Sundry Photography

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not Sure We Read The Right Release

Coming into earnings, DocuSign (NASDAQ:DOCU) had the problem that nobody believed it could grow faster, because Adobe (ADBE) and all. The stock has bombed in recent months, apparently due to concerns about commoditization, lack of moat, growth falling off due to lessened remote working, and so on and so on.

Well, earnings printed today and growth slowed further. Worse, cashflow margins were down considerably. So as you would expect, the stock moved… up?

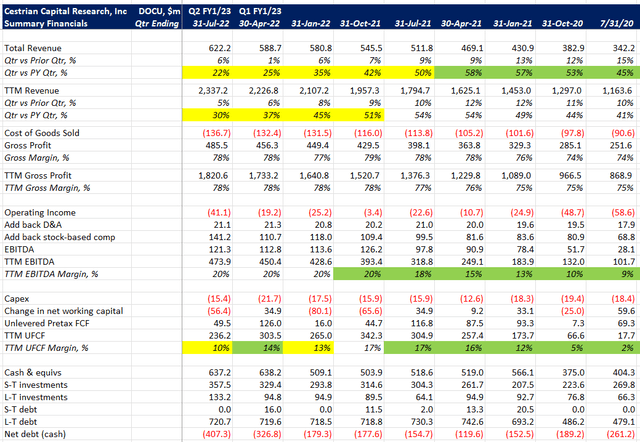

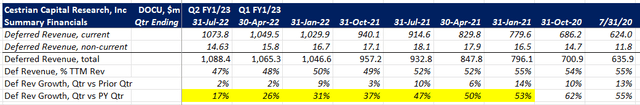

Here’s the numbers.

DOCU Fundamentals (Company SEC filings, YCharts.com, Cestrian Analysis)

DOCU Fundamentals II (Company SEC filings, YCharts.com, Cestrian Analysis)

The company guided to 17% growth for FY1/23 vs. FY1/22 i.e. a further slowing.

Now, we are the first to say that fundamentals are merely one input into stock prices; generally speaking, we look to other factors to overwhelm fundamentals on many occasions. Our recent video on HubSpot (HUBS) talks about this in detail. So our simple conclusion as to why DOCU rose on this print is … because the stock had sold off too much already.

The stock had sold off in a larger-degree Wave 2 down to just below the 78.6% retracement of the whole move up from a notional zero. Here’s how it looked at the close today. (Full page version, here).

DOCU Chart (TrendSpider.com, Cestrian Analysis)

In aftermarket hours the stock rose to $68.40 which is just slightly above that 78.6% retracement line you see on the chart above. This is a typical bottoming level for a Wave 2 down. So perhaps we can conclude that the market has adjusted to a slower-growth DOCU and that if matters at the company improve from here, the stock may commence a Wave 3 upwards. It’s hard to see that happening absent an improvement in fundamentals, and guidance gives no comfort that this will take place. But we have long learned to respect technicals ahead of fundamentals, so, we remain at ‘Hold’ rating in anticipation of an improvement in the price.

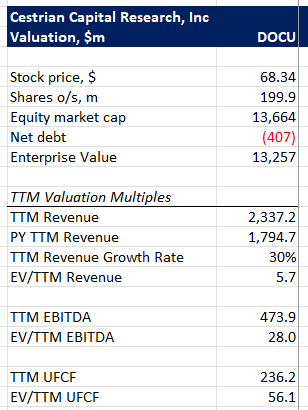

We also remain of the view that the company is ripe to be acquired by a consolidator in the software sector – a Microsoft, a Salesforce, someone of that nature. Fundamental valuation multiples are at a level where that is viable.

DOCU Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

If you are thinking of buying DOCU stock for the ride up, you might consider placing a stop loss somewhere below the recent lows of $52 or so – that’s close enough to not blow too much of a realized hole in your account should it trigger, whilst being far enough away to give the stock scope to breathe and not just trip on a momentary swoon.

Cestrian Capital Research, Inc – 8 September 2022.

Be the first to comment