Dow Jones, Nasdaq 100, ASX 200, Fed, Treasury Yields, Technical Analysis – Asia Pacific Indices Briefing

- Dow Jones, S&P 500 and Nasdaq 100 weaken over the past 24 hours

- Fed boosted 50-basis point rate hike expectation, Treasury yields rose

- ASX 200 in focus as rising trendline pressured despite strong PMI data

Thursday’s Wall Street Trading Session Recap

Market sentiment soured during Thursday’s Wall Street trading session. Futures tracking the Dow Jones, S&P 500 and Nasdaq 100 fell 1.05%, 1.46% and 1.97% respectively. The tech-oriented Nasdaq 100 is now on course for a third consecutive week of losses, the worst losing streak since May 2021. The ratio of the Nasdaq to Dow Jones fell to its lowest since then as well.

Much of the focus was on the Federal Reserve on Thursday. Hawkish commentary from Chair Jerome Powell continued to propel Treasury yields higher. He further confirmed the possibility of a 50-basis point rate hike for May, offering further support for aggressive tightening in the coming meetings. Traders are now increasingly betting on a third 50-basis point hike for July amid 40-year high inflation.

The 2-year Treasury rate is up about 8.9% this week, recently outperforming longer-term yields. This has been bringing the closely watched 10-year/2-year curve back towards inversion territory. Growth-oriented have been under increasing pressure as of late. Despite stellar earnings, Tesla stock evaporated much of the upside gap seen at the Thursday open.

Dow Jones Technical Analysis

Taking a look at the 4-hour chart, Dow Jones futures established and rejected a zone of resistance between 35413 and 35281. That is sending the index back towards the 34104 – 34002 support zone. Clearing the latter could be a signal of further pain to come. Such an outcome would expose the 38.2% Fibonacci retracement at 33536.

Dow Jones 4-Hour Chart

Friday’s Asia Pacific Trading Session

The sour mood on Wall Street could signal a tough day ahead for Friday’s Asia-Pacific trading session. The relative underperformance of growth-linked stocks could leave the Hang Seng Tech Index vulnerable. Australia’s ASX 200 will also be interesting to watch following better-than-expected manufacturing PMI data for April. Rising demand from Europe can continue having a positive knock-on effect on the economy. This will likely be balanced with a more hawkish Reserve Bank of Australia however. For now, the Australian benchmark stock index is outperforming the S&P 500 since February.

ASX 200 Technical Analysis

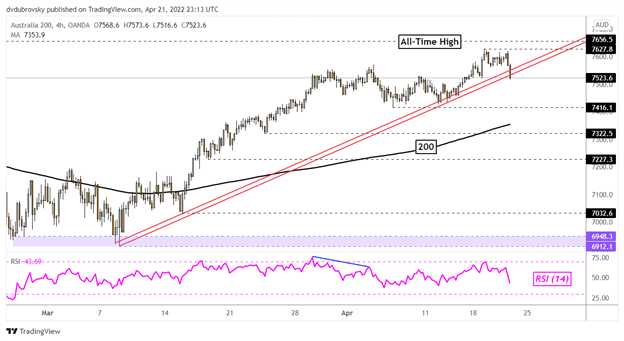

On the 4-hour chart, the ASX 200 appears to be trying to break under a rising trendline from Match. Further downside confirmation could spell trouble for the Australian benchmark stock index. Such an outcome would place the focus on 7416 before the 200-period Simple Moving Average could reinstate an upside focus. Uptrend resumption entails a push above 7627.8 resistance.

ASX 200 4-Hour Chart

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment