Artur Nichiporenko

One of the biggest problems that have been plaguing many Americans over the past year is the incredibly high level of inflation that we have been seeing throughout the economy. This has gotten so bad that many people have been forced to take on second jobs just to feed their families as the inflation has been centered around food and energy, which are necessities. Fortunately, as investors, we have other methods available to us that we can utilize to obtain the extra money that we need to support ourselves in today’s economy. One of the best of these methods is to purchase shares of a closed-end fund that focuses on the generation of income. These funds provide investors with easy access to a diversified portfolio that can usually deliver a higher yield than pretty much anything else in the market.

In this article, we will discuss the DNP Select Income Fund (NYSE:DNP), which currently yields an impressive 6.98%. This yield is clearly sufficient to turn the heads of many investors, and as such can act as a respectable source of income. I have discussed this fund before, but that was nearly eighteen months ago, so naturally, a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances. Let us continue on and see if this closed-end fund (“CEF”) could be a good addition to your portfolio today.

About The Fund

According to the fund’s webpage, the DNP Select Income Fund has the stated objective of providing investors with a high level of current income and growing its income over time. This is something that is certainly nice to see given our thesis of raising our incomes to combat the effect of inflation. This is because inflation is constantly reducing the goods and services that we can purchase with a given level of income. As such, if the fund simply aimed to maintain a static distribution, the purchasing power of the distribution would steadily decrease over time. Thus, it is very nice to see that the fund is seeking to grow its distributions and by extension our incomes over time.

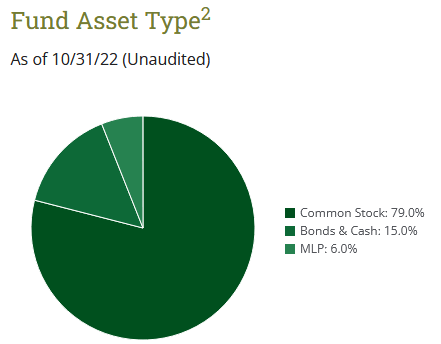

In order to achieve this objective, the fund invests primarily in common equity and fixed-income securities issued by utility companies. This is likely not very surprising. Utilities are very well known for their conservative natures and high yields. These companies also tend to increase their dividends annually. With that said though, fixed-income securities do not usually increase their payments to investors over time. This is because these securities do not benefit from the growth and prosperity of the issuing company. After all, a company will not increase the payments that it makes to its creditors just because its profits go up. This fact may have some people questioning why the fund includes fixed-income securities at all if the fund is looking to grow its income over time. The biggest reason for this is that fixed-income securities, particularly preferred stock, typically have a much higher yield than the common equity of the same company. However, this fund is mostly invested in common stock and bonds:

Duff & Phelps

The rule about fixed-income securities typically having higher yields than common stock is not true for bonds. This is because interest rates have been at or near all-time lows for more than a decade so most bonds have a fairly low-interest rate on them. That has begun to change this year though as rising interest rates have caused bond prices to fall to the point that someone purchasing a bond today will get a yield that likely beats the common stock of the same company. This same dynamic of falling bond prices has pulled down the value of bonds held by the fund for a while though, which is unfortunate.

As we can clearly see though, 79.0% of the portfolio consists of common stock so these securities will have much more of an impact on the fund’s portfolio. The overwhelming majority of these holdings are utility companies, as might be expected:

Duff & Phelps

This is quite nice to see for those that are seeking safety and security because one of the defining characteristics of utility companies is that they have remarkably stable cash flows. The biggest reason for this is that utilities provide a service that most people consider to be a necessity for modern life. After all, how many of us do not have electricity or running water in our homes? As such, most people will prioritize paying their utility bills over making discretionary expenses. This could be important today considering that inflation has been pinching the finances of many families. The same characteristic of stable cash flows applies to telecommunications companies too because of how necessary Internet access and cellular phones have become to modern life. We can also see that approximately 21.0% of the portfolio is invested in oil & gas storage, transportation, and production companies. These are mostly midstream firms, which likewise enjoy stable cash flows. This is due to the business models that these companies use.

In short, midstream companies enter into long-term contracts with customers under which the company transports and stores their hydrocarbon resources and bills the customer based on resource volumes, not resource values. In addition, these contracts include minimum volume commitments that specify a certain quantity of resources that a customer must send through the midstream company’s infrastructure or pay for anyway. These commitments add another element of stability since they protect the company against the volume declines that might otherwise occur in a low-price environment. Overall, the takeaway here is that the companies that the fund is invested in should enjoy a great deal of cash flow stability, which lends itself well to providing dividends to the shareholders.

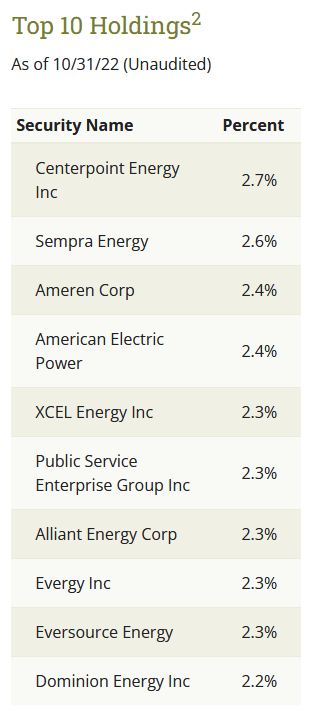

As my regular readers are likely well aware, I have devoted a considerable amount of effort over the years to discussing companies in the midstream and utility sectors in this column. As such, many of the largest positions in the fund will undoubtedly be familiar. Here they are:

Duff & Phelps

I have discussed most of these companies at some point over the past several years. In fact, the only companies on this list that I have never discussed are Sempra Energy (SRE), Xcel Energy (XEL), and Dominion Energy (D). All three of these are electric and natural gas utilities though so their basic fundamentals are likely to be similar to the other companies on the list. The portfolio is actually quite similar to what we saw eighteen months ago. In fact, the only changes to the top ten positions list are Crown Castle International (CCI), CMS Energy (CMS), and WEC Energy Group (WEC) being replaced by CenterPoint Energy (CNP), American Electric Power (AEP), and Evergy (EVRG). It is difficult to complain about these changes as CMS Energy is somewhat overleveraged compared to the other firms in the sector and WEC Energy is somewhat overvalued today. As we largely see utilities being replaced with other utilities, there are no real changes to the fund’s sector exposures.

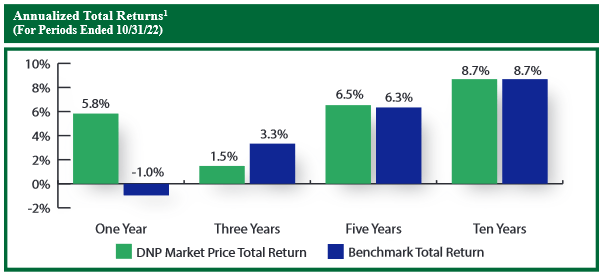

The fact that so few positions have changed over the eighteen-month period would lead one to believe that the fund has a fairly low annual turnover. This is in fact the case as the fund’s current annual turnover is 12.00%, which is one of the lowest levels that we can find among any equity fund. This is something that is fairly nice to see because of the fact that it costs money to trade stocks or other assets, which are billed to the fund’s shareholders. Thus, a high turnover makes management’s job more difficult due to the need to generate a sufficient excess return over the market to cover these costs. This is a task that few managers succeed at consistently and as such most actively-managed funds trail the market. This one has historically done fairly well though as it has beaten its benchmark index during most time periods:

Duff & Phelps

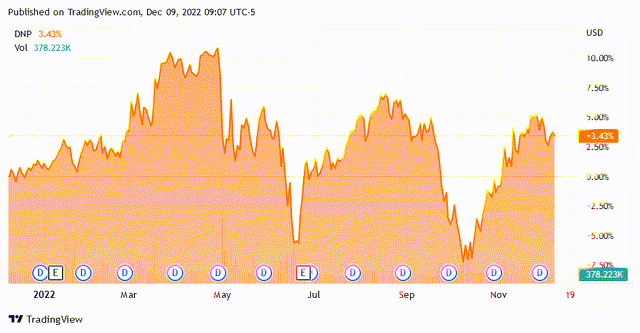

As of the time of writing, the DNP Select Income Fund is up 3.43% over the past twelve months:

This is an impressive result considering that nearly everything outside of the fossil fuel energy sector is down over the same period. When we consider that the fund was paying out a high yield over this entire time period, it becomes even more impressive and easily makes this one of the only closed-end funds that managed to deliver a positive total return to investors this year. This alone will likely appeal to income-focused investors.

As my regular readers on the topic of closed-end funds are no doubt well aware, I do not typically like to see any individual asset in a fund account for more than 5% of the fund’s assets. This is because this is approximately the point at which that asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio, then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market does not, and if this asset accounts for too much of the portfolio, then it may end up dragging the entire fund down with it. Fortunately, though, we do not appear to have to worry about this problem with this fund as there is no individual asset that accounts for an outsized proportion of the portfolio. Overall, this one appears to be quite well-diversified.

Leverage

One of the advantages that closed-end funds enjoy over other types of funds is the ability to use certain strategies that have the effect of boosting their portfolio yield beyond that of any of the underlying assets. One of these strategies that are employed by the DNP Select Income Fund is the use of leverage. Basically, the fund borrows money and then uses those borrowed funds to purchase more assets. As long as the purchased assets deliver a higher total return than the amount that the fund has to pay on the borrowed funds, this strategy works pretty well to boost the overall portfolio yield. As the fund is able to borrow at institutional rates, which are much lower than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword. This is because debt boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since this would expose us to too much risk. I do not generally like to see a fund employ leverage that accounts for more than a third of its assets for this reason. The DNP Select Income Fund is abiding by this restriction as the fund’s levered assets currently account for 25.78% of the portfolio. As such, it appears that this fund is currently striking a pretty good balance between risk and return. We do not appear to be exposed to a particularly high level of risk due to the fund’s leverage here.

Distribution Analysis

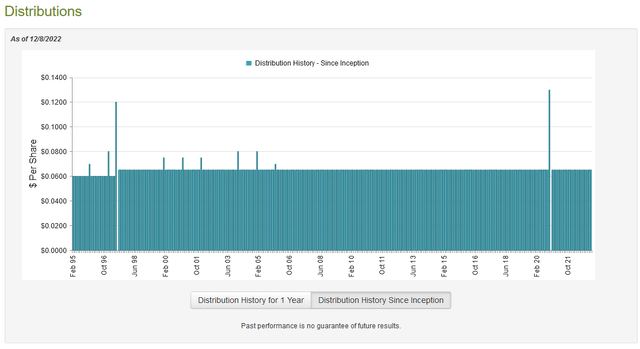

As stated earlier in this article, the fund’s primary objective is to provide its investors with a high level of current income. It does this by investing in a leveraged portfolio of utility stocks and other sectors that are fairly well-known for their high yields. Thus, we will likely conclude that the fund itself boasts a very respectable yield. This is certainly the case as the DNP Select Income Fund currently pays a monthly distribution of $0.0650 per share ($0.78 per share annually), which gives the fund a 6.98% yield at the current price. As is the case with most Duff & Phelps funds, this one has been remarkably consistent with its distribution over the years as it has maintained the same distribution since 1997:

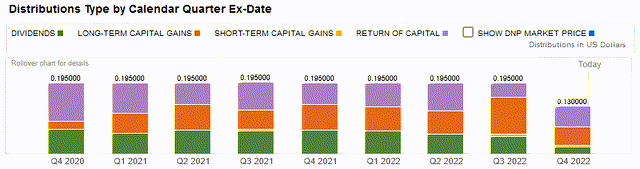

This is a remarkable track record that is easily one of the best that we will find in the entire closed-end universe. Unfortunately, it does fail to achieve the fund’s objective of delivering income growth over time. Still, the general consistency here will likely appeal to those investors that are looking for a stable and secure source of income with which to pay their bills or otherwise support their lifestyles. Unfortunately, those same investors might be a bit concerned about the large return of capital distributions that the fund has been making over the past few years:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital, such as distributing unrealized capital gains to the investors. As such, we should investigate to determine exactly how the fund is financing these distributions and how sustainable they are likely to be.

Unfortunately, we do not have a particularly recent report that we can consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, it will not include data for the past several months, which was a period of great volatility for the market. It will still show us how the fund performed in the first quarter of the year though, which was the time that the Federal Reserve began its current monetary tightening policy and the markets began to turn sharply negative. During that six-month period, the DNP Select Income Fund received a total of $12,018,043 in interest and another $69,766,056 in dividends from the assets in its portfolio. However, $14,279,583 of this was considered a return of capital distribution as opposed to income since it came from master limited partnerships. The fund also had some securities lending income so when we net all this into the total, the fund had $67,732,652 of total reportable income. It paid its expenses out of this amount, leaving it with $39,367,204 available to investors. This was, however, nowhere close to enough to cover the $135,097,674 that the fund actually paid out in distributions during the period. This is certainly concerning on the surface.

However, it is important to keep in mind that the fund has other means by which it can obtain the money needed to cover the distributions. The most important of these is capital gains, although as mentioned the fund did receive some return of capital distributions from various master limited partnerships. The fund was actually quite successful in achieving capital gains during the period as it realized net gains of $102,791,592 and benefited from another $157,255,695 net unrealized gains. Altogether, the fund’s assets increased by $220,578,589 even after accounting for the money that it paid out in distributions. Overall, the fund’s distribution appears to be fairly safe.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the DNP Select Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. This is unfortunately not the case with this fund today. As of December 8, 2022 (the most recent date for which data is currently available), the DNP Select Income Fund had a net asset value of $9.11 per share but the shares actually trade for $11.15 per share. This gives the shares a 22.39% premium to net asset value at the current price. This is quite a bit above the 21.99% premium that the shares have averaged over the past thirty days and it is overall an incredibly high price to pay for any closed-end fund. Overall, it makes sense to wait for the price to come down before buying into this fund.

Conclusion

In conclusion, there is certainly a lot to like about the DNP Select Income Fund. The fund boasts a well-diversified portfolio of utilities and other companies that should enjoy remarkable cash flow stability. This stability extends to the fund’s distribution, as DNP Select Income Fund has enjoyed more consistency over the years than pretty much any other fund in the market. Unfortunately, all these good things come at a price, as the fund is trading at an enormous premium to the net asset value. This is a great fund, but the price is overall way too high. It is probably best to sit on the sidelines for now.

Be the first to comment