metamorworks/iStock via Getty Images

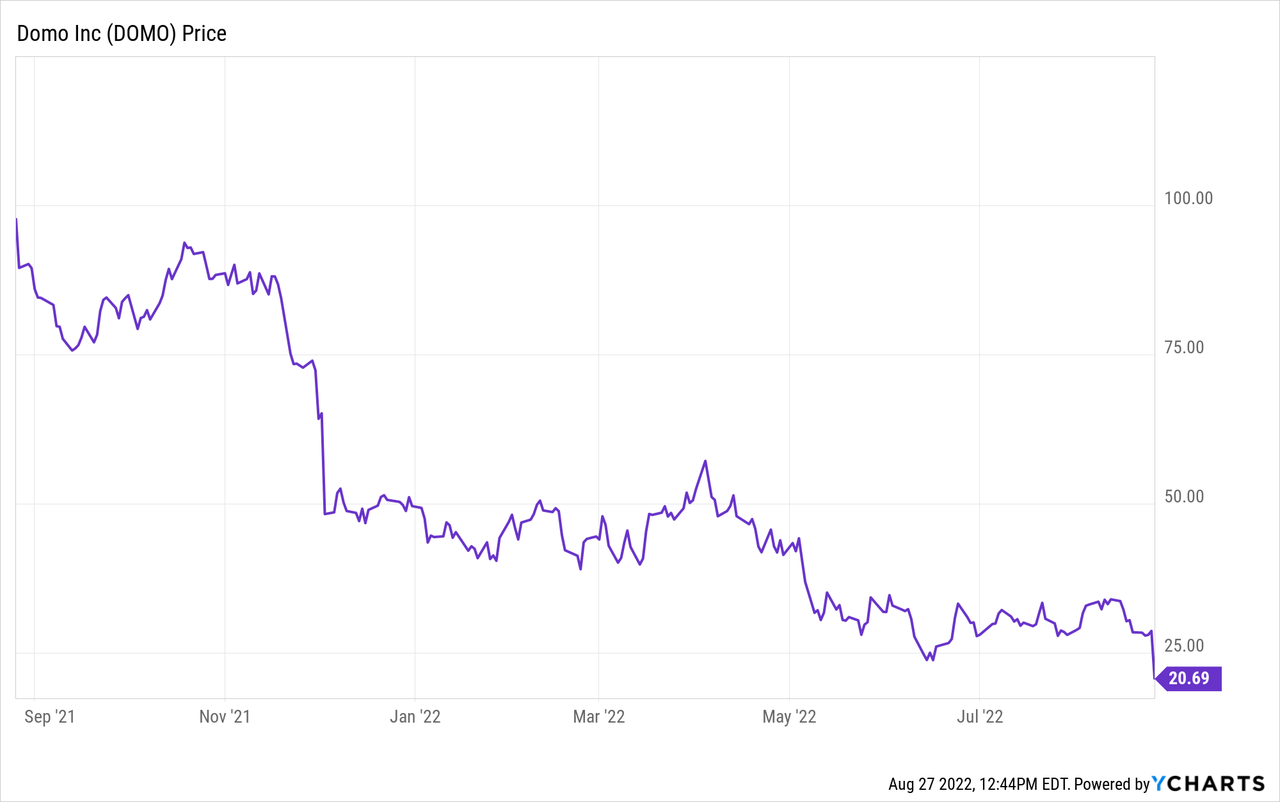

Friday, August 26 was a double-whammy day for Domo (NASDAQ:DOMO), the business intelligence software company that holds the distinction as one of the few major SaaS companies to be headquartered in Utah. Not only did the rest of the market tumble ~3% after Fed Chair Jerome Powell’s hawkish comments at Jackson Hole, but Domo itself was reeling after a big Q2 earnings disappointment.

This small-cap software company, which has been a bastion of volatility since its IPO, has lost ~60% of its value this year, and the post-earnings reaction alone cut ~30% out of Domo’s stock price. It looks like it’s all downhill for Domo with sentiment at multi-year lows, but I think intrepid and patient investors have a lot to gain here.

We’ll dive into the details of Domo’s second-quarter disappointments in the next section, but in a nutshell: the company suffered from a number of factors including higher sales department churn, lower close rates in enterprise, and macro headwinds – causing the company to take down its revenue and billings forecast for the year. We’ll note that Domo is hardly the only tech company to cut guidance this earnings season; in fact, maintaining (or even raising guidance) has been more the exception than the norm.

I remain bullish on Domo. Though the Q2 news was certainly hard to swallow and opened up new risks, I think there are still bright spots to acknowledge, such as Domo’s improving operating margins (once a major black spot for the company, especially right after its IPO). I also like where the company’s valuation is sitting, and continue to believe Domo could be ripe for a potential acquisition scenario if the stock continues to drop.

Here’s a full rundown of my long-term bull case for Domo:

- There’s some evidence that competition arguments are overblown. One of the original criticisms of Domo is that it plays in a heavily competitive BI space against other powerhouses like Tableau (now owned by Salesforce.com) and Microsoft Power BI. Domo founder Josh James is of the belief that many Domo customers aren’t exactly looking to rip out their existing BI systems, but to supplement them with other products for different use case. So while there is certainly competition, it may not be a dealbreaker for many prospects.

- High pro forma gross margins. Domo’s subscription pro forma gross margins are north of 80%, which gives the company plenty of room to scale its operations profitably as it grows.

- Domo is closing the profitability gap. The company is trending toward a single-digit pro forma operating loss margin and steadily improving.

- Acquisition possibility. While it’s never smart to bank an entire investment decision on hoping for a takeout, Domo is a very small company with a compelling technology platform and recurring revenue. I could easily see a larger software company wanting to absorb Domo into its portfolio.

Valuation is another big plus here. At current post-earnings share prices near $21, Domo trades at a market cap of just $698 million. After we net off the $80 million of cash and $106 million of debt on Domo’s most recent balance sheet, the company’s resulting enterprise value is $724 million.

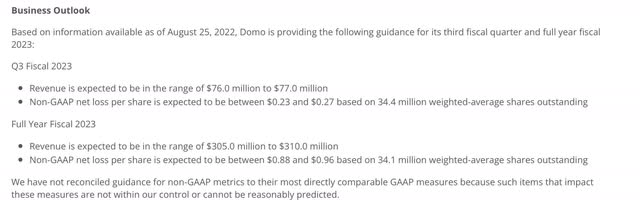

Meanwhile, as shown in the chart below, Domo has lowered its full-year revenue outlook to $305-$310 million, representing 18-20% y/y growth: which is four points weaker than a prior outlook of $315-$319 million, or 22-24% y/y growth. Domo also cut its billings guidance from a prior view of 22% y/y growth to just 13% y/y growth, reflecting the slower performance it experienced in the tail end of Q2.

Domo guidance update (Domo Q2 earnings release)

Is the guidance cut steep? Yes, it is; but so is the resulting drop in valuation. Domo now trades at just 2.3x EV/FY23 revenue based on the midpoint of its new guidance – which, to me, is quite a bargain for a company still expected to grow at least in the high teens, with 80%+ subscription gross margins as well as approaching pro forma operating margin breakeven.

Sentiment is low, but so is valuation – there’s a balance here that wise investors should appreciate. While it may take several quarters for Domo to stage a turnaround, I think it’s a great move to capitalize on Domo’s bargain-basement valuation to pick up a small position.

Q2 download

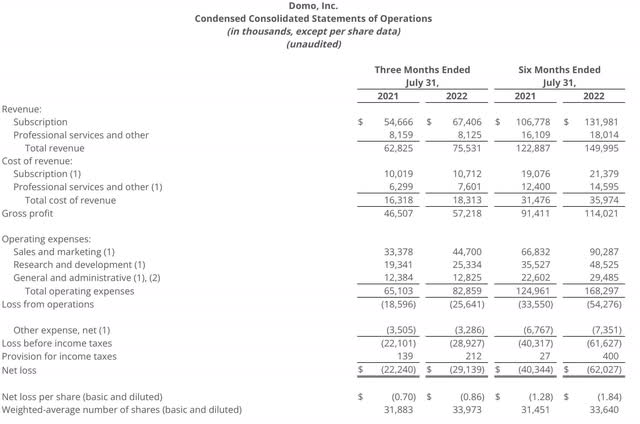

Let’s now discuss Domo’s latest Q2 results in greater detail, which were far more benign than the company’s outlook cuts. The Q2 earnings summary is shown below:

Domo Q2 results (Domo Q2 earnings release)

Domo grew its revenue in Q2 at a 20% y/y pace to $75.5 million, slightly missing Wall Street’s expectations of $76.4 million (+22% y/y). Revenue growth also decelerated four points versus 24% y/y growth in Q1. Billings growth still also came in stronger than revenue at 21% y/y growth; though this is down four points as well versus 25% y/y growth in Q1.

Management called out a big divergence in performance between corporate accounts (customers with revenue up to $1 billion) and larger enterprise accounts, with the latter seeing a huge slowdown in performance. This jives with the commentary we’ve heard from other SaaS names, noting that large companies are belt-tightening. This started with layoffs and hiring freezes, but has also extended to capital investments including software, which has led to elongating deal cycles and more scrutinized approval processes.

Here is some helpful commentary from CEO John Mellor on the dynamics that the company is seeing, as well as the follow-up actions that Domo is taking to react; taken from his prepared remarks on the Q2 earnings call:

However, when you parse these results there is a significant divergence between our two major sales groups that I’ll highlight. In corporate, we had very good growth. We classify corporate as companies with up to $1 billion in revenue. And to be clear, corporate deals are not small, our average selling price is over $50,000 and deal sizes can range well into the six figures. In corporate we experienced over 25% growth in new ACV, revenue growth of over 30% with this group and our growth with North American corporate customers was even higher […]

In the enterprise, we experienced revenue growth of only about 10% and ACV growth of 6%, well below our overall target growth rate. The changes we made to our enterprise go to market earlier this year has not produced the results we were looking for. And in fact have led to recent rep turnover. So on the enterprise side we are entering Q3 with less ramped sales capacity than planned. Our value proposition for enterprises is extremely strong. We provide unique and transformative data experiences, especially for the line of business that help solve the last mile challenge of data leverage. However, the costs and the time it takes to sell to these customers have been significantly more than for our corporate customers. Enterprise is still about half of our recurring revenue, but given the more efficient higher growth we are seeing in corporate we are realigning more of our new logos sales force in favor of corporate so we can generate higher long-term growth and do it more cost effectively. We think this reallocation of resources, particularly makes sense in an uncertain macroeconomic environment […]

To drive up profitability and cash flow, which we believe will strengthen us for the long term we have also implemented a cost reduction plan for the second half of the year. These changes for the sales realignment and overall cost reductions have already been implemented. The cost reductions are across the Board and do somewhat further reduce some of our sales capacity in the near term.”

In a nutshell, Domo is effectively realigning itself to be more of an SMB-driven company, because contribution/profitability from selling into complex enterprise accounts is falling. We think this makes sense for Domo’s positioning, as larger enterprise accounts are more likely to purchase software from similarly-sized vendors (think Microsoft (MSFT), which has its PowerBI solution, and Salesforce (CRM), which bought Tableau to compete in BI).

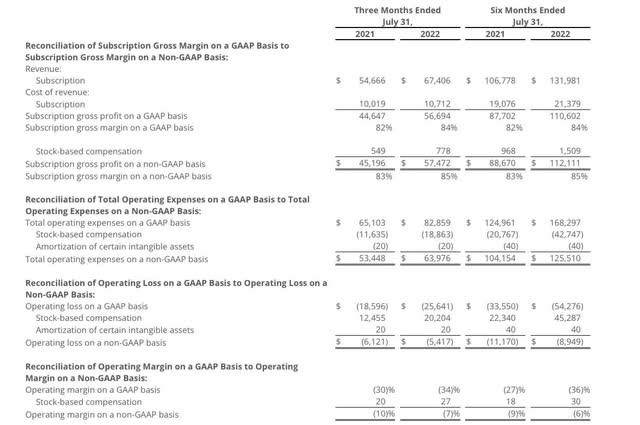

We are glad, however, that Domo has put the focus on profitability, because margins remained a standout in Q2. Pro forma subscription gross margins ticked up two points to a sky-high 85% in the quarter, as shown in the chart below:

Domo margins (Domo Q2 earnings release)

Note as well that pro forma operating margins rose three points to a near-breakeven -7%. Domo is rare among SaaS companies to actually improve profitability margins in Q2; whereas many others cited inflationary pressures and wage increases as the drivers for margin decay.

The company expects that its cost-cutting actions in the sales department will produce 200bps of operating margin improvement relative to Q2 levels by the end of the year.

Key takeaways

In my view, Domo’s much lower share price more than makes up for the new risks that have opened up with the company’s guidance cuts. At any rate, the current market cares much more about profitability than growth; and Domo’s confident statements about improving operating margins should help to turn sentiment around within the next few quarters. Stay long here.

Be the first to comment