olaser

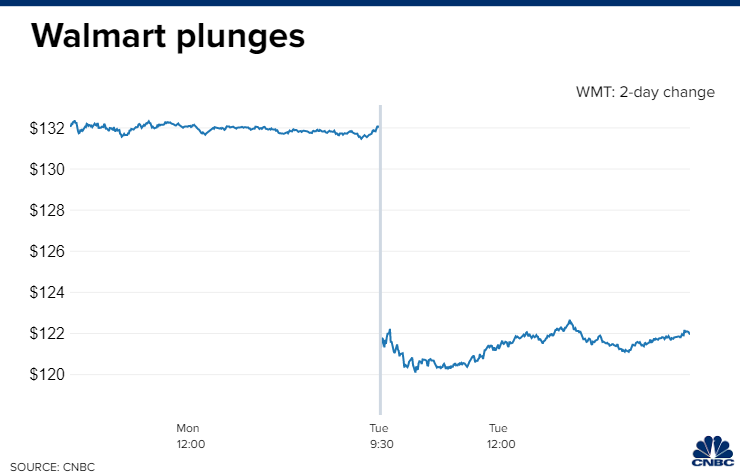

Consumer discretionary stocks led the market’s decline yesterday after Walmart reported it would fall short of profit estimates for the rest of this year. This followed a dismal report and outlook from Snap last week, which sent shock waves through advertising-related social media names. These could be company-specific issues, which is my position, or indications of a much more pervasive deterioration in consumer spending and the economy. We will have a much better idea of which by the end of this week, but some key reports after the close should ease concerns.

Finviz

Alphabet’s results fell modestly short, due largely to currency headwinds, but the company’s ad revenue was better than expected, which suggests that Snap’s problems are company specific. Microsoft told a similar story but gave strong guidance through year end. Texas Instruments crushed earnings estimates and raised guidance for the year. As the maker of chips for a broad array of products, its results raise serious doubts about a collapse in consumer demand. The company also benefited from the reopening of factories in China, as the Covid-related lockdowns come to an end, which should start to ease the supply constraints that a company like General Motors faced. GM fell short of profit expectations because of the semiconductor shortage. Overall, the sense is that earnings are not as bad as feared, which should help support the major market averages at current levels.

CNBC

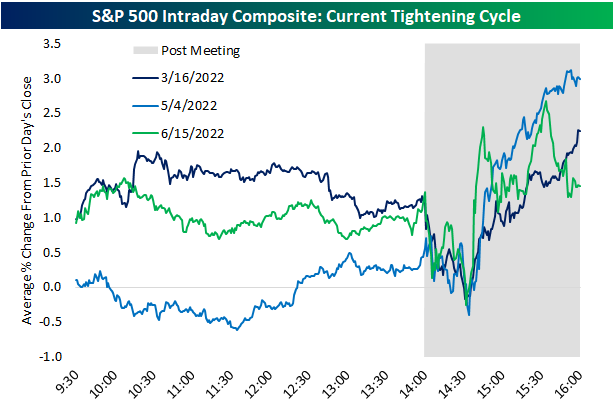

I also expect today’s decision on interest rates by the Federal Reserve to be not as bad as feared. The consensus expects a 75-basis-point rate increase, which will move short-term rates up to 2.25%. Chairman Powell’s press conference that follows the decision will be pivotal for markets. We have seen the S&P 500 dip immediately following the rate decision at each of the last three meetings, but it has rallied sharply once Powell starts to speak. Today, I expect him to acknowledge progress on slowing the rate of economic growth to the extent that it should alleviate inflationary pressures this fall. I think that message will produce a bullish response from markets provided expectations for rate hikes in the futures market do not increase.

Bespoke

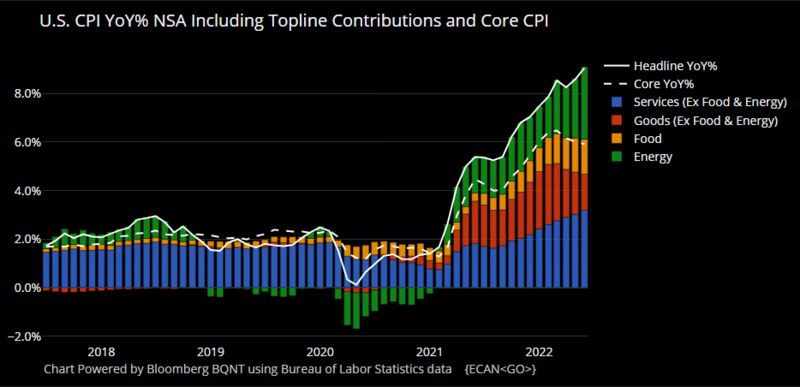

If we can have an inflation report on Friday that is not as bad as feared, it should be the catalyst to another leg up in the major market averages. The personal consumption expenditures price index (PCE) is the Fed’s preferred measure of inflation, and the consensus is expecting the core rate to remain unchanged at 4.7%.

Bloomberg

There is a tremendous amount of negativity built into market today, which is why I think all it will take to build on this second half recovery are earnings, interest rates, and inflation that are not as bad as feared.

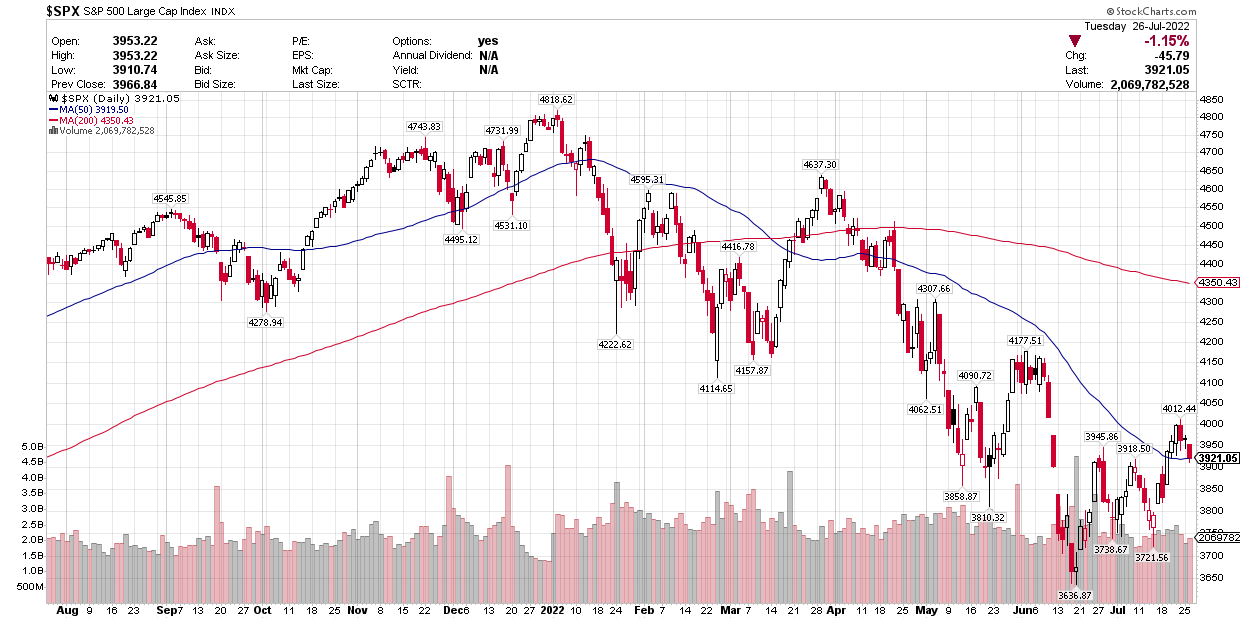

The Technical Picture

Yesterday’s market decline in the S&P 500 found support at the 50-day moving average, which I find encouraging. Pullbacks to support are the building blocks to an uptrend, as they shake out weak shareholders. Hopefully, we can hold that level and test the 4150-4200 level.

Stockcharts

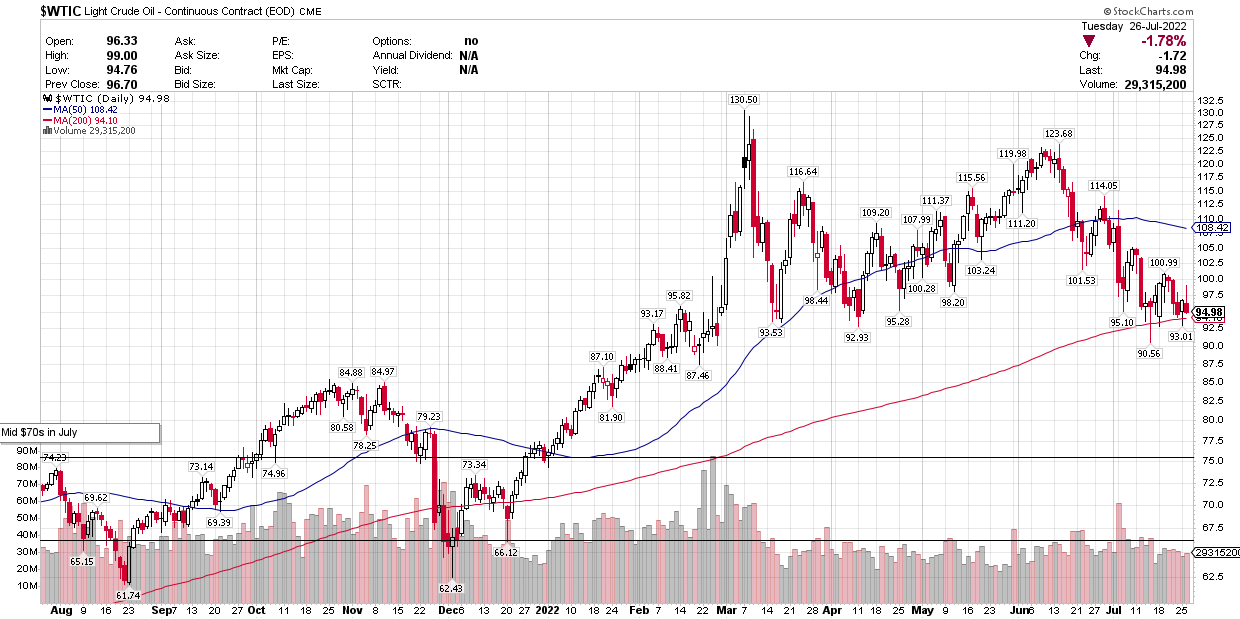

Crude oil looks poised to fall below major support at its 200-day moving average, which could portend further weakness. Gas prices are close to falling below $4 a gallon in my neck of the woods, which should start to lift consumer sentiment.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment