Sundry Photography/iStock Editorial via Getty Images

DuPont de Nemours (NYSE:DD), or simply DuPont, is a Delaware-based company involved with chemical production and sales. The company is split into three different divisions, a move made in June 2019, and has benefited the company by allowing each of the three spin-offs to focus on their specific areas. The company was right to do so as some segments performed better than others. As evidenced by the company’s recent decisions to divest certain businesses while using funds earned to acquire more viable businesses, the company seems to be heading in the right direction.

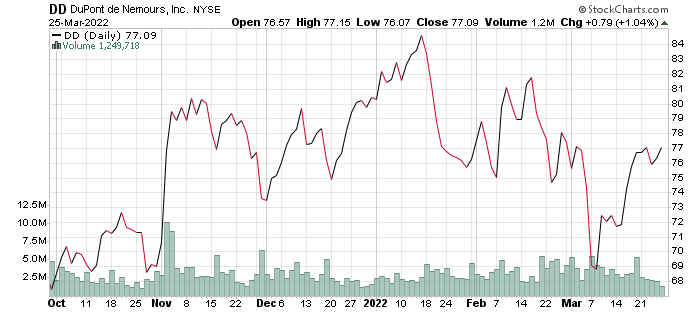

stockcharts.com

A brief look at the company’s financials and recent press releases builds towards a narrative of careful growth highlighted by the ability to direct the merged companies in the right course. We will get into a detailed version of a story that looks to have a happy ending for bullish investors.

Company Overview

DuPont boasts three of some of the largest chemical companies in the world and has a current market cap valued at over $39 billion. Despite the recent merger with Dow and E.I. Du Pont Chemical in 2017, in a reportedly $130 billion deal, the company went on to create spinoffs to manage all its assets. The Electronics & Industrial segment deals with the supply of necessary items needed for most mobile electronic devices, as well as television sets and others. The Mobile & Materials segment provides a range of products used for the engineering and production of an equally extensive range of electronic devices. These include thermoplastics, adhesives, silicone, and advanced films. Finally, the Water & Protection division works with industrial systems to provide products for water purification, energy, transportation, and construction use. The aforementioned three divisions all make up the largest chemical company in the world. According to the company, about 95% of all smart devices in use are enabled by DuPont’s materials. Given its product and service range, it isn’t hard to believe. No matter how small the components that make up most smart devices today, it is enough to potentially disrupt the industry if DuPont ever stops its supply.

Financials

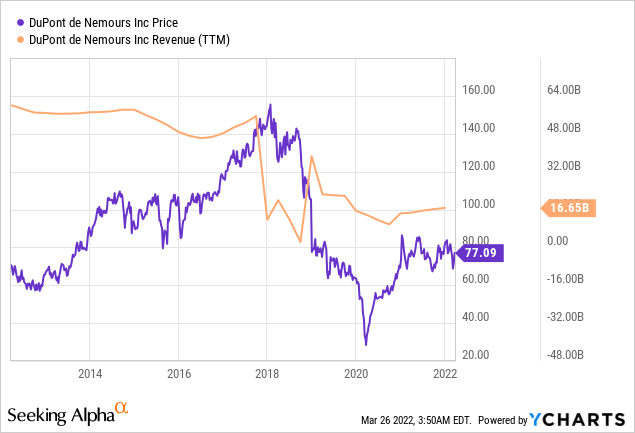

ycharts.com

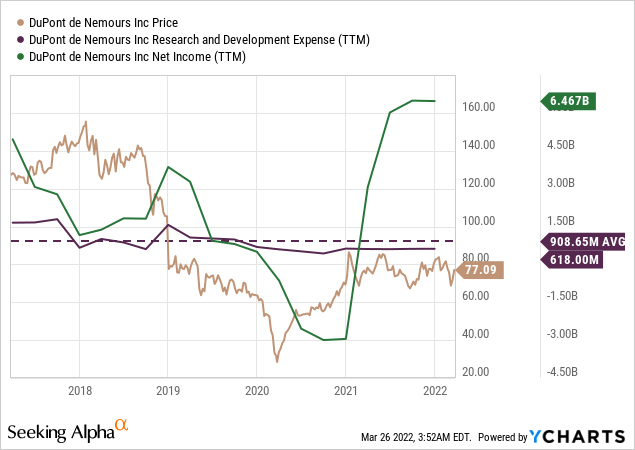

DuPont saw its net sales reach $4.3 billion in the fourth quarter of 2021. This represented a 14% increase compared to the same quarter a year before. An increase in the price of the products resulted in growth and strong demand for the products the company supplies, most notable with regards to the return of industrial operations and the necessary ingredients many industries need to operate. Annual net sales reached $16.7 billion for the full fiscal year, an improvement from the $14.3 billion reported at the end of 2020. Yet despite the appreciation in prices and increase on a year-to-year comparison, revenue still did not get close to what was reported at the end of 2018, when the company saw $22.6 billion in revenue for the whole year. However, what is interesting to note when analyzing the company’s income statement is the percentage of spending vs the income and how much the company was able to generate in income. As it turns out, despite not achieving the same in revenue, the company substantially decreased its spending, going from over $1 billion in Research & Development to spending a little over $600 million in 2021. Other costs were cut, resulting in the company earning over $2.5 billion more in net income compared to 2018’s figures. This shows the company’s capacity to manage itself well, perhaps aided by the spin-off divisions recently created.

ycharts.com

DuPont’s adjusted earnings per share saw an increase of over 50% in 12 months, rising to $1.08 as per the end of the fourth quarter, caused mainly by a reduced share count and higher segment results. This was slightly lower than the $1.15 reported in Q3 and equaled Q2, but it nevertheless maintained the company’s recent positive trend and beat the $1.01 estimates. The annual EPS ended at $4.30, which marked a 95% appreciation from the year before, and estimates are that the EPS will grow to a further $4.82 by the end of 2022. Operations are expected to run smoother this year as much of the recovery work is in the past, and expenses can be estimated to keep going down. If that’s true, the company is on course for another year of growth, with significant returns for investors. Net operating cash flow saw a reduction from over $4 billion to approximately $2.3 billion in a year. This was easily attributed to the surplus in inventory caused by the high demand and bottlenecks created to deliver supplies. The current year should resolve that issue but has nevertheless served as a lesson on properly managing crises such as those that arose in the past two years.

Future Projects

Keeping track of DuPont’s movement can seem a little daunting after only a few years. Upon completing their merger, it didn’t take the company two years before it opted to split into three segments. The company has recently announced that it will divest a majority of the Mobility & Materials division for $11 billion cash, a deal which will see several select products and business lines handed over to Celanese Corporation (NYSE: CE). However, this behavior is far from erratic, as each time the company has moved to make a decision as big as this, it has turned out for the better. The transaction will see the aforementioned business, which together generated approximately $3.5 billion in 2021, completed by the end of 2022. The company is also looking to divest Delrin, a business that generated sales of approximately $550 million in 2021 by the beginning of 2023.

However, it isn’t all divestments, as the company also moved to purchase Laird Performance Materials in a $2.3 billion deal announced earlier in 2021. The acquisition added to the company’s portfolio, which now includes electronic materials used in smart vehicles and mobile devices that use 5G. This was part of the reason revenue increased throughout the year, and the positive developments will provide more encouragement to pursue the acquisition of Rogers Corporation in an all-cash transaction valued at about $5.2 billion. The transaction will further expand DuPont’s portfolio and will give shareholders $277 in cash per share once settled by the end of the second quarter of 2022.

Conclusion

The chemical industry grew an estimated 1.5% in the past year and is expected to double in 2022. As markets continue to reopen and demand for products increases, the many businesses and products DuPont has to offer will continue to be in high demand, and profits are available for the taking. The company is currently beating its competitors at a reported P/E ratio of 16.2 compared to the industry average of 12.45. DuPont was also able to return over $2.7 billion of capital to shareholders and de-levered the company’s balance sheet with a $5 billion reduction in long-term debt.

While the chemicals industry is not one of the largest at the moment, DuPont is certainly the largest of them all when combining all its many businesses. The market is still in recovery and, by all measures, is expected to continue to grow in the coming years if no new global crises arise. Until then, investors can safely take a bullish stance when looking into DuPont’s future.

Be the first to comment