DOW JONES, NIKKEI 225, ASX 200 INDEX OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 closed +0.30%, -0.09%, and -0.60% respectively

- Forced liquidation on Archegos’ holdings dragged financial sector lower

- The Nikkei 225 and ASX 200 indexes may move higher on infrastructure hopes

| Change in | Longs | Shorts | OI |

| Daily | 13% | 2% | 6% |

| Weekly | -10% | 3% | -2% |

Infrastructure, Archegos, Yields, US Dollar, Asia-Pacific at Open:

Wall Street equities closed mixed on Monday, with the Dow Jones continuing to outperform the tech-heavy Nasdaq 100. President Joe Biden will announce a massive $3-4 trillion infrastructure and job-creating plan on Wednesday, boosting reflation hopes further. He also said that 90% of US adults will be eligible to Covid-19 vaccines, which buoyed market confidence about a faster pace of reopening. Meanwhile, hedge fund Archegos’ forced liquidation led to concerns about its ripple effect across financial markets, weighing on bank stocks.

A rapid US recovery narrative eclipsed a potential third viral wave in Europe, sending the DXY US Dollar index to a fresh four month high as the Euro continued its decline against the Greenback. A strengthening US Dollar may serve as a near-term headwind for Asia-Pacific emerging markets, which are likely to see capital inflows slowing. The prospects of another large US spending plan sent Treasury prices lower while yields higher, as markets foresee more issuance of government bonds to fund fiscal stimulus. The 10-year Treasury yield resurged to above 1.70%, potentially weighing on precious metals and risk assets.

DXY – US Dollar Index

Chart by TradingView

A $20 billion forced liquidation of positions held by family office Archegos pulled several stocks sharply lower on Friday, including ViacomCBS, Discovery and Chinese ADRs Baidu, Tencent and Vipshop. Bank stocks declined on Monday as investors weighed their potential losses from this incident. Japan’s largest investment bank, Nomura, saw its stock price plunge 16% after it flagged an estimated $2 billion losses at its US subsidiary. Credit Suisse also warned “significant and material” impact from “a US-based hedge fund defaulting on margin calls”. Its share price tumbled 15% as a result. Other banks involved in the liquidation include Goldman Sachs, Morgan Stanley and Deutsche Bank.

Asia-Pacific markets look set to open stronger on Tuesday, with futures across Japan, Australia, Hong Kong, Taiwan, Singapore, Malaysia and Thailand are pointing to trade mildly higher. Australia’s ASX 200 index opened up by 0.52%, led by utilities (+1.28%), communication services (+0.76%) and information technology (+0.71%) sectors, while consumer discretionary (-0.17%) lagged behind.

Japan’s Nikkei 225 index opened modestly higher on Tuesday after the release of an upbeat jobless rate and retail sales figures. The unemployment rate came in at 2.9%, lower than a baseline forecast of 3.0%. Retail sales grew 3.1% MoM, smashing analysts’ forecast of a -0.5% decline.

Meanwhile, Bank of Japan Governor Haruhiko Kuroda reassured markets that the central bank will continue to purchase ETFs and will not unload its huge stock holdings even after the pandemic subsides. His comment may help to lift market sentiment as the BoJ is the largest investor of Japanese stocks with more than $ 400 billion holdings.

Looking ahead, German inflation data headlines the economic docket alongside the US CB consumer confidence index. Find out more from the DailyFX calendar.

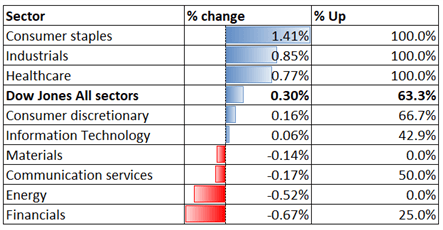

Looking back to Monday’s close, 5 out of 9 Dow Jones sectors ended higher, with 63.3% of the index’s constituents closing in the green. Consumer staples (+1.41%), industrial (+0.85%) and healthcare (+0.77%) were among the best performers, while financials (-0.67%) and energy (-0.52%) lagged behind.

Dow Jones Sector Performance 29-03-2021

Source: Bloomberg, DailyFX

Discover what kind of forex trader you are

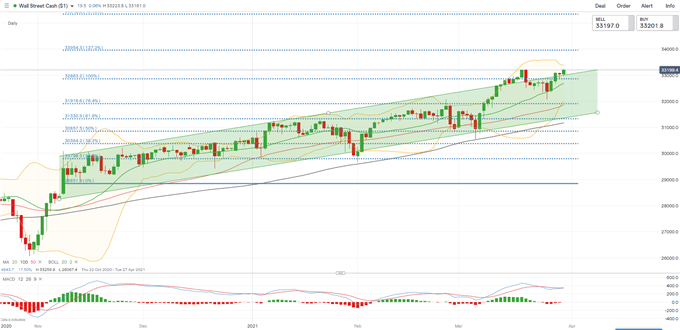

Dow Jones Index Technical Analysis

The Dow Jones indexbroke above the ceiling of the “Ascending Channel” for a second attempt this month, underscoring strong upward momentum. The index has also broken an immediate resistance level at 32,863 (the 100% Fibonacci extension) and thus opened the door for further upside potential with an eye on 33,954 (127.2% Fibonacci extension). The overall trend remains bullish-biased as suggested by the upward-sloped moving averages. A bearish MACD divergence however, suggests that a near-term pullback is possible.

Dow Jones Index – Daily Chart

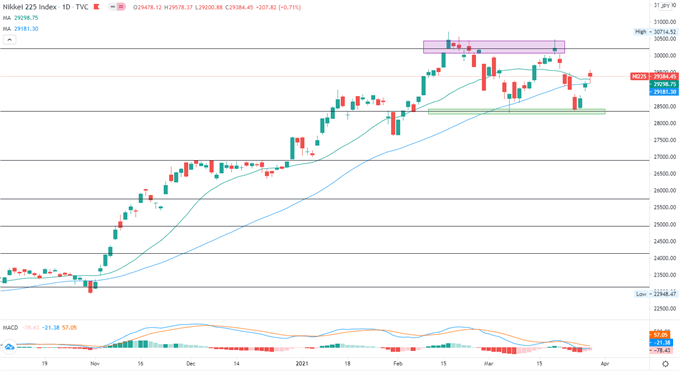

Nikkei 225 Index Technical Analysis:

The Nikkei 225 index bounced off an immediate support level at 28,357 (100% Fibonacci extension). The index appeared to be range-bound between this level and 30,214 ( the 127.2% Fibonacci extension) since mid-February. The 20-day SMA lines is about to cross below the 50-day line, potentially forming a bearish crossover. The MACD indicator is trending lower, suggesting that near-term momentum is tilted to the downside.

Nikkei 225 Index – Daily Chart

Chart by TradingView

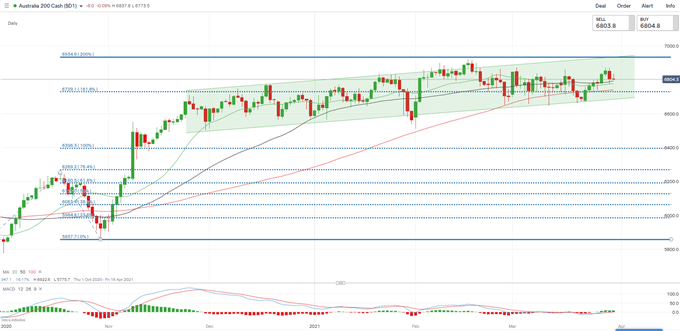

ASX 200 Index Technical Analysis:

The ASX 200 index remains in an “Ascending Channel” but upward momentum appears to be fading as suggested by the downward-sloped MACD indicator. The overall trend remains bullish as suggested by upward-sloped 50- and 100-day SMA lines. Holding above 6,730 – the 161.8% Fibonacci extension level – may pave the way for further upside potential towards 6,935 – the 200% Fibonacci extension.

ASX 200 Index – Daily Chart

Recommended by Margaret Yang, CFA

Improve your trading with IG Client Sentiment Data

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter

Be the first to comment