monsitj/iStock via Getty Images

Investment Thesis

Donaldson’s (NYSE:DCI) sales growth is expected to benefit from the strong demand in the end market in the near term. Also, the company is increasing prices to offset the cost inflation in the market, which is benefitting the company’s sales growth and margins. The company is diversifying its business portfolio to meet the needs of its current and future customers. This will be done organically by investing in R&D and inorganically through acquisitions. The company recently acquired Solaris in Q1 FY22 and Purilogics in June 2022. On the margin front, the company is expected to implement price hikes if the current inflationary environment exists, which should underpin margin growth. Also, the company resolved a supply issue related to one of its raw materials, which should result in sequential margins improvement.

Donaldson Q3 2022 Earnings

Donaldson recently reported mixed third-quarter 2022 financial results, with better than expected sales and lower than expected earnings. The net sales in the quarter were $853 mn (up 11.5% Y/Y), beating the consensus estimate of $823.99 mn. The adjusted EPS during the quarter was flat Y/Y at $0.67 (vs. the consensus estimate of $0.72). The Y/Y sales growth was driven by 6% higher sales volume, and a 9% contribution from pricing, partially offset by currency headwinds of 3%. However, the operating margin in the quarter was down 130 bps Y/Y to 13% due to the pressure on the gross margin. Due to increases in raw materials, freight, energy, and labor costs, the gross margin dropped by 220 basis points in Q3 FY22. This resulted in the flattish adjusted EPS versus a year ago, which missed the consensus estimate.

Revenue Growth Prospects

In Q3 2022, the company tackled the headwinds related to supply chain and cost inflation in raw materials, freight, energy, and labor through pricing, utilizing global footprint, and inventory investments. Pricing was the largest sales driver in the quarter, and the company plans to continue implementing these price hikes if the cost inflation continues in the market. While facing supply chain challenges, the company leveraged its global footprint by sourcing products from different regions and supporting its customers. The company proactively increased its inventory levels and utilized its balance sheet efficiently to meet the needs of its customers. The inventories at the end of Q3 FY22 increased $30 mn sequentially and $150 mn Y/Y to $510 mn.

The sales of the company should continue to reflect the stronger demand in the end markets. The strong backlog orders and lower inventory levels in the distribution channel should support the sales growth of the company in the near term. Along with this, the sales of the company are benefitting from the incremental pricing actions. In the first half of FY22, the pricing increase contributed 450 bps in revenue growth, whereas in Q3 FY22, it accelerated to 900 bps, which shows that pricing is playing an important role in the sales growth. As a result of strong demand in the end market and incremental pricing benefits, the management has increased its sales guidance for FY22 from 11% to 15% to 14.5% to 16.5%, including a 3% negative impact from currency translation.

In the long run, the company is planning to grow its business in China and slowly gain market share in the region. The Chinese region contributed ~6% to the total sales and ~31% to the APAC region sales in Q3 FY22. The company is winning programs in China through PowerCore Technology which should be beneficial for the company to gain market share in the region. PowerCore Technology focuses on providing air filtration solutions flexibly in different conditions and configurations. The company is putting a second PowerCore line in China. The Chinese market is experiencing some weakness currently due to the Covid-related lockdowns which have led to OEM shutdowns, supply chain constraints, and decreased working hours. However, DCI’s longer-term prospects in this market are good as it continues to win market share.

Other than this, DCI has been diversifying its business organically and inorganically to meet the needs of its current and future customers globally and cementing its position as a leader in technology-led filtration. On the organic side, the company is investing in R&D to develop new products and inorganically. The company recently acquired Solaris Biotech in Q1 FY22 to expand into the Life sciences and the food and beverages end markets. Solaris is a designer and manufacturer of bioprocessing and filtration equipment used in the food and beverage, biotechnology, and other Life sciences markets. This should benefit DCI as it can leverage Solaris’ technology and customer relationships to advance its capabilities in this space. In June 2022, the company acquired Purilogics to further expand its Life science business portfolio. Purilogics is an early-stage biotechnology company that leverages a novel technology platform to develop membrane chromatography products.

DCI Margins

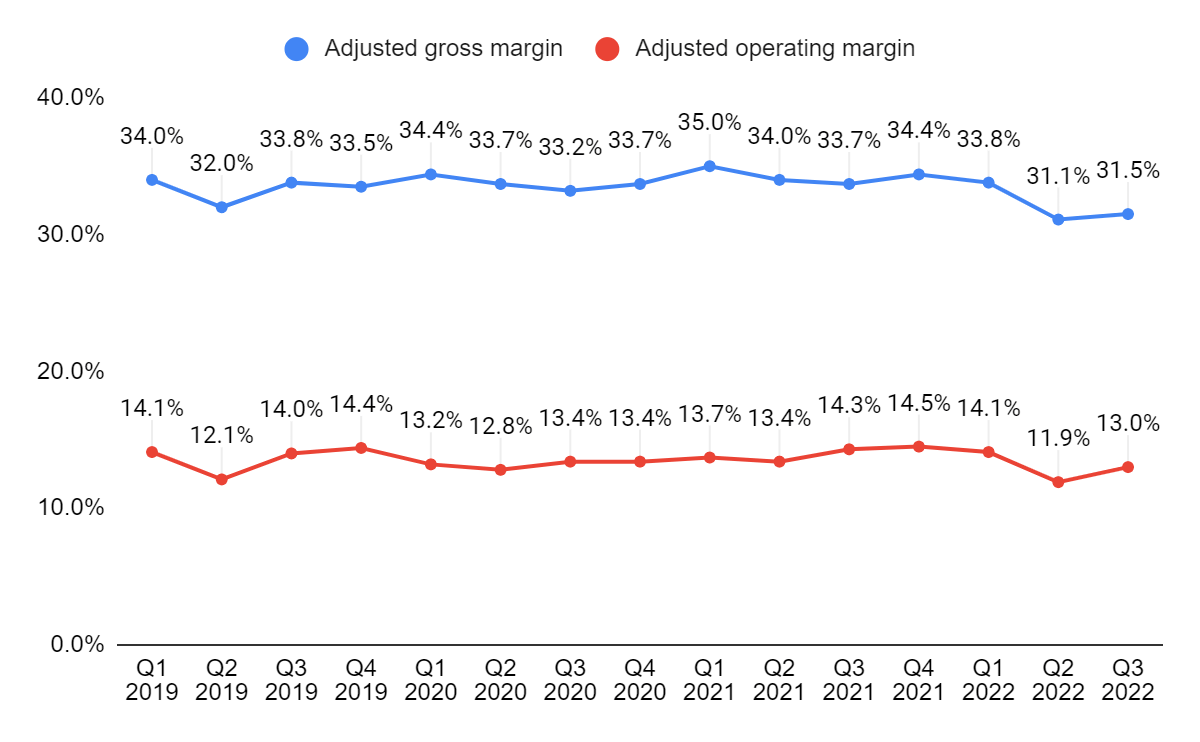

The gross margin was up sequentially but was down Y/Y due to the continued step-up in raw materials, freight, energy, and labor costs. The operating margin in Q3 FY22 was down 130 basis points Y/Y to 13% due to continued gross margin pressure. Other more temporary headwinds, such as manufacturing inefficiencies that were driven by an acute supply issue of a petroleum-based chemical also affected the margins in the quarter. This chemical goes in about 90% of all the air-based products that the company manufactures and due to the supply issue the company witnessed a significant downtime. However, the company has resolved this issue now and the margins should improve in the fourth quarter of FY22 and beyond. Also, the company plans to take additional pricing in Q4 FY22, which should improve the operating margin sequentially.

Donaldson Adjusted operating margin and Adjusted gross margin (Company data, GS Analytics Research)

The company is organically investing in higher-margin products, and over time it should improve the mix of the company. The company also plans to leverage its infrastructure to bring down its operating expenses, which should eventually drive the operating margins. Due to the underperformance in margins in Q3 FY22, the company has lowered its full-year 2022 guidance range by 50 basis points, resulting in a 150 to 200 bps decline year over year. The company is expecting to pay 14% more year over year for raw materials which should impact the gross margin of the company in FY22 along with additional headwinds from labor, freight, and energy inflation and manufacturing inefficiencies. Due to pressures on gross margin, the outlook for the operating margin range has decreased from 14% to 14.4% to 13.5% to 13.9%. In the long run, the company is expecting an operating margin above 15% as the mix of the product portfolio improves towards higher-margin products.

Valuation And Conclusion

The stock is currently trading at a P/E of 17.19x FY22 consensus EPS estimate of $2.69 and 15.10x FY23 consensus EPS estimate of $3.07. This is lower than its five-year forward P/E average of 23.54x. The demand in the end market is expected to remain strong in the near term, which should support the sales growth of the company. The company is increasing prices across its business portfolio, which should underpin both the sales and margin growth. Furthermore, the margins are expected to improve sequentially as the supply issue related to a key raw material is now resolved. The cheap valuations and good revenue and margin growth prospects make DCI a good buy.

Be the first to comment