monsitj

Investment Thesis

Eaton (NYSE:ETN) benefited from the robust end-market demand, which resulted in higher-order rates in the last quarter. The company’s backlog increased as a result of higher-order rates and supply chain constraints. The supply chain constraints are expected to ease in the second half of 2022, and the company should be able to convert its backlog into revenue at an increased pace. This should help the company’s revenue growth in the short term. As the company plans to expand into new spaces such as EV charging infrastructure, energy storage, etc., the ongoing infrastructure investments around this sustainable technology across the globe should benefit the company’s growth in the long run. The company has been implementing various price hikes to offset the cost pressure and improve margins in the near term. The company plans to achieve a segment operating margin of 21.5% by 2025 through the Eaton Business System (EBS), operational excellence, and actively managing its business portfolio.

Eaton’s near-term revenue growth prospects look good

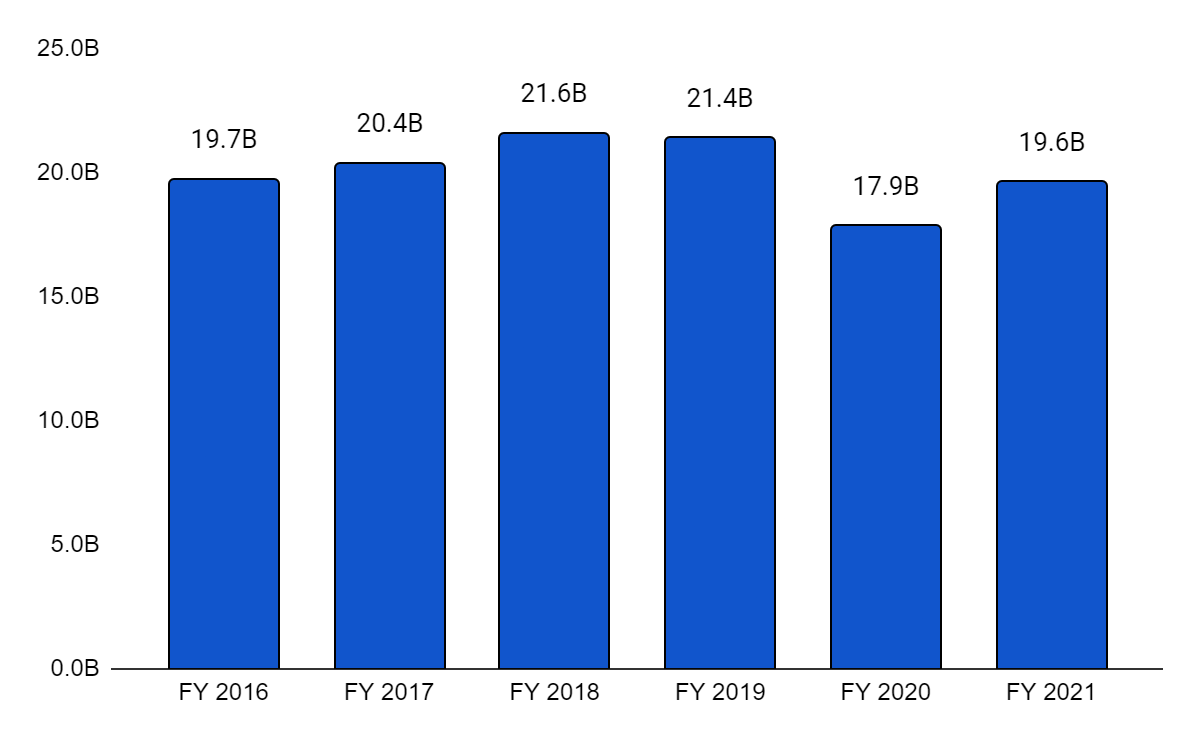

Eaton’s revenue trend (Company data, GS Analytics)

Eaton’s revenues dropped significantly in FY20, i.e., during the Covid period. The company is yet to reach its pre-covid revenue levels, which I believe should be achieved in FY22. The demand trend continues to be strong and the company’s revenue in the first quarter grew 3% Y/Y with 10% organic growth, offsetting the headwind of ~6% from acquisitions and divestitures and a negative impact of ~1% from FX. The growth across all segments (especially the Electrical Global and Aerospace segments, with 18% and 15% organic growth, respectively) was the primary factor in the 10% organic growth, which was higher than the management’s guidance range of 7% to 9%. Despite challenges caused by labor shortages and supply chain limitations, the company was able to deliver this outcome. The net impact of M&As was negative with the addition of 6 percentage points in revenue growth from the acquisition of Tripp Lite and Cobham Mission Systems more than offset by a 12 percentage points decline in revenue growth due to the sale of the Hydraulics business.

The demand in the industrial, commercial, and residential markets for electrical and commercial aftermarket and commercial OE for aerospace remains strong. The orders in the combined Electrical were up 30% on a rolling 12-month basis and 21% up sequentially in Q1 FY22. The combined Electrical segment includes the Electrical Americas segment and the Electrical Global segment. The strong order rate and supply chain constraints led to the increased backlog levels at the end of Q1 FY22. The backlog grew 76% on a rolling 12-month basis and 56% sequentially.

The industrial sector portfolio of ETN, which includes Aerospace, Vehicles, and eMobility segments, is also seeing strong demand for its products. In Q1 FY22, within the Aerospace segment, the orders on a rolling 12-month basis were up 35% and 19% sequentially, which resulted in a 14% increase in backlog. The organic growth in the segment was due to the strength in the commercial aftermarket and commercial OEM markets. As the airlines have started to rebuild their inventory for spare parts, the aftermarket business of ETN is benefiting from it. The ongoing supply chain constraints related to semiconductors affected the organic revenue of the Vehicles segment in the last quarter.

Looking forward, the supply chain constraints are expected to ease in the second half of 2022, which should further improve the sales volume of the company. The demand from end markets and a healthy backlog across the business portfolio should also benefit the company’s growth in the near term. Last quarter, the company has increased its organic growth guidance for FY22 from 7% to 9% to 9% to 11%.

Long-term secular growth

The company is focusing on three pillars as a way to change the growth rate of the company through sustainability, digitization, and energy transition. The core electrical business should grow naturally as the world transitions to using renewable energy in daily life. The company is making big investments to participate in value streams such as electric vehicles, electric charging infrastructure, energy storage, and grid resiliency. The company is transforming the business by focusing on new spaces and products that are not tied to Internal Combustion Engines. ETN has won a program with a Chinese OEM for electronic traction control devices and is currently pursuing a pipeline worth $500 mn in annual revenue for powertrain solutions for leading EV OEMs.

The U.S. infrastructure bill of $1.2 trillion that was passed last year has many parts that are expected to support the growth of Eaton’s business starting in 2023 and beyond. Approximately $88 bn has been set aside for power grid updates and EV charging networks and incentives. In Europe, EUR 807 bn is set aside as a part of the New Generation EU (NGEU) stimulus. The bill outlines approximately EUR 240 bn to be spent on the green energy transition and approximately EUR 160 bn to be spent on the digital transition. In China, the government has set clear goals to lower carbon emissions and has laid out plans to strengthen its grid by 2025 to include more wind, solar, and low-emission coal plants. The company should also benefit from the increased investment in the defence sector given the geopolitical tensions between Russia and Ukraine. The U.S. government has increased its FY23 DoD budget by 4.1% Y/Y to $773 bn. This should benefit ETN’s business, especially in 2023.

The company increased its 2020 to 2025 organic revenue CAGR targets to between 5% and 8% on its investor day earlier this year which is higher than the company’s previous target of 4% to 6%. The company should benefit from favourable secular growth trends, changes in its portfolio, and organic growth initiatives.

Additionally, the company is focusing on acquisitions and divestitures to expand in higher growth and margin categories and eliminate businesses that have lower margins and do not align with ETN’s long-term plans. The acquisitions of Souriau-Sunbank (in 2019), Cobham Missile Systems, and Royal Power Solutions have expanded the company’s addressable market by over $20 bn across the Industrial and Electrical markets. The company has a strong balance sheet with net debt to EBITDA ratio of ~2.1x, which provides it ample flexibility for M&As.

Margin growth prospects look good

The company’s margins dropped to 14.7% in Q2 FY20, i.e., during the Covid period, but have regained pre-covid levels since then. Since the second half of 2021, margins have been declining sequentially due to inflationary cost pressures and supply chain inefficiencies. In the last quarter, the adjusted operating margin was up 110 bps Y/Y to 18.8% but was down 50 bps sequentially. The combined Electrical business margins were up 20 bps as the Electrical Global segment saw improvement in its margin due to the strong operating leverage, which led to incremental margins of 36% in Q1 FY22. However, the Electrical Americas segment was affected due to supply chain challenges and cost pressures. To offset the inflation the company is taking price hikes but due to the timing impact, it will take a couple of more quarters to offset inflation. The aftermarket side of the Aerospace segment has been depressed over the last few years, but in Q1 FY22, the company saw strong growth in the aftermarket business. As a result of this, the Aerospace segment operating margin increased 360 bps Y/Y to 22.1%.

Looking forward, the company is expecting the FY22 segment operating margin to be between 19.9% and 20.3%. At the midpoint, it is higher than the previous year’s margin by 120 bps. The margins are expected to improve across all the segments except the Vehicles segment (the Vehicles segment is still expected to face pressure due to the inflationary costs and shortage of semiconductors). The second half of 2022 should see some modest improvement in the supply chain challenges and the price/cost should turn positive, driving the margin growth. Furthermore, as the volumes across the business improve, the margins should also improve. If inflation further increases, the company plans to reprice its backlog, which should prevent the margins from declining.

In the long term, by 2025, the company plans to achieve ~21.5% segment operating margin. This should be done by three initiatives Eaton Business System (EBS), operational excellence, and actively managing the business portfolio. EBS is the common set of processes and tools. This includes tools to drive continuous improvements at plants, benchmarking and accessing performance, and identifying and transferring learnings across the organization. The next initiative is operational excellence in manufacturing units. The company plans to deliver over $400 million in cost cuts over the next 5 years. The last initiative is about active portfolio management. It includes focusing more on high-value activities and less on lower-value activities – the company calls it grow the head and fix the tail. The company is applying this to M&As, factories, product lines, market segments, etc. to improve its profitability.

ETN stock valuation & Conclusion

The company is currently trading at a P/E of 17.04x FY22 consensus EPS estimate of $7.51 and a P/E of 15.33x FY23 consensus EPS estimate of $8.35. This is lower than the five-year adjusted forward P/E of 18.99x. The strong demand and healthy backlog should drive the company’s revenue growth in the near term whereas the infrastructure investments across the world should provide ETN with an opportunity to grow its revenue in the longer run. As the company offsets the inflationary cost pressures through price hikes the margins should improve in the near term. In the longer run, the initiatives such as EBS, capital allocation, and operational excellence should drive margin improvement. The strong growth prospects and attractive valuations make ETN a good buy.

Be the first to comment