stockcam

Intro

If you have ever wanted to learn a new language, chances are you’ve heard of Duolingo. Despite the mobile app’s immense popularity, Duolingo (NASDAQ:DUOL) has dropped over 25% since the beginning of 2022 as macroeconomic turbulence continues to plague tech stocks. Additionally, many bears of the market have been betting against the language-learning platform following this drop. Contrary to these headwinds, Duolingo’s solid fundamentals, strong earnings, and market leadership make the company a great long-term investment.

Company Overview

Headquartered in Pittsburgh, Pennsylvania, Duolingo is an American educational technology company that runs a language-learning app. Because Duolingo is free to download, the majority of its revenue (74%) stems from its subscription model, Super Duolingo, in which consumers can unlock personalized practice and remove ads. About 13% of its revenue is generated from advertisements, and the remaining 13% is from various in-app purchases and the Duolingo English Test (a widely accepted English certification assessment).

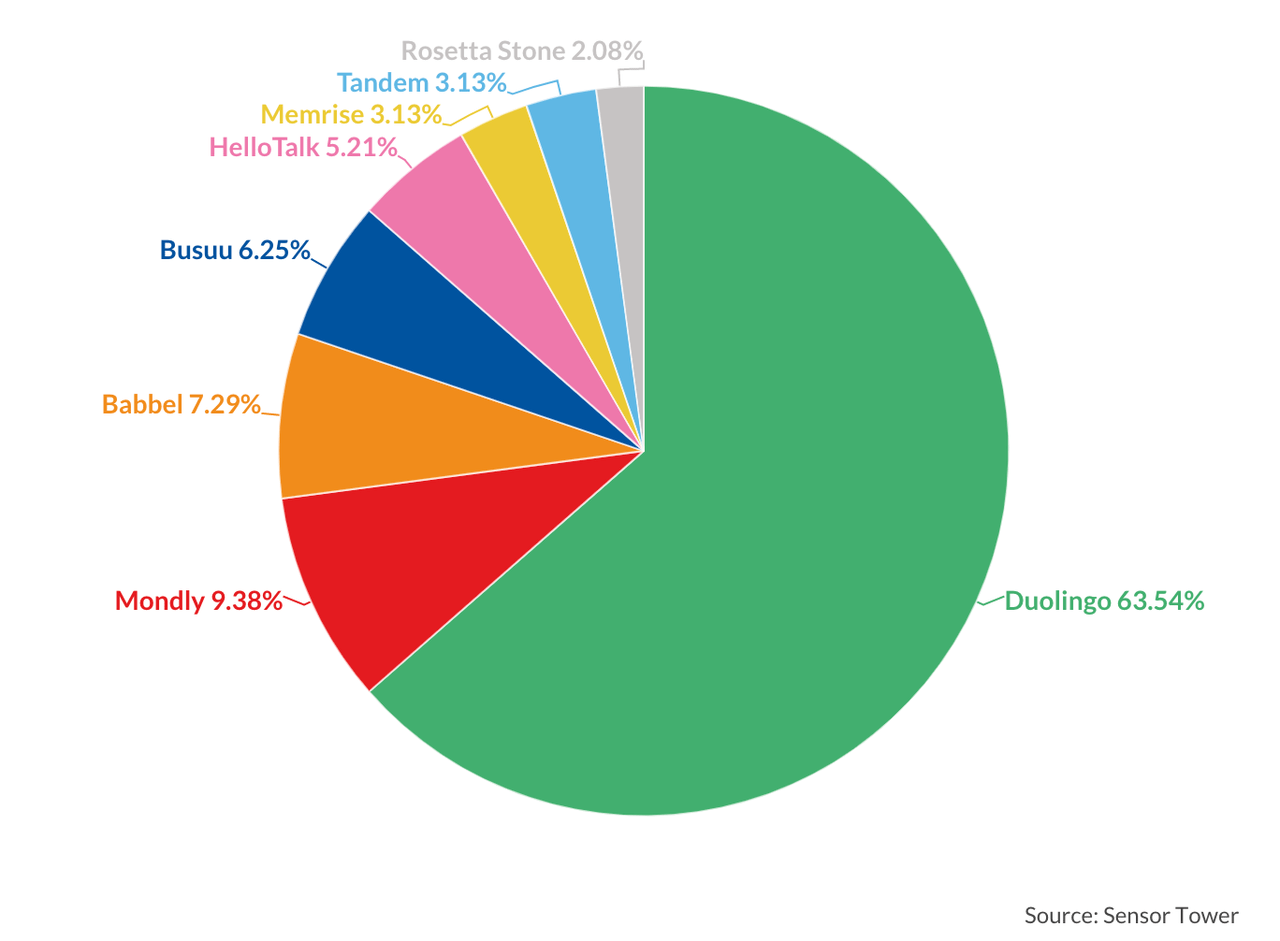

Consumers choose Duolingo for its approachable, game-like method of teaching. It offers helpful visuals and is very interactive, fostering users’ motivation. Additionally, Duolingo has effective marketing strategies that appeal particularly to the younger generation. Its TikTok page alone boasts a staggering 4.9 million followers, and the company often posts videos that conform with ongoing trends. Because of this, Duolingo is currently the most popular language app on the market, contributing 63.54% to total language app installs in 2021. Competitors are performing nowhere near as highly as this market leader.

SensoryTower

Rough Earnings

For Q2 2022, Duolingo had a total revenue of $88.4 million, which beat estimates by $2.68 million and increased 50% YoY. The company’s EPS saw similar outperformance as it reported an EPS of -$0.38, beating the consensus by $0.14. I view these better than expected results as a positive sign for investors, as the company works to grow its top line and improve its margins. In terms of guidance, management is expecting to see increased user engagement and higher revenue as they plan to release two new features: the Quests tab and Side Quests. I believe that these new features will continue to drive user engagement and attract more users as Duolingo solidifies its position as the go-to language learning platform. Additionally, the number of global daily active users (particularly in China) is expected to continue on an upward trend as the app was recently reinstated on Chinese app stores. In short, growth opportunities are plenty for the company, and I expect to see continued financial performance growth

Duolingo’s Sound Fundamentals

Duolingo has seen robust growth in other fundamental metrics. For Q2 2022, its Total Bookings in Q2 2022 (profits from Super Duolingo, Duolingo English Tests, in-app purchases, and advertisements) grew 51% YoY, comparable to the revenue growth in that same time span.

Additionally, Duolingo’s subscription service is still going strong. As of Q2 2022, 3.3 million users were paid subscribers – an all-time high and a 71% YoY increase. Furthermore, the number of Daily Active Users (DAUs) saw a growth of 44% YoY to 13.2 million. These metrics prove that Duolingo is exhibiting solid fundamental performance despite recent macroeconomic headwinds. Furthermore, a higher percentage of users appears to be paid subscribers in Q2 2022 than Q1 2022. In Q2 2021, roughly ~21% of DAUs were paid subscribers. In the recent quarter, that metric has increased to 25%. The growing percentage of paid subscribers compared to the number of DAUs shows the strength of the company’s business model and the value proposition of its products. Regardless, the increasing number of daily active users will likely support future revenue growth – as more users mean more advertisements and subscriptions.

ESG Considerations

The company’s mission and fundamental business contributes positively to society as a whole. Although a subscription model is present, students can largely learn for free. In addition, its language certifications are cheap and recognized by many institutions. Overall, Duolingo’s whole business does a huge part to address the inequality in education.

Internally, the company comprises employees from 25 different countries, and has set goals to hire 50% female and 50% people of color. Its employees are happy with the company, with a 4.6 star review on Glassdoor and rated “Best Workplaces” by Inc in 2018.

Valuation

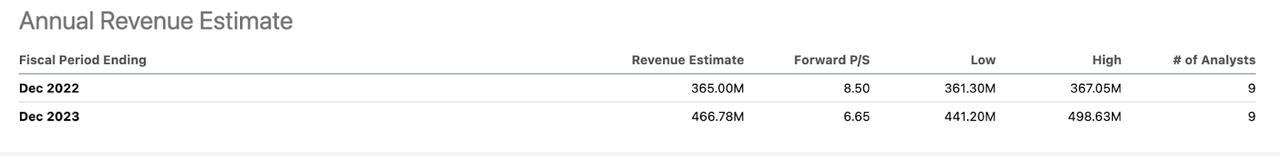

The online language learning market was valued at $59 Bn in 2021 and expected to grow to $191.06 Bn by 2028, with a 18.3% CAGR. Assuming that Duolingo grows along with the industry, that would leave its revenue at roughly $800 Mn in 2028, which is also roughly the growth rate that other analysts are predicting as well.

Seeking Alpha

However, even applying after P/S ratio of 10x, that leaves its market capitalization at $8Bn in 2028, and discounting it back with a 10% discount rate leaves a 45% upside in its stock. For me, I believe Duolingo offers too little of a margin of safety considering that a 10x P/S ratio is quite high, with the average software P/S ratio at just 4.04. Applying a 4.04x P/S ratio would actually mean a 25% downside in its stock price. Though the company has strong fundamentals, given the market environment, I am hesitant to value the stock based on a high P/S multiple.

To sum it up, in this environment with continued interest hikes, I believe the stock is exposed to downside risks from continued sell-offs and that investors can likely pick up the stock at a better price.

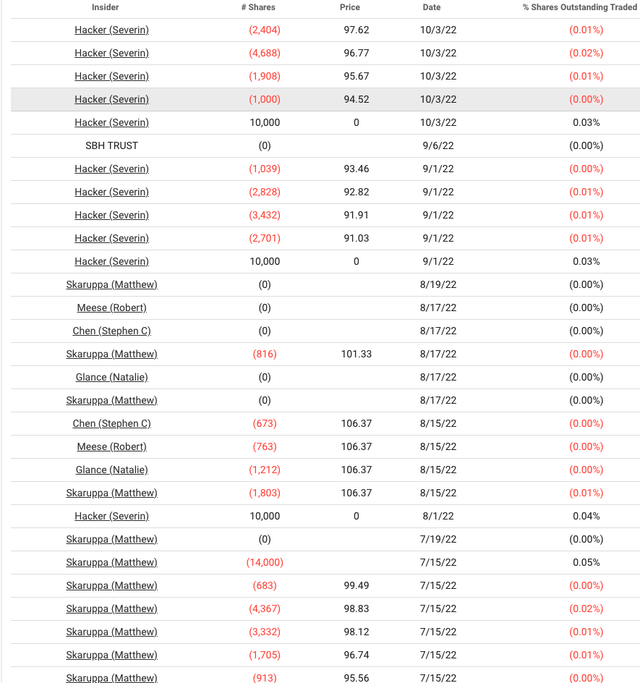

Insider Selling

There have been waves of selling by insiders in the company which raises a bit of concern in my view of the business. The company’s CFO and CTO have continually sold off the stock. In just the last 6 months, over 922,488 shares have been sold by insiders.

Risk

Duolingo primarily faces operation-based risks. Given that it is a mobile app, it has a heavy reliance on app stores, which can negatively impact its performance. Apple’s App Store, for instance, charges a 30% commission from all revenue Duolingo makes in the App Store, decreasing overall profits. App stores can harm Duolingo in ways other than commissions too. Apple and Google can implement policies that alter how Duolingo can advertise itself and can ban Duolingo altogether – something that has already happened in China (though Duolingo is now reinstated on Chinese app stores).

Conclusion

For the past year, Duolingo has been struggling with macroeconomic headwinds and market bears betting against them. Despite these troubles, the language-learning company has delivered solid earnings, proven to have strong fundamentals, and continues to be a market leader. However, the current market environment has been brutal for a long duration stock like Duolingo, and it is uncertain as to the extent of the macroeconomic picture. The valuation remains elevated in my view compared to the market backdrop, and I believe it is prudent for investors to wait for a better “buy the dip” opportunity. For these reasons, I recommend a “Hold” on this stock.

Be the first to comment