Justin Sullivan/Getty Images News

Nearly $5 billion in market cap was erased on Dollar General Corporation’s (NYSE:DG) Q3 earnings day. The culprit: a rare EPS miss of 21 cents, by far the widest gap to estimates witnessed in the past 20 quarters at least, which led to lowered expectations for full-year earnings.

Despite Dollar General having disappointed on the bottom line this time, I believe that DG is a stock to own — especially after this outsized pullback in share price that I believe to be overdone for such a high-quality company and stock.

Dollar General Q3 earnings: Strong growth

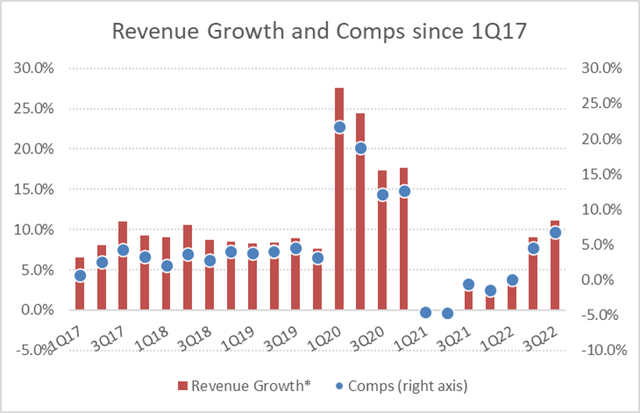

The Tennessee-based retailer delivered strong top-line numbers once again. In fact, YOY revenue growth of nearly 12% topped estimates by the widest margin of the past year and a half. Helping to boost the P&L was same-store sales increase of 6.8%, which landed solidly above the pre-pandemic historical trend. See the chart below.

Not unlike last quarter, revenues were supported by a healthy mix of higher traffic and larger basket size. Dollar General’s trademark strategy of aggressively expanding its store footprint also played an important role in pushing sales higher by double digits in percentage terms.

Dollar General’s Revenue and Same-Store Sales Growth since 2017 (data from company reports)

The elephant in the room, however, could only be found further down the income statement. In GAAP terms, gross margin of 30.5% was unimpressive when compared to 30.7% this time last year. Keep in mind that, in Q2, the company reported margin expansion of 70 basis points, as the cost headwinds that have become commonplace in the retail space in 2022 have not quite impacted Dollar General’s financial results to the same extent.

The good news is that the Q3 margin pressures (which the management team expects to spill into Q4, but to a lesser extent) seem unrelated to longer-term fundamental reasons. Dollar General pointed the finger at “unanticipated delays in acquiring additional temporary warehouse space,” which in turn led to higher storage fees and other transportation costs in Q3. The management team sees these headwinds as temporary.

To be fair, supply chain inefficiencies like this could taint Dollar General’s reputation as one of the best-managed retail chains in the country — especially when the issue leads to a sizable revision in EPS guidance for fiscal 2022 (projected earnings per share growth of 7.5% at the midpoint of the range vs. 13% before Q3 earnings day). But I find it a stretch to discount DG by nearly $5 billion in market cap, or almost 10% of the equity value, for a problem that could very well be water under the bridge in only a few months.

Why DG is a great stock to own

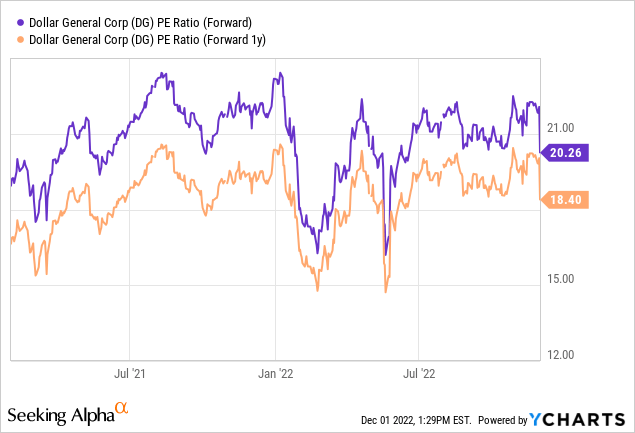

DG is a fairly expensive stock that trades at a current-year P/E of 20.3x (see below) for very good reasons. Among them, as I have explained a few times in the past, is the resilience of the business model, the financial results, and the stock price to downturns in economic activity.

The rationale is simple: while Dollar General benefits from a strong economy and robust consumer spending, like any other retailer, it still tends to do quite well when consumers need to tighten their belts to offset higher unemployment, wage growth softness, and/or rising consumer prices.

It explains why DG has done consistently so well in the past several years. For instance, same-store sales climbed 9% in 2008 and 7% in 2001, two recessionary years. Ahead of what could be another period of economic deceleration, I think that owning DG at its current price of $235 apiece makes a lot of sense.

Be the first to comment