Evgenii Mitroshin/iStock via Getty Images

Earthstone Energy (NYSE:ESTE) may now be able to generate around $480 million in positive cash flow in 2022 at current strip prices. This positive cash flow would allow it to nearly pay off its credit facility debt by the end of 2022 when combined with the proceeds from its recent unsecured note offering.

Based on current 2023 strip prices, Earthstone may be able to generate over $600 million in positive cash flow next year due to its increased production (with a full year of contributions from its Chisholm and Bighorn assets) as well as fewer hedges.

If prices can average around current strip for the next couple years, Earthstone would be able to end 2023 with nearly zero net debt if it doesn’t make additional acquisitions in the meantime.

Offering Of Unsecured Notes

Earthstone recently announced a private offering of $550 million in 8.0% unsecured notes due 2027. Earthstone is using the net proceeds from this offering to repay of part of its credit facility borrowings.

This increases Earthstone’s annual interest costs by around $27 million as its credit facility borrowings had an interest rate of 3.11% at the end of 2021.

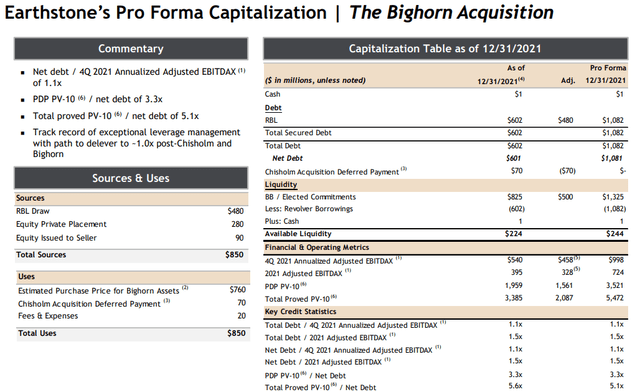

This gives Earthstone additional liquidity as it had $1.082 billion in credit facility borrowings (proforma for its acquisitions) compared to a $1.325 billion borrowing base.

Between the unsecured note proceeds and projected cash flow for 2022, Earthstone should be able to pay off most of its credit facility borrowings by the end of 2022. This also gives Earthstone room for more acquisitions, although it is also incurring the increased interest costs.

Updated 2022 Outlook

At current strip (approximately $97 WTI oil and $6.35 NYMEX gas) for 2022, Earthstone is now projected to generate $1.47 billion in oil and gas revenues before hedges. Earthstone’s 2022 hedges have an estimated value of negative $203 million at those oil and gas prices.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 9,876,900 | $96.00 | $948 |

| NGLs (Barrels) | 6,263,400 | $41.00 | $257 |

| Natural Gas [MCF] | 47,698,200 | $5.55 | $265 |

| Hedge Value | -$203 | ||

| Total Revenue | $1,267 |

Source: Author’s Work

Earthstone is projected to generate $480 million in positive cash flow in 2022 at current strip prices now.

| Expenses | $ Million |

| Lease Operating | $181 |

| Production Taxes | $113 |

| Cash G&A | $33 |

| Cash Interest | $35 |

| Capital Expenditures | $425 |

| Total Expenses | $787 |

This would result in it having approximately $613 million in net debt at the end of 2022 if it makes no further acquisitions. This also assumes that the net proceeds from its recent note offering are around $538 million after commissions and related expenses.

Earthstone’s Pro Forma Capitalization (earthstoneenergy.com)

Earthstone’s net debt at the end of 2022 would be approximately 0.65x EBITDAX, allowing it to easily meet its target of 1.0x leverage.

Potential 2023 Results

The current strip for 2023 involves high-$80s WTI oil along with $5.15 NYMEX gas. At 80,000 BOEPD (41% oil) in average production, Earthstone would be able to generate $1.565 billion in oil and gas revenues, while its 2023 hedges would have negative $40 million in estimated value.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 11,972,000 | $87.50 | $1,048 |

| NGLs (Barrels) | 7,592,000 | $35.00 | $266 |

| Natural Gas [MCF] | 57,816,000 | $4.35 | $251 |

| Hedge Value | -$40 | ||

| Total Revenue | $1,525 |

This would allow Earthstone to generate $606 million in positive cash flow in 2023 at current strip prices. I’ve assumed that Earthstone spends $500 million in capex in 2023 due to cost inflation plus supporting a larger asset base post-acquisitions.

| Expenses | $ Million |

| Lease Operating | $219 |

| Production Taxes | $120 |

| Cash G&A | $35 |

| Cash Interest | $45 |

| Capital Expenditures | $500 |

| Total Expenses | $919 |

Valuation

Due to the potential for strong positive cash flow over the next couple years, I now estimate that Earthstone would be worth around $18 per share in a long-term (after 2023) $70 WTI oil and $3.50 NYMEX gas scenario. This assumes current strip for 2022 and 2023 before commodity prices revert to those longer-term prices.

In a scenario where prices were around current strip for 2022 only before reverting back to longer-term prices, Earthstone would be worth approximately $16 per share in a long-term $70 WTI oil and $3.50 NYMEX gas scenario.

Conclusion

Earthstone has issued high-interest unsecured notes to help pay down part of its credit facility. If Earthstone doesn’t make any more acquisitions in 2022, it should be able to mostly pay off its credit facility by the end of the year.

At current strip prices, Earthstone may also be able to generate over $600 million in positive cash flow in 2023. This could leave it with nearly no net debt by the end of 2023 and would help give it an estimated value of $18 per share in a longer-term (past 2023) $70 WTI oil and $3.50 NYMEX gas scenario.

Be the first to comment