Fritz Jorgensen

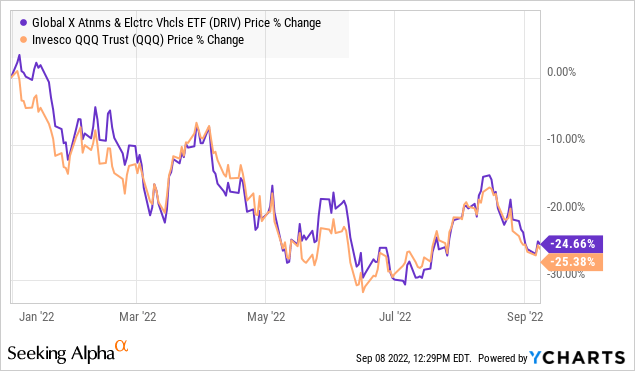

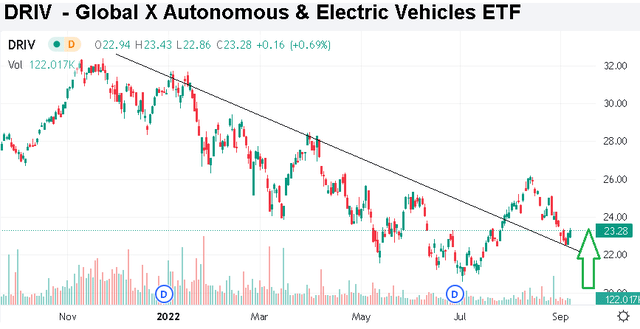

The Global X Autonomous & Electric Vehicles ETF (NASDAQ:DRIV) invests in companies involved in the development of autonomous vehicle technology and electric vehicles along with related (EV) components like the materials for lithium batteries. This is a high-growth segment supported by an accelerating global shift away from internal combustion engines toward next-generation transportation technologies. On the other hand, DRIV hasn’t been immune to the stock market volatility this year, down about 25% in 2022 considering the macro headwinds and a reset of valuation among underlying holdings. We like DRIV at the current level, with a view that the selloff has gone too far, representing a new buying opportunity.

What is the DRIV ETF?

The DRIV ETF is a passively managed fund that technically tracks the “Solactive Autonomous & Electric Vehicles Index”. According to the methodology, companies are expected to have significant exposure to EVs, either as direct producers or from suppliers of ancillary parts. On the autonomous vehicle technology side, the concept is a bit more broad-based to include related hardware and software that at least facilitates its development within the industry.

Other selection criteria include a minimum market capitalization of $500 million along with a market liquidity threshold. Finally, there is a free float market cap weighting although each holding is subject to a 3% cap following a semi-annual rebalancing.

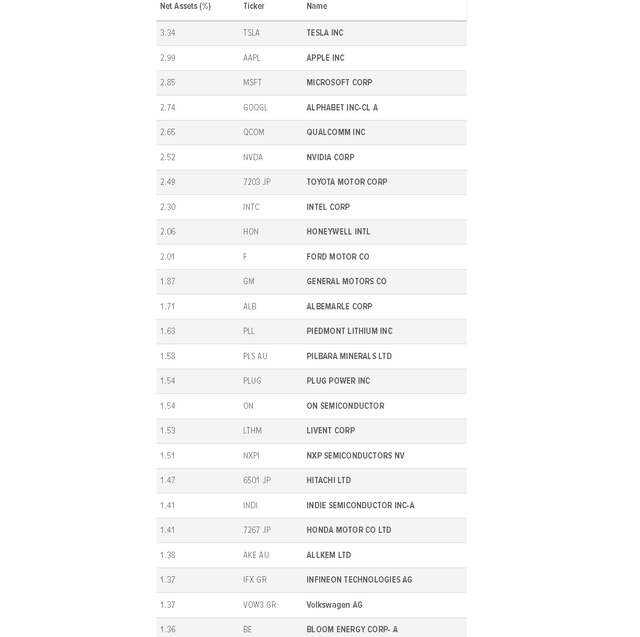

Taking a look at the current portfolio with 75 holdings, Tesla Inc (TSLA) is the largest holding which is consistent with the company’s position as a pioneer and leader in the segment. Down this list, other EV manufacturers and legacy automakers that have pivoted towards electrification are included with names like Toyota Motor Corp (TM), Ford Motor Co (F), General Motors (GM), Honda Motor Co Ltd (HMC), and Volkswagen AG (OTCPK:VWAGY). Emerging Chinese players like NIO Inc (NIO), and XPeng Inc (XPEV) are included as well as a few others.

source: Global X, DRIV top 25 holdings

We can also bring up positions in companies like Albemarle Corp (ALB), Piedmont Lithium (PLL), Pilbara Minerals Ltd (OTCPK:PILBF) as major lithium miners that are important suppliers to EV makers.

In terms of the related tech, we’d argue most of the holdings here are not necessarily “pure plays” on autonomous driving technology. That’s the case with stocks like Apple Inc (AAPL), Microsoft Corp (MSFT), Nvidia Corp (NVDA), Qualcomm Inc (QCOM), and Alphabet Inc (GOOGL)(GOOG) that are in the top-10 holdings.

The idea here is that software and semiconductors are the core of the technology that makes autonomous driving a reality. Apple is recognized as working on autonomous systems and is even rumored to be working on an Apple car, while Microsoft is partnered with EV makers.

Correlated with Big Tech

One criticism we have of the DRIV ETF is that its exposure to those same mega-cap tech names may be a bit too large and misses the “spirit” of what a thematic ETF should be. Ideally, we want to see a more focused fund that can be used to complement a portfolio that already includes broad market ETFs which hold AAPL, MSFT, and GOOGL. Curious that the DRIV ETF nearly matches the performance of the NASDAQ-100 (QQQ), both down 25% in 2022.

The way we see it is that Global X and the Solactive tracking index, through the official methodology, are sort of hedging their bets on the theme by tilting the fund more towards fundamentally stronger companies that helps balance the more speculative nature in some of the smaller holdings.

If natural “EV stocks” like Nikola Corp (NKLA) or Lucid Group Inc (LCID), which currently represent less than 2% of the fund, were given greater importance, DRIV would be more volatile and higher risk. At the same time, for anyone that is very bullish on the segment, a case could be made that those smaller players are best positioned to capture the trends and outperform to the upside. The point here is to say that DRIV is not perfect but otherwise gets the job done.

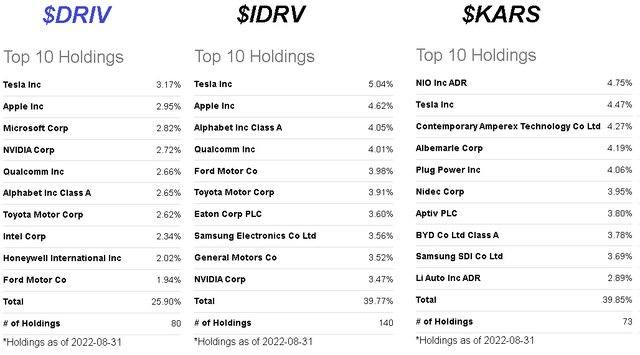

Investors have a few other options among ETFs with a similar profile. There is the iShares Self-driving EV and Tech ETF (IDRV) which features some of the same mega-cap tech names among top holdings. A key difference would be a higher weighing cap at 5% compared to 3% in DRIV.

There is also the KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) that we would describe as more of a pure-play on the segment by excluding names like Apple Inc and Alphabet Inc which are featured in both DRIV and IDRV. In this regard, KARS is a higher-risk fund and is expected to be more volatile. DRIV stands out as the largest fund in the group with AUM near $1 billion and it has higher market liquidity for trading purposes.

DRIV Price Forecast

The bullish case for DRIV is based on the understanding that the global adoption of electric vehicles is still in the early stages. Similarly, autonomous driving remains at the cutting edge technology that has the potential to revolutionize transportation. The underlying holdings of the DRIV ETF are well-positioned to capture these trends.

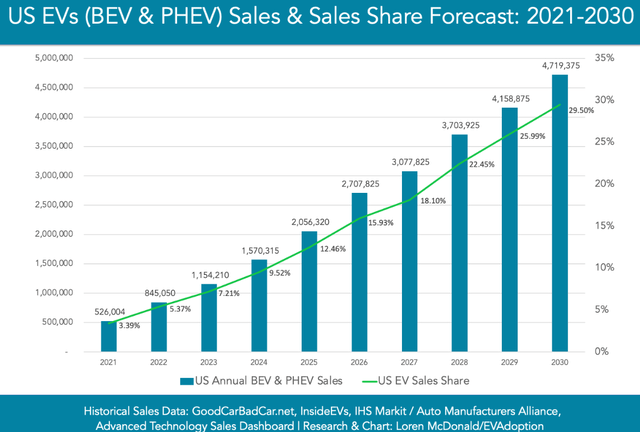

For context, from battery EVs and plug-in hybrid vehicles together representing a market share of just 3.4% in 2021 and 5.4% this year in the United States, the forecast is for penetration in total vehicle sales to reach 30% by 2030. The trend is similar in other countries as the push is being incentivized worldwide as part of clean energy policies.

The more pressing concern remains uncertainties related to the macro environment amid high inflation and rising interest rates. A generalized slowdown of economic activity, particularly compared to the pandemic boom, means that the stock market has been volatile and lacking positive sentiment.

The way we see it playing out is that global conditions have room to surprise to the upside compared to what has been deep pessimism and low expectations. Whether “the bottom” in stocks was reached in June when the DRIV ETF traded as low as $20.56, or the selloff will continue over the next few months, there’s an argument to be made that the current level offers a good entry point for a long-term holding.

Final Thoughts

The DRIV ETF is a good option to capture diversified exposure to the leading EV and autonomous vehicle stocks. While the portfolio structure has some weaknesses, the overall profile includes a good balance of high-quality leaders in the category along with several emerging players that together can outperform going forward.

In terms of risks, a deeper deterioration of the global economic outlook could open the door for further downside. Global clean energy and sustainability policies along with a quarterly update from sector leaders are key monitoring points.

Be the first to comment