Editor’s note: Seeking Alpha is proud to welcome Kyle Wales as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ANSVEL/iStock via Getty Images

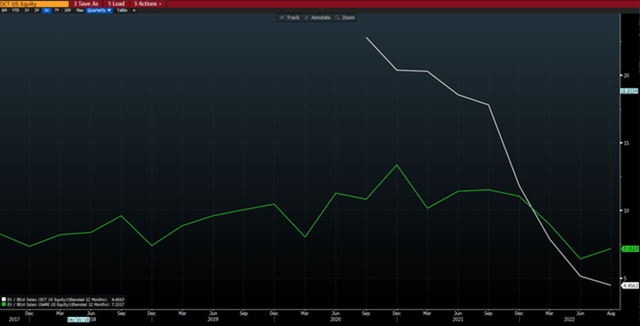

Duck Creek (NASDAQ:DCT) is a controversial company. It was listed in the heady days of 2020 when money was flowing fast and valuations for anything tech-related were stratospheric. At its peak it traded at an EV-to-(forward)-sales ratio north of 20x. As of August 18, 2022, it trades at a price-to-sales ratio of only 4.5x, which I believe is not expensive given its growth profile. My call on this stock is that it’s a strong buy.

What does Duck Creek do?

Duck Creek sells core business solutions to short-term insurers. It sells 3 basic modules: one for policies, one for billing, and one for claims. These modules can be bought on an a la carte basis or as a package. The history of Duck Creek is as follows: It was originally a tier 2/3 player in the market until it was acquired by Accenture (ACN) in 2011. A private equity player, Apax, then bought a stake in Duck Creek in 2015, and the company was finally IPOed in 2020. In some ways, Duck Creek is in a unique position because while it is a follower in its industry by revenue, it is the leader in the cloud-based solutions segment of its market – which is the segment exhibiting the most growth.

I will begin by giving a brief introduction to Duck Creek and explaining why its addressable market is so attractive. I will then do a detailed competitor analysis between it and its larger peer, Guidewire (GWRE), to show that Duck Creek is still eating Guidewire’s lunch. That’s despite the fact that Duck Creek’s results have disappointed in the last two quarters, while Guidewire’s have impressed. This should bode well for Duck Creek’s revenue and earnings growth going forward, and makes the discount it trades at relative to Guidewire unjustified in my view. Lastly, I will attempt to place a value on the company.

What is so attractive about Duck Creek’s target market?

Short-term insurers collectively write an estimated $2.5 trillion in premiums annually and spend an estimated $88 billion on IT. Of this total IT spend ($88 billion), $20 billion relates to software, which is the market that Duck Creek is playing for. Historically, large short-term insurers built their own core business solutions, but many of these solutions are now outdated and they are gradually starting to upgrade them to better third-party-designed solutions, leaving them free to focus on what they do best – (hopefully) underwriting. Today it’s estimated by some that only $2 billion (of the $20 billion total software pie) has been outsourced to third-party providers. This means that Duck Creek’s target market is only 10% penetrated.

Who are Duck Creek’s competitors?

Duck Creek’s largest competitor is Guidewire. Guidewire earned almost $750 million in its largest financial year (until July 2021) vs. Duck Creek, which earned only $260 million in its last financial year (until August 2021). Guidewire is therefore 3x larger than Duck Creek in terms of revenues. Given that Guidewire’s market share is 25%, Duck Creek would have an implied market share of 8%.

However, while Duck Creek is small, it is the revenue leader in the cloud-based-solutions segment of its market. The reason for this is that Duck Creek went “all in” with its cloud solution in 2016/17, at the expense of its (perpetual/term) license business, while Guidewire continued to do business on the same terms it had always done business. Today, that decision is paying dividends to Duck Creek and giving Guidewire a headache.

I believe Duck Creek’s lead over Guidewire is among the widest between a disruptor and incumbent in any industry. This is evident from the number of Guidewire consultants who are cloud certified. As one would expect given its larger size, Guidewire has a larger overall number of system integrator consultants at its partner firms than Duck Creek (18,000 consultants as of Q3 2022) vs. Duck Creek’s 5,400 (as of Q4 2021). However, only 4,400 of Guidewire’s consultants are cloud certified vs. almost all of Duck Creek’s. This is also evident in the numbers reported by the two companies.

To make my case, let’s start by looking at Duck Creek’s and Guidewire’s revenues and GP margins (over the last seven quarters) by type of revenue. For simplicity sake, I will assume that Duck Creek and Guidewire have the same financial year-end, even though their year-ends differ by a month.

Also, for those who are not familiar with the term, “ARR” is annualized recurring revenue. ARR is a measure that tries to adjust for when large contracts are signed late in the current quarter (so negligible accounting revenue is recognized in the current quarter), but the company expects to earn greater revenue going forward as a result of signing the contract. For example, if Duck Creek or Guidewire signed a large contract on the last day of the current quarter (consequently negligible revenue recognized in current quarter) but they expect to earn $10 million in revenue per quarter going forward, they would include $10 million in ARR (and not 0).

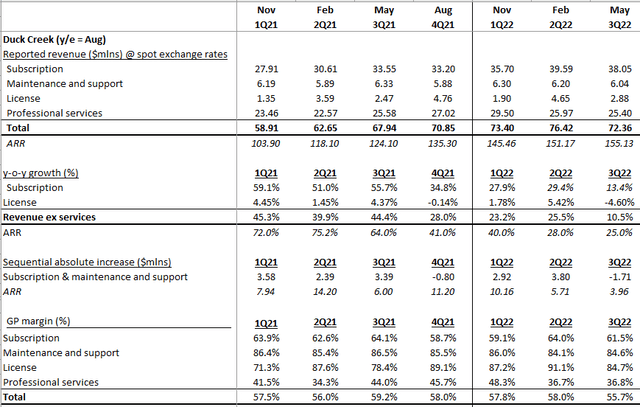

Let’s begin with the numbers reported by Duck Creek:

Duck Creek financials (Company disclosures)

I will not discuss its “maintenance and support” and “license” revenues, which are immaterial and also in decline. Instead, I wish to draw your attention to Duck Creek’s “subscription” and “professional services” revenues (i.e., its cloud revenues). There are a couple of things one will notice here.

First, while Duck Creek’s subscription revenues has seen a sharp deceleration in YoY growth over the last 7 quarters, ARR (which is a leading indicator) is still growing strongly (last print up 25%). The company attributes the deceleration in both measures due to the deals that have been delayed because of the uncertain economic outlook, even though they remain very optimistic about their future deal pipeline.

Second, while one would expect any increase in its subscription revenues to be accompanied by an increase in its professional services revenues because its professional services mainly relate to Duck Creek implementations, this is not the case. Duck Creek’s professional services revenues have been flat even though its subscription revenues have been growing strongly. The company attributes this to it outsourcing more of its implementation work to systems implementation partners like Accenture.

Third, despite its small scale, Duck Creek’s GP margins are very healthy for its material revenue streams. The GP margin on its subscription revenue is in the vicinity of 60%, while the GP margin on its professional services revenues is around 40%. GP margins trickle down to EBIT margins.

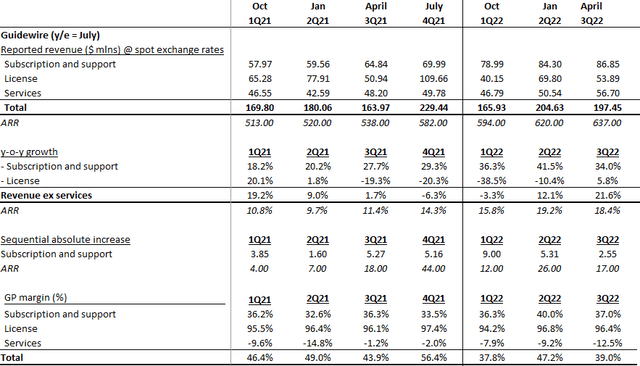

Next, let me take you through Guidewire’s numbers:

Guidewire financials (Company disclosures)

There are several items to make note of here. To begin, legacy revenue streams like “license” revenues are much more material in Guidewire’s life than in Duck Creek’s. The contribution of its “subscription and support” revenues (assume that’s analogous to what Duck Creek calls “subscription” revenues) to its total revenues is relatively small.

Guidewire’s subscription and support revenues, though small, are also growing strongly, and for the last three quarters have even grown faster than Duck Creek’s subscription revenues. However, all this growth has come at the expense of its license revenues. This means the bulk of Guidewire’s growth has come from switching its license clients over to its subscription products, rather than winning new clients. It much easier to convert an existing client over to a new version of your product than to sell to a new client. While this flatters the growth it is reporting for subscription and support revenues in the short term, this does not augur well for the long term.

In addition, Guidewire’s gross margin profile is far weaker than Duck Creek’s, even though one would expect a larger company to have higher margins because of better fixed cost absorption (operational gearing). Guidewire’s GP margins for its subscription and support revenues is below 40% as it needs to invest heavily in its cloud product to bring it up to scratch. It also earns negative gross margins on its professional services, which means it effectively has to offer its clients discounts for them to upgrade to its cloud product.

Lastly, even if one takes the recent deceleration in Duck Creek’s growth into account, it is still growing faster than Guidewire. Its Q3 2022 ARR was 18% vs. 25% for Duck Creek.

But what does this all mean for valuations?

I value Duck Creek on an adjusted discount cashflow method taking a long-term view (5 years plus). I expect Duck Creek to grow its subscription revenues to grow at 35% over that period. By contrast, its overall revenue will grow in the mid-20s, as I forecast no growth for its maintenance and support revenues as well as its license revenues. This is in excess of what management has guided to and is without a doubt a chunky number, but the implied market penetration of Duck Creek’s target market is only 20% at the end of my forecast period and its market share is only 20%. I believe this is conservative.

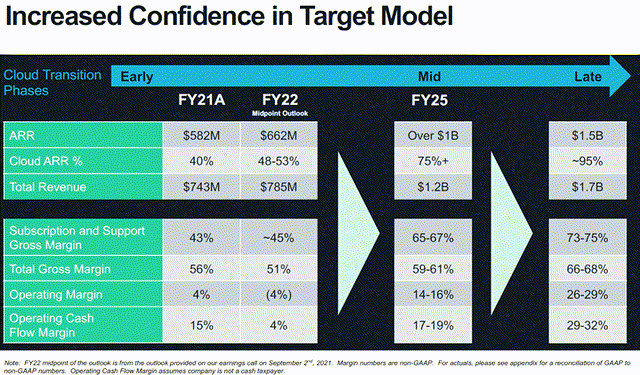

Duck Creek provides limited guidance for what its normal EBIT margin should be. Guidewire believes that it will eventually achieve an operating margin of 26%-29%. I believe that Duck Creek will achieve a slightly higher operating margin than this because it has fewer legacy versions of its products to maintain. Guidewire incurs costs to maintain legacy, on-premise versions of its software.

Guidewire EBIT margin guidance (Company disclosures)

Finally, I use a terminal multiple of 19.2x to value Duck Creek. That is higher than the multiple I would use to value the market overall, for which I would use a 16x multiple given the high-quality, SaaS nature of its business. Other SaaS businesses trade at much higher multiples than this – for example, Intuit (INTU) trades on a blended forward multiple of 34x and Adobe (ADBE) on a blended forward P/E multiple of 28x.

Risks to the Duck Creek investment case

One risk I see is competition. While I believe Duck Creek is positioned well relative to its competitors, its competitive advantage (relative to Guidewire especially) may erode over time. In this respect, the fact that Guidewire’s subscription and support revenues have outgrown those of Duck Creek’s may be a concern, although I believe reported revenue figures (a lagging indicator) are less relevant than ARR – which is a leading indicator.

There’s also the risk of share price volatility around results. Because Duck Creek is a growth stock that is only breakeven on an EBIT basis, its share price reacts disproportionately when results or guidance beat or miss analyst expectations.

Conclusion

While many bears on Duck Creek have a very short-term investing horizon, I believe it offers compelling value for the long-term investor. I believe a fair value for Duck Creek of $27 vs. a recent share price of $14.07. My call on Duck Creek is therefore a strong buy.

Be the first to comment