fredrocko

Introduction

The market is in turmoil. Traders are panic selling again as uncertainty is going through the roof. I have to say that I’m not thrilled as I became bullish on the Ford Motor Company (NYSE:F) earlier this month in an article covering the company’s impressive turnaround. Since then, the company has lost roughly a fifth of its market cap. However, I am not at all worried, despite the warning that supply chain issues and inflation will cost the company more money than expected. What we’re now seeing is that analysts and related commentators are warning that Ford is in trouble. That’s simply not the case as I will explain in this article. The company has a stellar balance sheet, it has a fantastic product portfolio as it doesn’t say “goodbye” to the conventional internal combustion engine, and it does not suffer from unusual supply problems that are unique to Ford.

The company even said that it can catch up on any delays in the fourth quarter.

If anything, the company is perfectly following market sentiment, which is opening up new opportunities.

After all, I believe Ford was trading at $25 for a reason earlier this year.

We’ll see these prices again.

Let me explain why that is.

Don’t Blame Ford?

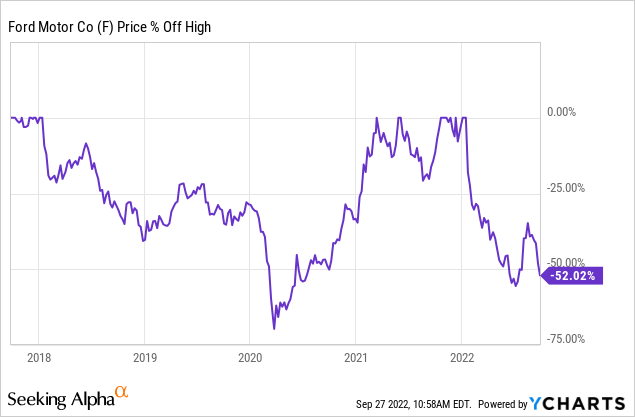

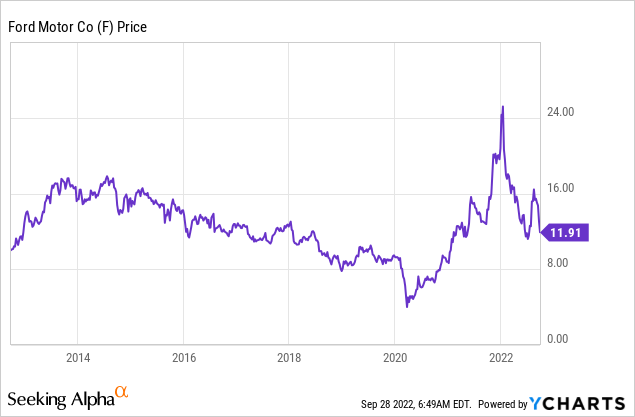

Ford shares are currently trading as if the auto manufacturer needs to fear for its future. The Dearborn-based automaker is more than 50% below its recent high and down roughly 42% on a year-to-date basis.

These numbers are absolutely brutal and I have to say that I didn’t expect that it would get this bad this quickly.

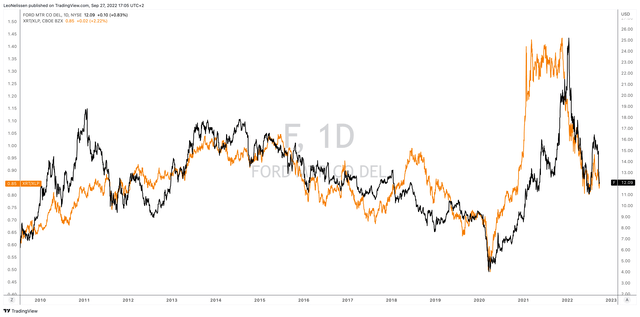

However, let me show you a very important chart. It may be the most important chart in this article. What you are looking at below are two indicators. The black line is the Ford stock price. The orange line displays the spread between the SPDR S&P Retail ETF (XRT) and the SPDR Consumer Staples ETF (XLP).

TradingView (Black = Ford, Orange = XRT/XLP Ratio)

While these lines do not move in lockstep, it is fair to say that the ratio between cyclical consumer stocks and defensive consumer stocks is a good indicator of investors’ willingness to take on risk in a certain market environment. The upswing in sentiment after the 2020 lockdowns indicated a strong, strong rally for Ford shares. Moreover, the ratio peaked before Ford peaked, which is also quite important to note.

Also, the entire sell-off since then has been guided by that ratio. Even the “little” upswing a few weeks ago.

In an article this week, I covered my market outlook using macro developments. What we are seeing is a strong risk-off (no willingness to take risks) situation fueled by slower economic growth, high inflation, and an aggressive Fed trying to tame inflation.

This is the TL;DR version:

The market has become a total mess. Economic growth is slowing dramatically, yet the Federal Reserve is not willing to step in as it aims to reduce persistent inflation.

The worst part is that the Fed isn’t even overly hawkish yet. If anything, rates just made it into neutral territory, which means more work will likely be needed to get inflation down to acceptable levels.

On top of high market volatility, this is resulting in an alternative for stocks as bonds have fallen in lockstep with stocks, providing investors with an alternative to “TINA”. This underlines that we’re indeed in a new environment for stocks for the first time since the start of the Great Financial Crisis, which marked the start of a long zero/low-interest rate period.

As Ford is the nation’s largest automotive company, its stock is obviously on the chopping block.

It also doesn’t help that the company has supply issues.

Ford’s Supply & Demand Issues

Earlier this month, Ford commented on a very sensitive issue: supply chains. Its comments caused the stock price to decline by more than 12%.

The problem is that supplier costs will end up at least $1 billion higher in the current quarter.

This is resulting in expected adjusted earnings before interest and taxes between $1.4 and $1.7 billion. The preliminary estimate was $3.7 billion, which shows how bad this adjustment is. Moreover, in 3Q21, the company did $3 billion in EBIT, which means supply issues will risk a 50% year-on-year decline.

These estimates also include its inability to turn backlog into finished products as it will likely finish a number of high-margin products in 4Q22 instead of the current quarter.

According to the company:

The supply shortages will result in a higher-than-planned number of “vehicles on wheels” built but remaining in Ford’s inventory awaiting needed parts, at the end of the third quarter. The company believes that those vehicles – an anticipated 40,000 to 45,000 of them, largely high-margin trucks and SUVs – will be completed and sold to dealers during the fourth quarter.

The quote above is important because the company is essentially hinting that only 3Q22 is a mess. On a full-year basis, the company still expects to earn between $11.5 and $12.5 billion.

The problem is that the market is making it so much easier to dump “risky” stocks as the overall sentiment is just terrible.

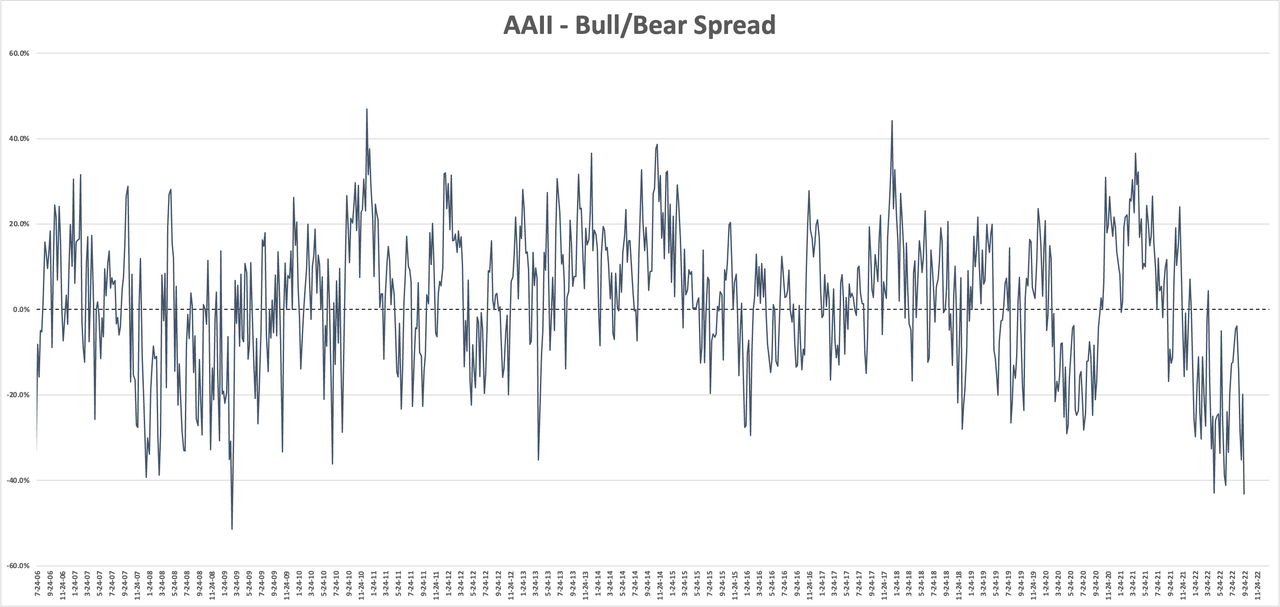

The AAII bull/bear spread is at its lowest level since the Great Financial Crisis. Giving investors bad news in this environment is almost a guarantee of more pain on the stock market.

Author (Data: AAII)

Moreover, supply chain-related comments are bad news in general as the market was slowly preparing for the end of these struggles. The base case was that the worst is behind us. A back to normal, so to speak.

Not that there is any doubt after Ford’s comments, but that back to normal isn’t happening, for now.

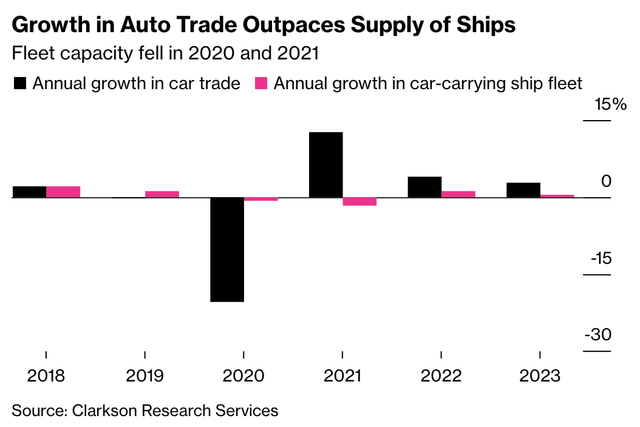

Automotive production is still dealing with a shortage of semiconductor chips and another major problem: ships.

According to Bloomberg:

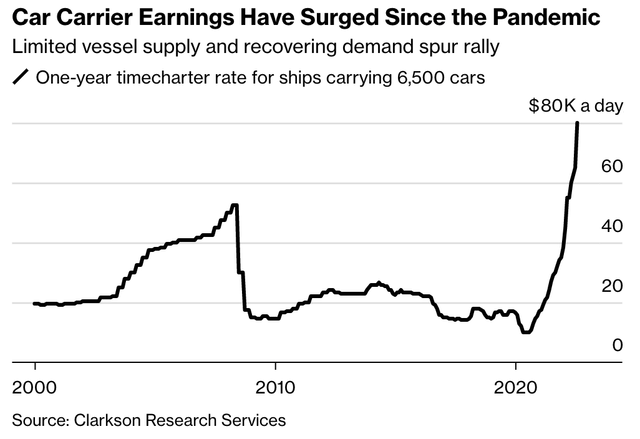

Earnings for freighters that move autos and industrial machines across the globe have surged to about $80,000 a day, the highest in data since at least 2000, according to Clarkson Research Services Ltd. a unit of the world’s largest shipbroker.

Unlike bulk shipping costs (like the Baltic Dry Index), shipping costs for cars have not eased.

Bloomberg

The problem here is that “nobody” really cares for automotive transportation. It is just a small part of global trade. Hence, rising demand for shipments as companies finally work on their backlog is meeting lower supply as shippers emphasized containers and bulk over cars.

It now costs roughly $740 per car to take a trip across the ocean. That’s up 5-fold versus pre-pandemic years.

Automotive companies had the same issues with chips (they still do) as automotive chips offer lower margins to suppliers than chips sold to i.e., high-tech industries.

The worst part is that as car companies are finally able to accelerate production (albeit with issues like we just discussed), the supply of ships isn’t expected to keep up. Not in 2022, and neither in 2023.

Bloomberg

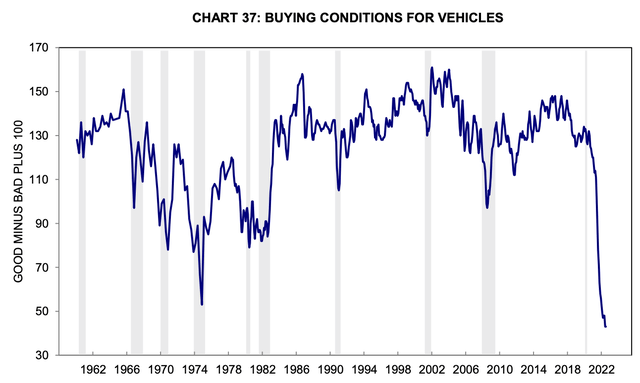

It also doesn’t help that demand is expected to be weak. The latest University of Michigan numbers show that buying conditions in the US for vehicles have fallen off a cliff, reaching the lowest level in the survey’s history.

University of Michigan

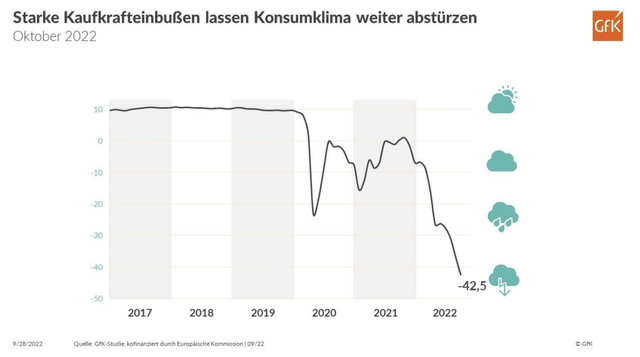

The same goes for other major car markets like Germany where consumer sentiment (in general) is so bad that GFK almost needs to come up with a new cloud on the y-axis to visualize how bad it is.

GFK

As a result, lightweight vehicle sales (cars and trucks) are stuck close to 13 million annual units. That’s well below a rather consistent range between 17 and 18 million units between 2014 and 2020.

Why I’m Not Too Worried

While everything we have discussed in this article so far is (looks) bearish, there are reasons to be optimistic. First of all, a lot has now been priced in.

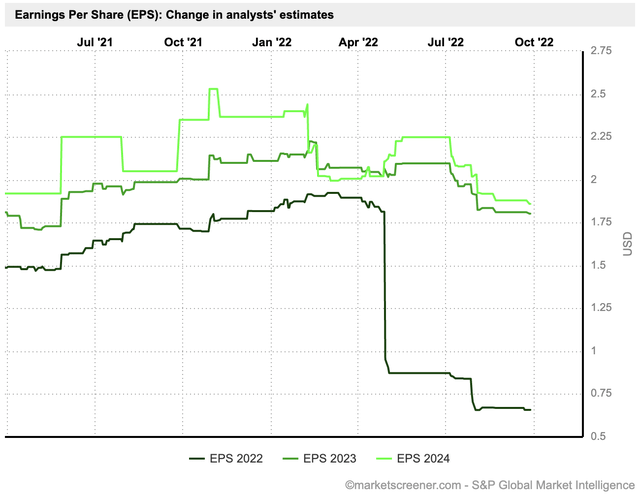

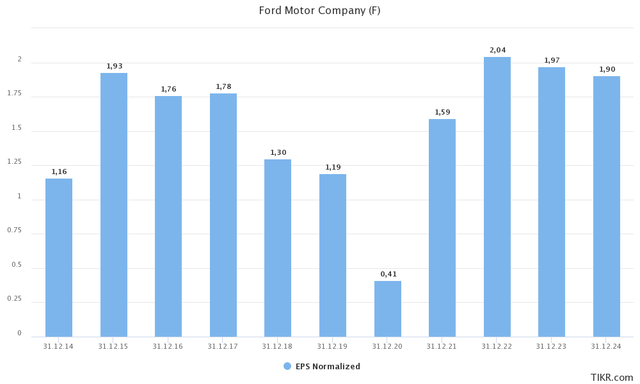

The chart below shows analysts’ estimates for Ford’s 2022, 2023, and 2024 earnings per share. 2022 estimates have been adjusted aggressively as a result of imploding consumer sentiment, lasting supply issues, and the company’s own comments.

2023 and 2024 estimates have come down as well, but they remain above $1.75 per share as Ford does have a lot of room to improve its financials.

MarketScreener

First of all, Ford has three years of backlog because of past supply issues, which is truly impressive. The company has also spent the past few years cutting low-margin vehicles and building a highly successful electric portfolio of the electric Mustang and the industry-dominating Transit.

Moreover, and I believe that’s why Ford is industry-leading, it will stick to internal combustion engines in its best-sellers like the “traditional” Mustang.

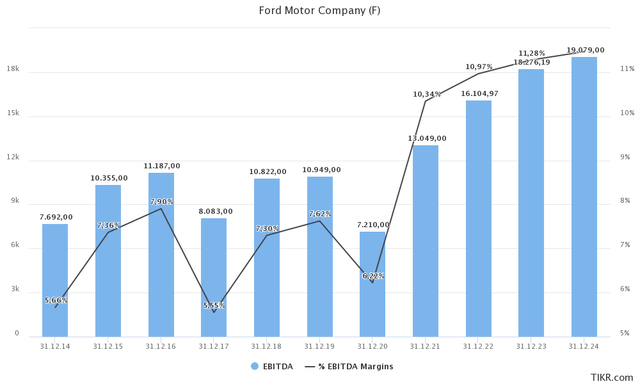

As a result, estimates are still that Ford has a path to adjusted EBITDA margins of more than 11.0% with rebounding EBITDA to at least $16.0 billion next year.

TIKR.com

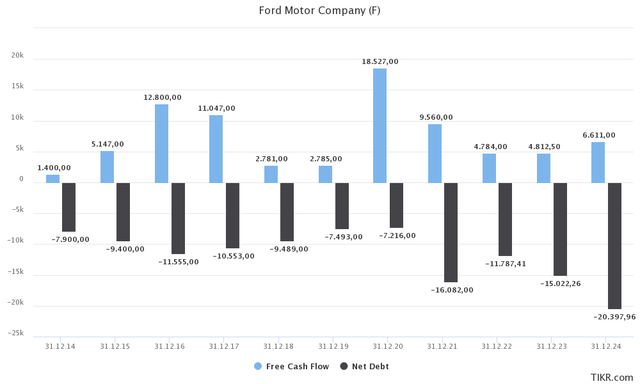

Moreover, Ford has a strong balance sheet. Ignoring liabilities related to Ford Credit, the company is expected to end up with the most net cash (negative net debt) in modern history (adjusted for inflation). It also helps that the company is expected to do close to $5 billion in free cash flow in both 2022 and 2023 despite high investments related to the (partial) EV transition.

TIKR.com

As a result, Fitch upgraded Ford’s credit outlook to “positive” earlier this year, leaving the credit rating at BB+. I expect that rating to be boosted to BBB somewhere next year.

With regard to the company’s valuation, Ford is now trading at roughly 6.0x normalized 2023 earnings per share.

TIKR.com

On a long-term basis, I do not believe that Ford should trade below 10x earnings. Especially now what I like to call Ford 2.0 (I covered the entire business transition earlier this month), which will achieve higher margins and deliver accelerating shareholder distributions on a long-term basis.

In my article earlier this month, I made the following case.

Based on Ford’s story and numbers, I believe that a fair value is $20-21 per share, which implies a 33% upside. On a long-term basis, I expect much more upside. Especially with accelerating margins going into 2026. At that point, CapEx will likely come down a bit supported by an increasing backlog and healthy orders.

I’m sticking to that.

The question is: how far can Ford fall?

It could fall to $8. That’s simply based on irrational behavior during bear markets. Just like a lot of stocks rise to overvaluation during bull markets, panic selling results in stocks reaching valuations that are way too low. At least in the case of companies that offer high quality, including the ability to withstand severe economic pressure.

I’m not making the case that Ford will fall to $8. I’m just saying that investors need to take high volatility into account.

Hence, my strategy when buying quality stocks in times of high uncertainty is to break up an investment. Start small and add gradually over time. If a stock continues to dip, investors can average down. If the stock suddenly takes off, investors have a foot in the door.

Takeaway

The best investments are made when it feels absolutely wrong. That seems to be the case with Ford right now. The company cannot catch a break as it continues to struggle with supply chain issues. The semiconductor shortage is persistent while shipping costs are remaining at historical prices to a lack of available ships.

Adding to that, the stock is being dumped as a result of the ongoing bear market, fueled by slower economic growth, high inflation, an aggressive Federal Reserve, and the related fact that consumer sentiment has imploded beyond anything the market thought was possible.

That said, a lot of bad news has been priced in. Especially after the double-digit decline when Ford announced an additional $1 billion in supply chain-related costs.

It is also extremely important to mention that the company is still expecting to meet its full-year targets as lost 3Q22 production will be completed in 4Q22.

Moreover, the company has a much healthier balance sheet (also a better credit rating), high free cash flow, and three years of backlog, allowing it to maintain steady cash flows while it waits for demand to improve again.

On a long-term basis, I’m also happy that Ford is sticking to its successful brands, without going all-in on EVs. I believe that the move to EVs will turn out to be highly expensive for consumers, meaning that Ford can still offer affordable alternatives as other companies will likely struggle with input inflation and material availability.

So, long story short, I remain bullish on Ford. The risk/reward is even better now.

However, please be careful. Volatility is high and irrational trading behavior in bear markets can lead to even lower prices. Consider this when working on your strategy (i.e., break up your initial investment).

Other than that, I think Ford remains in a pretty good spot on a longer-term basis.

(Dis)agree? Let me know in the comments!

Be the first to comment