SolStock/E+ via Getty Images

Investment Thesis

Doximity (NYSE:DOCS) is the leading digital platform for U.S. medical professionals, with more than 80% of physicians, more than 50% of nurse practitioners and physician assistants, and over 90% of graduating U.S. medical students on the platform. The easiest way to describe this company is like a LinkedIn for doctors, although it also develops digital tools and telehealth solutions for medical professionals as it works to achieve its mission “to help every physician be more productive and provide better care for their patients”.

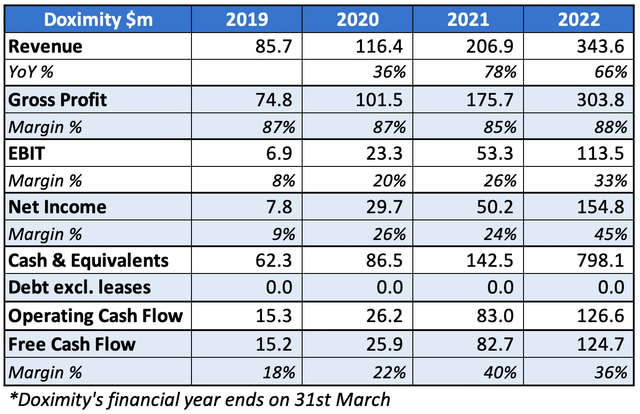

Doximity also operates a very attractive business model, boasting an EBIT margin of 33% in 2022 despite being a new company to the public markets – it’s not often you find a business with 88% gross margins, 33% EBIT margins, and growing 66% YoY, but that was Doximity’s story in FY22. This is probably a good time to note that Doximity has a weird financial calendar, and its financial year ends on 31st March.

My personal investment thesis for Doximity revolves around two economic moats: network effects and switching costs. Given that it is used by so many medical professionals, it almost becomes a prerequisite for all medical professionals to use it, particularly as Doximity continues to roll out new tools and solutions that help medical professionals work together. The switching costs are also high, and I believe in particular for Doximity’s advertising partners. There are few other avenues they can go down in order to accurately target doctors, so Doximity’s newsfeed is one of the best ways for them to advertise. Aside from this, I want to see Doximity continually adding new features to their platform & branching out into useful solutions such as its Dialer.

Yet following the release of its Q1’23 results, Doximity shares fell almost 20% – so what happened, why is the market upset, and is the thesis for this investment still on track?

Earnings Overview

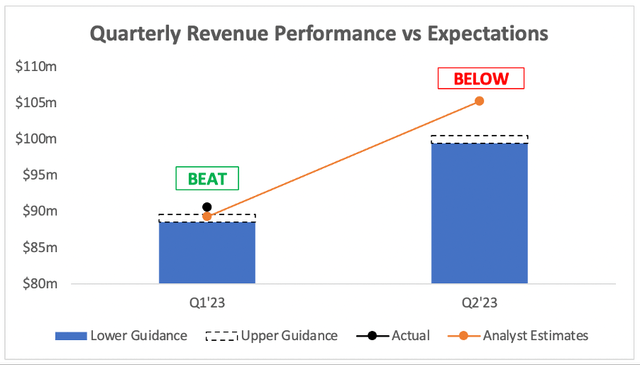

Starting with top line results, and Doximity grew revenue 25% YoY to $90.6m, coming in ahead of analysts’ estimates of $89.3m & also ahead of management’s $88.6-$89.6m guidance.

Investing.com / Doximity / Excel

This positive start swiftly turned around, as management issued Q2’23 guidance for revenue of $99.5-$100.5m, way behind analysts’ estimates of $105.3m & representing 26% YoY growth.

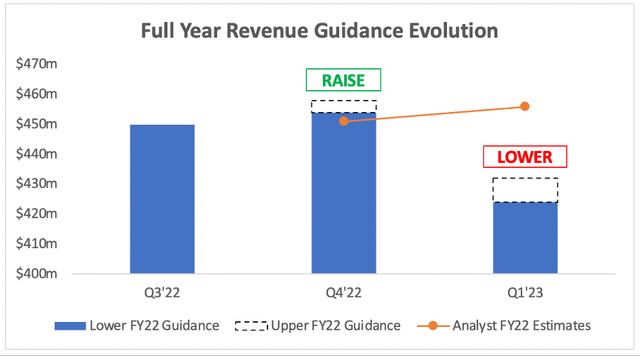

To make matters worse, Doximity also lowered its full year revenue guidance from $454-$458m to $424-$432m, a pretty substantial cut which was also below analysts’ estimates of $456m.

Seeking Alpha / Doximity / Excel

This new guidance implies that revenue in FY23 will grow by ~24.5% at the midpoint; a pretty dramatic slowdown from the 78% growth in FY21 and the 66% growth in FY22. But, realistically speaking, this isn’t a huge surprise. Many companies that rely on advertisements for revenue (such as Doximity) have seen advertisers pull back on their spend sharply, and Doximity is also coming up against tough comparisons in FY22 – still, this isn’t ideal.

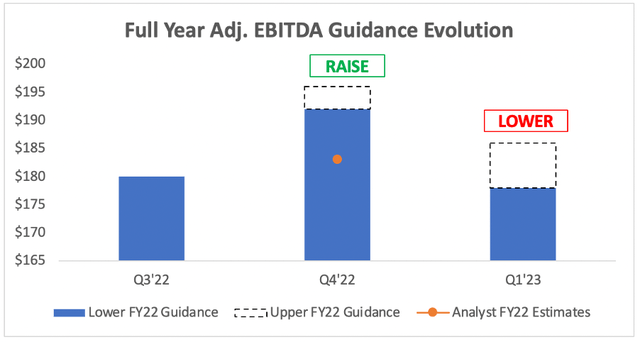

The company also lowered its full year guidance for adjusted EBITDA, which is not a surprise given the lower revenue guidance. It now expects adjusted EBITDA in the range of $178-$186m, which still represents a strong margin of ~43%.

ConsensusGurus / Doximity / Excel

All in all, there were plenty of reasons for the market to react negatively to Doximity’s Q1 results. This stock is by no means cheap, so any downwards guidance revisions are going to get punished – and that’s what is happening today.

What’s Driving The Slowdown?

Co-Founder & CEO Jeff Tangney was very forthcoming on the earnings call behind the core drivers of this slowdown, which I have highlighted in the below extract:

Now for the not so good news. Our historically stable upsell rate among our pharmaceutical clients, which accounts for 10% to 15% of our annual revenue, has slowed year-to-date. These upsells boost the results of our base subscription programs by adding interactivity, personalization or more audience.

Our formulary upsell module, for example, parses reams of insurer data for each doctor to show them which drugs offer the best co-pays for their particular patients. Doctors appreciate the clarity and personalization of our format. Clients appreciate that thousands of doctors now know that their drug is on formulary. And it only takes a few hundred new patients to pay for the program, so the ROI is very high. Our conference upsell module shows each doctor who signed up to go to a medical conference, a list of who they know who’s also going.

Doctors like our One Click interface to meet up with old friends or coworkers, and clients love that our default meet-up spot is their booth, which they probably spend millions of dollars on. Well, despite being steady sellers in the past, these modules haven’t done as well this year. We’ve realized that as a midyear add-on, they’re more discretionary and vulnerable to budget shifts.

Tangney highlights that he doesn’t take the decision to cut guidance lightly, and he will be shifting his personal focus to Doximity’s pharmaceutical products in order to steady the ship. He does also believe that this slowdown is transitory, and that higher growth rates will return. He said the following in this regard:

When macro belt tightening does hit, like Novartis’ decision this quarter to cut 8,000 people and $1 billion per year in expenses, it’s quickest and easiest for them to simply hit pause on new digital projects. But this digital air pocket is short term in our view. Pharma marketers get weekly reports on their sales and their results. And we believe that over time, they will continue to invest where they see the best ROI for their brands which is with us.

In short, a lot of industries are feeling the effects of inflation and the recessionary macroeconomic environment, and although healthcare is a necessity, the industry is still feeling the pinch & cutting costs where it can – which is evidenced in the guidance from Doximity.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Doximity is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

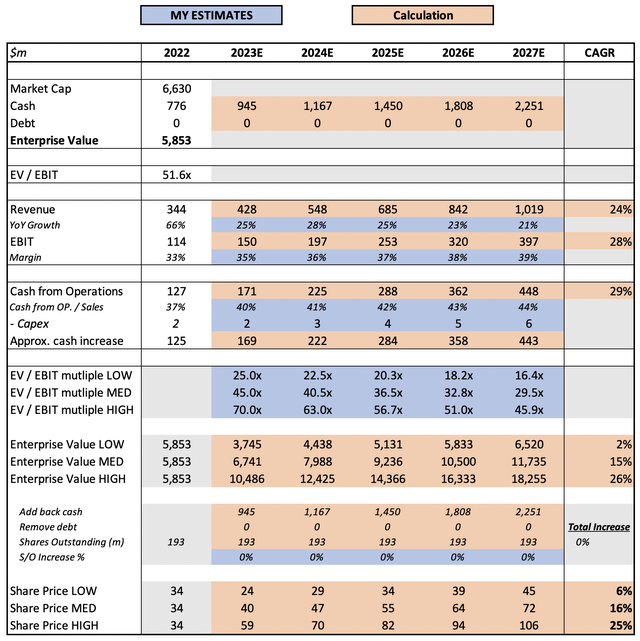

I outline the rationale behind my assumptions in a previous article, and will only comment on my updates – which, in truth, isn’t that much! I’ve updated the detail behind the enterprise value calculation, and adjusted down my 2022 growth rates to be in line with the midpoint of management’s guidance.

Put all this together, and I can see Doximity shares achieving a 16% CAGR through to 2027 in my mid-range scenario.

Investment Thesis: On Track

Despite the difficult quarter, I have not seen any evidence against the investment thesis that I outlined at the beginning of this article. I can understand Doximity’s recession-driven slowdown, but I do not think that impacts the long-term thesis for this business.

I will, however, downgrade my rating from a ‘Strong Buy’ to a ‘Buy’. I do believe in this business, and management appear to have been very forthcoming with investors, but a guidance cut is always a sign of short-term uncertainty. I still believe in this high-quality business, and I think the risk / reward scenario is attractive right now – but, there is just a little bit more risk than there was in the past.

Be the first to comment