ZargonDesign

What is a good return? This can be subjective as investors have different expectations. What is good for one, might be poor for the other. That said, one can use objective benchmarks to get comparisons. We are about to do just that for one popular fund, Eagle Point Credit (NYSE:ECC) and we will let the readers decide how good the returns have been. We will also tell you why forward 12-month returns are likely to be in the same range as the past.

The Fund

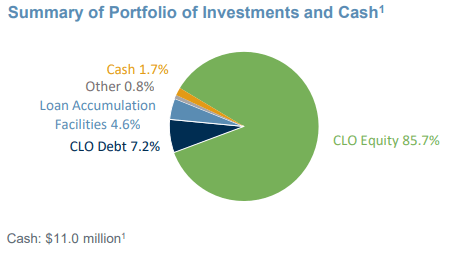

ECC’s primary investment objective is to generate high current income and it has a secondary objective to generate capital appreciation. Right off the bat, we can tell you that you can forget about the secondary objective as the NAV is half what it was when the fund started. As for the primary objective, the fund seeks to achieve this by investing in equity and junior debt tranches of CLOs that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans.

ECC June 30, 2022 Update

We have seen this shopping exercise previously, with Oxford Lane Capital (OXLC) and seen that the returns there have hardly been stellar. What about ECC?

The Allure & The Returns

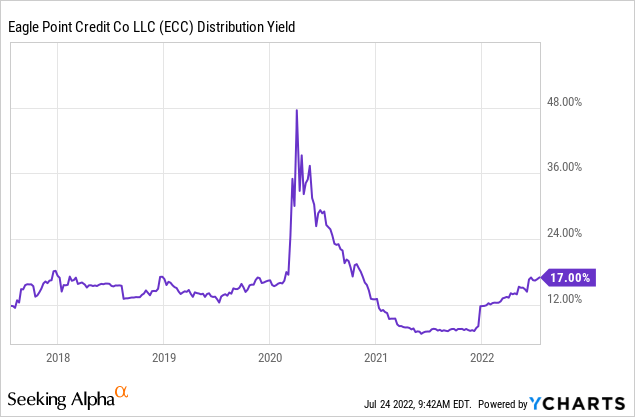

Let’s face it. ECC’s appeal has come from that distribution yield that has stayed in the high double-digits for most of the last 5 years. That number below is a bit off, as it includes the special distribution, but current yield is 14.4%.

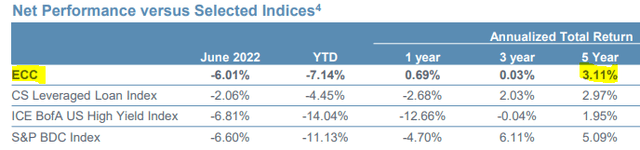

If you take a small leap of faith here and assume that the average was 14.4%, you would expect to double your money over the last 5 years (rule of 72). Actual total annual returns, as defined by the company, have come in at 3.11%.

ECC June 30, 2022 Update

This assumes reinvestment of distributions.

ECC June 30, 2022 Update

Now that return is not bad by itself. 3.11% exceeded the return on CS Leveraged Loan Index and on the ICE BofA US High Yield Index. Both those indices don’t have management fees, so you would expect an actively (or even passively) managed fund to lag. The outperformance here is good.

The contrast though, is gut wrenching from expected returns. 12-17% yield resulting in 3% annual total returns means that a lot of the return is literally your capital coming back to you. Bear in mind, we have pretty much given you what the company is telling you your total returns are. So those are the facts, and they are not in dispute.

Returns Under Other Circumstances

The DRIP plan is nice and helps investors enhance their returns. This is how it works.

If we declare a dividend or distribution payable either in cash or in Common Shares, we will issue Common Shares to participants at a value equal to 95% of the market price per Common Share at the close of regular trading on the payment date for such distribution. The number of additional Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the distribution or dividend by 95% of the market price. However, we reserve the right to purchase shares in the open market in connection with our implementation of the DRIP Plan. If we declare a distribution to Common Stockholders, the DRIP Plan Agent may be instructed not to credit accounts with newly issued shares and instead to buy shares in the open market if the price at which newly issued Common Shares are to be credited does not exceed 110% of the last determined NAV of the shares; or we have advised the DRIP Plan Agent that since such NAV was last determined, we have become aware of events that indicate the possibility of a material change in per share NAV as a result of which the NAV of the shares on the payment date might be higher than the price at which the DRIP Plan Agent would credit newly issued shares to stockholders.

Source ECC DRIP Description

The point here is that the DRIP plan is built into the returns shown above. What if you did not reinvest the distributions?

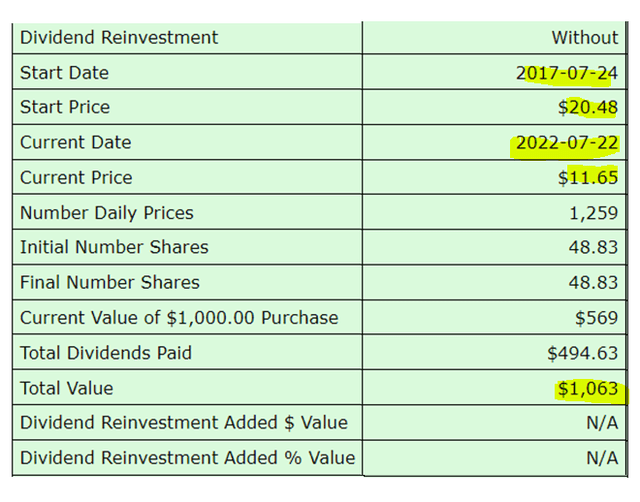

This is hardly unusual as the bulk of the investors invest here to meet their monthly expenses. For that, we used Buy Upside for the calculations. We will note here that period is slightly different and runs from July 24, 2017 to July 22, 2022. The company’s 5-year period shown above is from July 1, 2017 to June 30, 2022. Nonetheless, we can glean some great information here.

Buy Upside

1) The starting price was $20.48. The ending price was $11.65.

2) Total returns with distributions taken in cash was 6.3% ($1,000 becomes $1,063).

3) Total Returns were about 1.02% compounded.

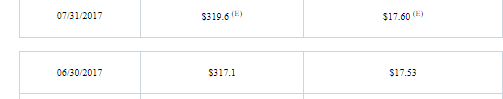

4) The returns were NOT driven by changes in premium. In June and July 2017, The NAV was around $17.60.

ECC NAV 2017

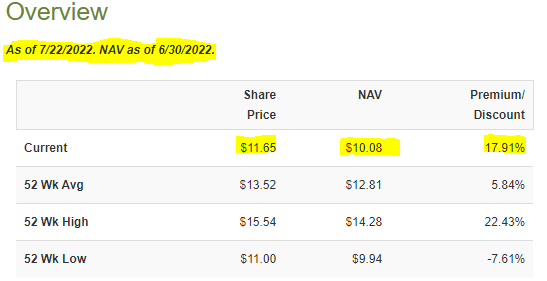

The Fund traded at a 17% premium to NAV.

This is almost identical to today.

CEF Connect

5) Your yield on original cost would have dropped from over 12%, to about 8.2% today.

6) Your initial investment value is down 43%.

Outlook & Verdict

Over the last 5 years, we have had the briefest (although extremely violent) of recessions. We have also had a normalization of credit spreads in the last 12 months. This 5-year period can be described as perhaps mildly challenging overall. Returns here were 1.2% compounded if distributions were taken in cash. Is that good? Is that poor? Investors can decide that. From our perspective, if all the benchmarks delivered those kinds of returns, it should tell you that the asset class is not designed to give you anything more.

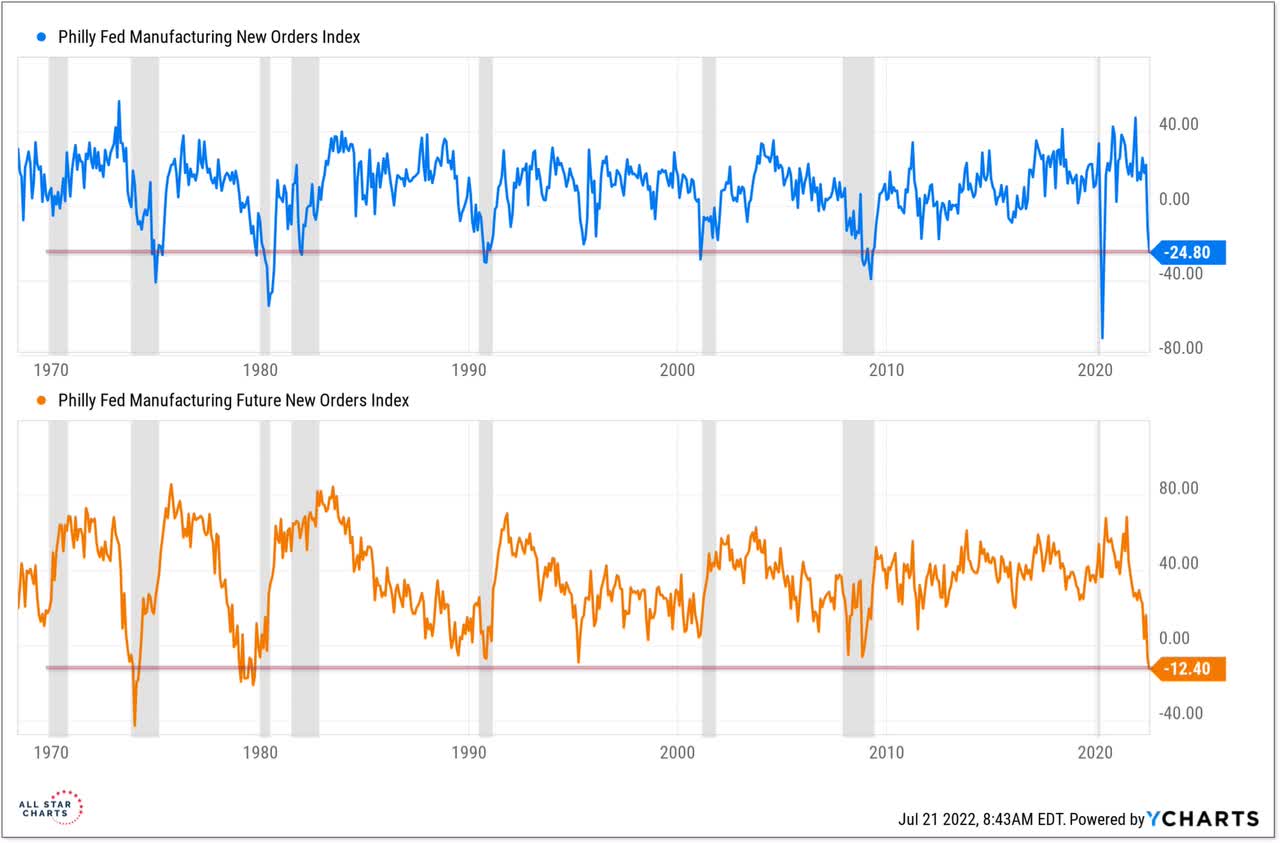

Over the next 12 months, the probability of an actual recession is quite high. We have several data points on this and Philly New Orders Index is one of the better ones.

YCharts, All Star Charts

What ECC and CLO indices do in that time frame is to be decided, but we would not be expecting total returns anywhere in the ballpark of that 14.4% yield. This total return for ECC also is likely to face the massive headwind of premium compression. If we trade at or below NAV in a recession, it would be hard to avoid negative double-digit returns. We rate the shares a sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment