Jaskaran Kooner

There are many articles stating Toll Brothers (NYSE:TOL) has what it takes to face the housing recession that most know is coming or has even already arrived.

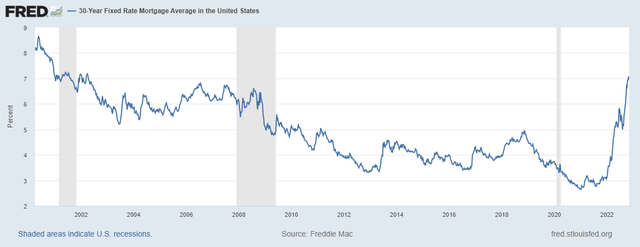

Why a deep housing recession is inevitable escapes no one. Housing prices are at historic highs, yet this time they face mortgage rates which are also at very high levels, not just compared to recent memory, but also looking back 2 decades. For instance, this is how the 30-year mortgage looks:

Now, on the face of this reality, Toll Brothers’ stock has already seen some punishment. It fell from $74.61 on December 6, 2021, to $47.12 as I write this. That’s a nearly 37% drop right there. Yet, many other contributors seem to think that’s enough, since recent analysis is broadly positive:

Seeking Alpha

Here, I’m going to rain on this parade.

No, Toll Brothers hasn’t fallen enough, in my view. And this is in spite of it carrying an apparent consensus Price/Earnings of 5.4x, even based on the worst of the consensus looking forward – for the fiscal year ending in October 2024.

Immediately, it sounds dumb to think a stock with a trough 5.4x P/E isn’t cheap. But let me explain why it isn’t cheap at all.

You see, housing is cyclical, and we all agree we’re entering a bad cycle here, given what was said regarding house pricing and interest rates. How bad a cycle is where we can have doubts. But let’s go through the evidence we have.

Interest rates we’ve already seen. They’re higher now (on a fixed 30-year mortgage) than at every point in the last 20 years, including the 2007-2009 housing crash.

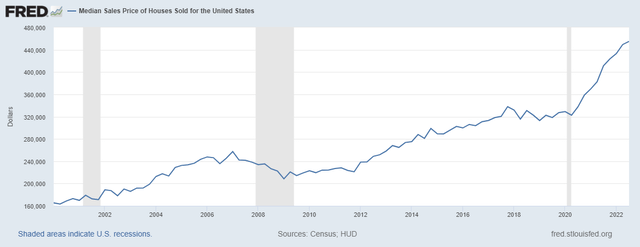

Now where are housing prices? Let’s look at the median home sales price:

Here, we observe that the median house price is 77% higher ($454,900) than at the peak before the 2007-2009 housing crash ($257,400).

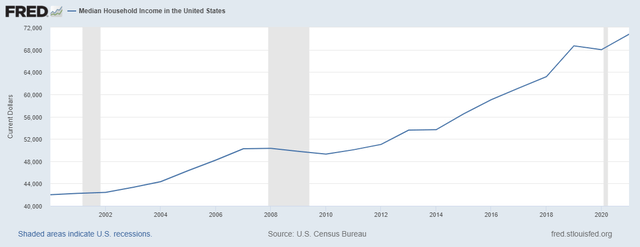

Ok, but people earn more now, right? So, they can “buy more house”. So perhaps it’s not as bad as it looks. Let’s see what has happened to the median household income:

That is surely a large increase. From around $50,000 during the 2007-2009 house crash, to $71,000 now. That’s a 42% increase (higher, if we consider 2022 incomes).

Now let’s put it together:

- The median house price is 77% higher than right before the 2007-2009 housing crash.

- Household income is 42% higher than right before the 2007-2009 housing crash.

- And unfortunately, mortgage interest rates are higher now than right before the 2007-2009 housing crash.

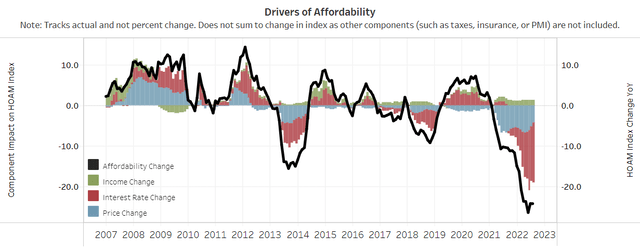

What this means, is that housing affordability right now is worse than it was right before the 2007-2009 housing crash. Housing prices went up faster than household income, and interest rates are worse too.

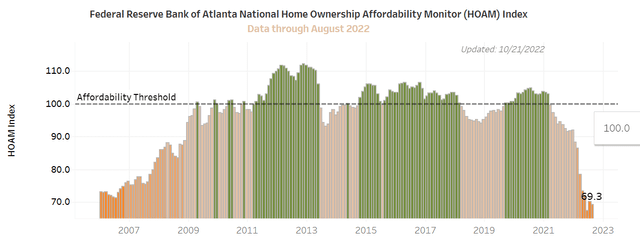

Indeed, since all factors are unfavorable, it’s significantly worse – though the Federal Reserve Bank of Atlanta, below, shows it only as somewhat worse (due to data going only to August 2022, and thus not capturing the latest interest rate increases).

Anyway, already we can conclude one thing: The current starting point for a negative housing cycle is worse than the starting point at the onset of the 2007-2009 housing crash.

Next, we’ll see why Toll Brothers, in that context, is going to be punished further. And why the low Price/Earnings can’t save it.

The reason is rather simple, actually, and typical across most cyclical industries. The reason is that on a negative cycle, markets have to force production capacity out of the market. And the way markets do this, is by making production be uneconomical. That is, unprofitable. That is, loss-making.

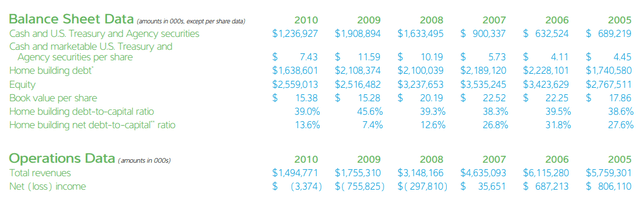

As we saw, the starting point for the current negative housing cycle is worse than what the market faced in 2007-2009. How did Toll Brothers fare through that 2007-2009 cycle, then?

Well, as one would expect it, Toll Brothers fell all the way into losses:

Indeed, it posted a full 3 years of losses (2008-2010) and yet another year of very lean profits (2007).

That is what will happen again, even on a cycle not as bad as the 2007-2009 one. Toll Brothers, and many other homebuilders, will go all the way towards posting losses. And they’ll cut building, which will eventually balance the market.

Now, to calculate a Price/Earnings, you need earnings. Right now, the consensus estimates on Toll Brothers are thus incredibly optimistic. Notice how the 2007-2009 housing crisis started only in 2007, yet immediately Toll Brothers saw nearly all its profits evaporate as soon as its revenues contracted. That’s likely to happen this time as well.

Yet, when we look at the current market consensus, we only see a mild EPS contraction between October 2022 and October 2023. How is that realistic?

The answer is: it’s not realistic at all. People will scream “backlog”, of course. But look to the chart depicting interest rates. The huge move from low 3%s to high 7%s took place in under one year. How much of that “backlog” is going to be able to close, when conditions changed so drastically? It’s obvious that what will follow will be a wave of cancellations – involuntary cancellations, if needed be.

Hence, next year’s consensus estimates will start plunging soon enough. And then probably in FY2024 Toll Brothers will already be into the red ink.

So, forget about Price/Earnings. Are you really wanting to buy Toll Brothers at $47 with first a profit plunge in excess of consensus and then red ink, dead ahead?

Conclusion

The massive drop in housing affordability and the very steep (and quick) increase in interest rates are going to drive a housing cycle not very unlike the 2007-2009 housing crash.

Toll Brothers is going to experience a large drop in revenues and earnings, and that will happen already in the year ahead of us. Then Toll Brothers will go all the way into red ink. Toll Brothers will also experience a wave of cancellations in the near future.

Given the above, the Price/Earnings and all other considerations are rather mute. Toll Brothers’ stock is likely to bottom much, much lower than the current levels. In 2007-2009 it fell around 72% from the top. Right now, it’s at just 37%. The drop might well double from here, into the low $20s.

Of course, the same logic could be applied to other homebuilders. However, it seems that Toll Brothers captures more of an unwarranted optimism than the others (where opinions are more mixed). Hence the focus on Toll Brothers, in spite of the cyclical logic applying to other homebuilders as well.

Be the first to comment