deepblue4you/E+ via Getty Images

Introduction

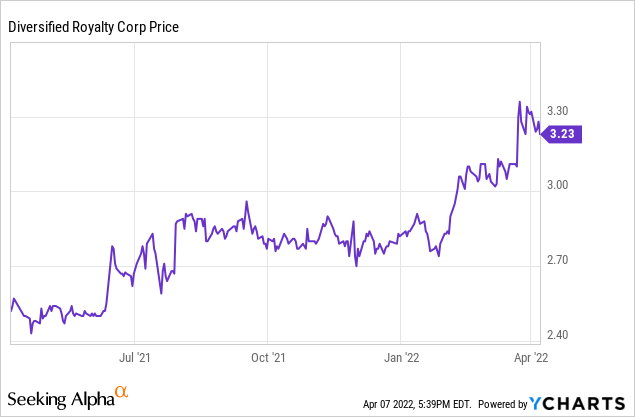

Diversified Royalty (OTCPK:BEVFF) is a Canadian royalty company. The business model is quite simple: In return for an upfront cash payment, Diversified receives revenue-based royalties from the investees. For those investees, it’s an easy way to finance themselves without having to issue debt and without having to give up voting rights while Diversified generates robust cash flows based on the revenue and not based on how profitable a company is.

Diversified’s primary listing is on the Toronto Stock Exchange where it’s trading with DIV as its ticker symbol. The average daily volume in Toronto is almost 400,000 shares per day, clearly making it a much more liquid listing than its US listing.

Diversified Royalty: A lot of cash flow, but almost everything goes to the dividend

Of course, a royalty company is only as good as its royalty portfolio is, and although it’s a revenue-based system, you still have to make sure the businesses you own royalties on are in good shape. If the operator goes bankrupt, your royalty will be worthless.

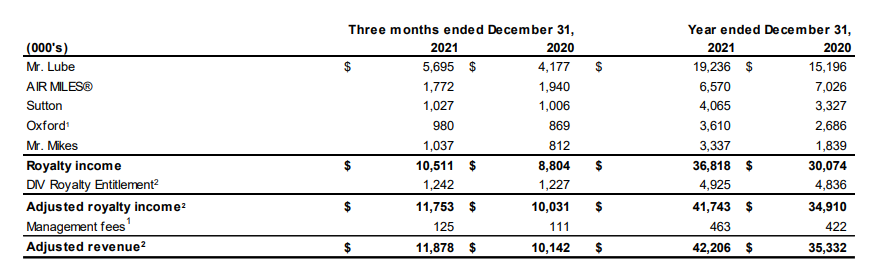

Diversified’s royalty portfolio consists of just a handful of royalties and as you can see below, almost 50% of its revenue is generated by the Mr. Lube royalty.

Diversified Royalty Investor Relations

Mr. Lube is a well-known name in Canada in the vehicle maintenance sector (think about changing tires or changing oil and other fluids). It wasn’t a surprise Mr. Lube performed poorly in 2020 due to the COVID pandemic, but we see the revenue pick up nicely in 2021.

AIR MILES is the second largest component of the portfolio. It’s a loyalty program which really has nothing to do with the aviation sector. In Canada, the Safeway grocery chain likely is the best-known user of the program, which is owned by Loyalty Ventures (LYLT). The concept is very straightforward: Safeway buys the “miles” from the program provider and gives them to its customers as a promotional tool (“spend $100 and receive X amount of miles”). The customers can subsequently use those miles for cash discounts on their next grocery purchase. Personally, I think the AIR MILES owner should perhaps consider changing the name as it has nothing to do with the aviation sector but it’s a difficult decision to choose between making your product offering clear and getting rid of a well-known brand name.

For a complete list of the royalties owned by Diversified Royalty, including the business models and specific details of every royalty, I’d like to refer you to the company’s Annual Information Form which provides a nice and detailed overview.

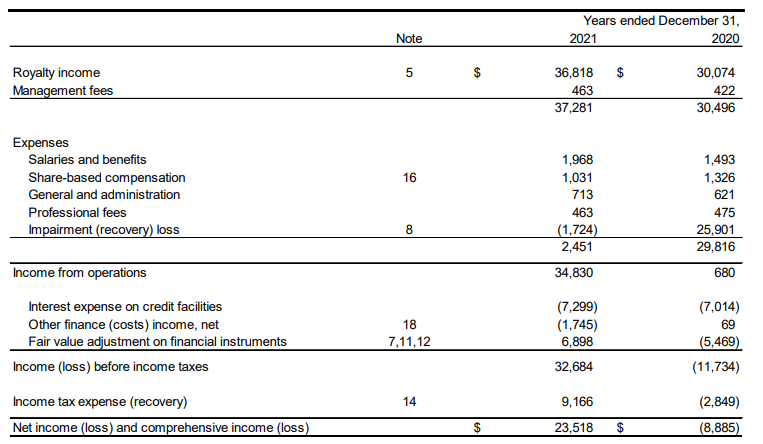

In 2021, the total reported revenue was approximately C$37.3M, a nice increase of in excess of 20% compared to the previous year as the operators of the underlying businesses were recovering from the pandemic. The operating income increased substantially to almost C$35M mainly due to the fact that Diversified recorded a large impairment charge in 2020 and was able to reverse a portion of that impairment charge in 2021. But excluding these non-recurring elements, the cash overhead expenses represent approximately 8% of the revenue.

Diversified Royalty Investor Relations

The reported net income was approximately C$23.5M which is roughly C$0.19 per share, but that reported net income was boosted by the C$6.9M fair value adjustment on financial instruments and the aforementioned C$1.7M reversal of the impairment charge.

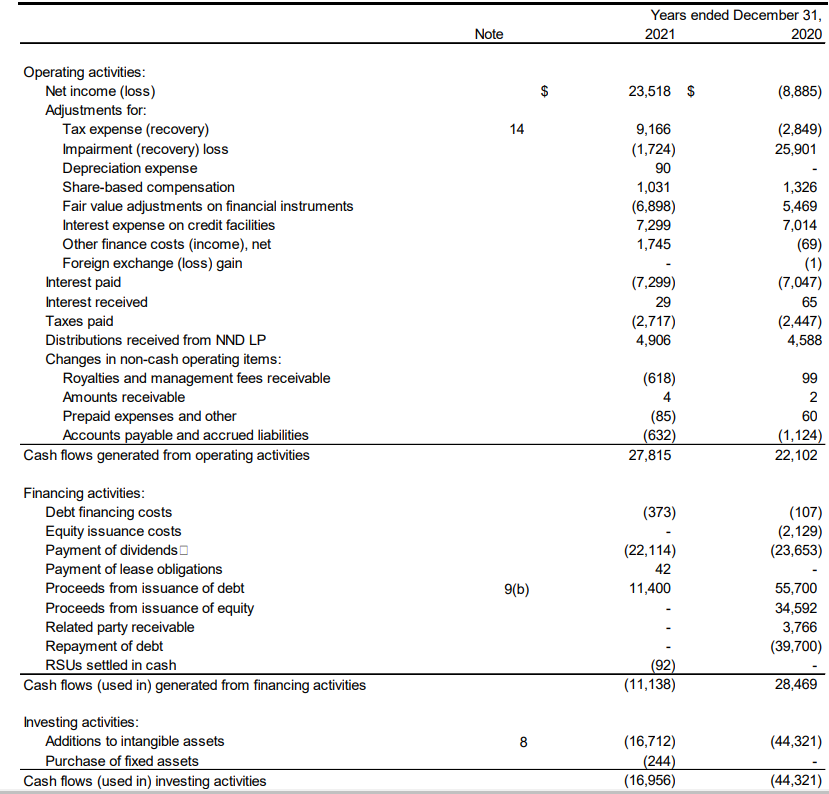

There are some non-cash expenses as well and a portion of the taxes are deferred. Diversified reported an operating cash flow of C$27.8M and an adjusted operating cash flow of C$29.1M while the capex was just a few hundred thousand dollars. That’s the beauty of a royalty company: There’s just one up-front sunk cost but no additional follow-up investments are required.

Diversified Royalty Investor Relations

If I would deduct the normalized taxes of around C$5.6M, the free cash flow result would be C$23.6M or C$0.192 per share. That’s lower than the current dividend which now comes in at C$0.22 per year (payable in monthly tranches) but keep in mind Diversified’s cash flow result improved in the second half of the year and I expect the dividend to be covered by the normalized free cash flow from next year on.

While the dividend is attractive, I own the debentures

While I expect the dividend to be fully covered, I sold my entire position in Diversified Royalty, after investing in the story in the C$1.30-1.40 range when the COVID pandemic was accelerating. I also bought the 5.25% debentures maturing at the end of this year but earlier this week I also initiated a long position in the recently issued 6% debentures maturing in 2027. Diversified Royalty will use the proceeds from the 6% debenture to call a portion of the 2022 bonds ahead of the maturity date.

The 6% debentures mature on June 30, 2027 but can be called from 2025 on. As the current bond price is just 98.35 cents on the dollar, resulting in a yield to maturity of around 6.3%. I like these debentures as debt obviously ranks senior to the equity and this means the debentures rank junior to the bank debt, but ahead of the almost C$200M in equity.

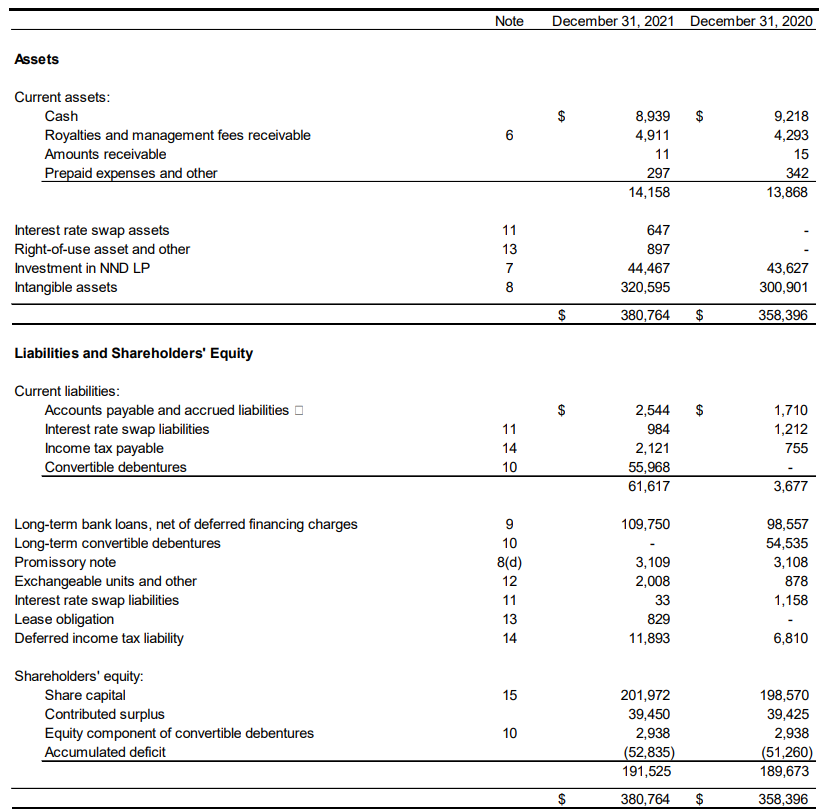

Diversified Royalty Investor Relations

While a total net debt of approximately C$157M isn’t low, I’m fine with that leverage considering a royalty company is a cash flow vehicle and the operating cash flow usually equals the free cash flow. This means that if there would ever be any repayment issues, Diversified can cut the dividend and make more cash available to strengthen the balance sheet. The dividend is currently costing the company about C$27M per year so it would be easy enough to rapidly reduce the cash outflow by cutting the dividend – if there’s ever any need to. Secondly, In order to avoid a default on the debt, Diversified can always issue more shares to rapidly reduce its net debt.

There’s an additional interesting feature making the bonds more appealing to me. While I understand every jurisdiction is treating withholding taxes in a different way and my situation may not be the same as yours, in my case my cash inflow from the bonds is actually higher than from the dividend.

According to the Canadian withholding tax system, there’s a 15% standard withholding tax on Canadian Dividends after completing some paperwork confirming you are not a Canadian resident. That’s a reduction from the “normal” rate of 25%. However, on bonds and debentures, there is no withholding tax. That means that after deducting the applicable withholding taxes, the dividend yield is approximately 5.8% while the bond yield is about 6.3%.

So for investors living in a jurisdiction where A) the 15% Canadian dividend tax cannot easily be reclaimed and B) the domestic tax on interest income isn’t punitive, it actually makes more sense to buy the debt as your yield including the Canadian withholding tax but before domestic taxes is higher for the bonds. This strategy won’t work in every country in the world as requirements [A] and [B] need to be fulfilled simultaneously.

Investment thesis

The dividend should be fully covered again from this year on but income-oriented investors should have a good look at the recently issued 2027 debentures. There’s only very little capital appreciation potential but I like the fact the debt is senior to the equity and the operating cash flow before making the interest payments exceeds C$30M per year, so Diversified is generating plenty of cash flow to cover the interest expenses.

Of course, a royalty vehicle could also be seen as a hedge against inflation. If the underlying businesses would hike their prices by 5%, Diversified’s cash flows would increase by a similar percentage which would further improve the dividend coverage ratio and pave the way for additional capital appreciation.

Diversified Royalty could appeal to income investors interested in both dividends and interests. In my personal case, owning the debentures makes more sense than the shares in my income portfolio. But that’s just a personal preference.

Be the first to comment