Khanchit Khirisutchalual

Business Overview

DoubleVerify Holdings, Inc. (NYSE:DV) operates a global digital media measurement, data, and analytics platform, enabling advertisers to improve their Return on Ad Spend (ROAS) and enabling publishers to optimize their inventory monetization.

DV possesses comprehensive capabilities around Ads Fraud, Brand Safety and Suitability, Viewability, Programmatic Targeting, Performance Insights, CTV Quality and Effectiveness, Measurement & Analytics, and Social Media Effectiveness. DV’s solutions include 1) DV Authentic Ad that evaluates Ad fraud, brand safety, viewability, and geography; 2) DV Authentic Attention that provides predictive analytics for Ads campaigns; 3) Custom Contextual solution that helps advertisers maximize user engagement and drive conversions; 4) DV Publisher suite that allows publishers to increase inventory yield; 5) DV Pinnacle that enables users to customize their media plans and track campaign performance at granular levels such as channels, formats, and devices.

DV serves customers on both demand and supply side, and demand-side revenue is more dominant (91% revenue mix in FY21). Demand-side revenue is generated through a fixed fee on the number of verified transactions measured on behalf of customers, and supply-side revenue is through a subscription model. In FY21, DV served ~1,000 customers across 90 countries globally. Among the top 700 global advertisers, DV had ~42% coverage. This business has high stickiness (~98% gross revenue retention, ~126% net revenue retention, and an average tenure of ~7 years for DV’s top 75 customers). DV’s solutions are highly integrated with a wide range of digital advertising platform partners (Programmatic, social, connected TV, Agencies, etc.).

Financial Summary

As per Q3-22 earnings release, DV reported Revenue of $112MM (Activation revenue $62MM, +48% YoY; Measurement revenue $39MM, +14% YoY, and volume growth, aka. Media Transactions Measured (“MTM”), was +48% YoY for CTV, and 23% for Social; Supply-side revenue $11MM, +57% YoY). This quarter hit the highest watermark driven by pre-campaign activation across Programmatic, Social and CTV, and I expect DV to continue accelerating its growth with long-term secular trends in Programmatic, Social, and CTV.

On the demand side, total Advertiser revenue grew +33% YoY (17% growth attributed to volume, Media Transactions Measured (“MTM”) and 10% attributed to rate, Measured Transaction Fee (“MTF”)).

New/Expanded partnerships with Netflix (NFLX), and TikTok will fuel future growth in CTV and Social.

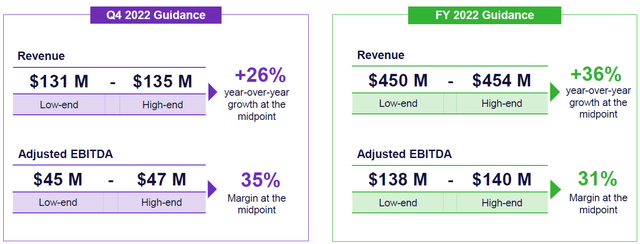

The following figure shows DV’s Q4-22 and FY22 guidance. I also compared the Q4-22 guidance from other Digital Ads players, which demonstrated DV’s resilient business model and exceptional growth potential despite the digital ads industry is being shaken up.

Netflix Q4-22 Revenue growth guidance: +9% YoY

Meta (META) Q4-22 Revenue growth guidance: +7% YoY

Snap (SNAP) Q4-22: “Given uncertainties related to the operating environment, we are not providing our expectations for revenue or adjusted EBITDA for the fourth quarter of 2022.”

TTD Q4-22 Revenue growth guidance: +24% YoY

Roku (ROKU) Q4-22 Revenue growth guidance: -7.5% YoY

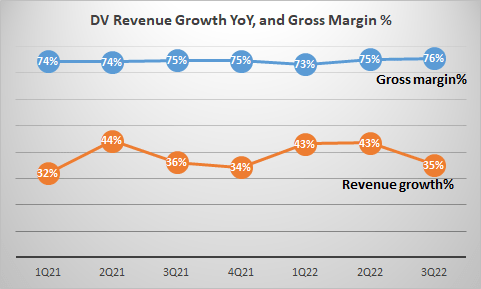

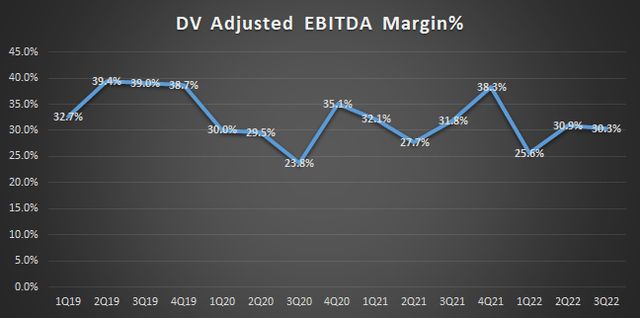

The following figures show DV’s revenue growth% YoY, Gross Margin %, and EBITDA Margin % in last few quarters. Overall, the business has been performing consistently well for both top line and profits.

Capital IQ

DV rides on several long-term secular tailwinds, and will continue to outpace the industry growth of digital Ads.

DV FY22 revenue growth is expected at 36% YoY according to company’s guidance stated in Q3-22 earnings call. For comparison, the worldwide digital ad spend is expected to grow at 8.6% YoY in 2022 according to eMarketer.

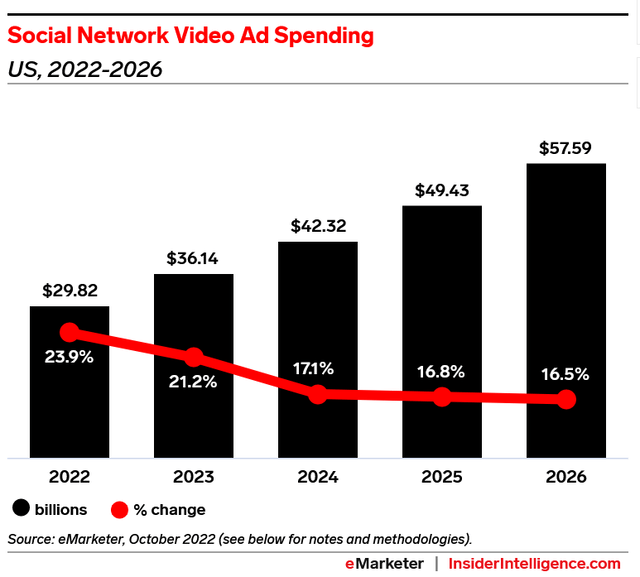

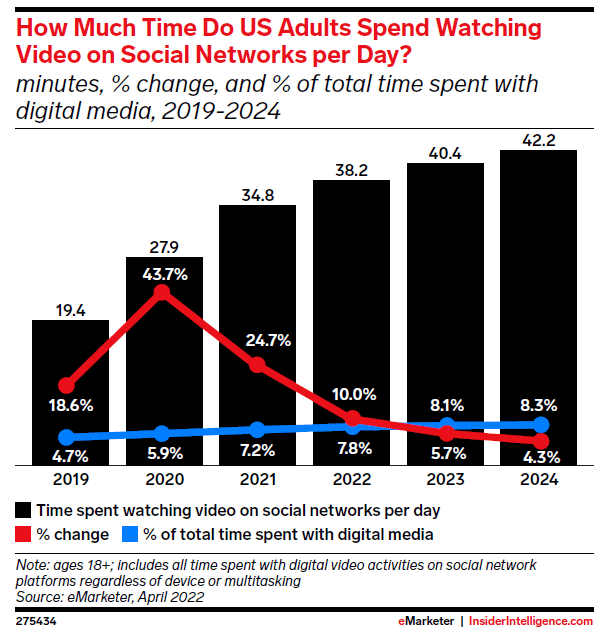

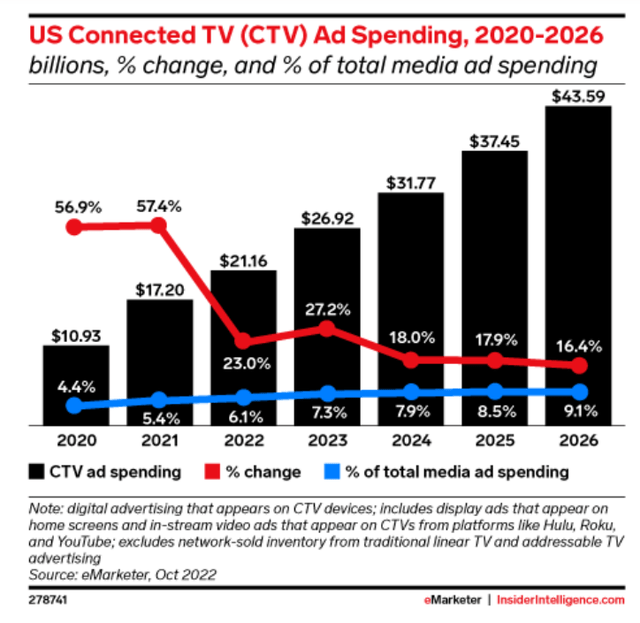

I expect DV to continue outpacing the industry growth considering several secular tailwinds: 1) Social Video Ads and 2) CTV.

In Dec-20, DV received the MRC (Media Rating Council) accreditation for 3rd party integrated impression and viewability measurement, and later expanded to Brand Safety and Suitability, and Brand Safety Floor services. On Sep.28 2021, DV announced its partnership with TikTok (according to eMarketer, US TikTok Ad Revenue is ~$6B, +184% YoY, and expected to nearly double to $11B in 2024), an addition to its already strong partnerships with Snapchat, Facebook, Instagram (GOOG, GOOGL), YouTube, Pinterest (PINS), and Twitter (TWTR).

For CTV (Connected TV), DV serves Netflix, Amazon Fire TV (AMZN), Hulu (DIS), and Roku (ROKU). This sector will continue to benefit from the budget shift from TV to CTV.

The following figures show the US Ad spend growth in Social Network Video, the US Social Video daily time spent growth, and the US Ad spend growth in CTV.

Massive untapped international markets provide additional upside.

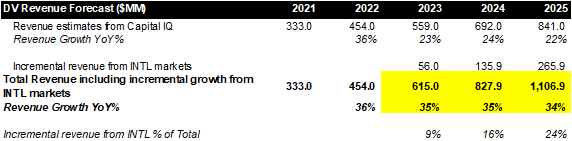

In DV’s Q3-22 earnings call, the company stated that 71% of the international wins were greenfield. DV does not disclose its revenue from international market. As it furthers its expansion efforts, I expect more growth from international markets (and this part hasn’t been priced in). If I benchmark with The Trade Deck, which has 16% of revenue from international market, I think DV will be able to gain incremental growth from international markets in next three years.

Company’s earning call slide Capital IQ

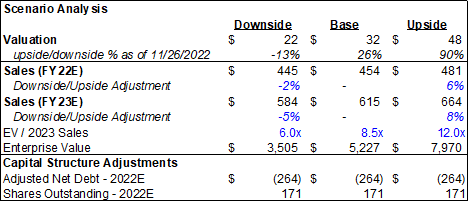

DV is worth $32 (26% upside) assuming 8.5x 12-month Enterprise Value/Sales (as compared to The Trade Desk’s 12.9x).

In the Ad Tech space, The Trade Desk is now traded at 12.9x 12-month EV/Sales, and its revenue growth is comparable to DV’s revenue growth. Applying 8.5x (-34% vs TTD’s 12.9x due to its difference in market cap), the base case price will be $32, representing 26% upside from its current price.

Note: this valuation is conservative because 1) it focuses on its near-term performance up to 2023 only, which is much more conservative than a 5-year EV/EBITDA valuation; 2) it does not fully capture its potential on the supply-side growth considering its nascent size in 2022; 3) it does not fully capture its incremental growth in international market in next three years.

Capital IQ

Conclusion

DV is a strong performer in the Ad Tech space. Its comprehensive measurement and analytics capabilities for Programmatic, Social Ads, and CTV, its resilient business model (attracting both Ad platforms and Advertisers), and its massive greenfield opportunities provide investors nice returns and a relatively high margin of safety.

Be the first to comment