MarsBars

It’s been a difficult year, to say the least, for investors of growth companies, as many once high-flying tech names are down big this year. This includes companies whose stocks were once thought of as being invincible, like Google (GOOG) (GOOGL) and Amazon (AMZN), not to mention a whole slate of smaller names such as Pinterest (PINS) and Snap Inc. (SNAP).

While I see plenty of potential in the first two aforementioned names, the market downturn is also a good reminder that long-term wealth is created by hitting lots of singles and doubles rather than trying to get a home run each time.

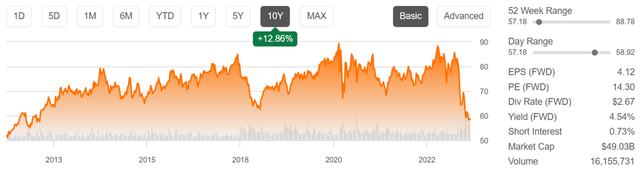

This brings me to utility companies, which have been steady performers amidst an otherwise highly volatile equity market. However, Dominion Energy (NYSE:D) hasn’t seen the same level of stability, with the share price falling by 25% since the start of the year. In this article, I highlight why the recent material drop in Dominion’s price opens up a great buying opportunity with a decent starting yield.

Dominion Stock (Seeking Alpha)

Why Dominion Energy?

Dominion Energy is a leading energy company that operates in 15 states across the U.S., providing electricity and natural gas to 7 million customers. It has over 30 GW of electric generation capacity and more than 90K miles of electric transmission. In addition, Dominion also owns an LNG export facility in Cove Point, Maryland and is constructing renewable energy assets.

Dominion has given its investors a fair amount of uncertainty in recent years, since selling its gas transmission assets to Berkshire Hathaway (BRK.A) (BRK.B) in late 2020, resulting in a dividend cut. Adding to near-term uncertainty, it recently announced the departure of its CFO, and stated that they are conducting a “top to bottom” review of the business, which may include its Cove Point LNG facility. If this happens, it would make Dominion more of “pure-play” utility focused on regulated electric and gas utilities.

Nonetheless, Dominion is demonstrating strong results across its business units, with third quarter operating earnings per share that were above management’s prior guidance. Moreover, it expects to meet its annual operating EPS guidance of $4.11 at the midpoint for the full year.

Looking ahead, the big story behind Dominion is its sizeable $37 billion of growth capital over the next 5 years, with 90% of it focused on low carbon and renewable energy projects. Over the next 15 years, Dominion forecasts $73 billion worth of capital investment opportunities. This adds a layer of execution risk with potential for cost overruns. However, Dominion’s projects are rate-regulated, which helps to mitigate some of the risk.

Moreover, while Dominion’s ambitious renewable energy capital plan comes at a higher cost than traditional fossil fuel projects, it will realize benefits from lower operating costs as it won’t have to purchase fossil fuel commodities as feedstocks for power generation. Management is also working to de-risk its project profile by securing fixed costs on certain projects, like offshore wind, as noted during the recent conference call:

Let me now turn to execution of that project, where we have further mitigated some of the project’s development risks that strengthen our confidence of remaining on time and on budget. We have continued to work closely with Bureau of Ocean Energy Management and other stakeholders to support the project’s time line, as we continue to expect to receive a draft environmental impact statement by the end of the year.

Development of the project has continued uninterrupted to maintain the project schedule, and we expect over 90% of the project costs, excluding contingency, to be fixed by the end of the first quarter 2023 at the latest as compared to about 75% today, further de-risking the project and its budget.

Meanwhile, Dominion Energy maintains a strong BBB+ rated balance sheet, and the recent price weakness has pushed its dividend up to a respectable 4.6%. Importantly, its dividend is well-covered by a 65% payout ratio, and management has shown a commitment to resuming dividend growth, with a 6% dividend increase earlier this year.

Lastly, I find Dominion stock to be appealing with it now sitting just shy of its multi-year lows, as shown below.

Dominion 10-Year History (Seeking Alpha)

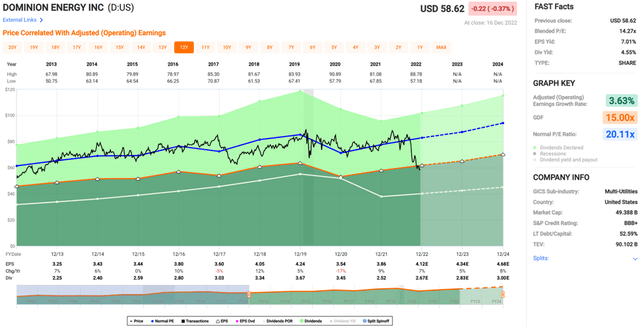

The stock also trades at a forward PE of just 14.3, sitting well below its normal PE of 20.1 over the past decade. I believe the market is assigning too big of a discount due to near-term uncertainties. Moreover, analysts have a consensus Buy rating with an average price target of $72.58, implying a potential 28% total return including dividends.

Dominion Valuation (FAST Graphs)

Investor Takeaway

Dominion Energy looks like an interesting investment opportunity, given the backdrop of a strong balance sheet, rising dividends and growth opportunities for renewable energy projects. While there are execution risks, the company’s rate-regulated structure helps to minimize some of those concerns, and management is working to secure fixed costs on projects. Lastly, the stock looks appealing at just shy of multi-year lows while offering investors a healthy and well-covered dividend.

Be the first to comment