5./15 WEST

Is Meta a value buy or value trap?

Meta Platforms (NASDAQ:META) needs no introduction. What does need introducing is that Meta is no longer a growth stock. Meta has fallen more than 70% so far in 2022 as revenues and net income decline. Thus it is now time to decide: are buyers getting a good entry point or is this a value trap?

With such a widely followed stock, it makes better sense to focus on the current arguments of bulls and bears rather than a fundamentals report.

The bear case:

- Core business revenue and users stall.

- A slowing economy will further slow ad sales.

- Competition for advertising sales is growing.

- The Metaverse built by Meta isn’t working.

- Biden and the US government can’t save Meta from TikTok.

- Mark Zuckerberg controls Meta and that’s a risk.

The bull case:

- Facebook and Instagram are hard to quit.

- Meta is still cash rich with good margins.

- Reels could yet help META match TikTok’s success.

We were particularly intrigued by the idea from our analyst team that TikTok is Meta’s biggest problem so a ban on TikTok would change Meta’s outlook entirely. Anti-China sentiment made a TikTok ban seem likely.

So we dug into this issue and not to bury the lead, but the chances of a ban by executive order, government agency or even congress holding up in court seems to be quite unlikely. Skip to point 5 for the breakdown.

The 200-Word Summary

User growth in rich countries has stopped and revenue is falling. A slowing economy will hurt ad sales further. On top of that, competition is indeed growing from Apple (AAPL), Amazon (AMZN) and Netflix (NFLX) amongst others while Meta wastes tens of billions of dollars a year on a metaverse that almost no-one uses. There also doesn’t seem to be much the US government can do to ban TikTok despite security concerns and even less that investors can do to get Mark Zuckerberg stop spending billions on the metaverse.

Yet, Facebook and Instagram are dominant in social media and retain big network effects. Society has built community activities around them and so they are hard to quit. Meta’s financial position remains strong and cash production remains high if wastage on the metaverse is stopped. Further if Reels do indeed take off and bring the fight to TikTok, then there is an opportunity for a big rebound.

The two key questions are: will Reels actually match or beat TikTok and can Mark Zuckerberg give up on the metaverse and return to the core business?

Currently, we have no confidence in either, so we are avoiding the stock.

1. Bear Case – Revenue and users stall

Meta sells access to eyeballs. When those eyeballs move to TikTok or elsewhere like Netflix, then that is a direct decline in Meta’s business.

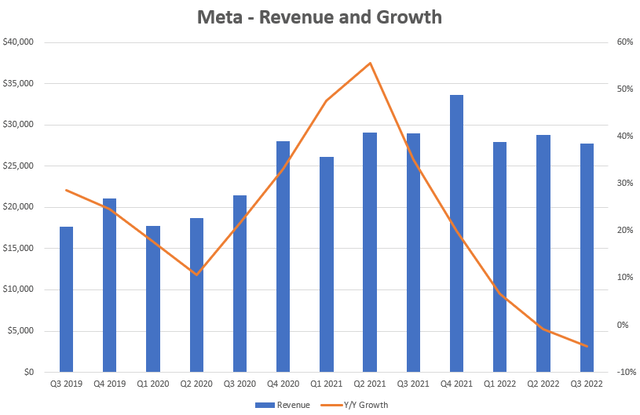

Meta’s revenue is declining, even for the core business.

Meta Revenue and Growth (Caterer Goodman)

The two main reasons are Apple’s anti-tracking technology and the emergence and rise of TikTok, particularly when it comes to teens.

Apple’s anti-tracking technology launched in Q2 2021 neatly coincides with the sharp decline in Meta’s revenue growth. In fact Meta’s revenue is now falling. Industry reports estimate that it might cost Meta up to $10 billion per year.

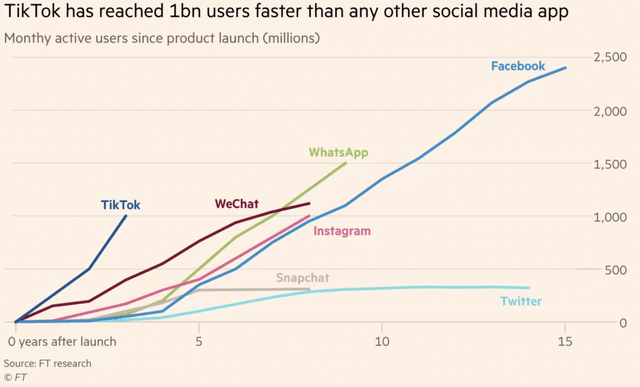

TikTok is becoming a serious challenger to Facebook and Instagram.

TikTok Rapid Growth (FT Research)

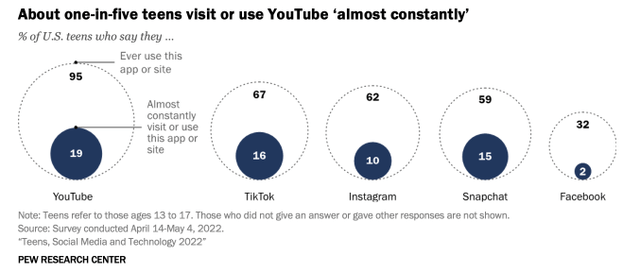

The teen audience in particular uses TikTok more than other social platforms with only YouTube showing a higher usage rate. YouTube isn’t a close competitor of Facebook and Instagram, but TikTok certainly is.

Teen usage of Social Media (Pew Research Centre)

Teen use of Facebook has more than halved from 71% in 2014-2015 to just 32% in 2022. Reports suggest that Facebook is not attracting teen installations and the stalling of total active users.

Worryingly Meta doesn’t report time usage statistics. This is like a free-to-air TV station reporting the number of people who visit their station for the day but not revealing the exact ratings for each show. But anecdotally, we see reports of usage time falling and TikTok’s increasing.

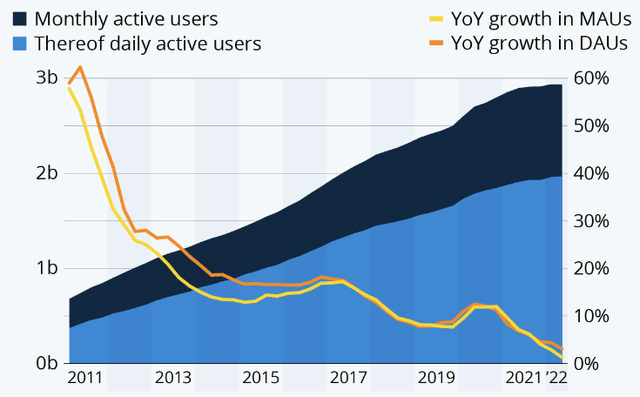

FB Monthly and Daily Active (Statista)

Yes, the family of apps daily and monthly usage numbers continues to grow. However this increasingly relies on growth in emerging markets, which don’t produce the same advertising revenue per user.

A focus on engagement isn’t healthy.

See his quote here from Q3 2022 earnings call from Mark Zuckerberg.

Our AI discovery engine is playing an increasingly important role across our products — especially as advances enable us to recommend more interesting content from across our networks in feeds that used to be primarily driven just by the people and accounts you follow.

So instead of seeing content from friends, it will highlight interesting content. The quote hinges on the word “interesting”. How is that defined? Alongside others, we believe that this focus on interesting content which leads to “engagement” is a serious mistake and is damaging Meta’s future.

When the algorithm serves up controversial content to generate engagement (say angry debates in the comments) over the original purpose of human connection, then this annoys users. It also worsens mental health and is causing growing numbers to reduce or stop using Facebook.

Can you think of another technology company that is so hated by its users? Only Twitter springs to mind.

People likely joined Facebook to connect to friends and enjoy human connection. Meta’s management don’t seem to see facilitating that to be the goal.

2. A slowing economy will slow ad sales

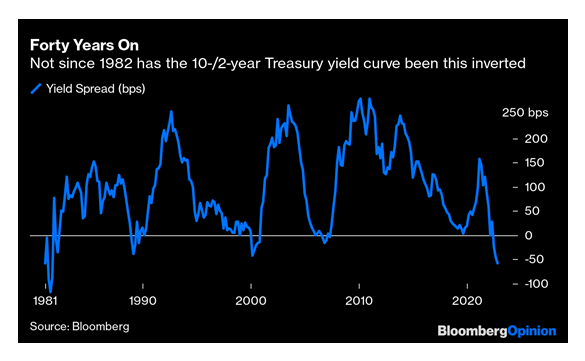

Interest rate rises will continue and eventually they will slow the real economy in a significant way. In fact most forecasters expect the chance of a recession to be higher than 90%. Recessions slow ad spending.

One of the best predictors of recession is an inverted Treasury yield curve, and the current one is more inverted than any since 1982.

Treasury Yield Inversion (Bloomberg)

The boomers amongst the readership will remember the early 1980s for a brutal recession. During the recession from 2007-2009 local and national segments of advertising fell by 21% and 14% respectively. We are already starting to see growing ad spend conservatism through the results of Alphabet’s (GOOG) YouTube where advertising sales fell 2% year on year.

That’s at least part a weaker economy, but also growing competition for digital advertising dollars.

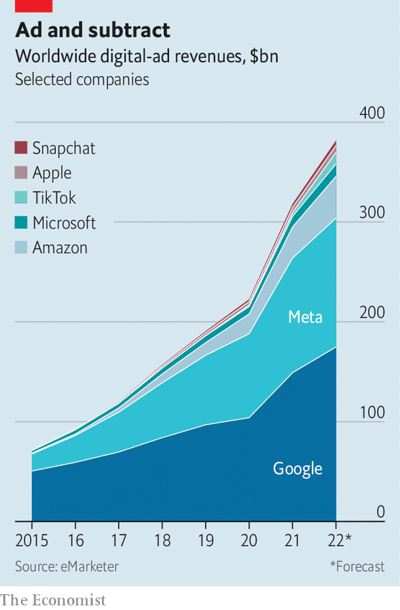

3. Digital ad competition is growing

Advertising Sales Market Share (Economist)

Apple is likely to be a bigger threat to Meta than just its “do no track” change from 2021.

This year and going forward Apple will compete even more directly by selling more ads.

Meta and Google have dominated so far, but competition is growing.

Other FAANG stocks are also attacking Meta’s digital advertising market share and given their size, are likely to have significant success.

- Netflix is adding an ad subsidized streaming service.

- Microsoft’s LinkedIn (MSFT) grew ad sales at 17% year on year.

- Apple’s digital advertising is growing fast and hiring aggressively.

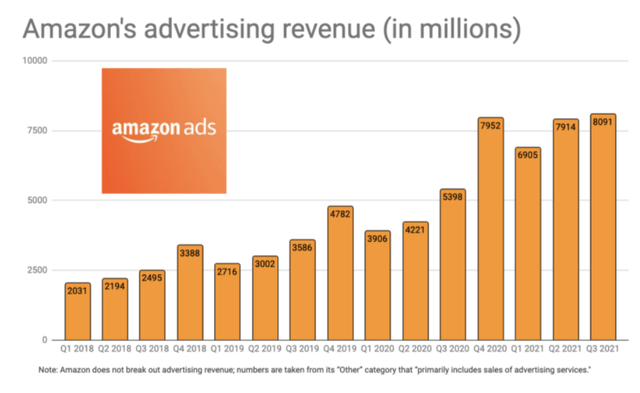

Amazon Advertising Sales (Geekwire)

Amazon sells 8 times more advertising than Snapchat (SNAP). Apple and Netflix are big operations with hundreds of millions of existing users and thus have plenty of scope to increase their share of digital advertising.

4. Metaverse Wasteland by M.E. Zuckerberg

Sometimes you build it, and they don’t come.

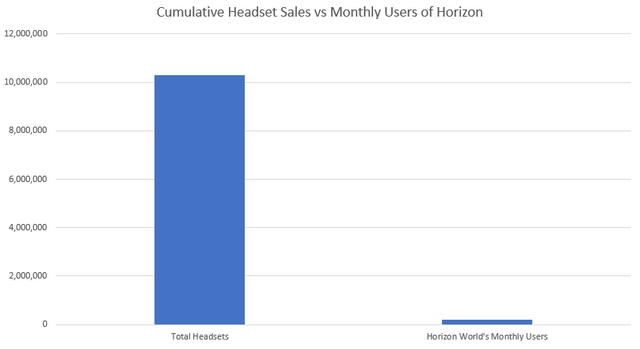

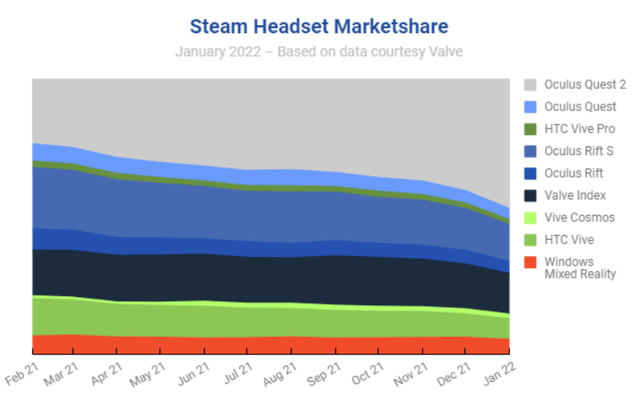

Outside of games there seems to be little demand for VR headsets. The social metaverse is a cool idea in search of a problem. Business strategists would describe by saying a VR headset driven metaverse as, “there is no market fit.”

There have been 10.3 million Oculus headsets cumulatively sold so far. Compare this to the less than 200,000 people who use Meta’s metaverse each month. This is the comparison to show the sense of scale.

Horizon Worlds Monthly Users (Caterer Goodman)

This is about 1.94% which is truly awful persistency.

It might be even worse. It might be new headset owners trying Horizon Worlds in their first month. The numbers are close. Meta reported in Q3 there were 471K headsets sales or about 157K a month. “Less than 200,000” is broad enough to be new owners plus a few thousand ongoing users like Meta staff.

Oculus VR headsets however are turning up on other platforms like Steam. This means that VR headsets are useful for quality games.

Purely socializing in VR worlds however, seems to be of little interest.

This would be all be fine if it were a small skunkworks. However Meta under CEO Mark Zuckerberg is betting the farm and burning billions per quarter.

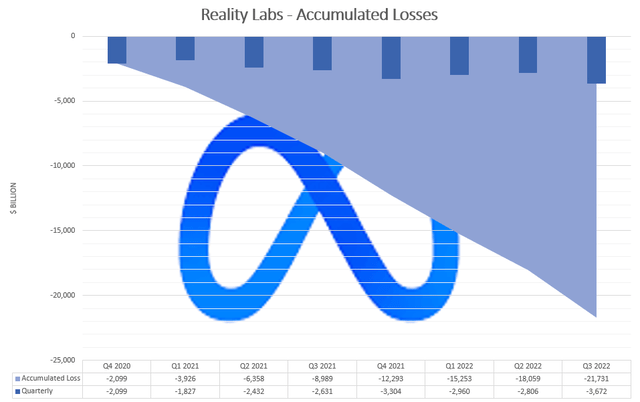

Reality Labs Accumulated Losses (Caterer Goodman)

Yup, accumulated losses are almost $22 billion in just 2 years.

In Q1, Mark Zuckerberg asked for patience until 2030 until the Metaverse started paying off. If spending is maintained, is the metaverse ever going to justify a further $40-70 billion investment? That seems a long shot.

Even where Meta is doing well – dominating headset sales, it isn’t such a strong story. It’s basically a massive subsidy to sell a great product below competitor’s price points. That’s a part of why Meta is bleeding billions.

Meta’s business strategy seems to be a printers and ink strategy, but without the certain demand of the ink. Without any sign of ink demand.

Still, bulls think the US government will help kill the TikTok threat. Will it?

5. Biden won’t save Meta from TikTok

TikTok is hot among teens and young adults. It is the biggest source of Meta’s financial pain. But what if TikTok got banned?

That would remove the biggest competitor and be huge for Meta’s stock price.

This was the initial idea that got our team interested. A ban on TikTok didn’t just seem possible, but likely. Few topics are more bi-partisan in Washington DC than anti-China sentiment. India has banned TikTok. Could the US be next? The Senate Intelligence Committee asked the FTC to review TikTok in July. TikTok is already banned on US defense sites. Even the head of the FCC recently thought a ban should happen.

So we called in an expert legal opinion from an experienced DC lawyer and engineer, Donald C. McMillan III and he offered us his opinion. We recommend the full text here, because context and nuance in an technical opinion is important, but the key conclusion is in the second paragraph.

It is arguably never wise to say that it would be absolutely impossible, but rather it (a ban on TikTok) is highly unlikely or even improbable for a number of reasons.

Donald went on to explain, that even if Biden or Trump or a government agency attempted a ban, you can be sure that successful influencers would tie it up in court before it was implemented. Probably for many years. He felt it was more likely that technology would render free social media apps obsolete before the government got their act together.

Other types of bans are possible but also unlikely.

Yes, it is technically feasible for Apple or Google to ban TikTok from their app stores. But would either risk the wrath of such an influential user base? Apple’s China manufacturing base would make it especially cautious.

Although the government might try something, it is risky to buy Meta on the expectation that a successful ban on TikTok is right around the corner.

6. The risk that Zuckerberg controls Meta

Meta/Facebook is Mark Zuckerberg’s baby. Giving himself 10-1 voting shares prior to the IPO back in May 2012 has ensured roughly 54% voting control.

Thus, despite Mark Zuckerberg’s missteps, and increasing shareholder unhappiness, he can’t be pushed out. Many large shareholders are voting with their feet by selling Meta stock, hence the big decline. So far, Mark has shown little sign he is listening to this criticism on metaverse spending. The departure of Meta CEO Sheryl Sandberg this year after 13 years with the company means there is one less powerful voice to question the company’s direction.

Mark Zuckerberg is driving Meta solo, so buckle up.

Mark is Driving (Business Insider)

With that much unfettered control and a docile board, you need to be OK with the risk that Mark will continue to spend billions chasing the metaverse dream while neglecting the core business.

Undoubtedly, Meta trades at a discount as a result of this control.

Still, Meta has remaining strength that can’t be ignored, assuming the founder/CEO can get his eyes back on the road.

1. Bull Case – Meta is still cash rich and high earning

Meta is still a company with a strong balance sheet and almost no debt.

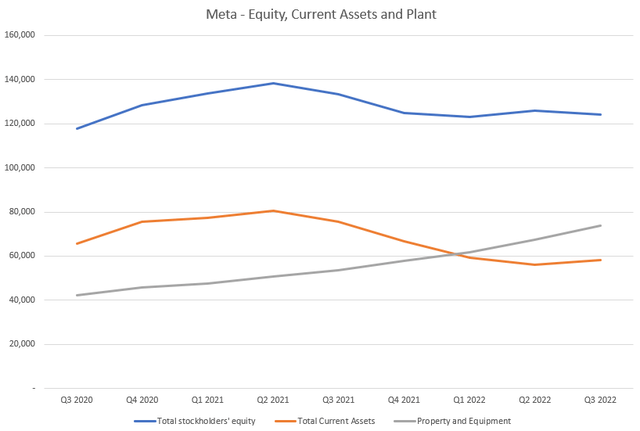

Having current assets of $58 billion at end of Q3 2022 more than covers the entire liabilities of $54 billion.

Meta Equity Current Assets Plant (Caterer Goodman)

However there are a couple of small observations.

Firstly, investment in plant continues to steadily rise to $73 billion. Meta is no longer an asset light company as it invests in the metaverse.

Secondly, for a big cash producing company that isn’t paying dividends, Meta’s equity is no longer increasing having leveled off about $120 billion.

Finally, Meta has just slightly tarnished its previously pristine balance sheet by taking $9.9 billion in debt in Q3 2022. That’s hardly excessive given its financial strength. Still, debt is no longer taboo and is worth watching.

Meta is still producing $5 billion+ in cash per quarter

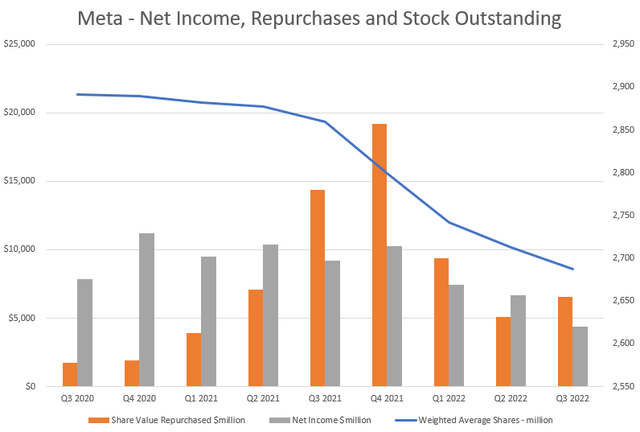

Besides the bonfire of metaverse vanities, that cash is ending up in buybacks. Meta repurchased $44.5 billion worth of its own stock in 2021 and $22 billion so far in 2022.

Meta Net Income Buyback Stock Outstanding (Caterer Goodman)

These buybacks should have helped support the stock price. What might performance be without them? Also, has that $66 billion over the last 7 quarters been shareholder cash well spent? It is hard to see how.

The good news, is that even with buy backs at a lower level to match quarterly net income, the number of shares outstanding is falling at quick rate given the stock price is now sub $100 per share.

Still, with a bit of cost control, net income of $5-7 billion at quarter is sustainable and that’s not the sort of company you should short-sell.

#2 – FB & Instagram are dominant and hard to quit

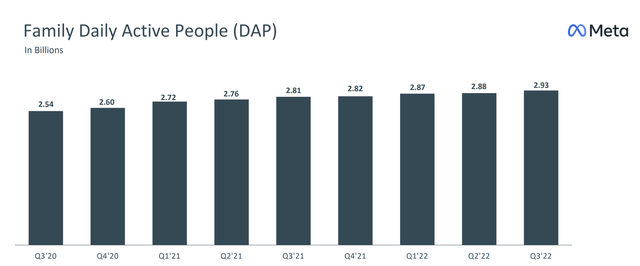

It is easy to forget that Facebook and Instagram are two of the biggest platforms in the world of any type. Further Instagram and WhatsApp are still growing giving a total global audience of 2.9 billion people.

Meta Family Daily Active Users (Meta)

We prefer the daily active metric, but in another strong sign is that a steady 79% of monthly active users are active on a daily basis.

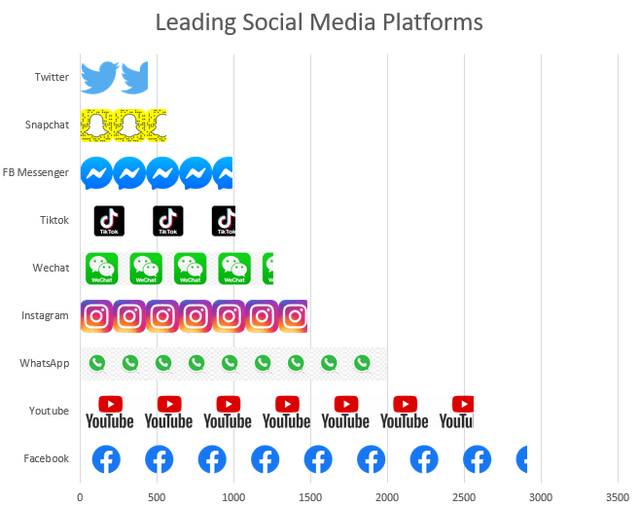

Another way of looking at the strength is showing how Meta dominates the league table of biggest social media platforms. Meta has 4 of the top 7 social media platforms around the world.

Leading Social Media Platforms (Statista January 2022)

Arguably, this graph even understates Meta’s strength. Is YouTube truly a social media platform? Or is it a cousin to an ad driven streaming platform similar to the one Netflix will shortly launch?

Are China dominant platforms like Wechat, Douyin, QQ and Sina Weibo truly a threat to Meta given they have minimal presence outside China?

The biggest and really only threat on this list to Meta is TikTok amongst youth with a billion users and growing. Snapchat and Twitter seem stuck in their niche with just 560 and 440 million users respectively.

Not only that, but Facebook is frustratingly hard to quit.

We tried last year and lasted almost an entire year. Why did we return? We simply got tired of missing out on announcements, events and information from schools, sporting clubs and community groups. We missed events in the lives of our friends. Our connection to community was noticeably weaker.

This integration into community activities is what makes Facebook and Instagram so strong. Meta ignores the human connection aspect at their peril.

3. Reels could yet help Meta match TikTok

Meta also has a history of copying features that are successful on other platforms and rolling them out to their market leading user base.

The strongest argument for Meta bulls is that the product “Reels”, a clone of TikTok’s short video product will soon start to generate strong financial results for Meta over coming quarters. Here is how Mark Zuckerberg described Reels growth during the Q3 2022 earnings call.

There are now more than 140 billion Reels plays across Facebook and Instagram each day. That’s a 50% increase from six months ago. Reels is incremental to time spent on our apps. The trends look good here, and we believe that we’re gaining time spent share on competitors like TikTok.

The impact on promoting Reels is having a headwind effect in the short term because it displaces parts of Facebook and Instagram that are higher earning at present. See more from the CEO on this.

I’ve discussed in the past how the growth of short-form video creates near term challenges since Reels doesn’t monetize at the rate of feed or stories yet. That means as Reels grows, we’re displacing revenue from higher-monetizing surfaces. I think this is clearly the right thing to do so that Reels can grow with the demand we’re seeing, but closing this gap is also a high priority. Even 3 with the progress we’ve made, we’re still choosing to take a more than $500 million quarterly revenue headwind with this shift. But we expect to get to a more neutral place over the next 12-18 months. I mentioned last quarter that Instagram Reels had crossed $1 billion annual revenue run rate. We continue scaling monetization across both Instagram and Facebook, and the combined run rate across these apps is now $3 billion

Despite the short term cost, it is a good move to compete directly with TikTok on Reels to prevent further audience loss amongst the young. The question remains however: will this be enough to be seen as cool again?

Valuation is attractive if business stabilizes

The valuation for Meta continues to improve and currently trades at just 8.6 times last four quarter earnings. So far Meta has earned about $18.5 billion in net income in 2022 and should earn about $5 billion in Q4 giving about $21.5 billion for this year. That then brings the multiple to about 11.1.

For 2023, if we project forward assuming continued investment in the metaverse, growing economic headwinds and increasing competition for eyeballs, then this is the range of valuations on forward earnings.

| 2023 Growth Range | 2023 Net Income | Forward Multiple |

| Recession + Competition | $15 billion | 16 |

| Competition | $22 billion | 10.9 |

| Reels Gains + Cost Control | $30 billion | 8 |

Predicting the future is hard, but here are some thoughts.

We can see some early signs of cost control, but we also don’t expect the economy or competitive situation to drastically improve either. Metaverse spending might moderate, but Mark seems committed. A good guess for 2023 is somewhere likely in $15-22 billion rather than the bull case.

However, with value trap businesses, where revenue and net income are falling consistently, it is typical to see single digit PE ratios each year. Value traps look cheap all the way down. That’s what makes them a value trap.

The key to look for is a fundamental improvement in the business. For Meta that would be ditching the metaverse and improving core products for users.

Avoid Meta until direction improves

Meta is a value trap with its current direction.

Revenue and net income are declining while the majority shareholder spends $12 billion a year on a metaverse that almost no-one uses.

No-one can stop him.

There is still time for a course correction and Meta retains a strong position in social media. So this isn’t a short-sell recommendation. But beware Meta bulls who blindly expect growth to return.

Buy when the direction truly changes.

Should Mark Zuckerberg ditch the metaverse and improve the user experience for Facebook and Instagram users, then Meta would be a buy. But if losing a personal $100 billion+ in wealth over the last 12 months didn’t awaken Mark Zuckerberg, it is hard to see what might.

Be the first to comment