freemixer/E+ via Getty Images

By Tim Murphy, Marketplace Success Manager

Thank you to all readers of our Marketplace Contributors Mid Year Roundtable series in June. Your comments and engagement were appreciated by all contributors involved.

With earnings season upon us, we thought now would be a good time to give you insight into what our contributors and services are focused on. For this weekend we start with the most beaten down group of stocks – Tech and Growth. It was a popular choice for our contributors, as some who normally cover other areas wanted to offer their insights here. As well, we only had one Biotech & Healthcare response, so it was included.

Our contributors were given the open ended question: What are you monitoring with your subscribers this earnings season?

Enjoy reading! Please share your comments below. We always love hearing your thoughts. Links to author profile and service are included. All services have either a two-week free trial or a limited one-month money-back guarantee. For a full list of Marketplace services, you can go here.

*Note for non-Premium readers: If the author provides a link to an article, we have included a dollar symbol ‘($)’ to indicate it is behind the paywall. Articles from this account, SA Marketplace, are not paywalled.

Joe Albano of Tech Cache: We’re looking for kitchen sink-like earnings, depending on the company. Micron (MU), as an example, just provided one, but Advanced Micro Devices (AMD), as another example, may not see as much weakness. Whether each company provides one or not, once there are enough cuts to earnings estimates and models, the market will look to the other side and price in the return of growth. Once this happens, growth and tech stocks will start a new rally. This is likely to happen through the end of this earnings season.

With inflation at its height, now is the time earnings will see significant slowdowns from the growth over the last year and a half. Micron set this process off after its poor guidance and analyst estimates were cut for the next year (and beyond in some cases). Since then it has shown signs of bottoming. Qualcomm (QCOM), Nvidia (NVDA), and AMD will be the next key players to set the kitchen sink quarter stage, and are the ones we’re watching closely.

Disclosure: Long MU, AMD, QCOM, NVDA

Andres Cardenal of The Data Driven Investor: The economy is under severe pressure due to record inflation and a sharp slowdown in growth. The key will be differentiating the companies that keep building the foundations for sustained long term growth and expanding competitive strength in a tough environment.

The economy will be tough for everyone, but great businesses can continue thriving through the economic cycle, especially when they make the right decisions in challenging times. Strong companies tend to get competitively stronger when the competition is contracting.

AMD (AMD) is an interesting name to watch. The semiconductor industry is cyclical, so economic headwinds are unavoidable to a good degree. But management is executing flawlessly and expanding into the right markets in the right way. I am keeping a close eye on AMD when it reports on August 2.

Disclosure: Long AMD

Victor Dergunov of The Financial Prophet: Big tech was the leading sector throughout much of the massive bull market for over a decade. My top portfolio performers were prominent technology names in this time frame. Stocks like Tesla (TSLA), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG) (GOOGL), Netflix (NFLX), and others provided remarkable returns while the market was booming. I called out the technology sector, and the market in general, for being significantly overbought last November in my The Drop Is Coming and It Could Be Epic ($) article. Big tech has been the leader on the way down since then. The bear market in quality technology stocks has been brutal. However, with many top tech stocks down by 50% or more from their highs, many compelling opportunities are materializing again. We could have more downside in the near term, but much of the “bad news” is already priced into the badly beaten down stock prices.

Therefore, I closely monitor significant technology earnings because the mega tech companies are today’s bellwether names. Moreover, the technology sector is the most substantial component of the S&P 500, and the top tech companies account for a significant portion of the major average’s weight. Growth prospects, profitability metrics, and forward guidance are essential components. Additionally, earnings results should provide a glimpse into the state of inflation and the overall economy, illustrating when a recession could materialize and what will likely come next.

Disclosure: Long TSLA, AMZN, GOOG, NFLX

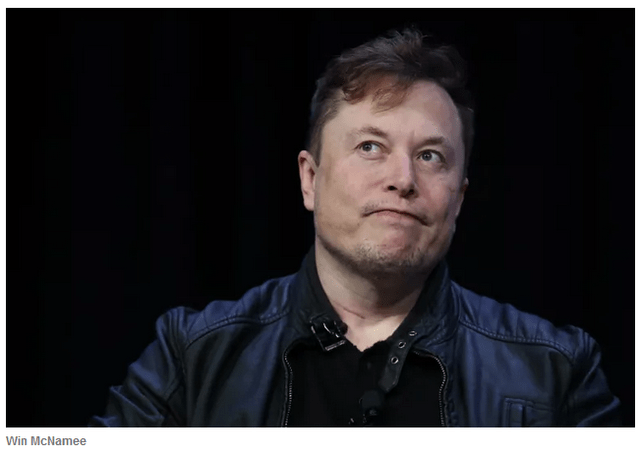

Chris DeMuth Jr of Sifting the World: I am particularly focused on Twitter (TWTR). It is a significant position for me, larger than any of their board members, despite my expectation of a weak quarter. I own it due to confidence in their Delaware suit against Elon Musk to live up to his contractual obligations. It is an epic battle – not just between Tesla’s (TSLA) Musk and Twitter – but between Musk and the rule of law. If it gets to a decision, the downside is about $20, upside is $54.20, and the probability of the upside is about 80%.

The outcome of this case could have a far-reaching impact on Tesla as well as Twitter. It is likely that the court finds for Twitter and that the appropriate remedy is specific performance, but that Musk will have nuked his debt and external equity financing. That could cause a need for him to dump far more shares of Tesla than he or the market anticipates.

There are a lot of ways to express a view on this situation with options. In Elon Musk’s Twitter Options And Yours ($), I pointed to June 16, 2023 $47 TWTR calls as attractive to buy; the deal will probably be resolved by then at the original $54.20 price or for a small price cut to avoid uncertainty and delay. But in either case, those calls are attractive here. We have been actively engaged with Twitter’s board and are reassured by their vigorous defense of our definitive merger agreement. It has been an unserious saga so far, but will get very serious once we get to court.

Disclosure: Long TWTR

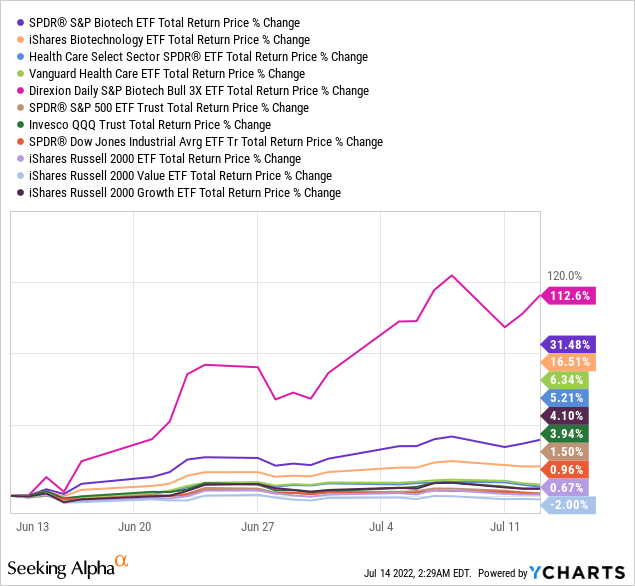

The Fortune Teller of Wheel of Fortune: We’ve been bullish on Healthcare & Biotech ($) for quite some time and this is starting to pay-off.

Over the past month, the sector has outperformed the main indices significantly, and our recent Roundtable suggestion (LABU) has more than doubled.

– (Y-Charts)

When it comes to Healthcare/Biotech there are three things we monitor closely during this earnings season:

- Clear indications by large pharma names regarding their appetite to start making some serious M&A-related moves, and what areas they’re most interested in. We would love to hear a firmer tone, more than just (the usual) hints, which would indicate that the worst for Biotech is behind us.

- Cash balances and expected runways. At a time of record-high inflation, rising interest rates, slowing economy, and recession fears, it’s more difficult to raise money, and so small-cap Biotechs must be very minded about liquidity management.

- FDA picking up pace. Only 16 new drugs were approved by FDA in 1H/2022, compared to >50 in each of 2021 & 2020. In order for the sector to keep the recent outperformance, we need to see a more open/willing FDA, because at the end of the day it’s a very simple equation: More approvals = more sales = more profits = higher stock prices.

But more than anything, we wish to see more deals being announced.

Aurinia Pharmaceuticals (AUPH) & especially Seagen (SGEN), two companies we wrote about recently, could (and should) be a very nice start for a new M&A wave.

Disclosure: Long LABU, AUPH, SGEN

Long Player of Oil & Gas Value Research: The overpriced tech and growth crowd.

The reason for this is a market rarely, if ever, corrects uniformly. Therefore, there is money to be made by finding the most overvalued sector of the market and buying puts. Diversification is essential and it won’t take more than at most a 5% of total investment money (as a basket of well-chosen puts) to show a decent return. The high-priced crowd has been correcting for some time now and it will continue to correct until that group is rationally priced for future prospects.

Tech and “one decision stocks” have a cycle just like anything else. But the current downturn is also a result of misguided monetary and fiscal policy that basically ended at the start of 2021. You had an overheated economy careening towards another 2008 when someone finally decided to fix things.

A traditional recession is unlikely because it appears to have been caught in time. But the overpriced crowd that benefited from the easy money policy will now head towards normal valuations as has happened many times in the past (last time was around 2000-2002).

So, there is good money to be made as the overpriced stocks deflate and puts are a good way to do it.

I do take profits off the board as the puts double and replace them with another put to keep the risk down. Risk takers can do things another way. This strategy has worked well for some time now but there is still a lot of air to come out of the bubble.

Disclosure: I own puts in NFLX TSLA AMZN DOCU SPOT

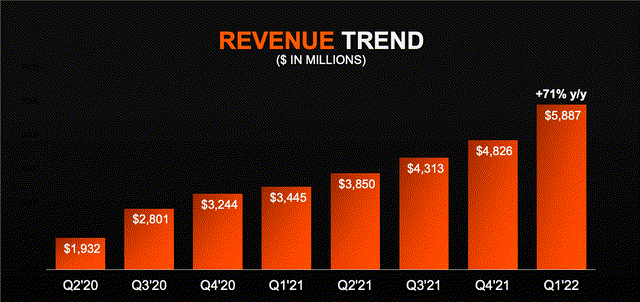

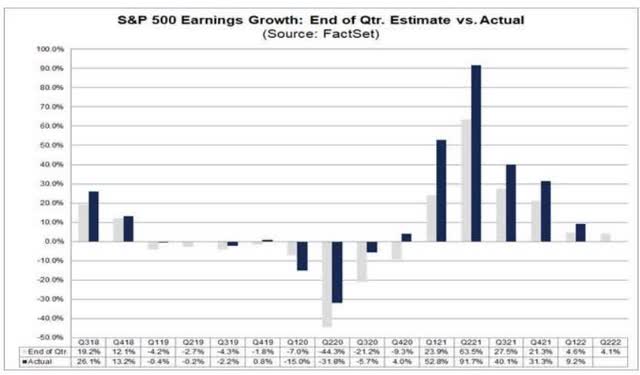

From Growth To Value of Potential Multibaggers: I think in Q2, we will see the trends of Q1 intensify. FactSet expects earnings growth of 4.3% for the S&P 500 for Q2 2022, down from the expectations of 5.9% growth on March 31. The reasons are known: inflated labor costs, supply-chain issues, higher costs for energy, the war in Ukraine, and the strong dollar.

For long-term investors, this is the moment to gradually build more significant positions in solid companies that are expected to grow for a very long time. The forward P/E Ratio of the S&P 500 is now 16.3, under the 10–year average of 17.

Once the market turns, new leaders will emerge. I think Cloudflare (NET) could be one of the new leaders. The company keeps chalking 50% revenue growth quarter after quarter and will not have to raise any money, which is essential in this environment.

The Trade Desk (TTD) is another potential future market leader. The Trade Desk has strong tailwinds with more privacy rules and regulatory pressure on the walled gardens (Facebook, Google). The company has been very profitable since 2013.

A company that is more under the radar is Adyen (OTCPK:ADYEY) (OTCPK:ADYYF), a Dutch payments giant. It’s very profitable and growing fast. These companies will look very expensive on a P/E basis but that’s not how you should value companies growing their revenue at 30% to 50% per year.

For most stocks, there could be more short-term pain, but I think the stock market is attractive over the longer term.

Disclosure: Long NET, TTD, ADYEY

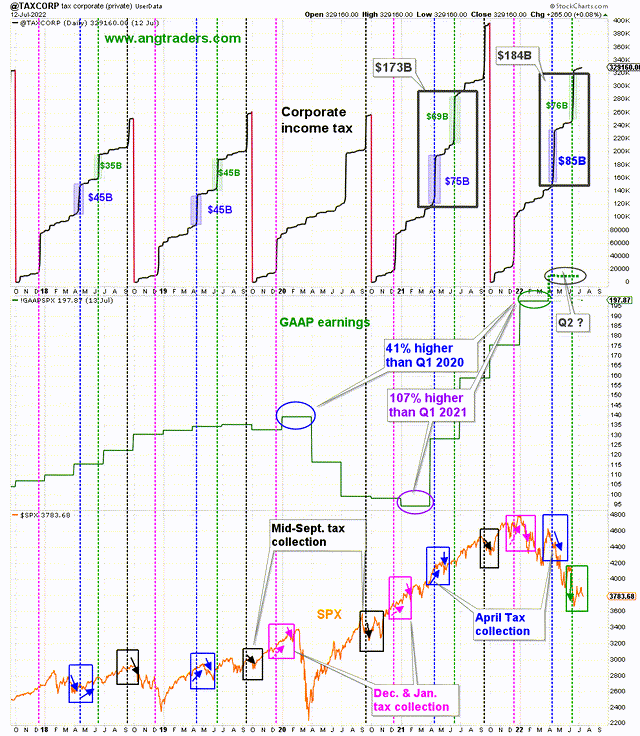

ANG Traders of Away From The Herd: Corporate tax collection is a proxy for corporate earnings. Because tax rates have not changed, we can surmise corporate earnings weeks ahead of earnings season by comparing the tax collected in corresponding quarters. The market is assuming (expecting) disastrous Q2 earnings, however, corporate tax collected in Q2 2022 is 6% higher than in Q2 2021. We suggest that Q2 corporate earnings will not be as bad as the market is pricing, and that equities will rally as this becomes apparent.

In particular, growth and tech will demonstrate that the market has overestimated weakness in earnings. We recommend TQQQ and ARKK.

– (ANG Traders, stockcharts.com)

Disclosure: Long ARKK, TQQQ

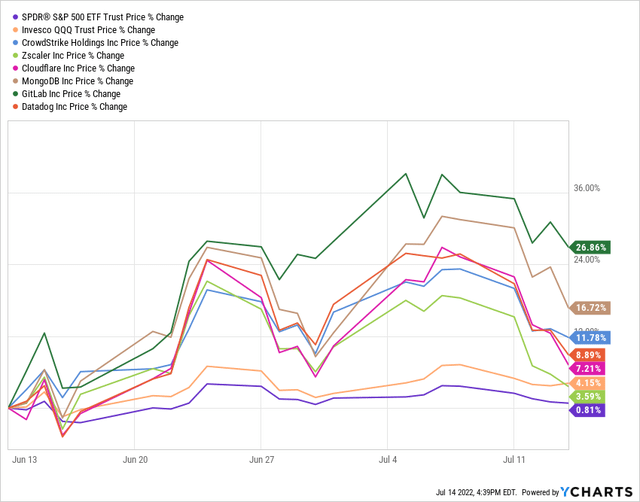

Cestrian Capital Research, Inc of Growth Investor Pro: In addition to the stuff everyone else looks at, grandpa’s Big Tech numbers and so on, we are very specifically watching the members of the New Cloud Generation for evidence of share gain, C-suite acceptance, and continued stock price appreciation (they have been moving up already when no-one was looking).

The New Cloud Generation stocks are those new-name enterprise software stocks which are high growth, have large forward contract books vs. their TTM revenue, are cash flow positive or about to become so, and which have rock solid balance sheets with no need for further funding. They are leading the next move down the cost curve in enterprise compute. Backing winning low-cost vendors is a tried-and-tested long term investment method that has worked since enterprise software was a thing. As Siebel gave way to Salesforce, so now is Splunk to Datadog. As Amazon AWS deflated the enterprise datacenter, so now is MongoDB undermining Oracle’s high cost model. This isn’t our first rodeo. But it’s a rodeo we’re very excited about. From the teeth of this selloff we think these names will emerge victorious.

In stocks such as DDOG, MDB, DT, NET, ZS, and others, we’re looking for which names can sustain or accelerate revenue growth rates; which are growing their unlevered pre-tax free cash flow; which are growing remaining performance obligations faster than they are revenue (this is a key tool to use with these names); and which have indestructible balance sheets.

New Cloud Generation Members vs. QQQ and SPY, last one month (YCharts.com)

Disclosure: Long DDOG, MDB, NET, ZS, DT, CRM, SPLK, DOCN, AMZN.

App Economy Insights of App Economy Portfolio: Between rising inflation and interest rates, the market has adjusted drastically. As a result, valuations have now retraced to their historical average or below. However, earnings could see downward revisions in the coming quarters, leading to further downward pressure.

It’s one thing for stock prices to go down. Fundamentals are the denominator here. If guidance gets cut, valuations may be less attractive than initially thought. We are bracing for a challenging earnings season with downward revisions in full-year outlooks (as evidenced by the few companies that have reported so far).

As best put by Maya Angelou: “Hoping for the best, prepared for the worst, and unsurprised by anything in between.”

One big question: How resilient will mission-critical software businesses look? I have in mind companies like CrowdStrike (CRWD) and Datadog (DDOG). CTO surveys in 2022 seem to indicate they could do relatively well.

We add new money to the App Economy Portfolio every month and focus on where the best opportunities are in real time. We update our ratings on every stock in the portfolio after each earnings report to make sure we put our money to work in the most compelling investments. If we look at past bear markets, the next 12 months are likely to offer tremendous entry points for those investing over multiple business cycles. And our community is rising to the occasion.

Disclosure: Long CRWD, DDOG.

EnerTuition of Beyond The Hype: The Q2 earnings season is an interesting one due to the recent economic uncertainty. At Beyond The Hype, we are constantly assessing how emerging trends impact stocks. For example, we have been ahead of the market in assessing how the economy was likely to snap back to a more service-oriented economy post COVID, and how that may depress semiconductor demand. Similarly, we forecasted that the crypto-driven GPU demand collapsing. Both these trends have materialized in H1, and the question now is what happens in H2.

For H2, Beyond The Hype is watching carefully the spending of technology companies as the public and private market valuations of these companies compress. With much wealth disappearing from this valuation compression and with cash burn becoming an important issue, will these companies continue their outsized spending? Especially when it comes to Machine Learning?

Machine Learning technology holds a lot of promise but there are limitations to the technology. For example, after about a decade of massive Machine Learning spending, the autonomous driving problem has not yet been solved. Technology companies need to retrench from out-of-control Machine Learning fishing expeditions and focus their efforts more narrowly on applications with near-term payback. If this thesis holds, would these companies continue to buy massive quantities of expensive Nvidia GPUs as they have been doing lately?

Call us skeptical. In H2, we expect to see a drop off in GPU spending worldwide.

Disclosure: None

Elazar Advisors, LLC of Nail Tech Earnings: It makes sense that there’s going to be an en masse guide down for Q3 in tech. Yes, a lot of people on the Street are talking about it so some of it is probably priced in. But the degree could be bigger than people think which wouldn’t be priced in.

One preview that we think is so important for each coming tech earnings season is Micron’s (MU) earnings report which comes out less than a month before. Micron, if you remember, lowered numbers big-time. I would argue that MU is the center of tech and so maybe the center of the stock market because tech matters so much. So, yes, you got me, I think MU is the center of the world.

Memory is sold alongside pretty much everything in tech. So when they have a giant guide down you have to believe there were a lot of other techie things not getting sold that didn’t need so much memory. I think that comes out in Q2 reports and what companies say about Q3.

Everybody and their mother up until Q1 was talking about endless tech ‘visibility’ as long as the eye could see. But that was probably because companies needed to order too much just to get what they wanted based on supply constraints. Now I expect a lot of (new word I learned from ANET speaking about their suppliers) ‘decommits.’ Customers can back out of those orders and probably freeze new orders. That should lead to tough Q2 reports based on tough Q3 guides in those reports.

We take it step by step and will predict and react to all of our coverage. But that’s our thinking early on.

Disclosure: None

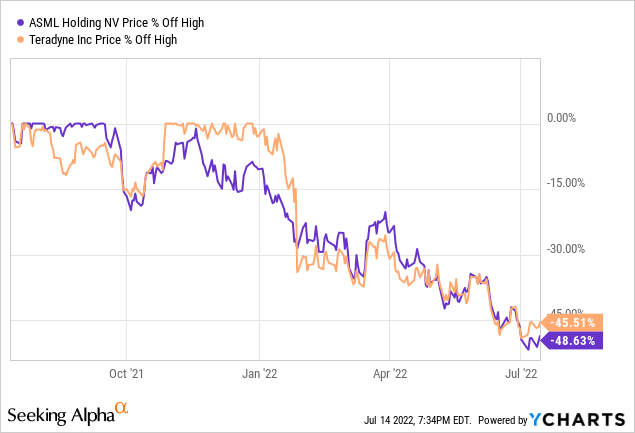

Trading Places Research of Long View Capital: My particular interest this earnings season is the semiconductor fabrication equipment companies, and for our purposes here, I will narrow it to two, ASML (ASML) and Teradyne (TER).

– (YCharts)

There are similar charts for many companies in this sector. Q1 was terrible, with huge supply chain problems limiting their ability to ship despite hot demand, estimated at $100 billion in 2022. But Micron (MU) just reported they will be cutting back on their Capex plans. We also got news of more possible restrictions on exports to China.

But backlogs were still very high at the end of Q1, and many companies looked set up for very strong H2-over-H1 performance in 2022 if demand holds and supply issues clear.

General questions for the whole sector:

- Are they still estimating $100 billion? Are there pulled orders in memory? Logic?

- Have supply chain issues gotten better?

- Have they seen any changes in Chinese demand?

ASML had the biggest supply-demand mismatch of anyone, including a factory fire. They projected 2022 demand for their cheaper DUV machines over twice 2021 capacity – are they on track to get capacity up? They only delivered 3 of the far more expensive EUVs in Q1 – what does that look like in the rest of year?

Teradyne’s revenue is closely tied to TSM’s (TSM) Capex cadence for top nodes. So the big question for them is whether TSM’s N3 orders are still on track for H2.Overall, if sentiment cooperates, there could be some big H2 performance in this sector.

Disclosure: None

Damon Verial of Timing the Market: In the current environment, tech stocks with high PER ratios are unlikely to see sustained growth. Margins are shrinking, and I expect to see weakened guidance in tech lead to a continuation of this much-needed correction in the tech sector. Many tech stocks affected will never see their previous highs ever again.

We are looking to short a lot of the tech companies that have yet to turn a profit but are nonetheless valued at high stock prices. We are also looking to identify those tech companies that are highly likely to bounce back from this correction. I think a lot of new tech investors are receiving a painful lesson right now, but they could also take advantage of the increased volatility by learning how to trade earnings, possibly recovering from their losses. We expect a lot of movement this earnings season and will be making some quick trades (hold over earnings) to leverage the increasing volatility.

As for specific tickers, in the meantime, we are holding a few long-shot plays that are uncorrelated with the tech cycle resetting – stocks such as SIGA Technologies (SIGA), the monkeypox play. We are also looking at still-overvalued plays relative to pre-pandemic times, such as Zoom (ZM), which is still nearly double what it was before 2020. A lot of good opportunities are coming up this earnings season, and I’ll be updating my subscribers as things progress.

Disclosure: None

Leandro (Invesquotes) and From Growth to Value of Best Anchor Stocks: This earnings season, we’ll be monitoring the fundamental performance of Best Anchor Stocks, as we always do. Most importantly, we’ll focus on the qualitative highlights to assess if the long-term thesis remains intact for all of our holdings. The current economic environment might make the numbers of our companies look weaker, but we don’t worry that much about this since we hold sound businesses that might even benefit from a recession.

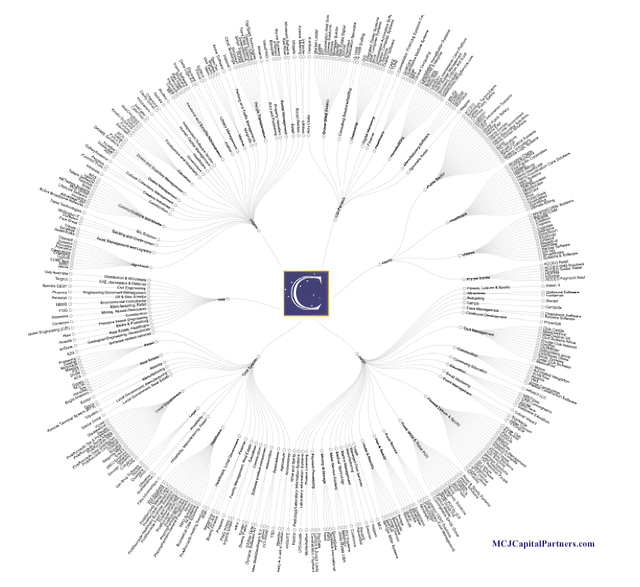

One of these businesses is Constellation Software (OTCPK:CNSWF) (CSU.TO), a company that would benefit from lower valuations in the VMS (vertical market software) space as it would be able to pursue its M&A strategy at lower prices. Constellation already owns a large universe of VMS businesses, but we expect this universe to exponentially grow amidst a tough economic period thanks to its resilient cash flows and dry powder. This is the whole portfolio of Constellation’s companies.

The benefits to Constellation during a recession will take some time to show up, but we are in this for the long haul, so we are not worried too much about the short-term impacts of a recession. We’ll take advantage of any stock weakness when it’s not coupled with fundamental weakness. We always remember that, when the stock market seems the riskiest, it’s probably the safest time to invest. The opposite also applies: when it seems the safest, it’s probably the riskiest.

Disclosure: Long CNSWF

Mike Fay of BlockChain Reaction: A lot of the crypto equities that have been highlighted in BlockChain Reaction are the public miners. There are two different strategies that most of these miners have tried to take thus far. Some, like Hut 8 (HUT), are trying to hold their entire mine supply to wait for higher prices. Others, like Iris Energy (IREN), actively sell their block rewards daily to continue funding operations. Since we already know what most of these companies mined and sold in June, I’m looking at cash levels. I specifically want to see how many more quarters of cash burn Hut 8 has before it potentially becomes a forced seller like Bitfarms (BITF) and Core Scientific (CORZ) were last month. Growth numbers from Hut’s data center segment is something to keep an eye on as well.

Disclosure: Long HUT & IREN

Be the first to comment