convinced that a recession is coming and demand for oil will collapse. Citi Group made some headlines saying that oil could hit $65/barrel. While Goldman Sachs is convinced oil could hit $140.

We remember a couple of years ago when Citi declared that $100 oil would “never” be seen again writing.

The idea of oil at $100 or higher, “has far more fantasy than reality at its heart,” the Citi analysts wrote, adding that over the long term, $45 per barrel of Brent was a far more likely oil price scenario than $60 a barrel.

In more pessimistic news, the Citi analysts said, “Oil product demand growth will falter significantly, change its contours and never return to pre-covid-19 rates of growth.”

Welcome to fantasy land.

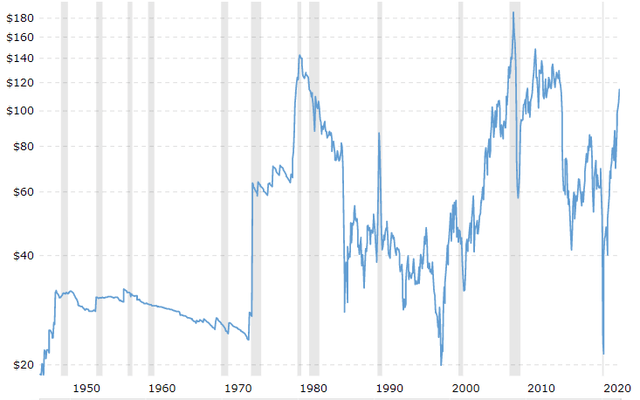

What does history tell us? Here is a look at historical oil prices adjusted for inflation:

Note that when oil has gone over $100, it tends to stay there for several years. There is a simple reason for that, oil doesn’t go over $100 unless there is a lack of supply, and it takes time for supply to start being generated. The GFC did cause a decline in demand and a temporary crash in oil prices, but prices rebounded quickly.

Today, oil is just getting started. It is very early on in the cycle of high oil prices and the reactions we’ve seen from oil producers have been one of caution. They aren’t backing up the truck and loading up on debt to increase production. Instead, they remain focused on maintaining healthy balance sheets and steady expansion. This is a recipe for high oil prices to persist for many years.

Warren Buffett has been backing up the truck and loading up with Occidental Petroleum Corporation (OXY). With a yield under 1%, OXY doesn’t fit our investment goals, but we can still follow Buffett into the oil sector.

BGR provides exposure to oil majors like Exxon (XOM), Chevron (CVX), and Conoco Phillips (COP). BGR has increased its dividend twice so far this year, and with NAV at pre-COVID levels, there is a good chance of more hikes as the dividend is still below historical levels.

The oil sector is having its time in the sun again, with strong fundamentals and favorable supply/demand dynamics. Prices will remain higher than they have been for most of the past decade, and that is extremely favorable for oil companies that have gotten used to squeezing pennies with oil in the $60s.

Buffett is backing up the truck on oil, and we want exposure to this hot sector as well. BGR is a great way to get diversified exposure and get a great dividend.

Dreamstime

Conclusion

With BGR and ECC, we gain valuable exposure to a wide array of income opportunities from the vast range in the market and economy. This way, we will enjoy the continual flow of income even if a recession arrives.

As a retiree, casting a wide net allows you to enjoy the rise and fall of different sectors without the worry of being overly concentrated in a single one and seeing your much-needed income go up in smoke.

I created my unique Income Method to derive high levels of immediate income from the market to reach my and your pockets today, not decades from now. It was designed to do this all while having our original invested capital alive and well, working and growing over the years even when we have stopped working ourselves.

You can disregard the dire warnings of economic calamity and enjoy the insane income opportunities all over the market.

Be the first to comment