Rawf8/iStock via Getty Images

Thesis

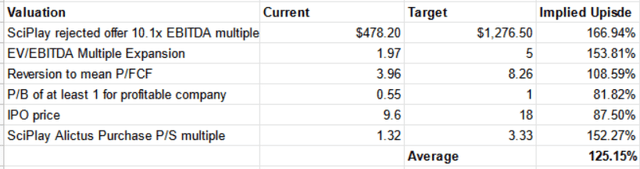

DoubleDown Interactive (NASDAQ:DDI) is an online gaming company where you can buy the operating business for a P/FCF of 1.99 based on their three year average free cash flow of $104m. More than half of the current market capitalization is held in cash and short term investments which are intended for M&A purposes within the year’s end. Despite profitability the company trades at a P/B of just 0.56. Based on six different conservative valuation approaches the company has an average 125% implied upside.

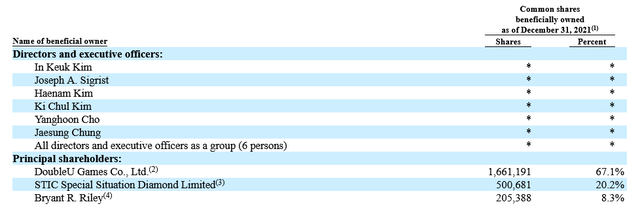

I believe that given recent macro changes in how app stores charge companies like DoubleDown that they are likely to see increased profitability as their largest expense decreases. Any acquisition done is likely to be immediately accretive, growing profitability even further and expanding the base of revenue, base of users, and perhaps even opening the door to new verticals in the gaming space. With 95.6% of outstanding shares held by insiders and related parties I expect that as DDI completes an acquisition and sees earnings growth from macro trends that the stock price will move upward with or without a multiple re-rating.

I believe that the IPO price of $18.00 represents a conservative minimum value in the name representing an 87.5% margin of safety. With the right M&A acquisition, continued diligence on the part of management, and macro changes, it’s possible earnings could grow significantly in the coming years. So I expect to see DDI around $18.00 anytime within the next 1-2 years.

All the following estimates assume a current DDI stock price of $9.60.

DoubleDown Interactive Company History

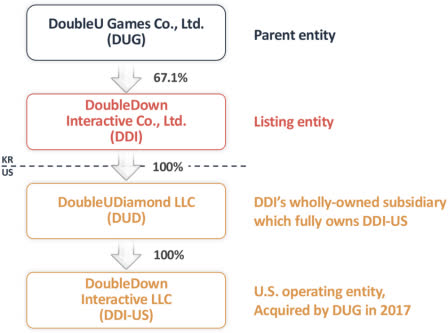

The company was originally established as The8Games in Seoul, Korea in 2008 with a focus on development and publishing of casual games and mobile applications. DoubleU Games (DUG) acquired the company in 2017. That same year DUG purchased DoubleDown Interactive US. The idea was that the two companies combined under DUG would create powerful synergies in the social casino gaming content space. They changed their name officially to DoubleDown Interactive in December 2019. In the following year, DoubleDown acquired Double8 Games from DUG as well.

The company initiated an IPO in mid-2020 which was not completed. A second attempt in August 2021 was done at ~8 EV/EBITDA valuation. DDI shares started trading on August 31st at $18.00 per share. B. Riley Securities was the sole underwriter and within a month of IPO affiliated B. Riley Financial launched a tender offer to purchase 2m shares of DDI at $18.00. In their press release announcing the offer Chairman B. Riley himself had this to say:

We have been a significant purchaser of DDI in the open market since its initial public offering. As a well-run, highly profitable company with a predictable business model, DDI is a company in which we have strong conviction. Through this tender offer, we are providing transparency to shareholders of our intent to acquire additional shares at what we believe represents a highly compelling value at the proposed tender price of $18.00. We look forward to commencing the tender offer process and continuing our partnership with DDI and its shareholders.

As of their most recent filing in February 2022, B. Riley owns 8.3% of shares outstanding. A June report from B. Riley indicated a price target of $20 for DDI which is lower from their previous $30 target. DoubleU Games maintains a 67% majority interest in the company as of November 2021.

Company Filings

Current CEO in Keuk Kim has been involved with DDI for years. He previously was employed at DoubleU Games, with a history dating back to 2013 and actually led the execution and acquisition of Double Down Interactive. Their Chief Data Officer Ki Chul Kim worked alongside I.K. Kim at DUG on the acquisition. Joseph Sigrist, CFO since 2019, brings history from the DoubleDown side where he was an executive from 2015. Prior to that he worked with the previous parent company of DoubleDown, International Game Technology (IGT), from 2012 as Senior VP of Global Product Development and Operations. DDI maintains a partnership with IGT to this day. I believe management overall brings valuable historical understanding and context of not just the sector, but the development of the different pieces of the company.

DoubleDown Business Overview

The company generates revenue through four free-to-play mobile games with their flagship game DoubleDown Casino being their key asset generating 96.6% of 2021 revenue. Three of their games are in the social casino category while their most recent launch Undead World: Hero Survival is their first RPG fast casual styled game. Let’s look at some baseline data on the games.

|

Game |

Launch Date |

Installs as of 12-2021 |

# of Reviews |

Average Rating out of 5 |

Estimated Revenue June 2022 |

|

DoubleDown Casino |

04-2010 |

>10m |

543,366 |

4.5 |

$10m |

|

DoubleDown Fort Knox |

04-2018 |

3.9m |

193,956 |

4.5 |

$100k |

|

DoubleDown Classic |

07-2017 |

2.0m |

131,648 |

4.7 |

$300k |

|

Undead World: Hero Survival |

09-2021 |

670k |

5,199 |

4.9 |

$70k |

*Data compiled from company filings and Sensor Tower data.

While the games are free to play, they offer in-game purchase options. For instance, the three DoubleDown games are platforms where you can use fake currency to play a variety of casino styled games, many of them slots styled. If a player uses all of the fake currency they are allotted they can choose to either wait for more or purchase more through the in-game store.

Given current mobile app dynamics, these games are predominantly distributed and marketed through Apple App Store, Facebook, Google Play Store, and Amazon Appstore. Each of these platforms charges around 30% on gross revenue received through the games and this represents the company’s largest expense. Recent litigation by Epic Games suggests that these 30% flat fees are likely to be decreasing as other options for companies open up. We’ll talk more about this later though.

DDI maintains a shared code base for all of their games which enables seamless upgrade cycles and lower ongoing costs. Not included in the games above is Save My Zombies which has been in beta since April. Another expected launch is Spinning In Space intended to go into beta this summer. Going into this next year their stated goal is to launch a gaming app once every quarter – and currently they are developing what they call Project G and K both in the hyper casual space. This translates to about four games in ongoing development which provide upside optionality. All of this development has come out of ongoing R&D costs and likely require minimal capital expenditures to maintain since it’s built on the shared code base. Management targets a six-month payback period for new launches.

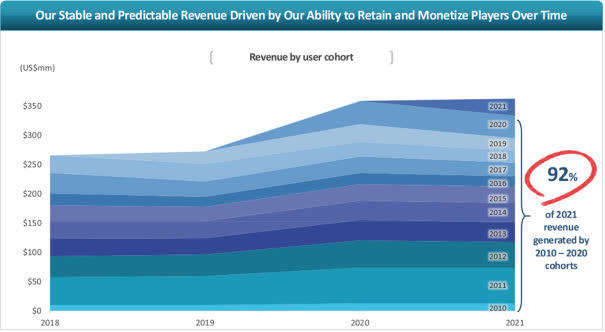

Revenue in 2021 was $363m which is up 36% since 2018. They generated $120m in FCF in 2021 and have quarter-to-quarter averaged a 29.8% FCF margin over the last two years. While the revenue comes predominantly from the one game, it’s seemingly very sticky as 92% of revenue in 2021 was generated from people who had downloaded the game prior to that year with some going back as far as 2010.

Company Filings

The fact that there are people still spending money in this game ten years after they first played it in my eyes helps to mitigate the concentration of revenue. It also demonstrates the value proposition of these types of games when done right. While DoubleDown Casino generates huge amounts of cash flow management is looking for ways to put it to work in M&A.

Valuation and Financials

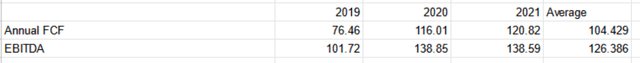

Averaging the past three years of FCF gives us an annual estimate of $104m. With a market capitalization of $475.776m we can back out the cash position of $268.205 and see that the operating business is trading for a P/FCF of just 1.99. This is a business with growing revenue, high margins, minimal cap-ex requirements, and a game which has been in the top 25 grossing mobile games annually on Apple App Store since 2015.

Despite being profitable the company is trading at a 0.54 P/B value. The cash and short term investments position represents 30% of DDI’s book value and they had $41.295m in debt as of their last quarterly announcement. Enterprise value is $248.871m and with a three year average EBITDA of $126.386m they are trading at an EV/EBITDA multiple of 1.97.

Author’s calculations using company filings.

Of note is that the P/FCF metric is based on historical data despite earnings growth. There are multiple realistic ways that earnings could expand significantly in the coming years yet we need not assume that growth to see the undervaluation. Instead, investors at this price are given a margin of safety with multiple optionality events perhaps compounding the return.

First quarter reporting revealed revenue decline year-over-year and EBITDA growth quarter-to-quarter. I’d say a conservative estimate of 2022 EBITDA and cash flow is either just below or around the three year average based upon the core games it has currently. If we annualized the $26.9m of EBITDA they did in the first quarter that would imply 2022 EBITDA of $107.6m.

The story is not in the revenue decline, it’s the telegraphed acquisition management is so keen to close on. An acquisition is likely to be immediately accretive to earnings, will expand the revenue base, and may potentially open the company up to new business verticals. Given their cash position reflects 56% of their market cap, a single large acquisition could likely serve as a catalyst to re-rate and bring attention to DoubleDown. Within the next year I suspect that acquisition is likely to happen.

How Does DoubleDown Compare To Peers?

DoubleDown has two very close peer companies which are also publicly traded: SciPlay (SCPL) and Playtika (PLTK). Both are bigger companies, have traded longer so are more well known to investors, and also create mobile app games in the social casino category. When we look at DDI amongst these peers it seems it is undervalued as well.

|

Peer Comparison |

Market Cap |

P/B |

Annual Revenue |

2021 FCF |

P/FCF |

ROE |

Revenue Per Employee |

ARPDAU |

Payer Conversion |

|

DDI |

478m |

0.55 |

363m |

121 |

3.96 |

9.64% |

1.60m |

0.97 |

5.70% |

|

SCPL |

1680m |

16.3 |

606m |

154 |

10.91 |

19.77% |

0.97m |

0.71 |

8.50% |

|

PLTK |

5000m |

– |

2583m |

504 |

9.91 |

0.00% |

0.65m |

0.68 |

2.90% |

*Data compiled from company filings.

There are two metrics that businesses in the sector focus on: average revenue per daily active user (ARPDAU) and payer conversion. ARPDAU is a metric that gives a window into how much revenue is being generated per average player each day. Payer conversion is a metric showing how many of the free players converted to paying players.

A couple of things I note from the table above.

-

The total peer group P/FCF average is 8.26. Reversion to the mean would imply an upside of 109%.

-

DDI is significantly more efficient than its peers with regard to revenue per employee and ARPDAU.

-

One of the peers, Playtika, currently has negative equity value which is why there’s no P/B or ROE. And yet it trades at a greater FCF multiple than DDI.

-

ROE for DoubleDown is depressed given the significant cash position and will be better understood once they deploy that cash.

Here on Seeking Alpha there have been three articles covering SciPlay and two on Playtika. Most recent coverage of Playtika argues that those shares are undervalued at current cash flow multiples. SciPlay is considered a hold in most recent coverage and considered to be near fair value. Besides opinions here there’s the fact that SciPlay received and rejected an offer to be acquired by their majority owner at a valuation of 10.1x EBITDA believing that it undervalued them. Playtika was recently in the rumor mill given a note that Joffre acquired a 20% stake at a 46% premium to current trading prices. In either case, if SciPlay and Playtika are undervalued then we can double down on DoubleDown’s undervaluation.

One Major Liability: Benson, et al. v. DoubleDown Interactive, LLC and International Game Technology

The company has an outstanding credible lawsuit where plaintiffs are asserting that DoubleDown games operate as illegal gambling and under Washington state law losses are recoverable from the company. Here’s why I say the lawsuit is credible: “Additional class actions have been commenced against other of our competitors on similar grounds, certain of which, including Churchill Downs, have finalized settlements which the court approved on February 11, 2021 in amounts of $6.5 million, $38.0 million, and $155.0 million.” SciPlay settled a similar lawsuit for $24.5m just last year.

DDI’s insurance company has already indicated that they would not cover any losses. While I think it’s likely to cost the company something, the wide range implied does not help make matters clear. Management’s own estimation is a loss between $3.5 million and $201.5 million.

This is definitely something to monitor and will have a material impact on the company. Although given how cheaply the company is trading and the cash on hand, it should merely be a one-time hit. It does not reflect any impairment to the business value of the company. Changes to their app model have already been made to better align with interpretation of the Washington state law so that this issue will not come up again in the future.

Interested readers can find more information on this space here and here.

Why Is DoubleDown Trading So Low?

If we step back from the company for a second and review its stock price performance since IPO we can observe it has shed 46.2% in value. It’s also trading near its lows.

DoubleDown has seen downward pressure just like everything these past few months though I believe it is compounded by the relatively new nature of the company and tight ownership. There are only two analysts with price targets out on DDI, one of them being a major shareholder in the company already, B. Riley, with their most recent $20 price target. Northland Capital Markets has a $25 price target set since Sept. 2021. Otherwise, coverage is scant. No one has written an update on the company on Seeking Alpha since IPO. It’s unwatched, unfollowed, and I think that represents opportunity.

|

Company |

Seeking Alpha Follows |

Stocktwits Watchers |

# of Analysts |

% of Institutional Ownership |

|

DDI |

420 |

63 |

2 |

10.25% |

|

SCPL |

2550 |

566 |

9 |

71.30% |

|

PLTK |

3730 |

1411 |

12 |

14.85% |

The stock has been trading around its lows for about a month now and has not been kind to investors who bought at the IPO. If we consider share ownership overall we can see that around 95.60% of shares are held by insiders and related parties – this translates to a very small number of shares likely trading.

Average daily volume of DDI stock this past month is around 6000 shares a day. The downward pressure of the market combined with tight float has likely caused many to move out of the position with fewer and fewer new buyers given the relatively unknown nature of the company. Illiquidity I think will be a benefit moving forward as I believe we are near lows and as the story becomes more clear there will be people interested in buying and not much floating around.

There is likely some discount being applied to the company given it is based in South Korea. Given these are ADS shares most brokerages will charge a fee for holding them though typically nominal. With tensions growing around the world and in the South Pacific specifically it’s likely there are some regional fears hanging over the name. It could be argued that being based in Korea is a benefit given it’s the fourth largest gaming market in the world and it’s known as “a country where developers often dictate the terms of development for the entire gaming market”.

Lastly, I’d just note again that the lawsuit above is likely to have a material one-time impact on the company in the coming years. I think this is balanced with the reality of cash on hand though it likely has impacted the stock price.

Three Things to Watch Moving Forward: M&A, Organic Growth, Declining Expenses

Management has this stack of cash on hand they have indicated again and again they intend to use for an M&A target as they believe it’s the best return for shareholders. In multiple conference calls they’ve been asked if they would consider other options such as a buyback to which the answer has been consistently that M&A is their preferred route. I think they are right given the low share count likely trading and they need to grow their revenue and acquiring more is fine. Given the mechanics of businesses in this space a deal is likely to be immediately accretive which would mean top and bottom line growth. Management believes they can leverage the technology platform they have built to improve margins at whatever company they might acquire.

Let’s estimate how much a possible M&A target might provide in value to the company. Starting with their $268.205m in cash and short term investments I think it’s reasonable to look at what a deal of $200m might do for the company. In terms of a valuation multiple for acquisition, let’s take a look at the recent purchase by peer SciPlay of Alictus.

SCPL acquired 80% interest in Alictus with $100m cash and they intend to purchase the next 20% of the company over the next five years. Given management commentary it seems the contribution from Alictus will be $30m in annual revenue to start. This implies a P/S 3.33 (of note is that DDI trades at 1.32 P/S). If we estimate a similar price tag for a company in the $200m dollar range we could estimate a possible $60m contribution in revenue to DDI. With an average FCF margin of 29.80% that would imply an additional $17.88m in annual free cash flow, an increase of 17%.

Overall the gaming sector is experiencing a wave of M&A which provides a meaningful backdrop for management to actually achieve a deal. For instance, according to this article late in 2021 844 deals had been done with a total transaction value of $71b.

Organic growth may come from the pipeline of games that have already been announced. Any of these four upcoming games are mostly upside optionality as they have been developed out of ongoing R&D costs, maintained on a shared code base, and can be easily winded down if not generating profitability. Keep an eye on how their games are doing including the most recent launch of Undead World.

Last piece I’ll note is the recent litigation against Apple (AAPL) and Google (GOOG) (GOOGL) regarding their fees to distribute in their app stores brought by Epic Games. This is DDI’s greatest expense – the 30% of all of their revenue that goes to the app store owners. Epic Games v. Apple has already been decided and while the decision was mostly in favor of Apple it has resulted in a significant change for publishers. Part of the ruling requires Apple to enable other payment options besides the ones subject to Apple’s 30% fees. These payment experiences would link outside of the app itself so it will require publishers to build architecture to support payments. One article describes it this way:

Basically, it’s a great opportunity for mobile developers to earn significantly more money while building deeper relationships with their players. You can link out to webshops where you can monetize without paying 30%, collect all the data you want, build direct relationships with your players, and leverage all the marketing power the web has to offer to acquire new users.

And this may just be the beginning of structural changes in the industry. Epic Games v. Google is ongoing though the details don’t look good for Google. The Epic Games lawsuits are a saga in and of themselves so I won’t get into all of the details here. But I’ll note that the results of the lawsuits have already initiated structural changes in the industry which should benefit publishers. There’s big money at stake in all of this, the metaverse is implicated, and small yet aspiring DoubleDown stands to benefit.

Did I mention that DoubleDown made a $1.5m investment in Epic Games? So owners of DDI can confidently say they own Fortnite.

Conclusion

DoubleDown Interactive is cheap. It’s cheap based on annual free cash flow, price to book ratio, and amongst peers. I believe the name is trading so low given that an estimated 5% of shares are likely trading in a stock that has not even been public a year yet amidst a broad market downturn. These structural elements have created an opportunity to purchase a capital light, high margin, high growth potential, and disciplined business at a P/FCF of less than 2.

I believe that the M&A transaction that DoubleDown has been looking for is likely to happen in the next year resulting in meaningful top and bottom line growth. Organic revenue growth is possible from moderate success of any of their pipeline of games without much additional risk. And macro trends in the industry seem to support DoubleDown growing as a business overall.

Based on six different valuation approaches I’ve estimated an average implied return of 125.15%. Many of these valuations are quite conservative and help to ensure a margin of safety with additional upside optionality.

Based on my evaluation I believe that DDI has a minimum value of their IPO price of $18.00 representing an 87% margin of safety. It’s possible given the factors described above that the company could be worth multiples more than that. A major risk in the form of a one-time litigation pay-out for the Benson case is something to monitor as well as capital allocation choices moving forward. If and when an M&A deal is announced the acquisition should be evaluated. If an acquisition is not done in the next six months then there may be more questions to ask here.

Risks

-

The pending Benson litigation is likely to be an actualized one-time expense for DoubleDown. It’s a question of how many millions. With a range of $3.5m-201.5m keep an eye out.

-

The large cash position may be used in an M&A transaction which actually destroys value. Details of any transaction should be monitored.

-

Revenue is highly concentrated in DoubleDown Casino. Any impact to the performance of this game would be materially significant to the thesis.

-

95% of shares are held by insiders and related parties. As a controlled company, this may represent risk depending on your opinion of the majority owners.

-

With only 5% of shares outside of that we estimate 2.18m available for trading. Given a 30-day average volume of 6000 shares a day there’s potential for illiquidity risk.

-

Geopolitical risk given that DDI is based in Seoul, Korea. Increased tensions in the Pacific region could impact the stock price and the company.

Be the first to comment