Sundry Photography/iStock Editorial via Getty Images

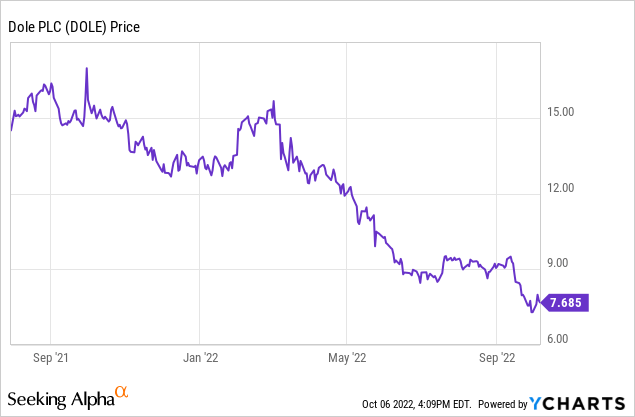

Dole (NYSE:DOLE) has gone in one direction since its IPO at $16/share – straight down. The entire way down there have been many well-articulated bullish writeups on Dole in the value investor community, including this excellent overview by Kingdom Capital, Dole Plc: There’s Money In The Banana Stock.

I believe most of these bullish arguments will eventually be proven correct, and a tough operating environment with inflation and supply chain issues is obscuring the long term value in Dole. I’ve entered the stock recently, as I believe we are near an inflection point and the shares are now too cheap to ignore.

Brief Background

I won’t go very deep into the background here as this has been widely covered by other authors. Dole is a fruit and vegetable company with a large, diversified business, consisting of 4 major segments:

- Fresh Fruit (bananas and pineapples, mostly)

- Fresh Vegetables

- Fresh Produce, EMEA (the legacy Total Produce business.)

- Fresh Produce, America + Rest of World

Dole returned to public markets last year in a merger with Total Produce, and is now managed by the Total Produce team. This is widely regarded as a positive over the previous Dole team.

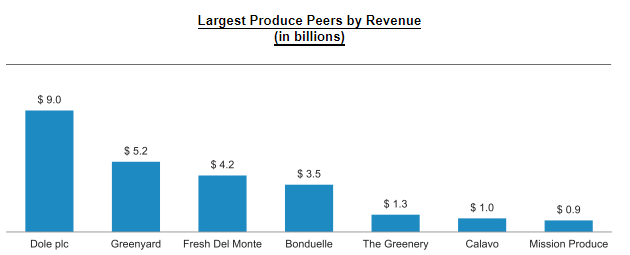

Valuation And Comps

At a 2023 forward P/E of ~6, Dole seems cheap, especially compared to its competitor Fresh Del Monte Produce (FDP) that has a forward P/E of more than double this. This is unusual because Dole is the larger of the two companies, with revenues nearly double FDP’s.

|

$m |

DOLE |

FDP |

|

Market Cap |

$728 |

$1,119 |

|

Net Debt |

$1,113 |

$448 |

|

EV |

$1,841 |

$1,567 |

|

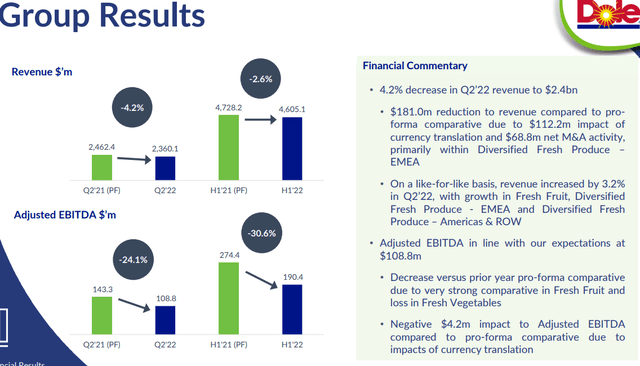

1H 2022 Adjusted EBITDA |

$190.4 |

$118.4 |

|

FY2022 EBITDA Guide (6 mo. actuals + guidance) |

$330-350 |

Not provided |

|

Debt / EBITDA |

3.27x |

2.24x |

|

EV/EBITDA |

5.3x |

7.8x |

On an absolute basis, Dole seems cheap. On a relative basis with competitor FDP, Dole also seems cheap!

Why Dole Is Down?

Dole has been the definition of a busted IPO. The IPO price was originally targeted at a range of $20-$23, which was then reduced to $16-17 per share. From there, it’s gone straight down.

There’s a number of reasons for this, primarily because Dole has gotten hit with a trifecta of higher inflationary costs, higher interest rates, and a stronger dollar.

Inflationary Cost Increases

Dole has been hit hard by inflationary costs. In discussing the last quarter’s results, Dole CFO Jacinta Devine said

The prior year comparisons had the benefits of strong market conditions, due to tight supply following the hurricanes in Central America in November 2020. And as expected, these conditions did not repeat in 2022. Adjusted EBITDA was also impacted by higher ocean and in-land freight costs, higher cost in packaging, fertilizers, and other material.

FDP SVP + CFO Monica Vicente gave good information on the components of inflation impacting food companies like Dole and FDP and put a specific number on it.

Higher costs across the board resulted in the increase in cost of sales of $100 million, including cost of packaging materials, fertilizer, ocean and inland freight, fuel and labor.

Add to this a slower than expected recovery in the value added salads business from the recall last year, and Dole’s 2022 results have been unimpressive for investors.

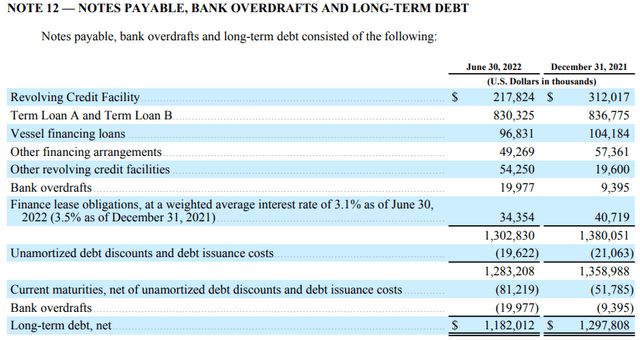

Higher Interest Rates And debt

Dole carries a significant amount of debt, most of which is floating rate.

Dole had good timing late last year and entered into 3-5 year swaps on approximately half the debt ($600 million) and added another $100 million in swaps in Q2. Even with this, net interest expense for the current year has risen to $60 million from $45 million in the original guidance.

Net leverage at the end of Q2 was 3.4x, with guidance that this is expected to decrease further in the 2nd half of 2022.

I believe this level of debt is manageable and expect Dole to deleverage significantly over the next year.

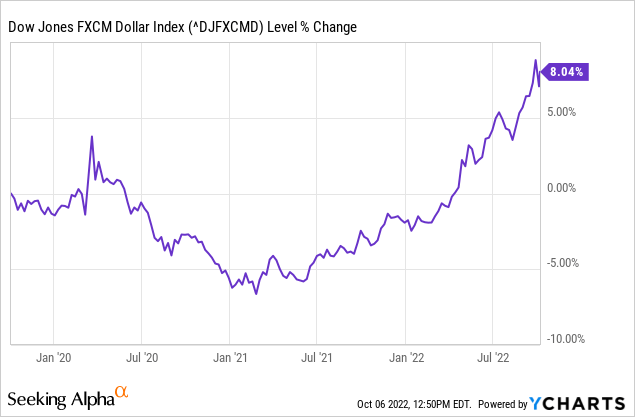

Stronger Dollar

With half of Dole’s business being OUS, the stronger dollar hurts them. Per the Q2 Conference call, a 1% strengthening in U.S. dollar has about 1 million impact to Dole’s EBITDA.

Since the beginning of this year, the dollar has appreciated around 12%. Not helpful, but not a disaster either.

Valuation Gap With FDP

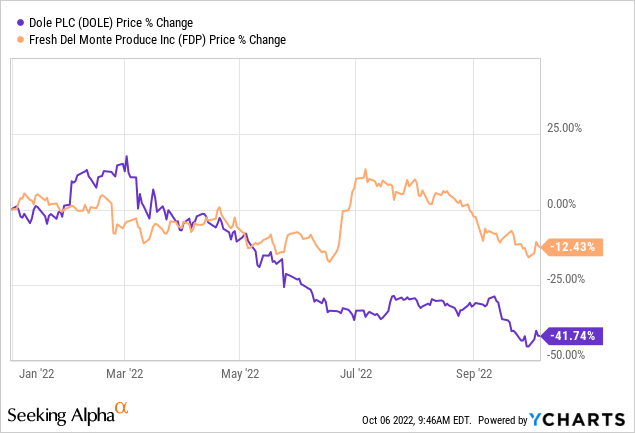

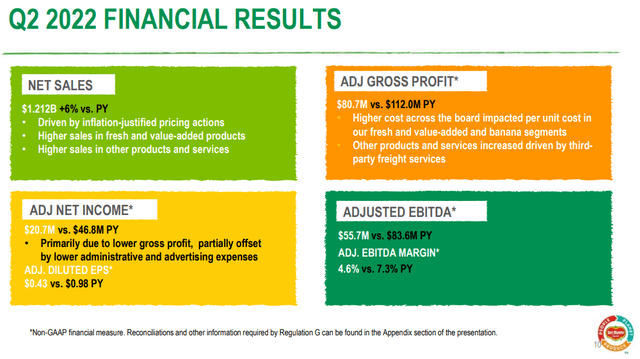

2022 has been rough for Dole, but it’s also been rough for competitors. In Q2, Dole’s EBITDA declined 24% and earnings dropped 40% ($0.44 cents from $0.74 cents in the year ago.)

Fresh Del Monte saw worse results in Q2 with EBITDA declining 33% and earnings dropping 56%.

Considering that Dole has done somewhat better than FDP, why has Dole declined 42% while FDP has only declined 12%? In July, FDP was actually up on the year while Dole was down 36%.

So why is Dole down so much, both in absolute terms and compared to its nearest competitor?

I think this is a case of a company that just came at market at the wrong time, and then got hit with every bit of bad luck possible. Everyone that owns this is underwater; people that bought near the IPO are badly underwater. The chart on this stock is as ugly as it gets, and I think many people have simply thrown in the towel.

Why I Think Dole’s Share Price Will Be Heading Back Up Soon?

I think the rest of the year will be good for Dole shareholders.

Reason 1: It has further price to take

The lag on prices will catch up and benefit Dole as contracts are rolled over. Retail food prices are up 8.9% through July this year. There is fear of a global food shortage heading in 2023, yet there seems to be little interest in owning this food producer!

From the Q2 Earnings Call

We have taken price and we are very happy with the price that we took during Q1, but we have a little bit more to take and we also have seen some additional inflation during the summer as a consequence of the war, right? So, there is some more price to be taken, but we expect to take that as we are negotiating the new contracts with the customers.

I expect the price increases to start flowing into Dole P&L over the next 6-12 months.

Reason 2: Dole’s specific inflation pressures are moderating

As noted above, FDP SVP + CFO Monica Vicente gave good information that smaller FDP faced a $100 million dollar COGS increases from the cost of packaging materials, fertilizer, ocean and inland freight, fuel and labor.

Let’s unpack each of these.

Cost of Packaging Materials

Jefferies analyst Philip Ng downgraded both International Paper Company (NYSE:IP) and Packaging Corporation of America (NYSE:PKG) to Sell-equivalent ratings after his channel checks suggested a significant supply/demand disconnect because of a “massive inventory glut in containerboard.”

This is the supply chain crisis in action. Everyone hoarded everything. The entire production world went from “just in time” to “just in case!”. Now everyone has excess inventory at a time when demand is weakening. The result will be lower prices. This unwind will benefit Dole in two ways – both lower prices and higher cash flow as working capital unwinds.

Fertilizer

Still elevated and likely to remain so in my opinion, but domestic prices have moderated since Q2.

Progressive Farmer (DTN)

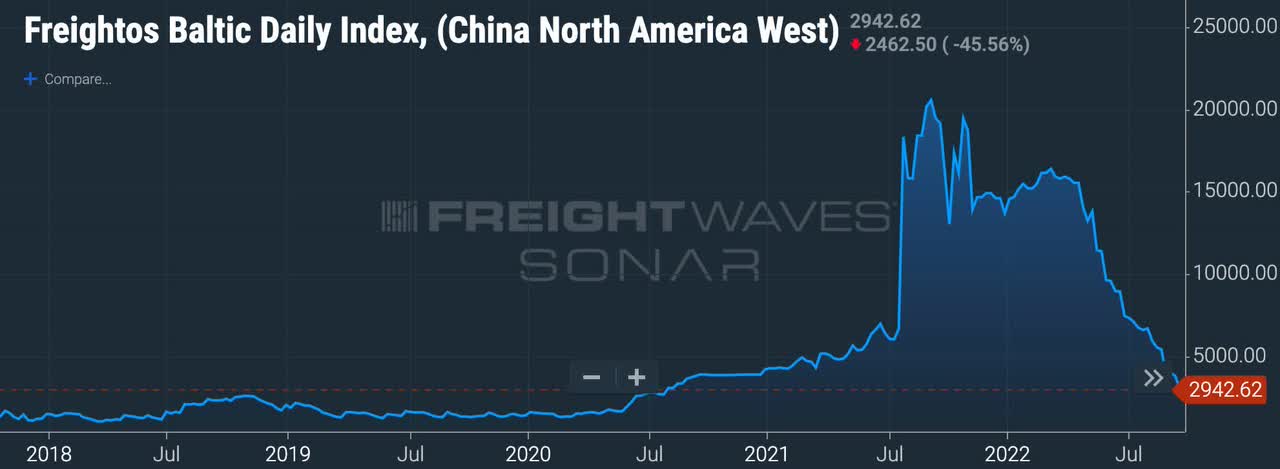

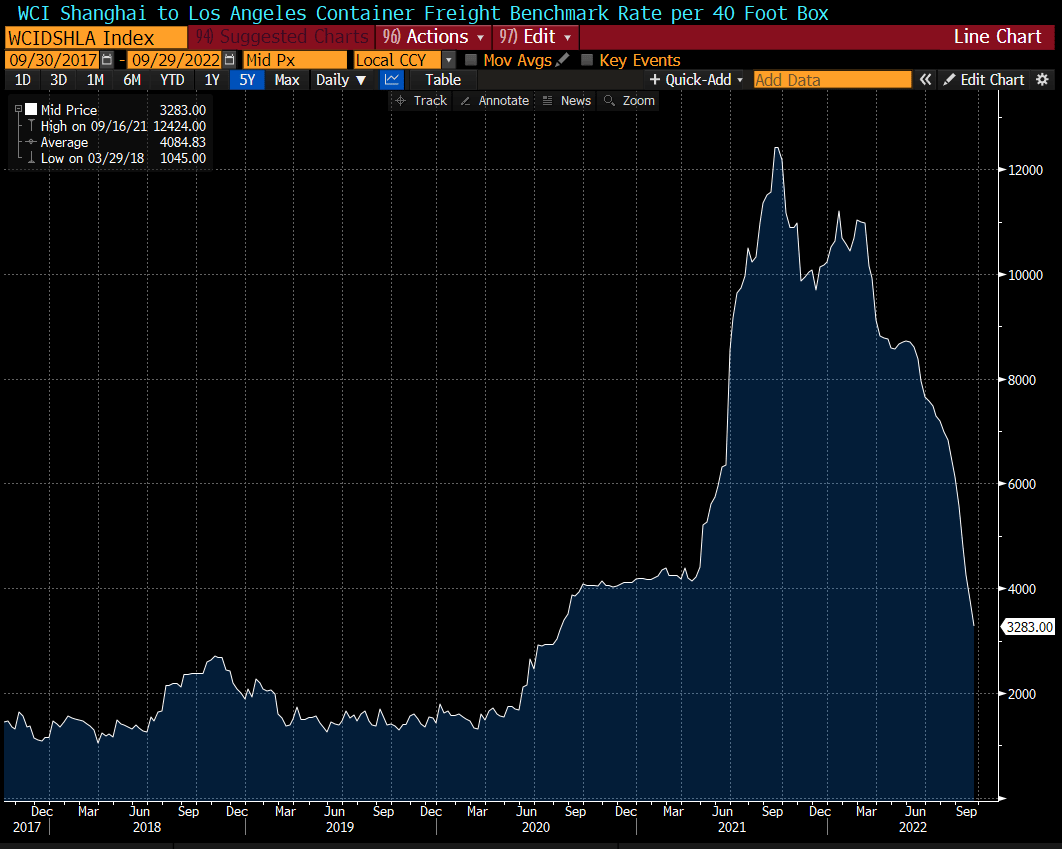

Ocean Freight

Ocean Freight has completely nosedived in the past 3 months. This is not a huge benefit for Dole as it owns many of their own ships, but shows how the entire shipping sector is normalizing fast.

Baltic Dry Index Freight Index

Inland Freight

Citi is warning on freight trends and warned that peak truckload freight not materializing and pace of imports is slowing into what should be a seasonally strong period. KeyBanc analysts Todd Fowler and Carney Blake note a “trucking winter” is coming. Rates are heading down here as well.

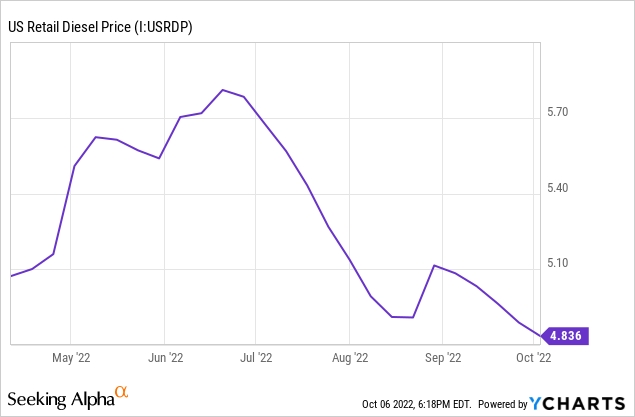

Fuel

Labor

I don’t see this heading materially lower (at least not yet) but I believe the pace of gains will slow. Dole had some positive commentary on it, with Dole COO Johan Linden saying

Additionally, on the positive side, we have recently been seeing some stabilization in prices in important commodities like packaging and fertilizers, as well as in fuel and we also started to see some signs that we are turning the corner on availability of labor.

In aggregate, I believe the pressures on Dole’s cost side since they gave their last report has moderated a great deal, and I think these trends continue.

Reason 3: Recent major investor purchases

In the past few months, there’s been significant accumulation by some folks that interest me.

- Bruce Taylor, CEO of Taylor Farms, acquired a 6.5% stake in Dole this June. Taylor farms is a competitor of Dole! Bruce knows about this business and clearly sees value here.

- Jan Barta, a partner with Czech investment firm Pale Fire Capital, acquired a 5.2% stake in Dole in August. Jan was involved in activist action with Groupon (GRPN). From the 13D filing, it says “The Reporting Person purchased the Shares based on the Reporting Person’s belief that the Shares, when purchased, were undervalued and represented an attractive investment opportunity. The Reporting Person intends to engage in communications with the Issuer’s Board of Directors (the “Board”), management team and other third parties regarding means to enhance shareholder value.”

- BDL Capital Management acquired a 5.4% stake in June.

Bruce Taylor’s purchases are really eye opening to me. Bruce bought Dole across a variety of entities

- 5,400,383 shares held by Taylor Fresh Foods, Inc.

- 537,101 shares held by Taylor Family Investments. LLC

- 200,000 shares held by the Bruce & Linda Taylor Family Trust.

How undervalued and unloved must shares be that someone that owns a competing firm loads up on your stock?

Reason 4: Banana Pricing

From Dole’s 2020 F-1, the Fresh Fruit category, which is mostly bananas and pineapples, was 30% of revenues but 46% of EBITDA. Dole is the #1 leader for bananas in North America and holds the #2 position for bananas in Europe.

Dole Banana Share (Dole 2020 F-1)

Bananas are cheap, as anyone that goes to a supermarket has seen.

When you think of everything that has to go into the production of Bananas – from growing them, shipping them overseas, transit to stores and then selling them, it’s incredible that they can retail for 69 cents a pound! Compare that with domestically grown strawberries, raspberries and blueberries that are usually closer to $4.99/pound.

There is a reason for it – Bananas are easy to grow and they grow year round in tropical climates.

You can even grow them inside in Philadelphia! (Yes, this is a dwarf Cavendish banana plant I bought off Amazon for $5 during COVID that grew from a 2 inch sapling to this monster that is now growing Bananas.)

The CEO of FDP had the following insightful commentary on Banana pricing (from the FDP Q2 Earnings Call)

FDP CEO Mohammad Abu-Ghazaleh:

The price of bananas hasn’t moved for the last probably 15 years on the shelf. And everything has moved, like, almost 100%, I mean, if you go to a supermarket today, you cannot buy an apple for $1 probably or $2 even in some cases, a piece of lemon, 1 lemon for $1, I mean everything is astronomical. And if you go to a pound of bananas and its $0.50, $0.60, it doesn’t make sense. I mean, we are like in between the hammer and the — I mean our producers cannot continue, shipping is increased, fuel has gone up the roof — through the roof. Everything has really increased. And we are at a point now where action needs to be taken as a matter of fact.

He continues in response to another follow-up question

Small, medium-sized growers are really having a lot of difficulties securing financing to continue operations. All these factors together, in my opinion, will drive the banana sector to a point where the production will come down, in my opinion, significantly in the future. And I cannot decide 1 year or 2 years. But I believe that the banana industry, in general, will not be able to be – to sustain the way it has been going for the last 10 years. I mean they were living on a lifeline. Money was easy. Interest was almost 0. Chemicals, fertilizers, inputs, transportation, you name it, everything was quite competitive, cheap. The picture has stand around completely now as you – everybody knows. So you add up everything, and it will not work.

I mean I wouldn’t be surprised to wake up one morning and see a banana box costing $20 and I’m not – this is not something that I speculate. I believe in this, and I have believed that for many years. And I think, there would come a time when everybody wakes up and there will be not enough bananas to feed the markets.

Of the folks that purchase Bananas today, how many are going to pull back if they go from 60 cents/pound to $1, or even $1.25, when other fruits are significantly more than that?

This has already started to play out with banana pricing accelerating so far in Q3. I think this is a major hidden catalyst that could emerge over the next few years for Dole.

Conclusion And Recommendations

In spite of all the negatives this year, Dole will still probably do $120-125 million in free cash flow which I believe they will use to further deleverage.

Looking ahead to 2023, we should see a reversal from the recall costs from value added salads, which should add $25 million (Dole’s 2022 estimate on the cost of recall from the Q3-21 Conference Call.) Dole guided to $30-40 million in merger synergies, let’s say they achieve half of the low end in 2023 for another $15 million. Then, between a combination of price increases and cost savings they recover half way back to 2021 Pro-forma results, which adds another $50 million.

So, without anything too crazy happening, just normalization, Dole could do $400+ million in EBITDA with $175 million in free cash flow in 2023. Used to deleverage, net debt at Dole would be closer to $900 million by the end of next year. Debt/EBITDA would drop to ~2.25x and Price to Free Cash Flow would be around 4x! I believe there is upside to this as well. Once leverage gets to a more comfortable level closer to 2x EBITDA, I would expect the activists involved to push for share repurchases if shares are anywhere near this cheap. In this scenario, returns of 100% in 18 months seem easily achievable, especially considering that a double from here is still below the IPO price of $16.

COO Johan Linden said the following on the last conference call

We are now pleased with the outlook and are looking forward to a strong second half outperforming our prior year comparatives. Our diversified business on a like for like basis had a very robust quarter, despite ongoing supply chain and inflationary challenges.

Dole seems poised to lap comps for the next year, and I believe conditions have improved since they gave this guidance.

Dole shares are heading higher.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment