AndreyPopov

DocuSign (NASDAQ:DOCU) jumped after releasing third quarter numbers. The stock had been battered more viciously than others, as it found itself trading below where it did 4 years ago. But alongside the valuation reset has come a reset in expectations and these numbers, while still showing meaningful deceleration in growth rates, were still “good enough.” In late September, DOCU appointed a new CEO in Allan Thygesen to replace long time CEO Dan Springer. It is unclear if that leadership change did the trick, but DOCU has increased full-year guidance and it may be time for analysts to warm back up to the name. I continue to find DOCU highly buyable here among the tech rubble.

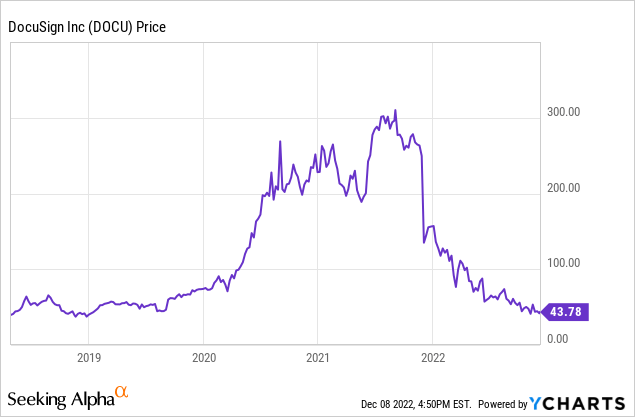

DOCU Stock Price

During the pandemic, the e-signature market became one of the more hyped stories, as DOCU saw its stock soar above $300 per share. It has since come crashing down not only to pre-pandemic levels but essentially erasing all gains since it came public in 2018.

I last covered DOCU in July where I rated the stock a buy but noted that in spite of the huge plunge since all-time highs, the stock was still not offering as much upside as peers. After another 30% drop since then, I can now recommend the stock without such reservations.

Did DocuSign Beat Earnings?

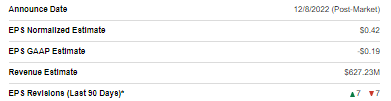

Heading into earnings, expectations were quite low. Analysts expected $627 million in revenues and $0.42 in non-GAAP EPS.

Seeking Alpha

DOCU Stock Key Metrics

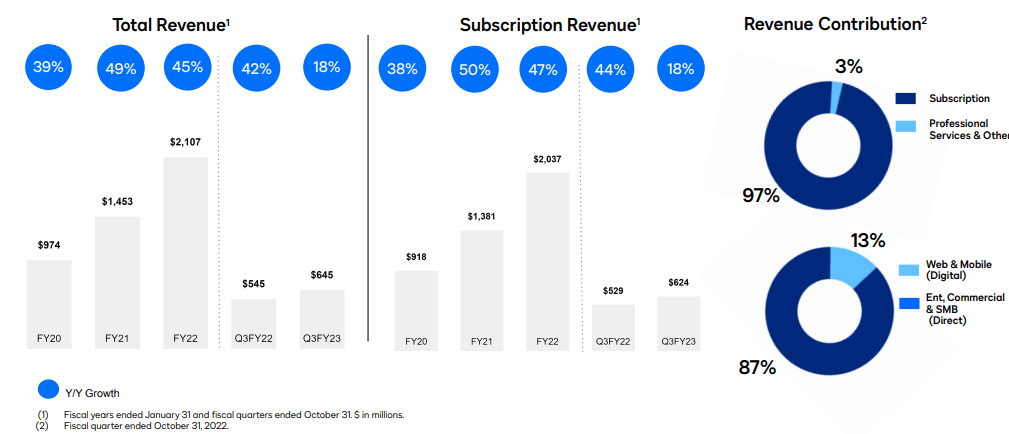

DOCU ended up easily beating those estimates, with revenue coming in at $645.5 million. Subscription revenue grew by 18% – far lower than the prior year’s growth rate but that deceleration had already been priced into the stock.

FY23 Q3 Presentation

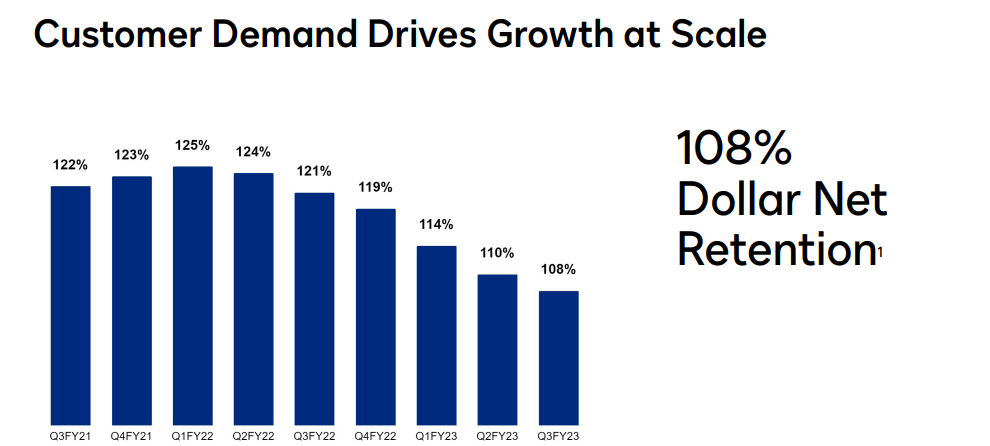

One of the main drivers of the deceleration in growth has been the steady decline in dollar-based net retention rates, which declined further to 108% in the third quarter.

FY23 Q3 Presentation

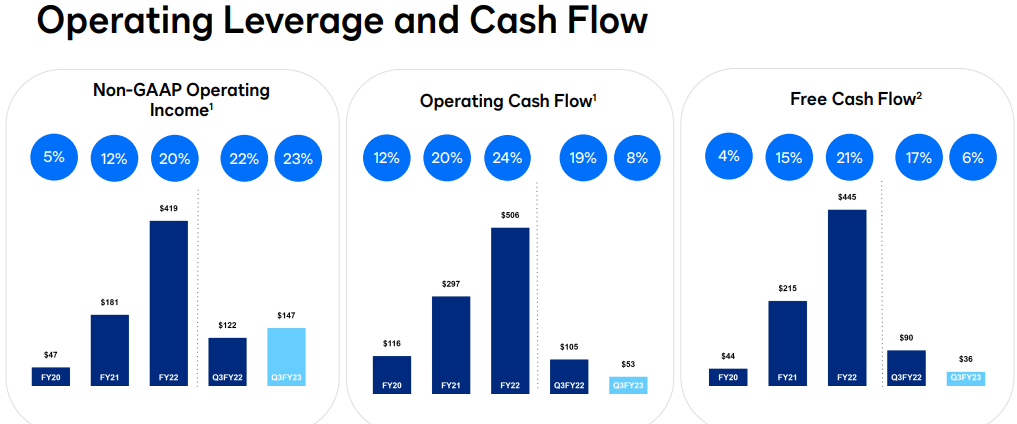

DOCU generated some margin expansion with non-GAAP EPS coming in at $0.57.

FY23 Q3 Presentation

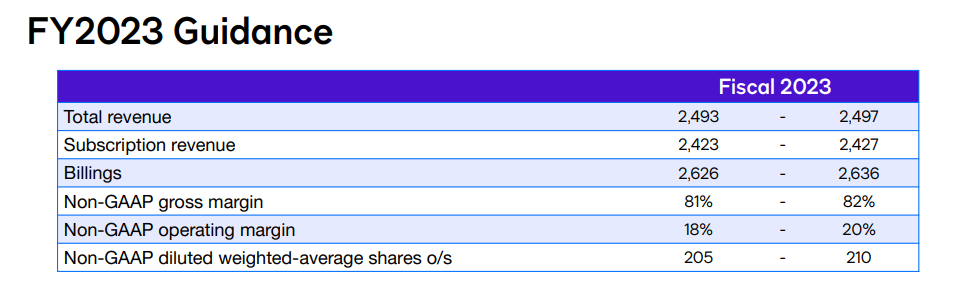

One of the main worries for DOCU had been what growth might look like in the next fiscal year. Previously DOCU had been guiding for $2.57 billion in billings this year, which suggested just 7% billings growth and a similar revenue growth rate next year. DOCU has increased its billings outlook to $2.636 billion, representing 10% growth and potentially a double-digit revenue growth rate in fiscal 2024.

FY23 Q3 Presentation

While that might not sound like a huge difference, it does make all the difference after DOCU has dropped 90% from highs.

What Is The Long-Term Outlook for DocuSign?

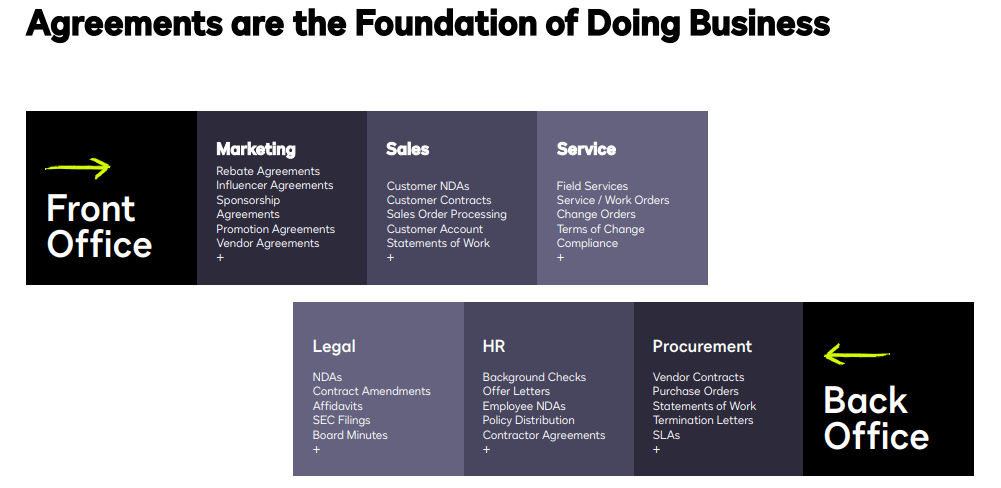

The long term growth story is quite easy to understand. While one might not realize it, agreements occur across all kinds of businesses – this is DOCU’s addressable market.

FY23 Q3 Presentation

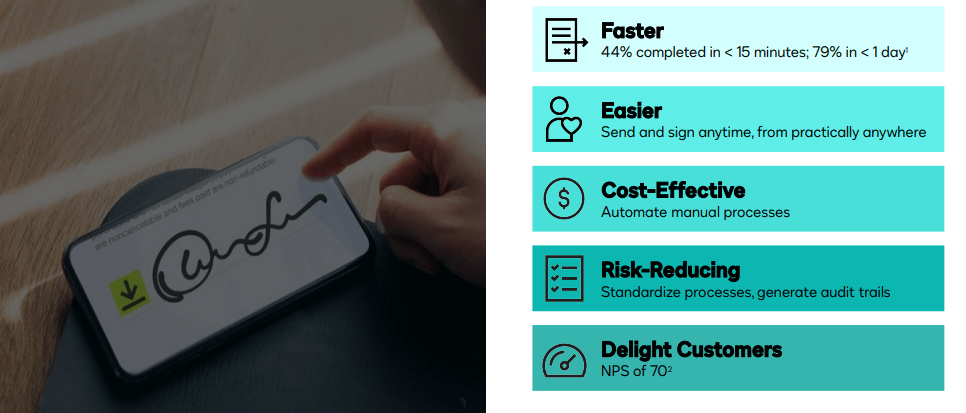

DOCU is like e-commerce for agreements, but the benefits go beyond convenience – e-signature products are faster to complete, easier to implement, cheaper to maintain, and reduce risk.

FY23 Q3 Presentation

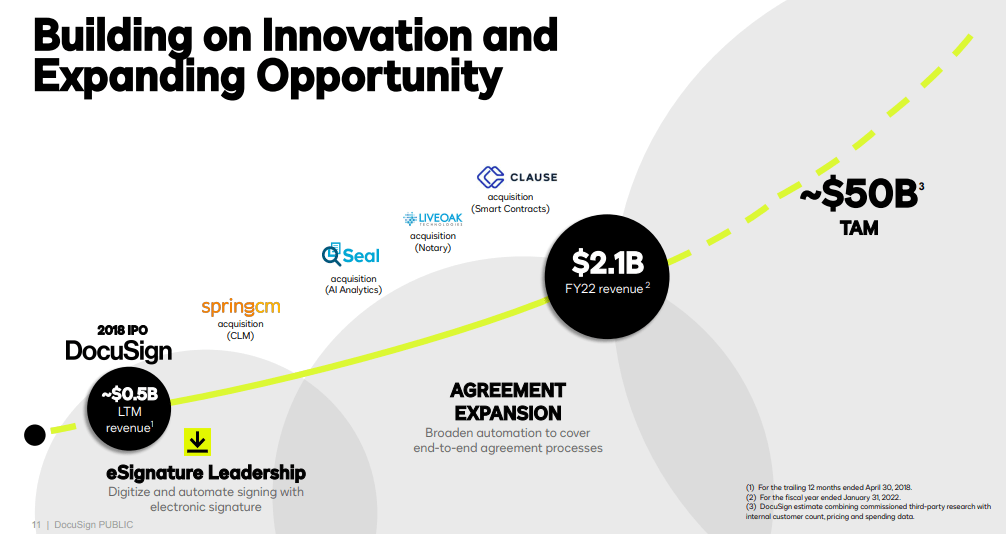

After various acquisitions which helped DOCU address the entire contract life cycle, DOCU estimates its total addressable market to be $50 billion.

FY23 Q3 Presentation

While growth rates may be slower than in the past, the world is unlikely to reverse course from e-signatures towards pen and paper.

Is DOCU Stock A Buy, Sell, or Hold?

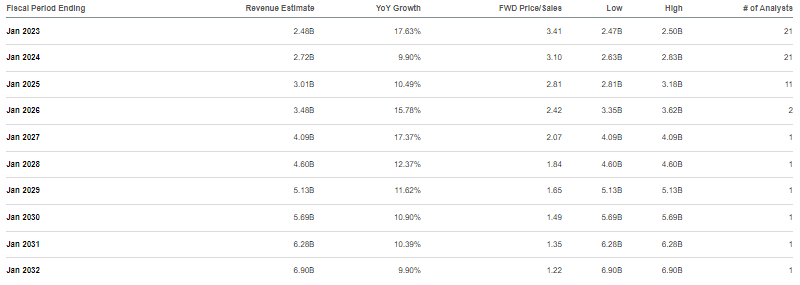

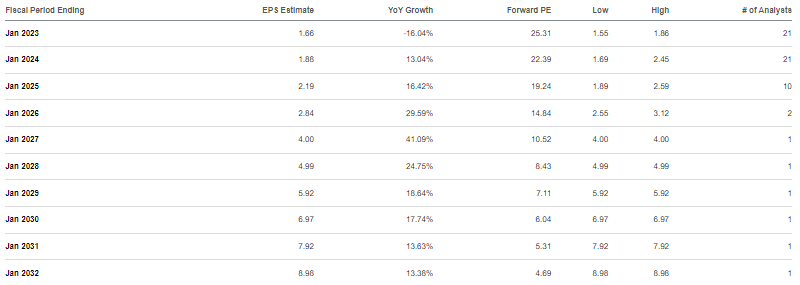

At first glance, DOCU might not appear that cheap. It certainly isn’t expensive, but the 3.4x price to sales multiple isn’t that off-base considering projections for low double-digit revenue growth moving forward.

Seeking Alpha

The key point here is that unlike many tech stocks, DOCU is generating robust cash flows. The stock is trading at 25x non-GAAP EPS estimates and earnings should grow at a materially faster clip than revenues on account of operating leverage.

Seeking Alpha

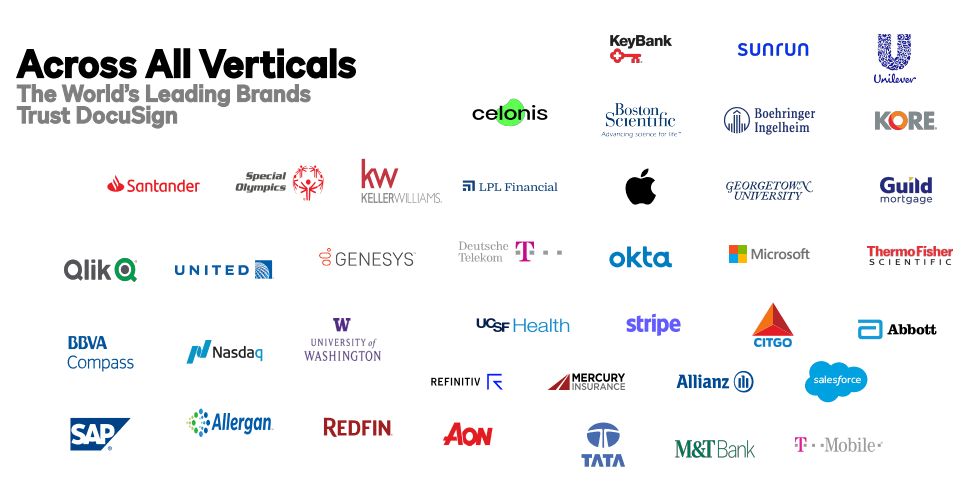

It may be ironic to note that while inflation and the recessionary environment may have popped the valuation bubble, they may also benefit DOCU’s business. DOCU is well known as the clear leader in the e-signature market, serving the world’s leading brands. It is possible that businesses will choose DOCU in today’s environment due to fears that competitors are not as financially stable.

FY23 Q3 Presentation

What is the fair value for DOCU’s stock? Assuming 10% long term growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I see fair value as being around 4.5x sales, representing a $58 stock price or 30% potential upside. There may be even more upside if growth returns in earnest, or if market sentiment drives a higher PEG ratio.

What are the risks here? Essentially all tech stocks are seeing some macro-impact to growth rates, but DOCU’s growth has been slowing down for many quarters already. It is possible that the growth slowdown is indicative of pricing pressures as it is possible that customers are more focused on price than functionality for e-signature products. In particular, DOCU faces steep competition from both smaller, cheaper vendors as well as large vendors like Adobe (ADBE). With $400 million of net cash and robust free cash flows, I am not concerned about financial solvency risk but I should note that DOCU is still not yet profitable on a GAAP basis and thus ongoing shareholder dilution is not completely offset by cash flow. While DOCU’s valuation has been largely de-risked, now trading at a low-single-digit multiple of sales, the stock may still prove to be volatile in the current market. The company did repurchase $38 million of stock in the latest quarter – ongoing repurchases may help to reduce the volatility – but absent a resurgence in growth rates, the range of fair values remains admittedly large. I have discussed with subscribers to Best of Breed Growth Stocks that a carefully chosen portfolio of tech stocks is the best way to take advantage of the ongoing tech crash. DOCU fits right in such a portfolio as a profitable beaten-down name – I rate the stock a buy for long term investors.

Be the first to comment