shapecharge/iStock via Getty Images

This article was first released to Systematic Income subscribers and free trials on June 10.

With the latest shareholder report out, we take this opportunity to take another look at the DoubleLine Income Solutions Fund (NYSE:DSL). The fund is one of a trio of DoubleLine multi-sector CEFs.

In our last review, we commented that the fund was not for everyone, owing to its large Emerging Market overweight as well as repeated bouts of deleveragings. As it happens, these two factors remained significant headwinds for the fund given recent weakness across Emerging Market debt as well as a recent deleveraging which we discuss below.

On the other side of the coin, the attraction of DSL rested and continues to rest chiefly in the following factors. First, its Emerging Market hard-currency corporate debt overweight is attractive as EM debt continues to trade cheaper than US corporate debt while boasting stronger leverage metrics. Two, DSL has a sizable exposure to floating rate debt in the form of loans, CLO Debt, non-agency RMBS and more. Three, it has about a 20% allocation to Energy debt – an attractive allocation given the upward recent trend in energy prices. Four, its very high coverage ratio, making it less likely to have a distribution cut. Five, its relatively wide discount in the sector which provided a margin of safety.

Despite these positives, we have recently reduced our allocation to DSL due to a number of income headwinds which we discuss in more detail below.

DSL Recap

DSL is the lowest quality and highest-leverage fund in the DoubleLine trio. Its main overweight is in high-yield Emerging Market debt, with significant holdings in Latin America – Mexico, Argentina and Brazil, in particular. The fund charges a 1% management fee on total assets which is on the high side for multi-sector CEFs but not excessively so. DSL is run by Jeffrey Gundlach alongside two other managers. The fund has a modest duration of 4.1.

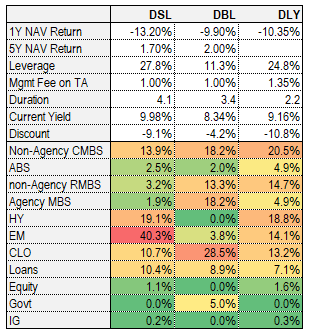

It can be easier to appreciate the characteristics of a fund in comparison to others. Below we show how DSL compares to the two other DoubleLine multi-sector CEFs.

Systematic Income

The EM allocation focus stands out as well as the higher leverage level and a slightly higher duration profile.

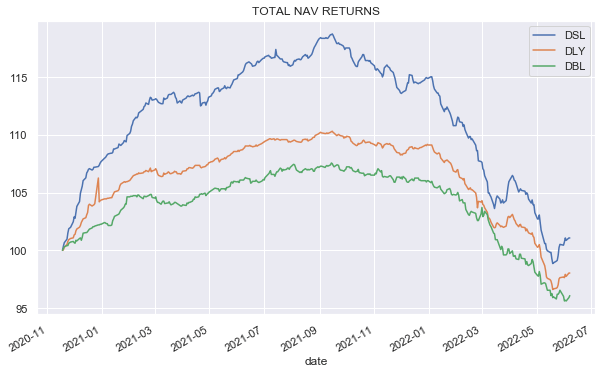

In terms of performance, DSL has outperformed the trio if we include the period where we have NAV data for all three funds.

Systematic Income

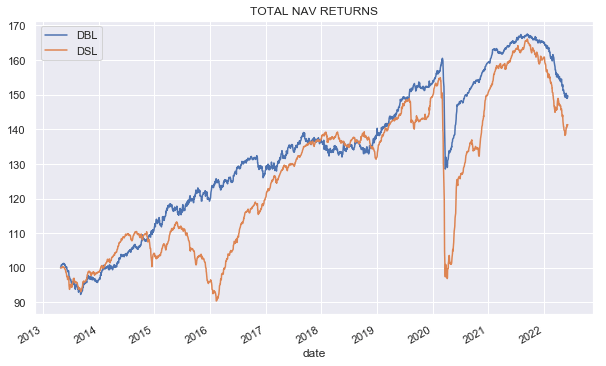

Excluding the more recently launched DLY, we see that DSL has modestly underperformed DBL from mid-2013 though it has outperformed DBL from our initial acquisition in the High Income Portfolio.

Systematic Income

Recent Update

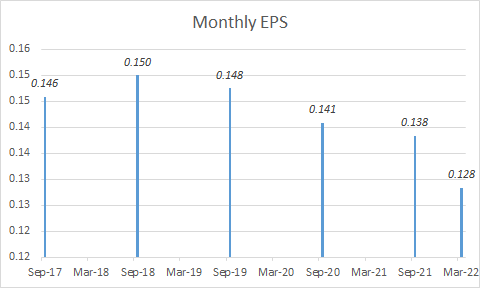

The fund recently reported its last semi-annual income profile which came out to net investment income of $0.128 per share per month. The good news here is that this is well above its $0.11 monthly distribution, i.e., a distribution coverage of 116%. The bad news is that this is 7% below the previous annual period which delivered a monthly EPS of $0.138.

Systematic Income

In our view, the reason for the downtrend is due to three factors. First, the fund deleveraged by about 18% (i.e., its total borrowings were reduced by 18% – from $770m to $630m). This, very likely, happened sometime in Q1. The impact on income is a reduction of around 4% – much of which is still to come since the latest semi-annual period reporting doesn’t capture the full deleveraging. As it happens this was a positive for the fund’s performance since credit markets weakened further in Q2.

The second reason for the drop in income is due to the fact that the recent rise in Libor had not yet fully fed through on the asset side by the end of the reporting period due to Libor floors on the 13% of loan holdings while it did feed through on the liability side, i.e., on the fund’s credit facility on which it pays 1-Month Libor + 0.7%.

The third reason for the drop in income has to do with defaults in the portfolio. A couple of examples include the Credito Real bonds as well as the Yuzhou Properties Company bonds which are no longer making payments.

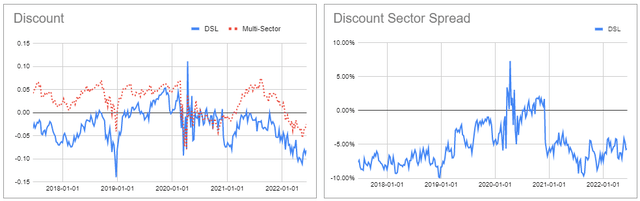

Turning quickly to valuation, the fund continues to trade wider of the Multi-sector CEF average, however, it has done this for a long while so it’s not obviously cheap on this metric.

Stance And Takeaways

We added DSL to our High Income Portfolio in 2021 based on its positive features highlighted above. Since then, it has performed roughly in line with the broader Multi-sector space. More recently, however, we have cut our allocation to the fund as we see a smaller margin of safety in its discount level. We also expect its income to move lower due to the recent deleveraging as well as a number of new non-accrual/PIK positions.

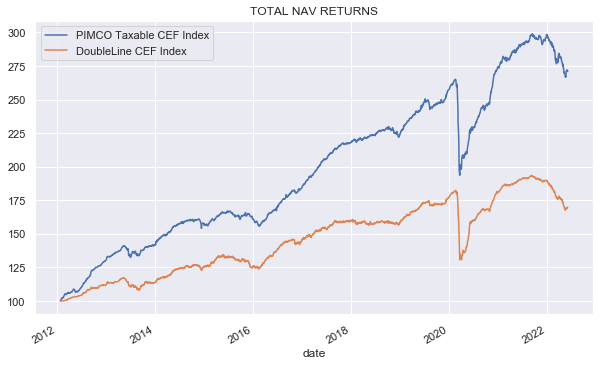

Specifically, we have rotated in part to the PIMCO Dynamic Income Opportunities Fund (PDO). This is for three reasons. PDO provides a similar multi-sector allocation profile as DSL, though with a smaller EM footprint. Two, historically, PIMCO CEFs have outperformed DoubleLine funds.

Systematic Income

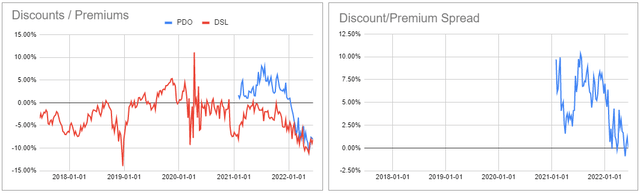

And three, the discount of PDO has now moved pretty close to that of DSL which offers a good entry point in our view.

Be the first to comment