DNY59

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 10th, 2022.

Earlier this year, I mentioned that Eaton Vance Tax-Advantaged Global Dividend Income Fund (NYSE:ETG) was a fairly attractive candidate worth considering. The market overall was and still is in decline, under pressure from interest rate hikes and an expected recession.

Within that article, I mentioned that despite being attractive, a trim to the distribution was possible. The simple reason is that equity funds such as ETG have to rely on capital gains to fund their distributions. Even ETG relies on capital gains regularly, and it is a fund with a relatively strong emphasis on dividend investments that leads to higher than usual net investment income coverage.

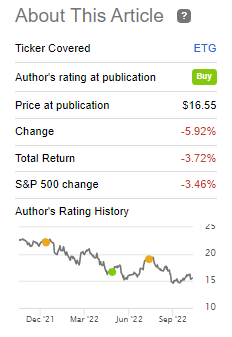

Since that update, we can see that the fund performed essentially in line with the broader market.

ETG Performance (Seeking Alpha)

However, we can also see that shortly after the update, I followed up quickly. I noted in that follow-up piece that I don’t normally update so frequently, but it seemed warranted after such a strong run. The fund rushed into premium territory, and thus, I wanted to mention that after such an event, I was no longer bullish. I don’t trade in and out of ETG. If it had hit an even higher premium, I would have considered it. Otherwise, to me, it is a core-type holding of global investments that aren’t overly focused on the tech space. That’s essentially what I find favorable about the fund, in general.

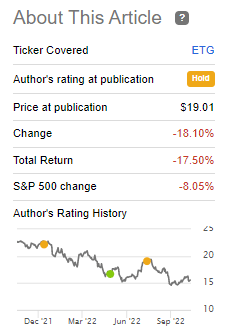

Since that update, though, we can see how the fund has reacted. In that case, the overall market decline also lowered the fund’s performance. The fund also returning to a discount meant the move downward was even more pronounced.

ETG Performance (Seeking Alpha)

All this being said, Eaton Vance came along and trimmed ETG’s distribution – among most of their other equity funds too. I will continue to believe that a distribution cut on its own isn’t indicative of a good fund or not. In fact, there is an argument to be made that a distribution trim in this environment is even a shareholder-friendly move.

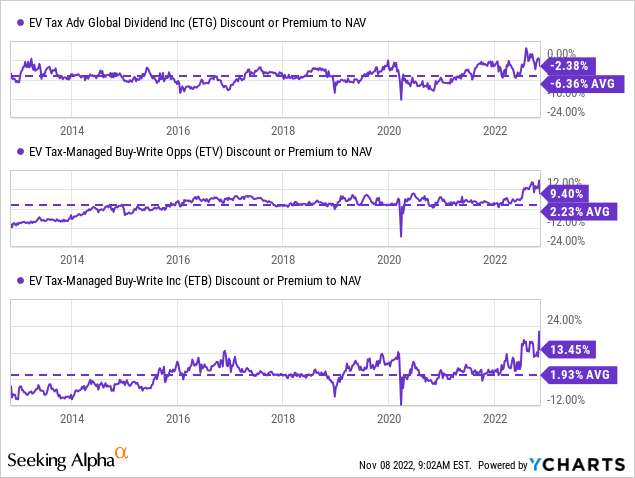

However, given the fund’s fairly shallow discount, it isn’t as interesting as it was earlier this year when I thought it was a buy. On the other hand, the overall declines in the market have meant that it is still cheaper on that basis, anyway. Therefore, I would continue to maintain that I feel that ETG is a solid “Hold,” and I would look out for further potential widening of the discount before getting back to a bullish view. Ideally, I want to see a discount of at least 5%+. That would be around its longer-running average.

The Basics

- 1-Year Z-score: -0.12

- Discount: 2.38%

- Distribution Yield: 7.71%

- Expense Ratio: 1.12%

- Leverage: 22.6%

- Managed Assets: $1.587 billion

- Structure: Perpetual

ETG invests “primarily in global dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income that qualifies for favorable federal income tax treatment.” This means they are looking for companies whose dividends are considered to be qualified dividend income. Of course, that is good for investors who might hold this in a taxable account. It would reduce the tax obligation for an investor, which is where the “tax-advantaged” portion of its name comes from.

Another area that is of particular note for ETG is the fund’s utilization of leverage. Other funds that were cut from Eaton Vance were option-based funds, which don’t have this issue but suffer from declining markets nonetheless.

In a rising rate environment, the costs of leverage are also going to be increasing. The reason behind this is that the borrowings are based on a floating rate. Higher interest rates mean LIBOR is rising, which means they pay interest on a rate of 1-month LIBOR plus 0.50%. This is as of their last report; with LIBOR being discontinued, we should see this transition over to something like SOFR.

To see how this is playing out, we can see in the last semi-annual report that the fund’s average borrowings for the six-month period came to 0.72%. However, the ending interest rate was 0.95%. 1-month LIBOR last reported is 3.84%; then ETG’s spread of 0.50% means they are now paying 4.34% for their borrowings. Quite a spectacular rise, which clearly would have an impact on the net investment income available for shareholders.

The total expense ratio in 2019 climbed to 2.23% when the Fed last made an attempt to raise interest rates. Given that context, it is quite clear the expenses due to leverage expenses are going to explode higher in this vastly more rapidly rate-rising environment.

Performance – Discount Not There Yet

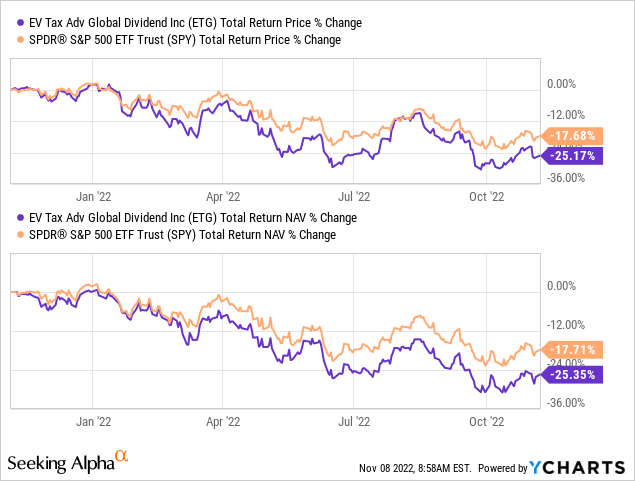

For the most part, the fund has been suffering through 2022 with the broader market. Even though ETG is tilted towards more value-oriented sectors relative to the S&P 500 (SPY), the leverage and global positioning seem to have dragged the fund down even further.

Ycharts

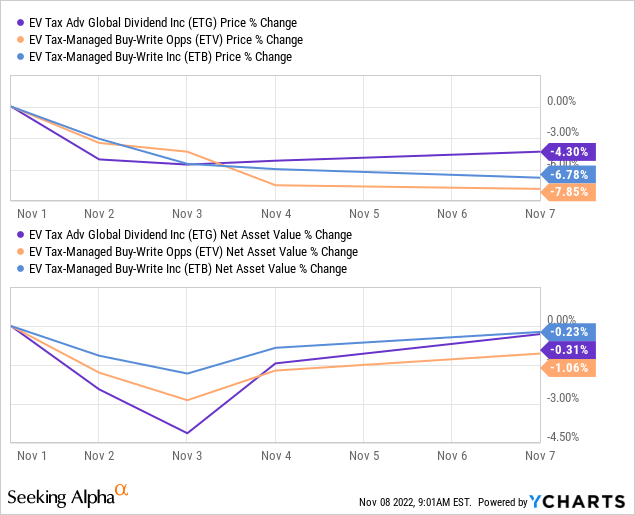

When those distribution cuts were announced, I was worried that investors in Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) and Eaton Vance Tax-Managed Buy-Write Income Fund (ETB) were going to get their prices chopped dramatically.

Fortunately, that didn’t end up playing out, as these funds have maintained their relatively higher premiums despite the cuts. Oftentimes, a higher yield plus a higher premium is a recipe for disaster.

That being said, since the beginning of the month when the cuts were announced, ETG has held up relatively better. This is only a short period, of course. The NAV performance was similar amongst all three of these funds in what is essentially about a week.

Ycharts

Despite these moves, the valuations of all three funds are above their longer-running average over the last decade. ETB is grossly overvalued relative to its historical level. Of the three, ETG is the best on this valuation basis, but still not looking overly attractive. This is what gives me my more neutral outlook at this time while still knowing full well that a rally in the broader market could take the fund up higher anyway.

Ycharts

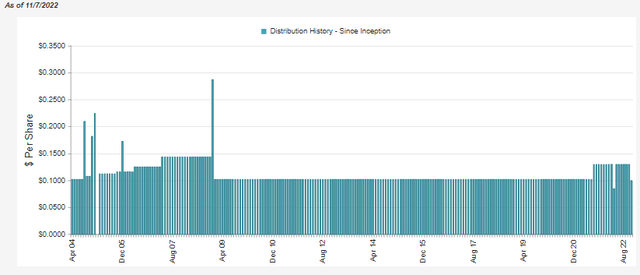

Distribution – A Cut After A Stellar Track-Record

ETG was a fund with only one cut in its history. That was in the GFC of 2008/09.

ETG Distribution History (CEFConnect)

Since then, a strong bull market meant that the distribution could be essentially maintained. With a strong run in the broader markets in 2020 and 2021, it appeared EV was ready to bump up the payout. Again, it wasn’t just ETG that received some love – but most of the other funds have now turned around and cut.

The reason that I had expected a distribution cut for this fund was the fact that they rely on capital gains to fund their payouts. Since that article in May 2022, the markets had a big rally but only to turn around and give that up.

The second risk is that I believe there is now a real risk of a distribution cut. ETG spent years with the same $0.1025 monthly distribution after only cutting once in its life. That was during the 2008/09 GFC. They then eventually raised this last year – finally!

Unfortunately, it seems to be at a terrible time now that we see how 2022 is treating us. From experience, though, Eaton Vance tends to be a bit quick to cut their distributions. Now that ETG’s NAV rate is pushing around 8.5%, I wouldn’t quite bank on that payout anymore.

Had they not raised last year, I suspect that they could still be continuing to pay out that same $0.1025 – which is essentially quite similar to the $0.1001 level they cut it to now.

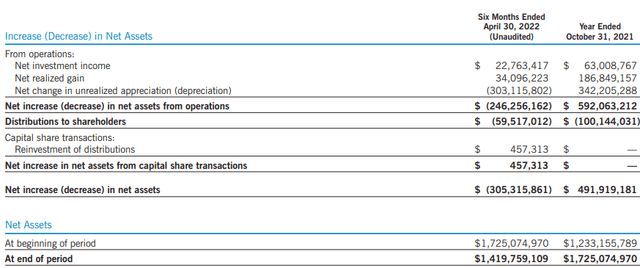

The fund’s NII coverage in their last semi-annual report came to 38.25%. Meaning the rest needed to be covered via capital gains or could result in a destructive return of capital. The NII dropped from the previous period, which reflects changes in total investment income and higher expenses.

TII a year ago was $48.618 million. A year later, we see a TII of $33.150 million for a six-month period. At the same time, the leverage expense went from $1.176 million to $1.366 million – only expected to rise even higher as that was as of April 30th, 2022, as discussed above. If we assume the same borrowings of $370 million, borrowings could rise to as high as ~$16 million.

Despite recently cutting, their previous report showed that the distribution was almost covered between NII and realized gains. These realized gains came from positions that still had unrealized appreciation in their portfolio. They also received proceeds from a securities litigation settlement and gains on their forward foreign currency exchange contracts.

ETG Semi-Annual Report (Eaton Vance)

Of course, since this report, the chop has happened. Based on the outstanding shares and the new payout over the next twelve months should be $91.678 million. Assuming the last NII was doubled to provide us with an annualized figure, we would come to $45.527 million over the next twelve months. However, we could also take out another $14.634 million, considering the expected higher interest rates.

What it eventually arrives at is an NII coverage that could be around 34% going forward. With that, I still can’t get comfortable with the current distribution unless the market recovers or interest rates come down. Assuming interest rates come down would probably provide a catalyst for the overall market to extend the latest gains they’ve been trying for. That is a big “if,” though.

That is another point I wanted to mention that a distribution cut isn’t necessarily a bad thing. For a longer-term investor, it could be argued that the trim is shareholder-friendly simply because that means they aren’t going to be overpaying. That means they aren’t utilizing a higher amount of potentially destructive payouts, which would reduce assets further. Reduced assets mean that when recovery happens, there would be fewer assets to recover with. That’s primarily what gets leveraged funds into trouble. We see this rapidly be the case when a fund has to deleverage.

ETG’s Portfolio

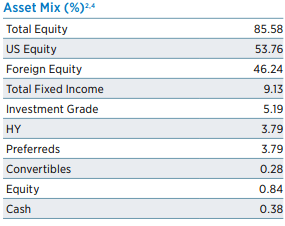

ETG is often heavily invested in equity positions, but the portfolio also has some fixed-income exposure. Essentially, it makes the fund a multi-asset fund.

ETG Asset Mix (Eaton Vance)

This flexibility even gets them into positions with bonds that have floating rates. However, it is not at a meaningful level. I also don’t expect them to change the fund drastically, as a major portion of the portfolio has regularly been held in equity positions. This is despite the fact that the fund’s portfolio turnover is quite elevated. In the latest report, they reported a turnover of just 28% in the last six months. Annualized, and this is still well on the low end as, over the prior five years, they’ve averaged a turnover of 163.4%.

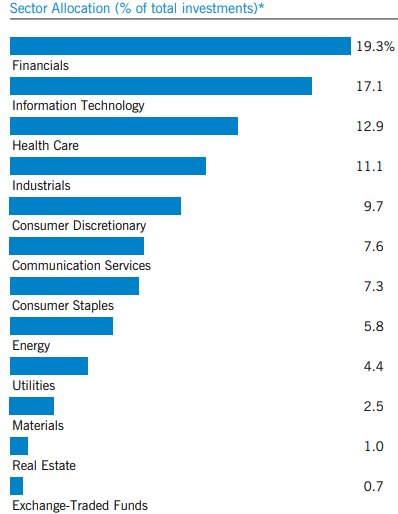

One reason that I’ve been drawn to ETG is the heavier allocation to financials. The fund has regularly overweighted to financials relative to the market. The below is as of April 30th, 2022. However, it is quite close to the same weightings we saw in their last annual report. In fact, the allocation to tech has slimmed up a tad since then.

ETG Sector Allocation (Eaton Vance)

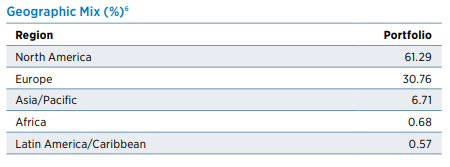

The diversification outside of just U.S investments has also made it an appealing fund for me to continue to hold. Investing in U.S. holdings has performed incredibly well, but that isn’t always the case. Having further diversification in one’s portfolio could mean taking advantage of any potential divergence in performance. Although, it also means participating in the downside too.

ETG Geographic Allocation (Eaton Vance)

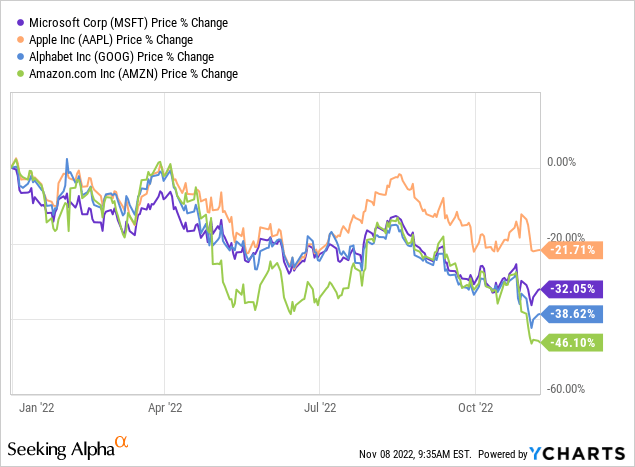

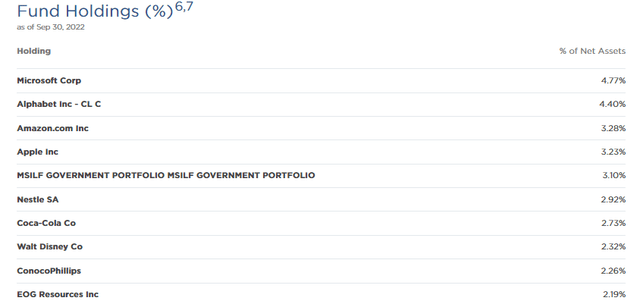

Looking at the top ten names, we still have the usual mega-cap tech names. However, from the sector weighting above, we know that underneath the hood further is a more diversified exposure. These positions had worked out incredibly well, too, over the years, so it didn’t hurt that they had exposure to these names.

I would still suggest Microsoft (MSFT) and Apple (AAPL) are worthwhile tech names. I think Alphabet (GOOG) (GOOGL) and Amazon (AMZN) could still be under further pressure in the short term. On a YTD basis, Apple has held up relatively well compared to these peers.

Ycharts

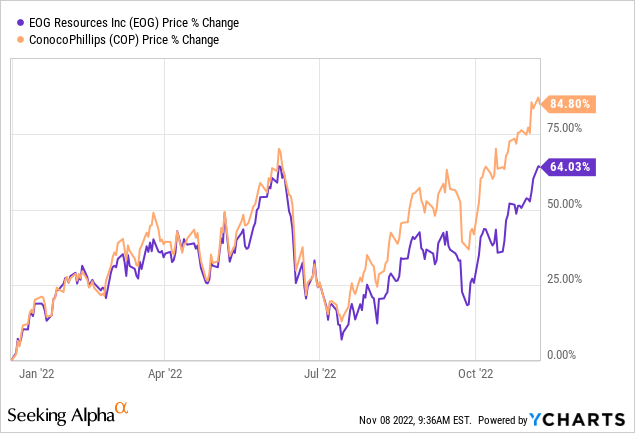

EOG Resources (EOG) had previously shown up in ETG’s top ten holdings, but we are now seeing another energy plan show up, ConocoPhillips (COP). These two energy names have been screaming higher on a YTD basis. This has been the case as energy prices skyrocketed. While a recession could cool off energy prices, there seem to be shorter-term catalysts that can continue to support elevated energy prices.

Ycharts

In fact, COP was a position in ETG earlier this year, with 251,437 shares being held at the end of April 2022. At the end of July 2022, they still list the same number of shares but, due to the results, have edged out other top names for ETG. These are the types of positions they can “harvest” gains from even in a down market.

Conclusion

The bear market has taken a bite out of ETG in more ways than one. First comes the market declines; second comes the distribution cuts. However, more could be coming down as long as the market remains under pressure. We covered this in the COVID crash in 2020, but it remains relevant today. It could be even more relevant as this downturn is much more prolonged. I don’t believe a distribution cut is a reason enough to sell a fund. I think the valuation of its discount/premium is still more important. It is telling us, at this time, that it is fairly valued.

Be the first to comment