wagnerokasaki/E+ via Getty Images

After our comment on Ecolab’s (NYSE:ECL) Q2 quarterly results, today we provide an update about Diversey Holdings (NASDAQ:DSEY). Yesterday, the company released its half-year report and the stock price declined by more than 10%.

Our internal team thinks that this negative reaction is totally unjustified given the long-term opportunity that Diversey Holdings is offering. Indeed, our buy case recap was based on:

- Higher revenue growth thanks to organic and inorganic opportunities (following our initiation of coverage of Ecolab, we understood that the USA market is very fragmented).

- Even if Diversey Holdings lacks Ecolab’s marketing presentation, we can clearly state that it is a “doing good while doing well” ESG corporation.

- A compelling valuation versus its closest competitor i.e. Ecolab. Cross-checking the multiples, for Ecolab, we derived a target price of $185 based on an EBITDA multiple of 18x, whereas, Diversey Holdings’ EBITDA multiple was just 13x.

So, what happened?

Last time, we reported one interesting factor that is helpful in understanding the -10% decline at the stock price level. “Diversey is the second distant cleaning chemicals provider in the United States, but at the same time, the company is the number one operator outside North America”. Looking at the highlighted phrase, we should note that Diversey Holdings has almost 70% of its total turnover from international markets. Thus, the company is more exposed to currency development.

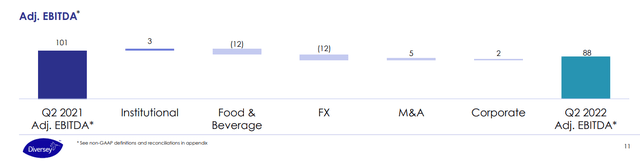

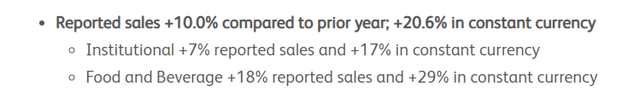

What is important to note is the very similar trends with Ecolab performances. Diversey volumes were up by 6.5%. Looking at the divisional segment:

- The Institutional EBITDA was up versus Wall Street analysts estimates. However, the EBITDA margin was lowered compared to last year’s performance and stood at 14.6%.

- The Food and Beverage EBITDA was below consensus expectation by more than $10 million. Excluding the currency development and the higher sales, EBITDA declined by more than 27%.

In both divisions, acquisitions increased the EBITDA by 4% for a total consideration of $5 million.

Diversey Holdings EBITDA evolution

Conclusion and Valuation

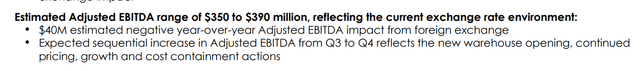

Quoting the CEO, Diversey “reaffirms 2022 full year revenue guidance but with a lower Adj. EBITDA forecast estimated in a range of $350 to $390 million to reflect the current exchange rate environment“. We confirm our buy rating based on the long-term secular upside and also thanks to the asset-light business model that supports FCF generation and debt reduction. However, adjusting the EBITDA guidance, we lowered our target price from $14 to $12 per share. Diversey is also primarily using the First-In-First-Out inventory methodology so this might add time to pass through raw material inflationary pressure to end-customers.

Be the first to comment