Drew Angerer/Getty Images News

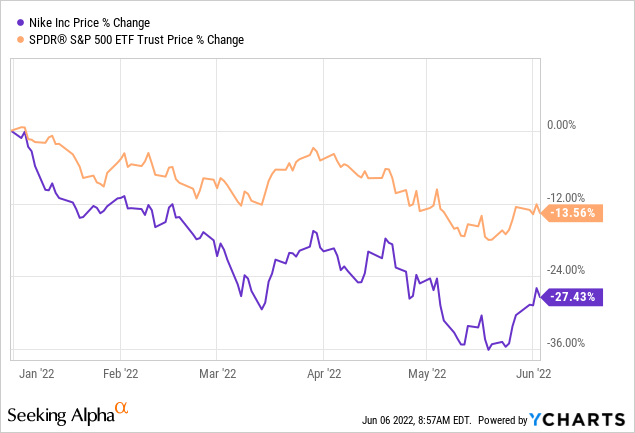

Nike’s (NYSE:NKE) stock price has fallen by more than 27% year-to-date, significantly more than the broader market.

Although we like Nike’s business for several reasons, we believe that the sell-off is justified and the stock is still overvalued based on several traditional price multiples.

Let us take a look at what we like about Nike and what headwinds we expect in the near term.

What we like

In this section, we are going to highlight a few factors that we think could justify an investment in Nike.

Dividends

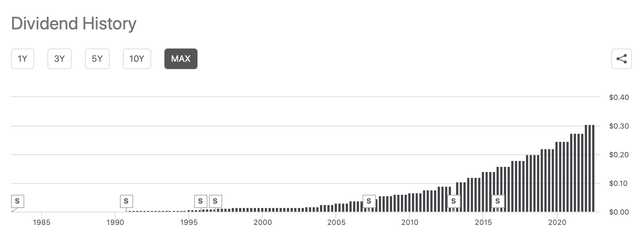

Nike has been committed to return value to its shareholders in the last 32 years. The firm has also managed to increase its dividend payout in the last 20 years, consecutively. We believe that Nike is unlikely to stop its dividend payments, as they have even continued to pay and raise their dividends during the pandemic.

Dividend history (Seekingalpha.com)

Nike has declared its most recent quarterly dividend of $0.305 per share in May.

When looking for dividend income and dividend growth, we also have to understand how safe or sustainable the dividend payments are.

Nike’s Dividend Payout Ratio (TTM) (GAAP) is about 31%, which means that the firm is able to easily cover its payments. In our opinion, even after a potential near-term decline in revenue due to certain macroeconomic headwinds, we believe that Nike will be well-positioned to continue its payments.

All in all, we believe that Nike could potentially be a good addition to a dividend growth portfolio.

Share buybacks

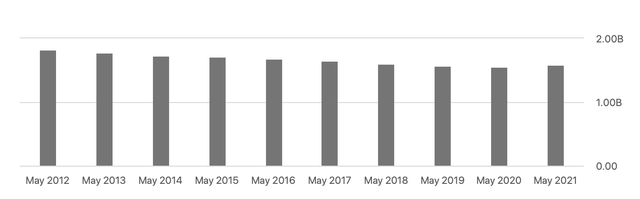

Nike has also stayed committed to return value to its shareholders through share repurchases.

Shares outstanding (Seekingalpha.com)

In the last decade, the number of shares outstanding has decreased by approximately 15%.

In general, we like to invest in firms which do not dilute their shareholders by issuing additional shares to get access to capital.

Liquidity

Nike has presented a relatively strong balance sheet in their latest quarterly earnings report. They currently have more than $13 billion in cash, cash equivalents and short-term investments, which is partially a result of the strong cash flow generation last year. On the other hand, the firm has only $8.8 billion in current liabilities and the long-term debt totals about $9.4 billion.

Further, their current ratio is about 3, while their quick ratio is 2, which both indicate that the company has sufficient cash to cover its current liabilities.

This allows the firm to have a certain financial flexibility in case near-term headwinds materialise.

Strategy

In the last quarters, the firm has been working on the implementation of its Consumer Direct Acceleration strategy. This strategy was expected to lead to expanding margins and eventually to higher earnings per share.

Based on the numbers reported in the first quarter, we believe that Nike’s strategy is playing out well. The firm’s direct sales have increased to $4.6 billion, up 15% year-over-year. Further, they managed to increase the Nike Brand digital sales by as much as 19%.

These have eventually led to a 100 bps increase in the gross margin, reaching 46.6%.

In our opinion, Nike has been executing well on the implementation of the strategy and we believe that is likely to create further value for the investors.

What we do not like

In this section, we are highlighting some of the factors why we believe that Nike’s stock is not yet a buy at the current price levels.

Valuation

According to several of the traditional price multiples, NKE appears to be trading at a significant premium.

Nike’s price-to-earnings ratio (FWD) is approximately 32x, which is more than double the consumer discretionary sector median of ~12.5x. The firm’s EV/EBITDA and P/CF are also showing a similar trend and indicating that Nike is trading at a significant premium compared to its peers.

We understand that Nike is a growing company and its strategic shift to direct-to-consumer sales may result in expanding margins; however, we believe that such a significant premium is not justified.

Further, we expect several macroeconomic factors in the near future to create headwinds for Nike’s business in the near term. These include:

- Nike’s exit from Russia, due to the ongoing geopolitical conflict in the Eastern Europe region, which could lead to a decline in revenues.

- Declining consumer confidence, which could potentially lead to a decrease in demand.

- Increasing commodity prices and supply chain disruptions could lead to increased costs and contracting margins.

Let us take a closer look at the last two points.

Declining consumer confidence

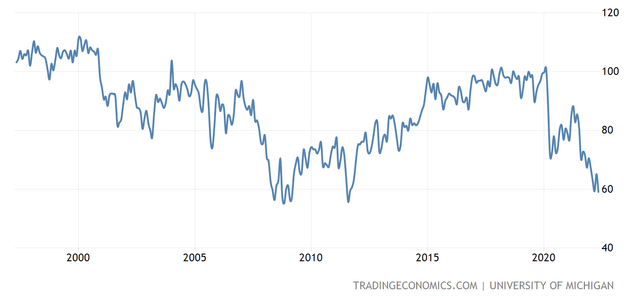

Although consumer spending has remained strong in the first quarter, consumer confidence has been declining steadily.

U.S. Consumer confidence (Tradingeconomics.com)

In fact, consumer confidence is at a 10-year low, even approaching the levels seen in 2008-2009.

In our view, low consumer confidence is likely to have substantial negative consequences for consumer spending especially in the consumer discretionary sector. When confidence declines, consumers are likely to postpone the purchase of certain non-essential products or switch to cheaper alternatives.

Although we believe that Nike has a loyal customer base and a very strong brand recognition, near term we expect the business to face a decrease in demand.

Important to mention that a significant portion of Nike’s revenue is from the Greater China region. As the COVID-19 outbreak in China continues and uncertainties remain high, the demand for the firm’s products in this region may be negatively impacted.

Increased commodity prices

Increased commodity prices have been a driver for elevated operational and transportation expenses in the first quarter for many firms. This has resulted in contracting margins and a weaker outlook in general.

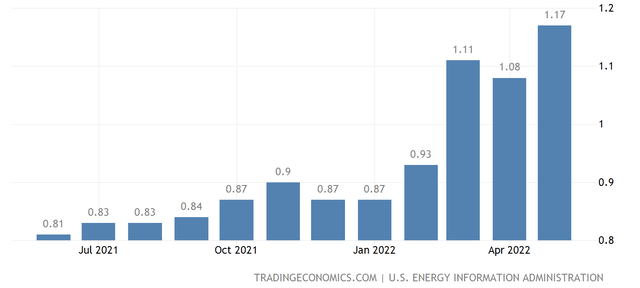

Gasoline prices USD/L (Tradingeconomics.com)

Despite the slight decrease in April, prices have reached new highs in May.

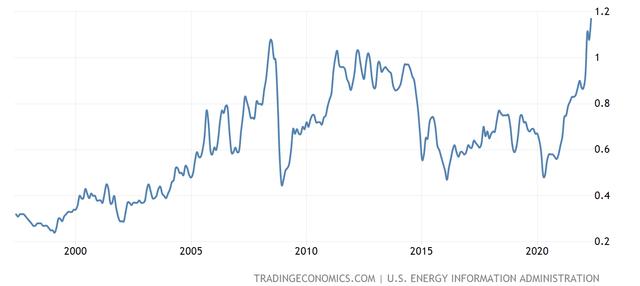

The current prices are actually representing a 25-year high.

Gasoline prices USD/L (Tradingeconomics.com)

There has been some positive news lately, indicating that OPEC+ is willing to increase their oil output starting from July, which could result in a slight decrease in the gasoline prices for the second half of 2022. However, the geopolitical uncertainty remains high, therefore we expect the prices to remain elevated for the rest of 2022.

This oil and gasoline price development is likely to negatively impact NKE’s margins and profit in the near term.

Key takeaways

Nike has been able to execute successfully on its Consumer Direct Acceleration strategy, leading to increased gross margin.

From a liquidity point of view, the firm is well-positioned to handle potential near-term headwinds, created by the macroeconomic environment.

Nike has been committed to return value to its shareholders both in forms of dividend payments and share buybacks.

On the other hand, we believe that Nike’s stock is significantly overvalued, and the premiums based on some of the traditional price multiples are not justified.

Macroeconomic headwinds are likely to impact Nike’s business negatively in the near term.

Be the first to comment