JamesBrey

Introduction

Yesterday, I wrote an article covering my macro outlook, which included an increasingly hawkish Federal Reserve, despite increasing financial market risks and (related) economic weakness. It caused the stock market to completely seize its attempt to recover. Not only that, but we’re now witnessing cracks in the quality of debt, which is the last thing this market needs. I’m bringing this up because, in that article, I also mentioned that I would give readers some “yield plays” that do well in a tough economic environment, offer a high yield, and a safe balance sheet in light of deteriorating financial stability.

While I have been bullish for a while, I decided that I will be aggressively adding to my most defensive stocks in the weeks ahead. Both Duke Energy (NYSE:DUK) and Xcel Energy (NASDAQ:XEL) offer very attractive yields – and valuations – as well as stellar business models that come with low volatility. These stocks not only make sense for income-oriented investors, but also for dividend growth investors like myself who want to buy a certain yield without having to give up satisfying long-term capital gains.

In this article, I will walk you through the economic environment, my thoughts on the market and the above-mentioned stocks, and my strategy going forward.

So, let’s get to it!

A Quick Recap – Macro Edition

For the sake of this article, it’s important to take a quick look at the bigger picture using the article I wrote on Friday, October 7.

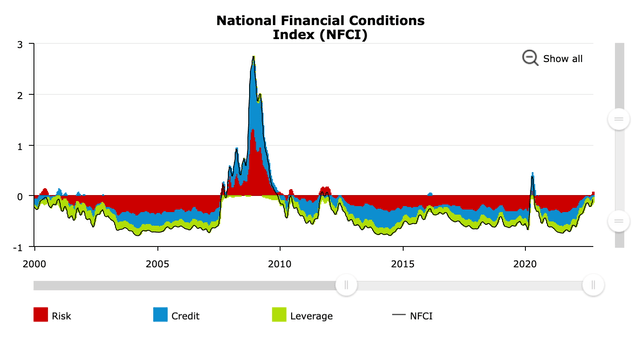

The market is extremely worried because the Federal Reserve made clear that it is determined to hike despite increasing economic worries. For example, financial conditions are starting to deteriorate on top of related financial stability issues like the Bank of England’s capitulation as it buys longer-maturity bonds again, Credit Suisse’s default risks, a weakening housing market, and a weakening labor market.

Chicago Federal Reserve

The problem is that the situation isn’t bad enough to warrant dovish Fed comments.

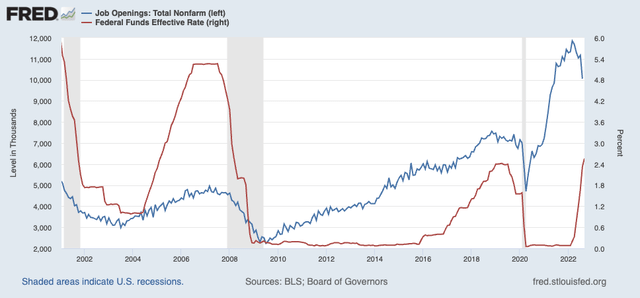

One important example I used is JOLTS (job openings and turnover survey). While the US economy saw 1.1 million fewer job openings in August. That’s one of the worst declines in the survey’s history. However, the US economy still saw 1.7 job openings per unemployed person. That’s inflationary and the Fed knows it.

St. Louis Federal Reserve

Moreover, as cyclical as it sounds, it also didn’t help that the US economy saw an increase of 263K in total non-farm jobs in September. This beat consensus estimates by 13K, which more or less confirmed that the hiking cycle, so far, hasn’t done a lot of damage to the economy. Moreover, wage growth came in at 5.0%, which J.P. Morgan calls “way too hot”.

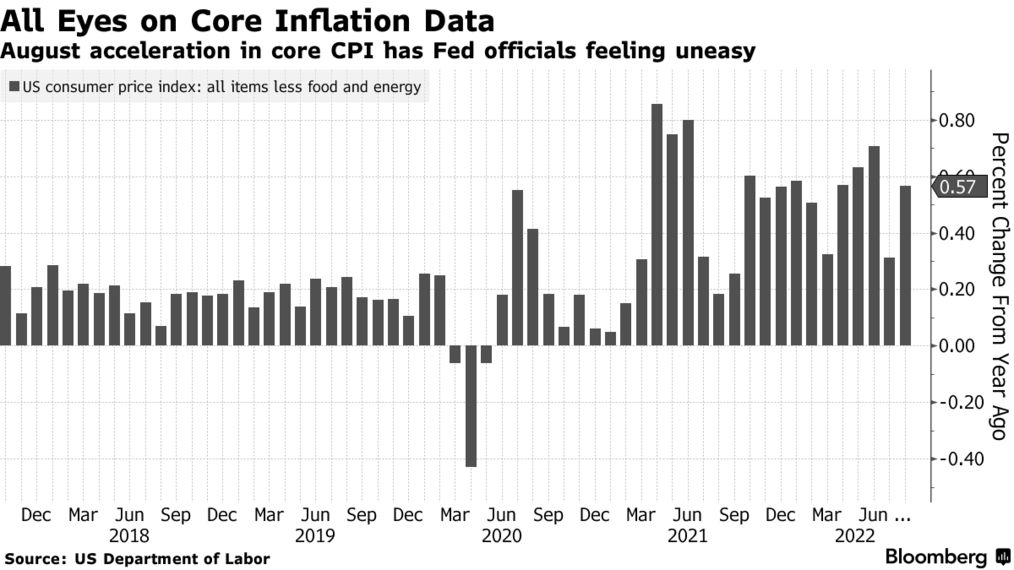

It also doesn’t help that inflation remains stubborn.

Bloomberg

To use my own words from the article:

However, we’re not out of the woods yet. Economic conditions need to become much worse for the Fed to pivot. That could end up pushing stocks lower than current levels again before we get dovish comments.

I expect a pivot in the first half of 2023. If economic growth continues to decline, I believe we will encounter elevated financial instability, pressuring the Fed enough to pick financial stability over pressuring inflation.

Why Safety Matters

I have to admit that I have one major weakness when it comes to investing. I tend to prioritize companies that I am passionate about. Think about railroads, machinery companies, and defense stocks. However, as I try to maintain a balanced portfolio, I “have to” buy stocks that I consider to be somewhat boring.

It helps that the stocks I am about to show you come with a great valuation, a high yield, and the ability to outperform, which is why I am actually quite excited to add to them in the weeks ahead.

I also want safe high-yielding companies in case the market remains weak on a prolonged basis. I discussed these risks in a different article last month.

With all of this in mind, it is important to own high-quality stocks with healthy balance sheets.

Related to what we discussed in the first half of this article, we’re now seeing developments that actually worry me.

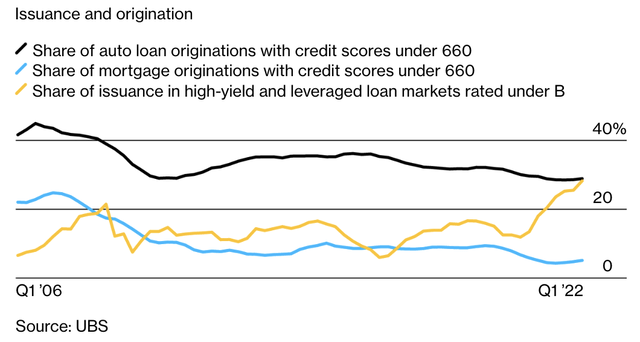

Financial stability is coming under pressure as the quality of debt on the market is deteriorating.

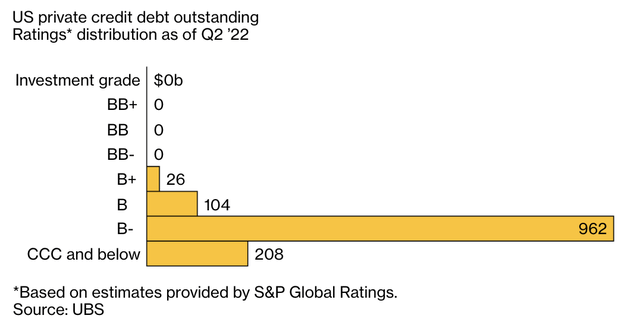

The good news is that since the Great Financial Crisis, the issuance of high-risk auto and housing loans (mortgages) has gone down quite consistently. However, the share of non-investment grade loans has gone up quite significantly. The orange line in the chart below shows high-yield and leveraged loans with ratings under B, that’s highly speculative debt.

UBS, Via Bloomberg

We’re also seeing a large increase in “unhealthy” companies as the share of outstanding loans to borrowers with a B- rating has risen to 24%. The debt-to-EBITDA ratio is making its way to 5.5x.

Moreover, portfolios of collateralized loan obligations (“CLOs”) now hold more than 25% B- debt. That’s up from roughly 5% in 2012.

Even worse is that private lending is accelerating, which isn’t aimed at the highest-graded borrowers. In 2Q22, most loans were issued with a rating below B. That is truly terrible and a sign of ongoing financial instability.

Bloomberg

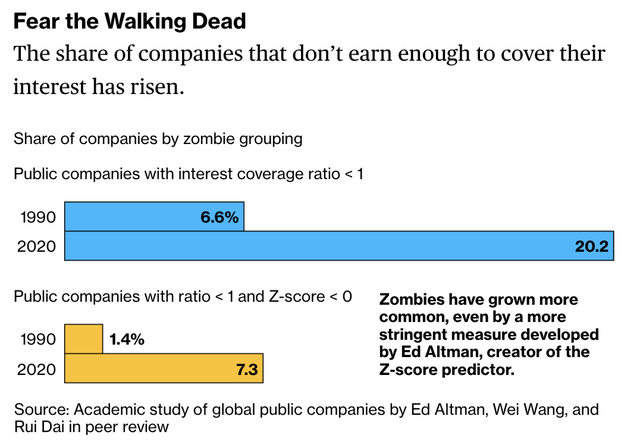

As a result, the number of companies with an interest coverage ratio of less than 1 has risen to 20.2% in 2020. Bear in mind that back then, rates were low and governments supported companies to stay above water. As the Fed is hiking rates into economic weakness, companies suffer from higher credit risks and lower growth to service these loans.

Bloomberg

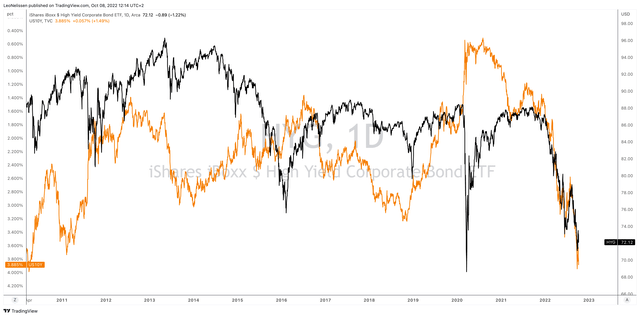

With all of this in mind, the chart below shows the iShares High Yield Corporate Bond ETF (HYG) compared to the US 10-year government bond yield (inverted). The massive surge in yields along with economic difficulties has pushed HYG down to its 2020 lows. This ETF owns mainly BB to CCC-rated debt (junk bonds) with an average yield to maturity of 8.5%.

TradingView (Black = HYG, Orange = US 10Y Yield (Inverted))

In this case, high-yield junk isn’t the only thing that suffered.

A lot of high-quality companies also suffered, which is why I am writing this article.

Buying My Two Favorite High-Yield Utilities

Buying stocks in defensive sectors doesn’t mean they don’t fall during bear markets. What it means is that they fall less (outperform). While that still doesn’t make it “fun”, it helps that most defensive stocks with decent yields start to get really juicy yields during downturns, which makes it fun to buy even boring stocks like the ones we’ll be discussing in this article.

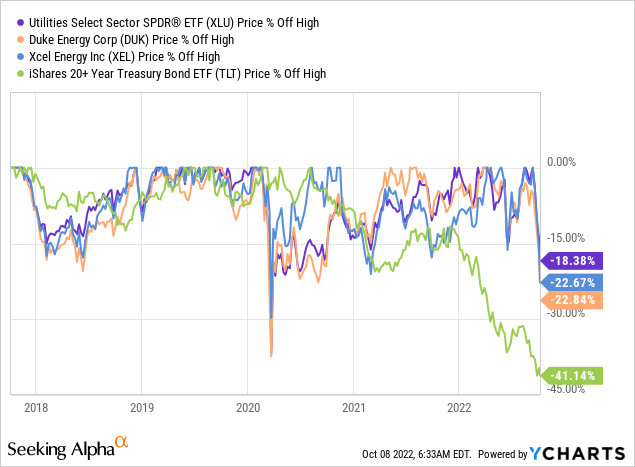

As the graph below shows, the increase in long-term bond yields as displayed by the decline of the iShares 20+ Year Treasury Bond ETF (TLT) is starting to take its toll on safer, high-yield stocks like utilities. The past few weeks have been brutal on utilities – using the Utilities Select Sector SPDR ETF (XLU) as a benchmark.

That’s OK, as it opens up new investment opportunities for income-seeking investors and the ones looking for dividend growth.

So, let’s start with the highest-yielding stock.

Duke Energy

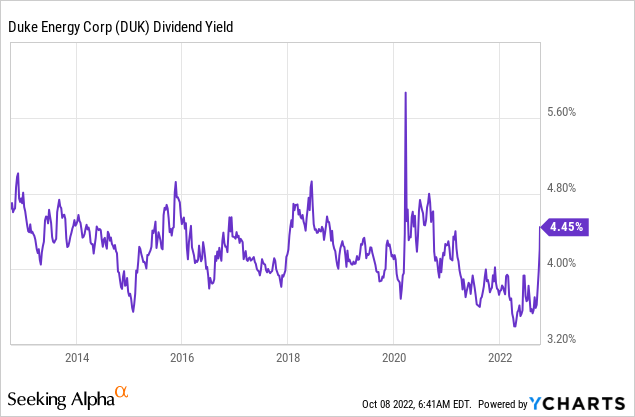

Duke Energy is paying a $1.005 quarterly dividend per share. That’s $4.02 per year. This translates to a 4.5% dividend yield using its current stock price.

This yield is now close to the upper bound of the historic range, if we exclude outliers like the one in 2020.

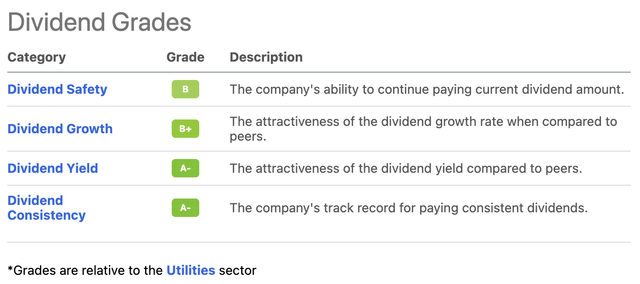

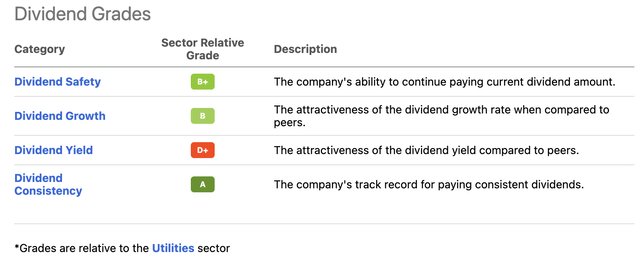

Looking at the Seeking Alpha dividend scorecard below, we see that the company is scoring high when it comes to dividend safety, growth, yield, and consistency – compared to its utility peers.

Seeking Alpha

Unfortunately, scoring high on dividend growth in this sector doesn’t mean that much as dividend growth is still low. These are the most “recent” hikes:

- July 2022: 2.0%

- July 2021: 2.1%

- July 2020: 2.1%

- July 2019: 1.9%

- July 2018: 4.2%

That’s not a lot, but it’s consistent. And it makes buying during a sell-off so much more important as it gives us a better “starting” yield.

For example, a 4.5% compounded by 3% over the next 10 years ends up becoming a 6.1% yield on cost. A 4.0% starting yield turns into a 5.4% yield on cost under the same conditions.

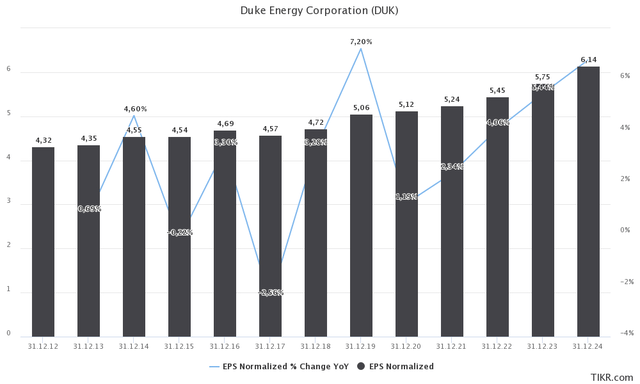

The 2022E payout ratio is 74% using the numbers in the chart below. The chart also shows that EPS growth is consistent. Int he years ahead, annual EBITDA growth is expected to accelerate to 6.7%, which supports dividend growth and debt servicing, which we will discuss as well. Also, note that earnings PER SHARE account for secondary share offerings for financing purposes. That makes these numbers quite good given the defensive nature of this business.

TIKR.com

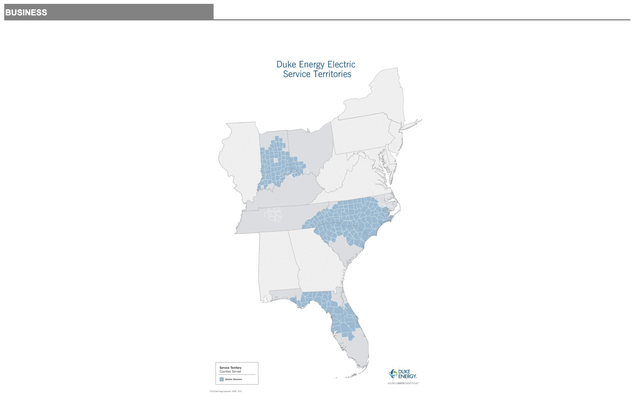

With that said, these numbers are backed by a stellar business model. Duke Energy is the second-largest regulated utility company in the United States with a market cap of $68.6 billion.

The company operates through five subsidiaries, providing energy to customers in Indiana, Southwest Ohio, the Carolinas, and the Sunshine State, Florida.

Duke Energy

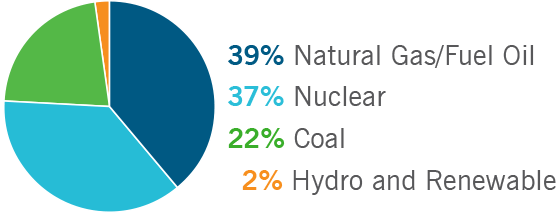

In 2021, the company generated 81.3% of the power it sold to customers. 18.7% came from third parties (purchased power). Just 1.5% was hydro and solar power. Roughly 30% was nuclear power. Natural gas came in slightly bigger at 31.8% with coal accounting for 18.2% of power generation.

Ignoring third-party power, this is what the breakdown of the company’s current generated net output in gigawatt-hours looks like.

Duke Energy

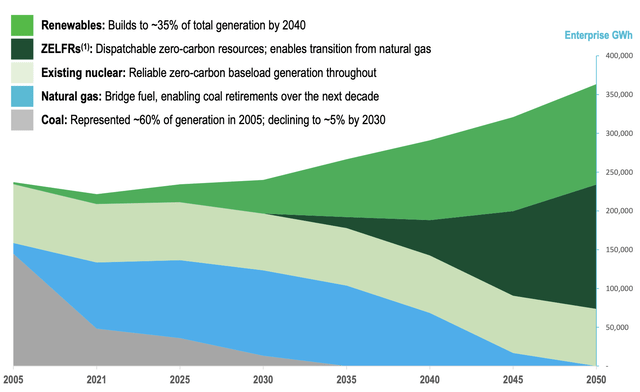

Like all major utilities, the company is pledging to become carbon neutral by 2050. Unfortunately, this is expensive. Fortunately, the company decided that nuclear is part of it, and as I am pro-nuclear energy, I am happy that the company generates a big part of its power from nuclear power.

That said, the company recently unveiled a $145 billion spending plan for the next 10 years. That’s $10 billion more than expected. As reported by Seeking Alpha:

Duke said 85% of the planned investment will fund its generation fleet transition and grid modernization, to include $75B to modernize and harden its transmission and distribution infrastructure; $40B for zero-carbon generation, such as solar, wind and battery storage resources, and extending the life of its nuclear fleet; and $5B in hydrogen-enabled natural gas technologies.

The company reaffirmed expectations to exceed 50% carbon reduction by 2030, and it established interim carbon emission reduction targets of 80% for Scope 1 emissions by 2040 and 50% for Scope 2 and 3 upstream and downstream emissions by 2035.

This is what that transition is expected to look like:

Duke Energy

With that said, on top of a recession-proof business model, the company has a healthy balance sheet, although the debt load itself isn’t “low” by any means.

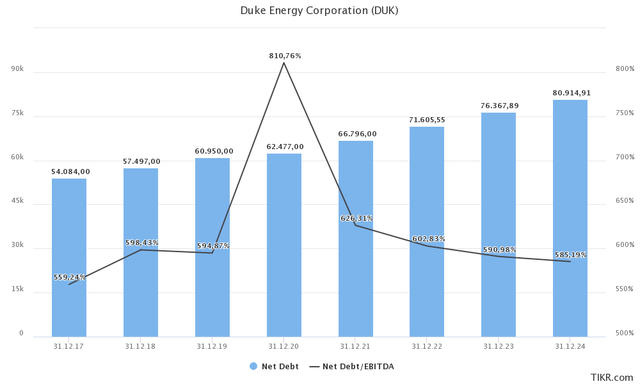

In 2024, the company is expected to come close to $80.9 billion in net debt (gross debt minus cash). That’s up from $54 billion in 2017. However, the debt ratio is expected to fall in the years ahead as EBITDA growth is expected to outperform net debt growth.

TIKR.com

Moreover, the company’s interest expense coverage ratio remains at 5.2x, which is very solid and in line with the numbers of the past 10 years.

Hence, the company continues to enjoy a high credit rating. Its issuer credit rating is BBB+ with a stable outlook. This is one step below the A-range.

Needless to say, rising rates are bad for companies that need to boost investments to develop energy sources, which is the main reason why DUK is falling. The other is general de-risking. As much as the tide sometimes lifts all boats, bad market sentiment causes weakness across the board. Even among anti-cyclical companies.

When it comes to the valuation, we find that DUK is trading at 11.4x NMT EBITDA of $12.9 billion. That’s based on its $147.7 billion market cap, consisting of a $68.6 billion market cap, $76.4 billion in expected 2023 net debt, $1.9 billion in minority interest, and $800 million in pension-related liabilities.

That is very cheap. I believe that DUK should be trading closer to 13x NTM EBITDA. Moreover, its dividend yield is high. When (not *if*) the Fed starts to pivot, investors will rush back to buy quality yields. DUK will be a huge winner in that scenario.

Hence, I believe that DUK is at least 30% undervalued.

Now, onto number 2.

Xcel Energy

With a market cap of $32.7 billion, Xcel Energy is significantly smaller than Duke.

Headquartered in Minneapolis, MN, the company was incorporated in 1909. Nowadays, Xcel Energy serves customers in eight mid-western and western states, including parts of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas, and Wisconsin. The company does this through six main subsidiaries.

Xcel Energy

The company services 3.7 million electric customers, and 2.1 million natural gas customers using an asset base of roughly $60 billion.

Xcel Energy

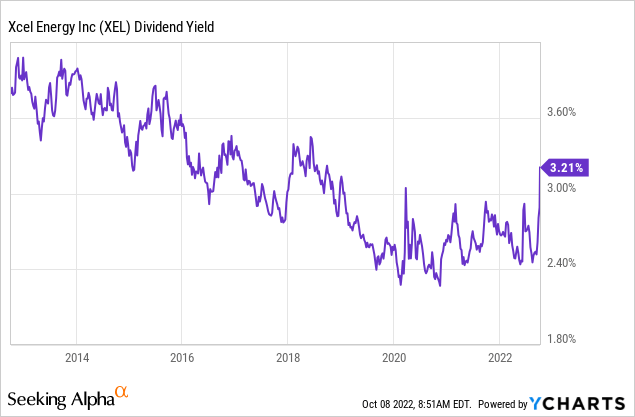

The company pays a $0.4875 quarterly dividend, which is $1.95 per year. Using its current stock price, we’re dealing with a 3.3% yield. That is below Duke’s yield, but still attractive, I think.

I’m saying that because the company scores high in every category, except for its dividend yield.

Seeking Alpha

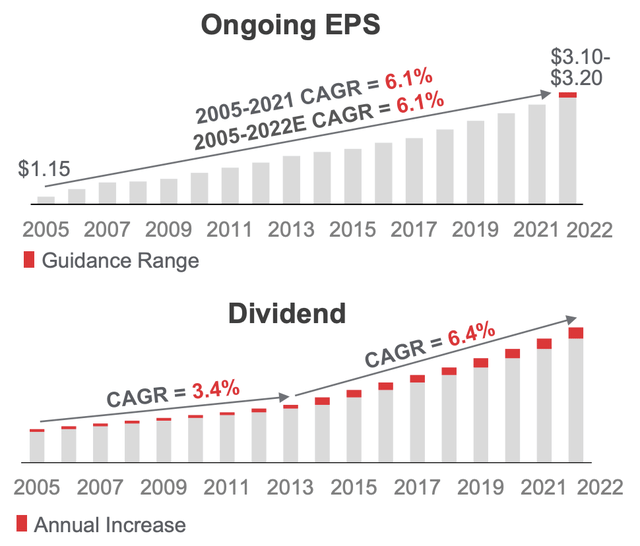

Over the past 10 years, the average annual dividend growth was 6.1%.

The most “recent” hikes are:

- February 2022: 6.6%

- February 2021: 6.4%

- February 2020: 6.2%

While its yield is lower, higher dividend growth will make sure that Xcel can “compete” with higher-yielding utilities as its yield on cost can quickly grow towards 6% over the next 10 years. That’s a good deal.

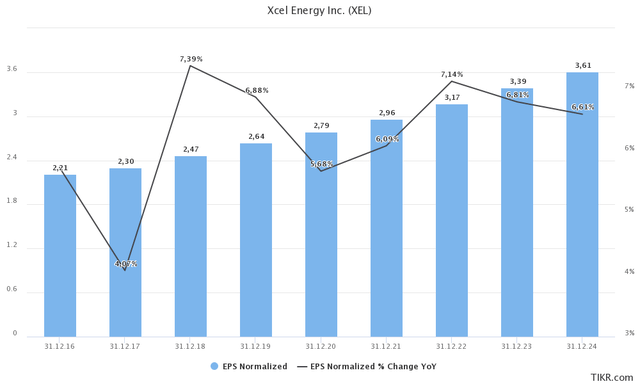

The company’s payout ratio is 61% using the expected 2022 normalized EPS. Note that the company is consistently growing EPS in the high 6% range.

TIKR.com

Dividend growth has been ramped up after 2012 as a result of consistently higher EPS growth.

Xcel Energy

Moreover, like all of its peers, XEL is moving toward a carbon-neutral future. In 2005, 56% of energy was generated using coal. In 2025, the company wants to reduce coal to 12%. Natural gas is expected to remain at 23%. Nuclear accounts for 12%. Renewables will likely account for 53% of the energy mix.

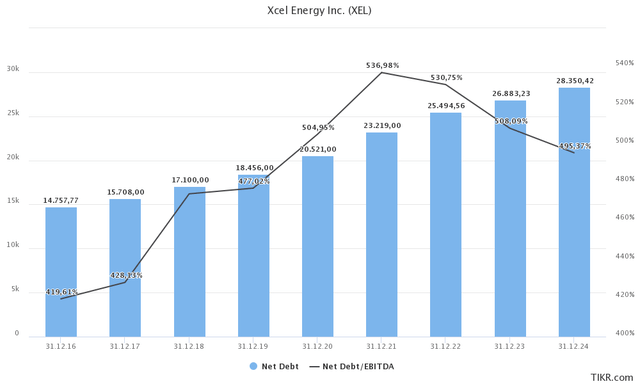

As a result, net debt is expected to gradually rise to $28.4 billion in 2024. However, the net leverage ratio is expected to fall to less than 5.0x EBITDA as a result of outperforming EBITDA.

TIKR.com

The interest coverage ratio is at 5.6x, which is in line with the numbers of the past 10 years.

As a result, the company has senior secured debt credit ratings in the A range and senior unsecured debt credit ratings in the BBB+ to A range. The company expects to maintain these ratings as it sees strong EPS growth and because higher debt is used to improve its business – it’s not wasted on money-losing projects.

When it comes to the valuation, XEL (11.3x) is trading at a similar EV/EBITDA multiple as DUK (11.4x). In this case, the multiple is based on its $32.7 billion market cap, $26.9 billion in 2023E net debt, $260 million in pension-related liabilities, and $5.3 billion in expected 2023 EBITDA.

Just like DUK, I believe that XEL should be trading at 13x NTM EBITDA, implying up 30% upside to fair value.

Takeaway

The market is tanking, losing roughly a quarter of its value from its all-time high. Economic growth is slowing, inflation remains stubborn, and the Fed is determined to hike cycles despite encountering increasing evidence of high financial instability.

While it isn’t fun to lose money. I am eagerly investing in my holdings (and new investments) whenever I like the valuation.

In this article, we discussed Duke Energy and Xcel Energy. Two companies with rock-solid anti-cyclical business models that enjoy healthy balance sheets, and the ability to consistently hike quarterly dividends.

This is extremely important as we’re witnessing cracks in the financial system due to a deteriorating quality of debt, slower economic growth, and the aforementioned hiking cycle of the Fed.

Both companies are now trading at very attractive valuations with what I consider to be juicy dividend yields. Rapidly rising rates have weakened even defensive yields as investors have panic-sold stocks in every sector while higher rates are bad news given the future financing needs of both Duke and Xcel.

However, the sell-off has gone too far, which is now providing at least a 30% upside until “fair value” for both companies has been reached.

I will be adding to these two companies over the next 2 months, and I believe that both high-yield investors and dividend-growth investors will enjoy these two picks for decades to come.

(Dis)agree? Let me know in the comments!

Be the first to comment