The best photo for all

DocuSign (NASDAQ:DOCU) was a poster child for the covid excesses where business lockdowns necessitated a shift into their digital signature product offerings. The stock has fallen from a high over $300 to a low below $50 making DocuSign a very hated stock here. My investment thesis is Bullish on the stock following the collapse and the lack of market interest in a technology industry leader.

Low Expectations

Analysts are now uniformly tepid on the long-term prospects of DocuSign. Out of 21 Wall St. analysts, only 5 analysts are Bullish on the stock while 3 are Bearish.

Source: Seeking Alpha

Close to the stock peak in early 2021, analysts had 17 out of 20 ratings Bullish on the stock. Not one analyst had a Sell rating on DocuSign and 13 of the positive ratings were Strong Buys.

The stock traded in the $200 range on the way to $300 in late 2021, but DocuSign didn’t reach more than 1 Sell rating until the stock fell all the way to the $60s. Clearly, the market has very low expectations for the digital signature company, but analysts are usually great contrarian indicators.

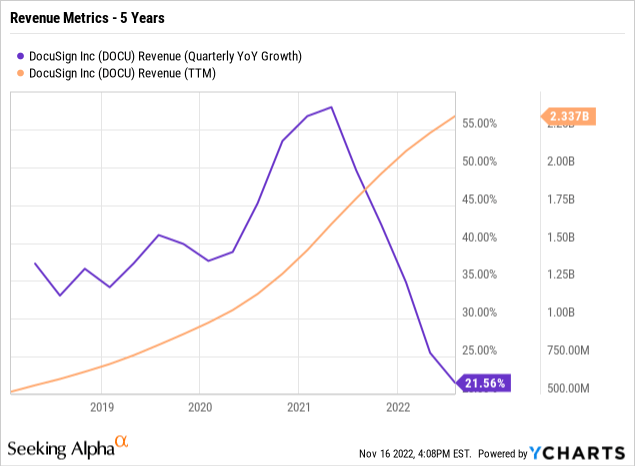

Not surprisingly, the analyst ratings appear to tie directly into the reported revenue metrics. DocuSign reported revenue growth topping 55% in early 2021 and analysts were all bullish on the stock. Fast forward to mid-2022 where billings growth slows and analysts are tepid on the stock with very few Buy ratings.

In the whole process, DocuSign has grown revenues dramatically. Any business with accelerated growth similar to what this company achieved in early 2020 through 2021 will need a period to absorb these growth rates.

The market has no patience for slowing growth stories regardless of the logic. The stock is clearly hated by analysts when the average rating is a Hold after falling over $250.

Still Upbeat

Despite the founding CEO leaving the company after repurchasing shares at far higher levels, DocuSign still reported a strong quarter for the period ending July. The company hired a new CEO in October and slashed 9% of the workforce prior to his arrival so the financial picture isn’t completely clear. As with most tech companies, DocuSign had grown the headcount by 1,500 employees in the last year alone completely outgrowing the actual growth rates now.

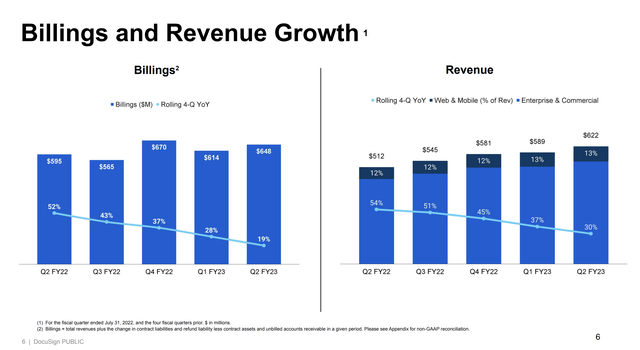

For FQ2’23, revenues grew a very strong 22% due to a big $20 million beat. DocuSign was still seeing strong subscription growth, but the fears in this market is that slower growth is ahead.

Source: DocuSign FQ2’23 presentation

The company guided to FQ3’23 revenues of $626 million for 15% growth. The market keyed in on the billings guidance at $589 million for minimal 4% growth and a turnaround in this metric is crucial for a turnaround of the business.

Regardless, the digital transformation remains full speed ahead. Enterprises working with key contracts and digital signatures are not looking for a cheaper solution to save money on these crucial products. DocuSign added 44,000 customers in the quarter to highlight competition isn’t the issue.

The amount of customers spending over $300K in annualized contract value continues to reinforce the long-term value of the solutions offered by DocuSign. The company now has 992 customers in this category, up from only 852 at the end of FY22 despite the huge growth from 599 at the end of FY21.

The biggest issue is that net dollar retention continues to slide with a further shift down to 110%. Due to the macro environment, DocuSign faces a tough environment with key real estate and lending customers facing massive headwinds as mortgage rates rise and home prices fall leading to reduced transactions.

The stock trades at only 4x FY24 sales despite a large 85% gross margin typically attracting far higher multiples. Even during this time period, DocuSign produced $106 million in free cash flows during the last quarter and the business can still cut operating expenses to further boost profits.

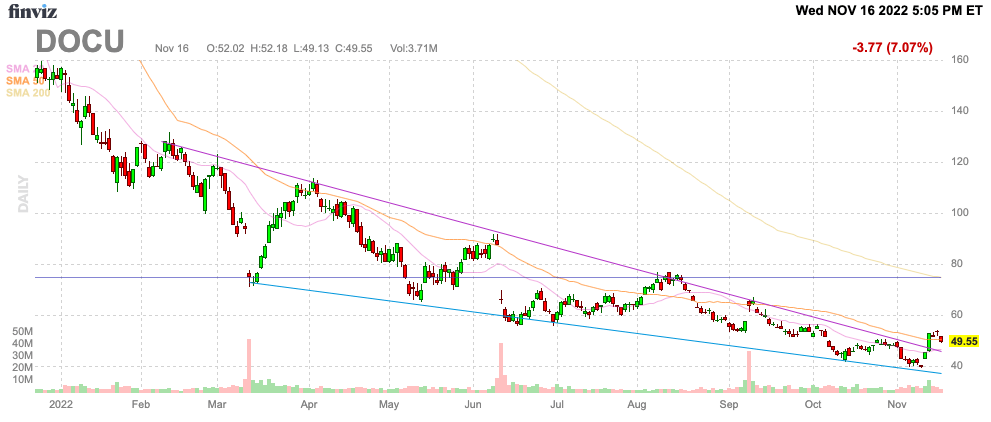

If DocuSign can create a lower low here in the $45 range, the stock becomes a clear buy. The stock definitely faces some risk with the new CEO only recently starting October 10 and still being silent on any plans to restructure the business.

Source: FinViz

Takeaway

The key investor takeaway is that DocuSign exhibits every sign of a hated stock. The software company has no analyst push and the stock has lost $250 from the highs and trades below the pre-covid levels of $60.

The stock definitely isn’t without risks with an unproven CEO and business still trending down. DocuSign appears a good long-term bet, though the next year will be very volatile.

Be the first to comment