Kevin Dietsch/Getty Images News

My main coverage in the past couple of years has been Chinese American Depositary Receipts [ADRs] as I sought to provide an on-the-ground perspective enriched by my frequent travels to China (before the COVID-19 pandemic struck). Hence, I believe the majority of my followers on Seeking Alpha became acquainted with my writings on Chinese companies like Alibaba Group Holding Limited (BABA), JD.com Inc. (JD), and Baidu, Inc. (BIDU).

Along the way, I came across numerous comments questioning why investors should bother with Chinese internet stocks. Many critics touted American tech giants like Apple Inc. (AAPL) and Amazon.com Inc. (AMZN) as “no-brainer” investments. I explained belatedly why the myths for both AAPL and AMZN as “no-brainer” stocks are debunked.

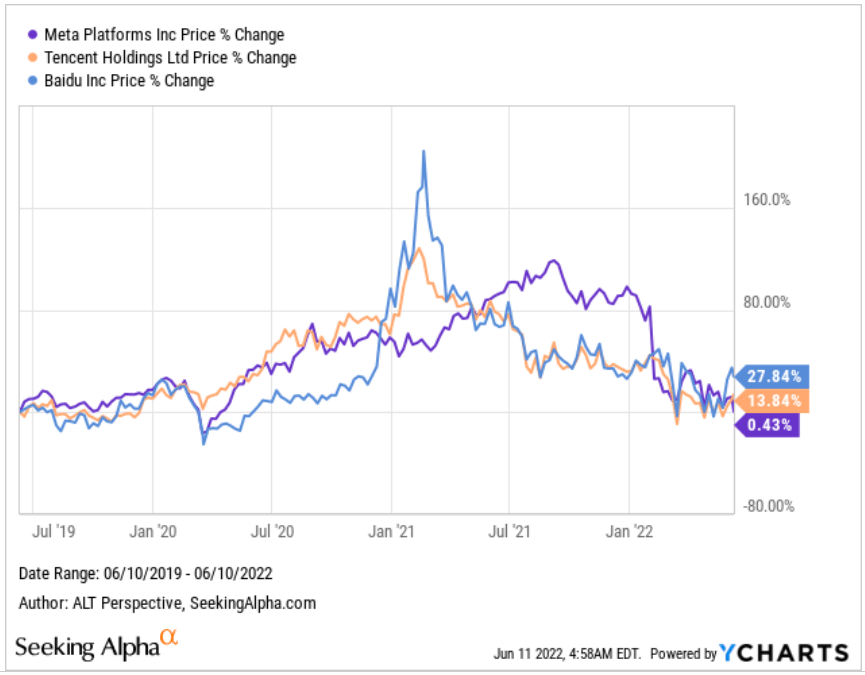

Unfortunately for shareholders of Meta Platforms Inc. (NASDAQ:META), formerly named after its flagship platform Facebook and traded under the ticker code FB, their return from the social media giant over a three-year period was even inferior to the much-maligned Chinese internet stocks Tencent Holdings Limited (OTCPK:TCEHY)(OTCPK:TCTZF) and Baidu.

Notably, META stock is barely positive after three years, despite being one of the four poster boys under the acronym FANG, while TCEHY stock is up 14% and BIDU stock is up 28%, even as naysayers claim there’s always something to fear about Chinese stocks.

YCharts

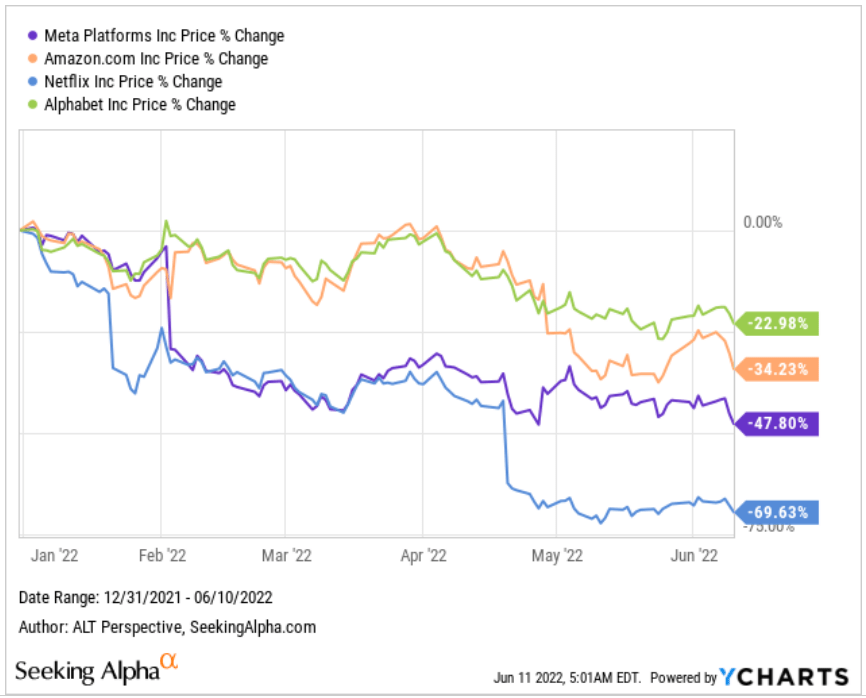

Among the FANG stocks (or if you prefer their updated acronym MANA), META has fared better than Netflix Inc. (NFLX) year-to-date, dropping 48% versus the latter’s 70%. However, AMZN stock and Alphabet Inc. (GOOG)(GOOGL) have declined less, at -34% and -23% respectively.

YCharts

Leadership Exodus, Advertising Headwinds, And Regulatory Scrutiny Are Driving Bearish Sentiment

Digital advertising stocks took a hit on May 24 after Snap Inc. (SNAP) warned that it expected its second-quarter revenue and EBITDA would fall below its previous low-end guidance from just a month prior. Snap explained that “the macroeconomic environment has deteriorated further and faster than anticipated.” Since advertising forms the bulk of Snap’s revenue, market players wondered if it was the “canary in the coal mine,” leading to a sell-off in related companies such as Alphabet, The Trade Desk (TTD), Pinterest (PINS), Twitter (TWTR), and Meta Platforms.

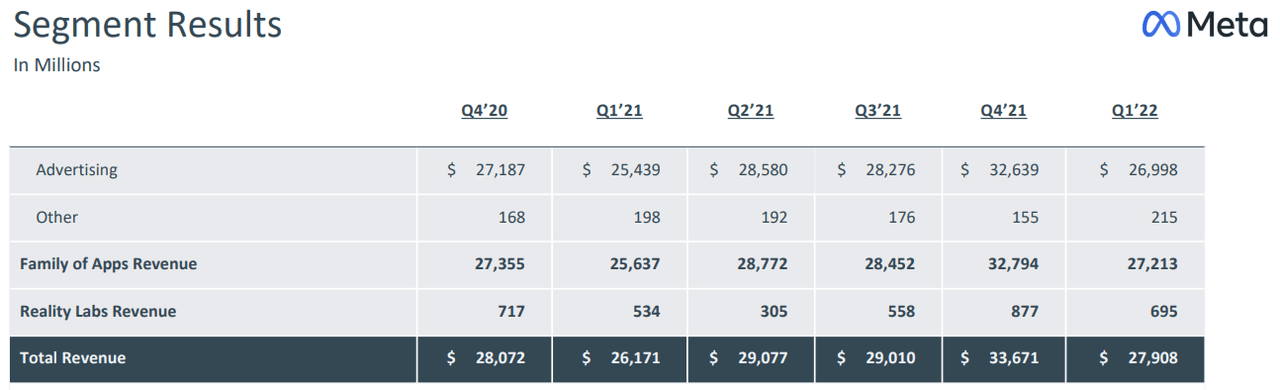

Although Meta Platforms has evolved to be more than just Facebook – now also comprising Instagram, WhatsApp, and a growing augmented reality/virtual reality [AR/VR] business arm – its main source of revenue remains advertising by far. Non-advertising revenue made up less than 1% of Meta’s overall sales in the last several quarters.

Meta Platforms

Nevertheless, investors seemed to have greater confidence in Meta Platforms managing the advertising headwinds much better than Snap. While SNAP stock plunged over 40% on May 24, META declined less than 10%.

The news of the pending departure of long-serving executive Sheryl Sandberg on June 1 as chief operating officer of Meta Platforms sent META stock tumbling again that day. Market players were worried about how the company would cope without Sandberg, who has been the external-facing leadership representative of Meta Platforms. CEO Mark Zuckerberg subsequently announced that Chief Growth Officer Javier Olivan will replace Sandberg when the latter leaves in the fall. In addition to leading areas like Meta’s infrastructure, analytics, and growth teams, Olivan will also have responsibility for the company’s integrated ads and business products.

Besides Sandberg, a top engineer was also reportedly stepping down. David Mortenson, in charge of Meta Platforms’ data centers and core infrastructure, will be leaving that role to take a long break. Mortenson spent 11 years in various engineering leadership roles at Meta and took the top job about two years ago. Jerome Pesenti, who is leading artificial intelligence at Meta, is also exiting his role later this month amid a company-wide AI integration.

Other negative drivers include greater regulatory scrutiny afflicting the major tech platforms. On May 26, the Competition and Markets Authority [CMA], a British regulatory agency, announced that it was launching a second probe into the company’s advertising business, this time focusing on ad technology. Lina Khan, the chairperson of the Federal Trade Commission [FTC] and a well-known tech critic, fired a salvo at the tech giants, declaring in a recent interview that the agency has “an incredibly active agenda and a whole set of really major initiatives that I think will come to fruition over this next year.”

The FTC regained a Democratic majority with Alvaro Bedoya’s May confirmation. Khan highlighted her intention to “address the rapid expansion of tech giants into new lines of business, such as virtual reality.” Mark Zuckerberg is steering his company towards metaverse, a VR world of living and working, setting Meta on the target board of Khan. Her distaste for expansionist acquisitions would also pose a challenge for Meta Platforms’ potential inorganic growth in the metaverse space.

META Stock Key Metrics

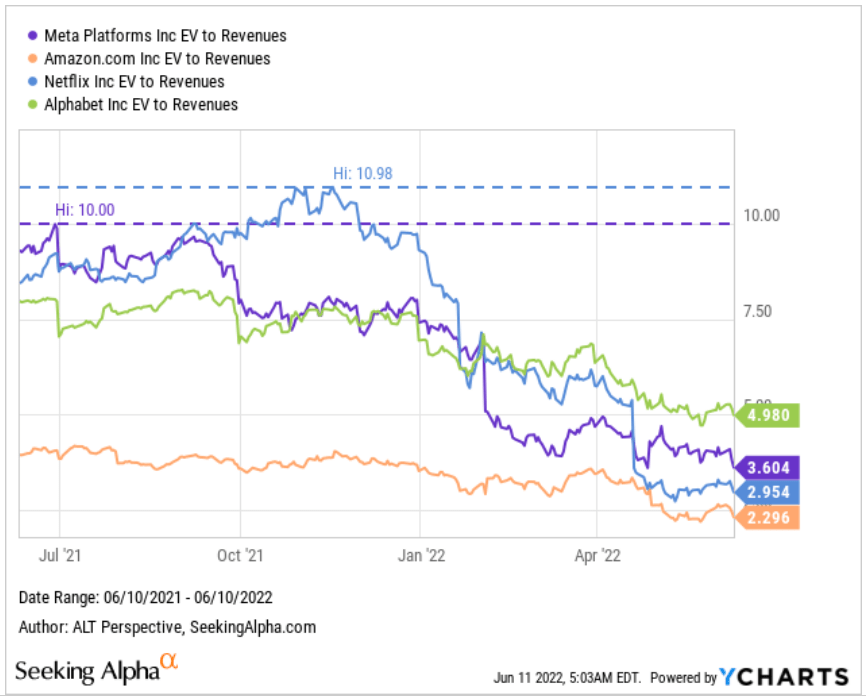

Despite the substantial decline over the past year, META’s EV-to-revenue remains the second-highest among the FANG/MANA at 3.6 times. Nevertheless, note that META used to trade at the highest EV-to-revenue among the four (and as recently as September 2021). A year ago, META sported an EV-to-revenue of 10 times. Netflix traded even higher at 11 times but has since fallen to below META at 3.0 times.

YCharts

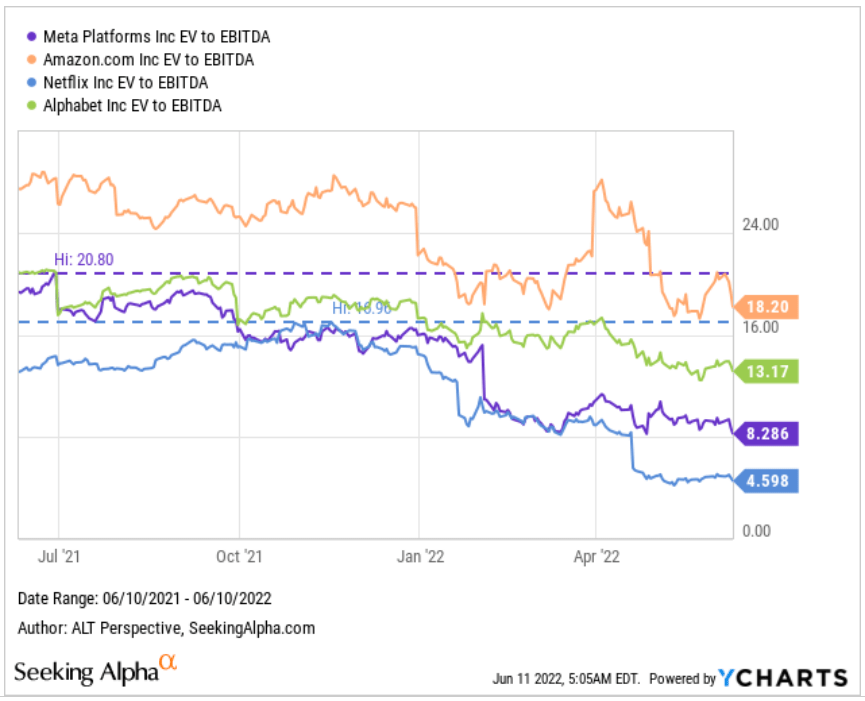

In terms of EV-to-EBITDA, META stock retains its third-cheapest ranking among the FANG/MANA based on the year-ago multiple and presently. At 8.3 times, only NFLX stock is trading lower at 4.6 times, while GOOG stock and AMZN stock are higher at 13.2 times and 18.2 times respectively.

YCharts

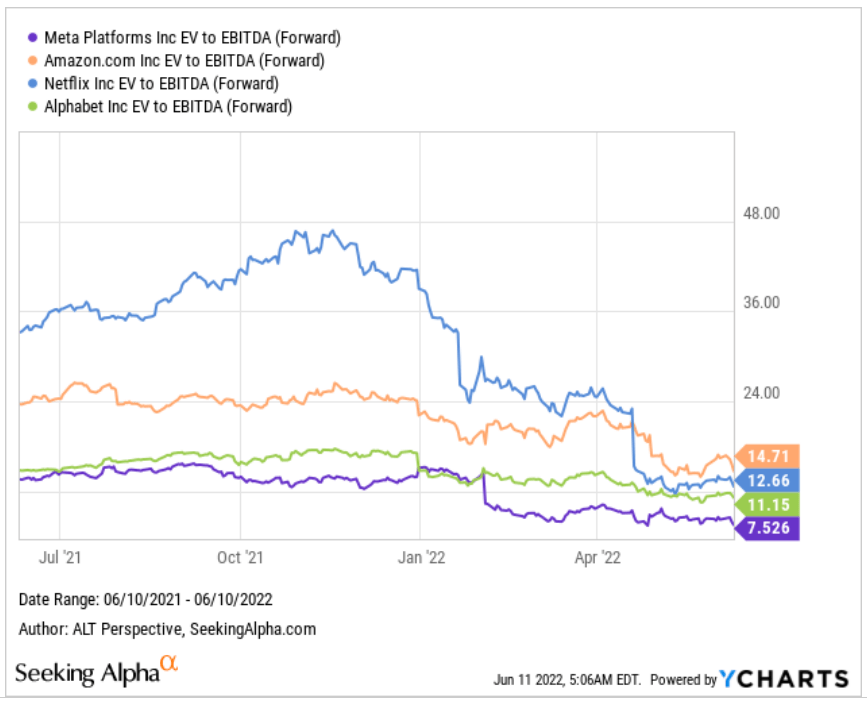

On the EV-to-EBITDA forward basis, however, META stock is projected to be the FANG stock with the lowest multiple at 7.5 times, nearly half that of AMZN stock. This makes it hard to argue that META stock is expensive relative to other FANG members.

YCharts

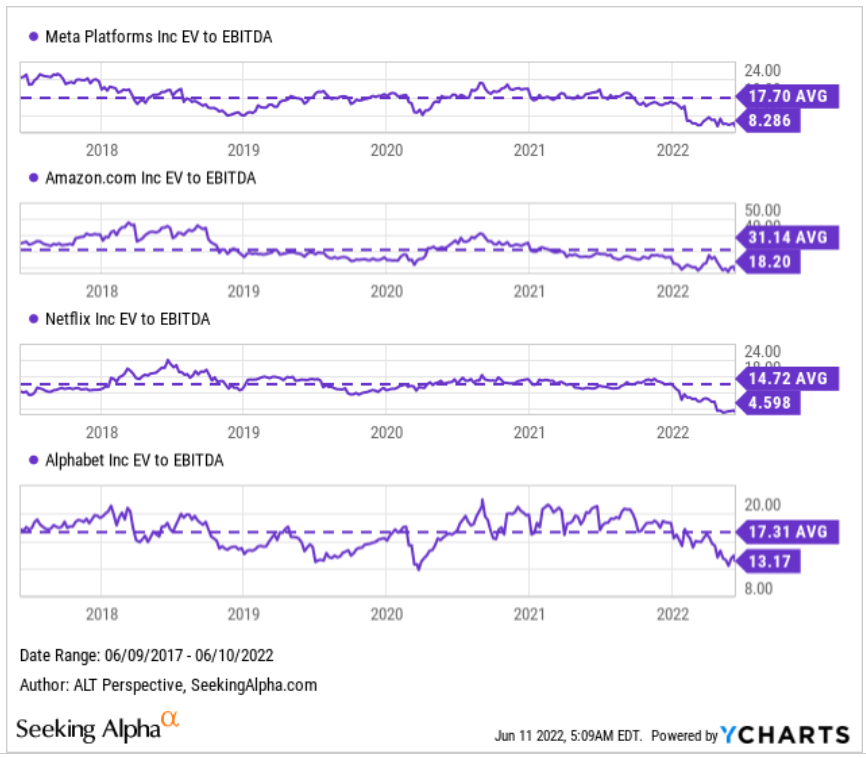

This is true even when compared to its five-year historical average of 17.7 times EV-to-EBITDA, where the current ratio is less than half. Only Netflix is trading further from its five-year historical average but that is a different story for another day.

YCharts

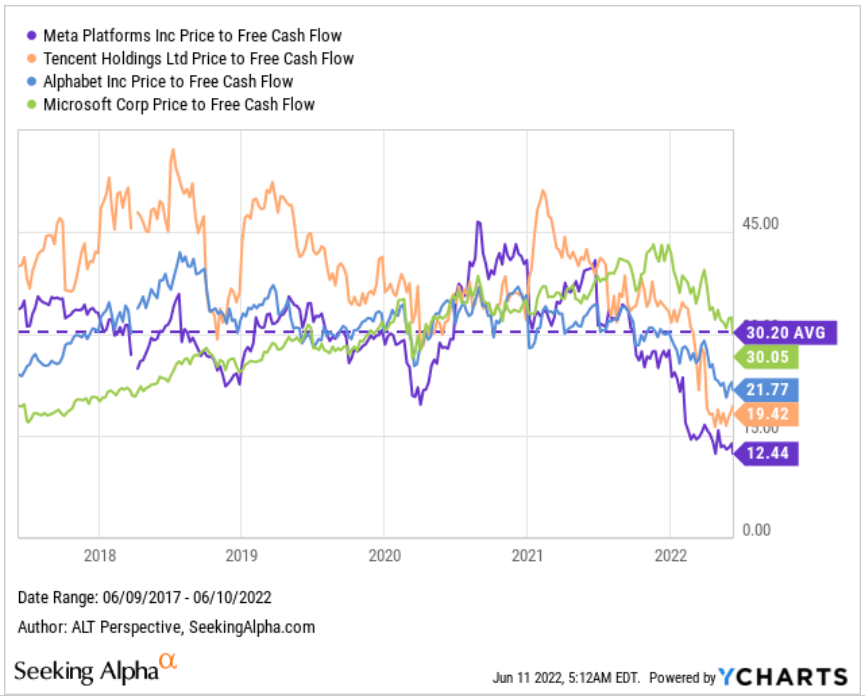

Meta Platforms is also trading at the lowest multiple among the FANG/MANA quad on a price-to-free cash flow [P/FCF] ratio. At 12.4 times, it is valued on a P/FCF ratio less than half that of its five-year historical average of 30.2 times. From being the second-most expensive FANG/MANA stock five years ago to the cheapest currently, there may be a limited downside to expect from META stock.

YCharts

What Do Analysts Think About META Now?

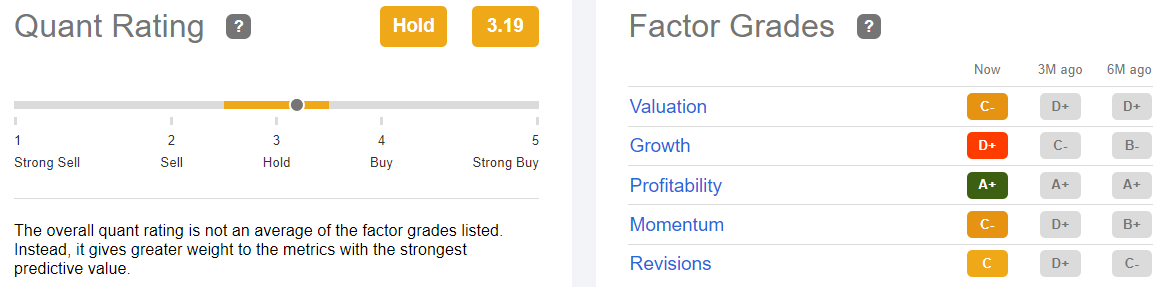

Seeking Alpha’s quant system has rated META stock a ‘Hold’ with a score of 3.19 out of 5. Looking at the factor grades constituting the quant rating, we would notice that its valuation has improved from D+ three months ago to C-, which is expected given the steep drop in its share price during the period. Its growth has deteriorated, falling from C- to D+, while its profitability remains solid at A+. Its momentum grade has improved from D+ three months ago to C-, a little puzzling because of the seemingly unabated weakness in META stock. Meanwhile, the grade for revisions has improved from D+ three months ago to C, a reflection of the limited revisions to its EPS and revenue over the past month.

Seeking Alpha Premium

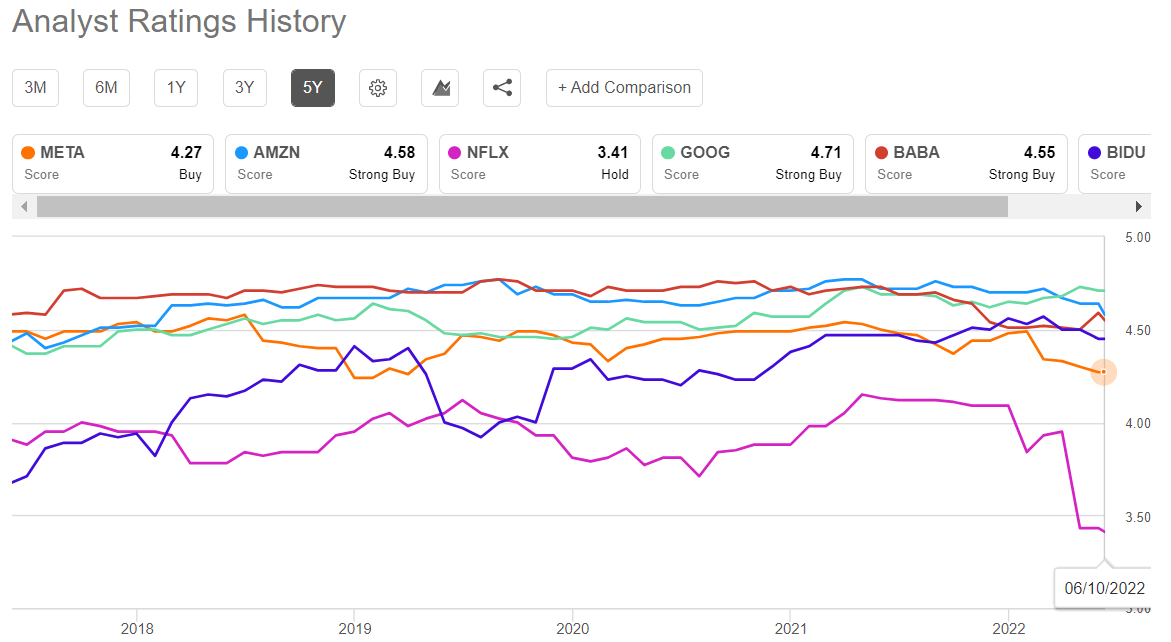

Wall Street analysts have generally lowered their outlook for the social media titan but META stock remains a consensus ‘Buy’ with a score of 4.27. While this is higher than NFLX, it is lower than AMZN and GOOG. META is scored lower than BABA and BIDU too, an incredible realization considering that the latter two were just months ago deemed “uninvestable” by Wall Street. Nonetheless, this should not be surprising to those who read my May 1 article titled Alibaba: The Great Wall Of Worry Is Crumbling.

Seeking Alpha Premium

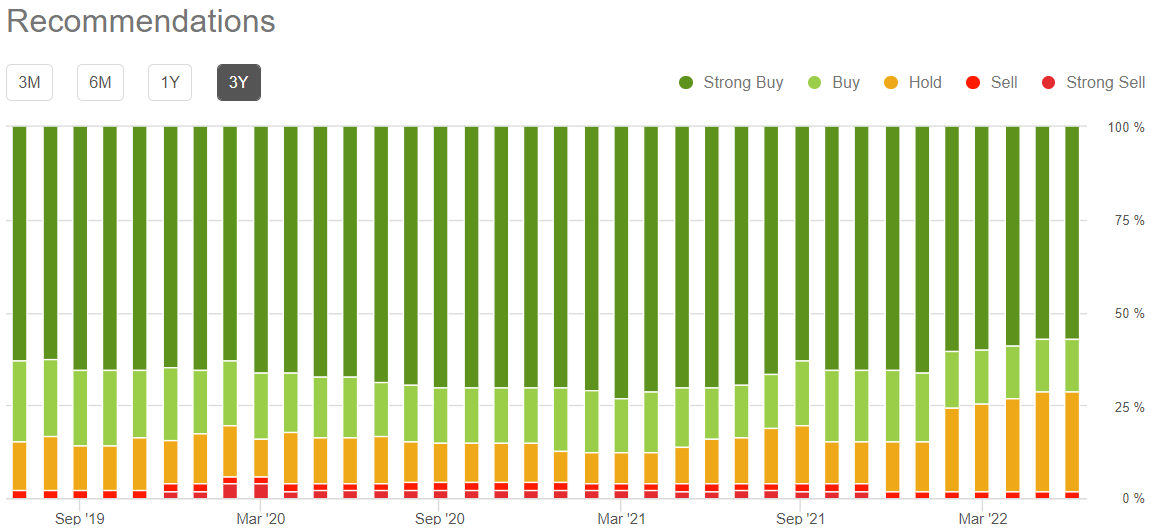

In a sign of Wall Street’s hesitancy, the number of Hold calls has risen to a multi-year high. The bear camp would caution investors that analysts typically have to avoid offending the companies lest they retaliate against negative coverage by withdrawing businesses from their employers. Hence, we should regard Hold calls as sell signals. The bull camp, however, likes to deem Wall Street downgrades as contrarian signs of reversal, much like the chorus of Sell calls on Chinese ADRs in mid-March subsequently led to a massive rebound.

Seeking Alpha Premium

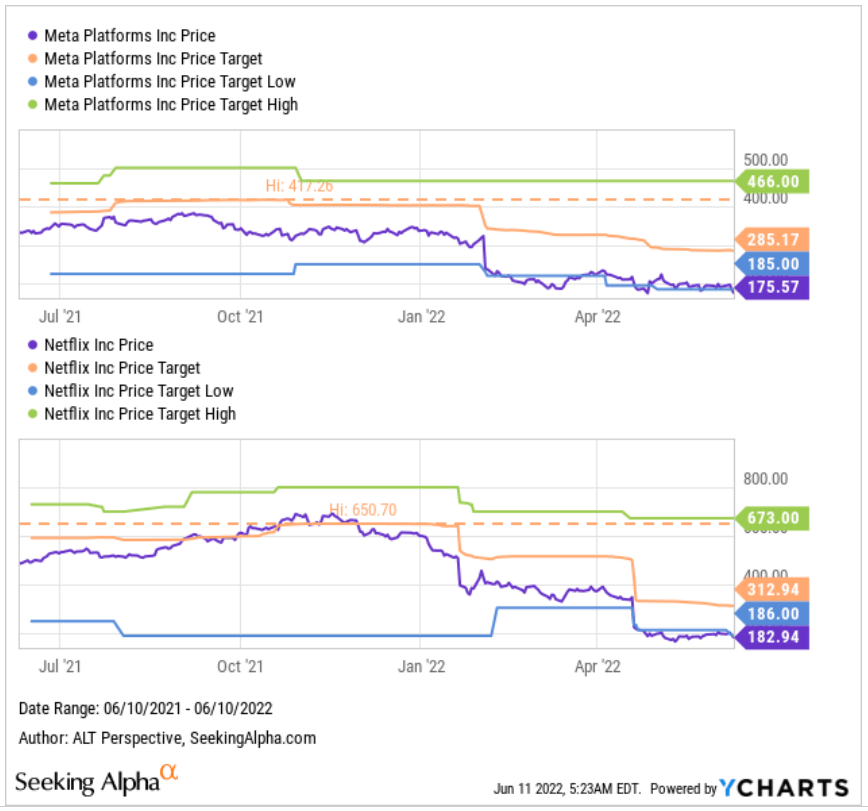

Meanwhile, many analysts still appear to take a wait-and-see approach. The share price of the Facebook owner is even trading nearly $10 below its lowest price target at $185. NFLX stock, which suffered two significant plunges thus far this year (versus one for META), is trading $3 below its lowest price target at $186. META stock has declined 54% over the past year but its target price is only down by 32%.

YCharts

Will Meta Stock Recover?

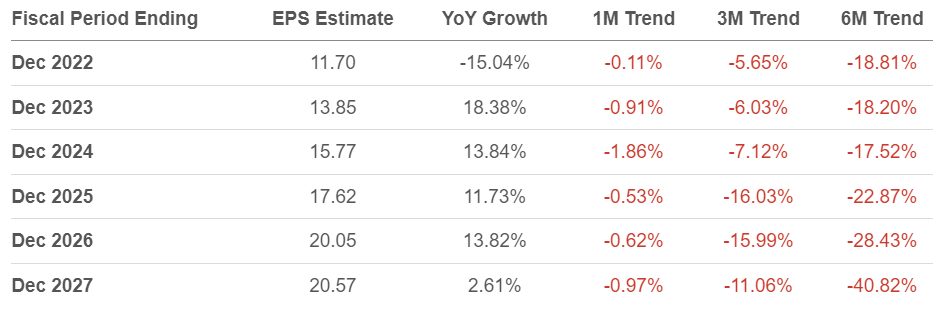

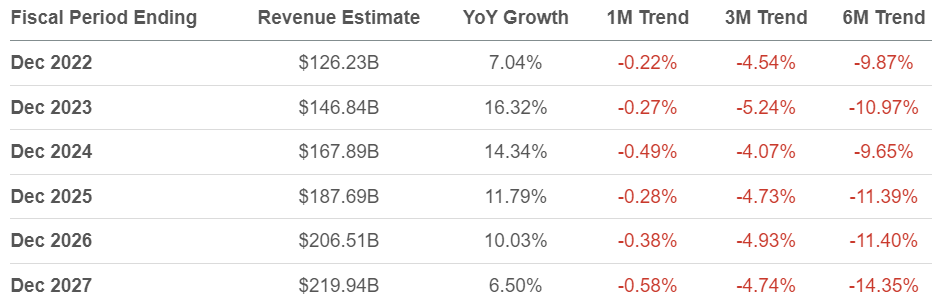

Over the last three months, Meta Platforms has received a whopping 44 downward revisions in revenue and no upward revision in revenue. The social media giant also has 29 downward revisions in EPS and only three upward revisions in EPS. This is understandably a gloomy picture but fortunately, the wave of negative revisions has abated substantially over the past month.

For the fiscal period ending December 2022, analysts slashed 18.8% off their consensus EPS estimate for Meta Platforms from half a year ago but in the past month, that has changed by a mere -0.1%. Similarly, META’s revenue estimate was 9.9% lower from six months ago but only 0.2% lower in the past month. This suggests that Wall Street has already factored the headwinds facing Meta Platforms into their forecast models, barring any further black swan events later in the year.

Seeking Alpha Premium Seeking Alpha Premium

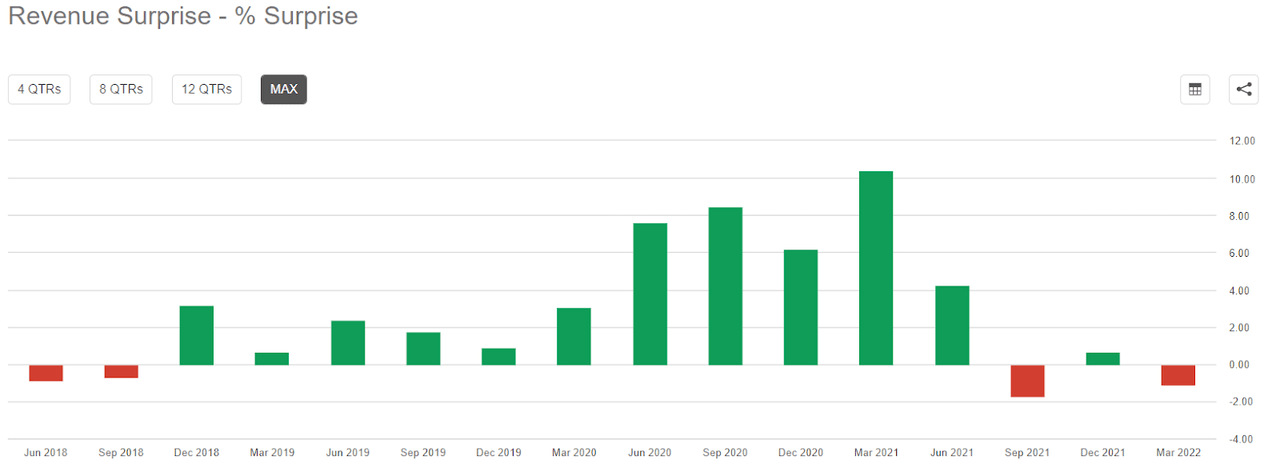

Meanwhile, with Meta Platforms missing the consensus revenue estimates for two of the recent three quarters and only narrowly surprising for the penultimate quarter, it suggests market players are already mentally prepared for another lackluster beat or even a negative surprise for the quarter ending June 2022. In other words, META may be set up for an upside move if the company surprises with a higher than consensus revenue forecast.

Seeking Alpha Premium

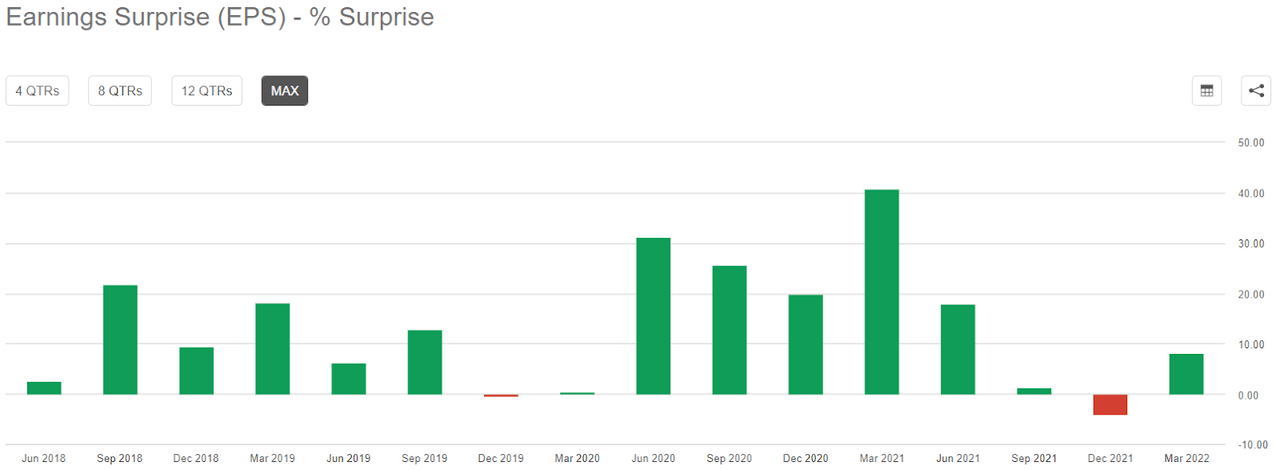

The set-up is less obvious on EPS from the last three quarters but META had delivered stellar EPS surprises previously. Hence, expectations for the next quarterly report may be tempered much like for its revenue. This is not pure fantasy. On April 28, the share price of Meta Platforms surged by double-digit percentages after it announced a beat on first-quarter EPS, as market players prioritized profitability over revenue growth.

Seeking Alpha Premium

However, with seemingly no tech stock spared from the bloodletting in the past months, investors have already gotten the message that the stock market is not going to take kindly to any company continuing to pour funds nurturing a loss-making business unit. Mark Zuckerberg has made clear that he is steering the company into the metaverse. The name change, together with the ticker change, brings this strategy pivot beyond doubt. Yet, Zuckerberg had tempered expectations that some products would not be ready for 15 years, and creating the metaverse will cause the company to lose “significant” amounts of money over the next three to five years. In 2021 alone, Meta Platforms spent $10 billion in early works on the metaverse.

I see parallels with Sea Limited (SE) where shareholders were previously enamored with the company’s ability to use the cash flows from a profitable gaming unit to fund its loss-making e-commerce operations. When I warned about the “illusions of growth” last year, I was greeted with plenty of angry comments. SE stock has declined over 60% since. Hordes of shareholders, including Cathie Wood’s ARK Invest have been selling in recent months. Should the Facebook owner keep diverting its advertising profit from its cash cows to a potentially bottomless pit, would shareholders keep faith with their META holdings?

Market players would be questioning if Roblox (RBLX), the gaming platform born with the ‘engine’ for an immersive virtual world, would be a more natural contender to be a leader in that space. Its main user base, comprising young demographics, would be of working age in another decade or so. They would be ready to work in the metaverse.

Meta Platforms with its heavy investments and focus may still emerge as a key player in the metaverse. Meanwhile, there will be a strong tussle between the believers and naysayers, much like those who chose to place their bets on Tesla (TSLA) taking the lion’s share of the electric vehicle and autonomous driving/robotaxi markets than traditional car makers such as Ford Motor Company (F).

In this fragile investing climate and uncertainties abound for the company and the macroeconomic environment, I rate META stock a Hold.

z

Be the first to comment