Editor’s note: Seeking Alpha is proud to welcome Amir Hossein Shamshiri as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto/iStock Editorial via Getty Images

There is a disturbing seasonal effect in Cognizant Technology Solutions’ (NASDAQ:CTSH) operating cash flow, decreasing the free cash flow to the lowest value in the first quarter of each year. The main reason for this is mismanagement in controlling non-cash items in the firm’s operating cycles. In the worst-case scenario, in which the firm cannot handle this seasonal effect, CTSH will make $4.24 EPS in the year 2022, which leads to an intrinsic price of $92 for each of its shares. Considering its current price, CTSH is roughly 5 percent undervalued, though the valuation has been done in the firm’s worst-case scenario.

Company Description and Recent News

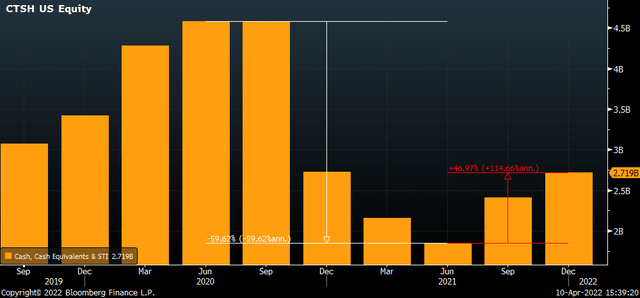

Cognizant is a high-tech company working in technology strategy consulting, data warehousing, and business intelligence. During the past two years, the company expanded its digital capabilities toward data clouding and artificial intelligence by acquiring digital engineering assets from Hunter Technical Resources. Also, their recent acquisition of ESG mobility should help them to use their data science and full-stack science in the electrical vehicle industry. In addition, Cognizant Tech Solution Co. has acquired an Australian-based data science company, Servian, and the US-based software development company, Magenic, to improve its technical skills when it comes to entering an emerging green industry like electrical vehicles. All the mentioned acquisitions significantly decreased the cash item of CTSH’s balance sheet by roughly 60% in June 2021 compared with the same month in 2020. However, as shown below, Cognizant’s cash has recovered by 47% since then:

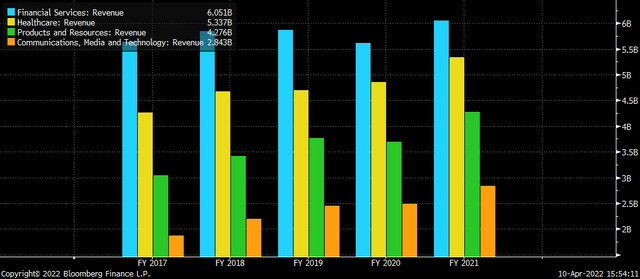

Since the data cloud revolution, the need for financial services, communication, and media industries toward using firms like Cognizant has increased to cloud their database and decrease their data warehousing expenses. Having looked at CTSH’s revenue stream, we can see that financial services, healthcare, product and resources, communication, and media industries have been the main targets of their products during the past 5 years. As shown below, the Financial Services segment comprises 32.7% of the overall product segmentation, while the media segment has a share of 15.4%.

The above chart shows that Cognizant’s market share has been stable in the Financial Services segment, with an average annual growth rate of 1.16%. However, due to the recent acquisitions, the company has seen annual growth rates in the Communication and the Product and Resources segments of 8.97% and 7.78%, respectively.

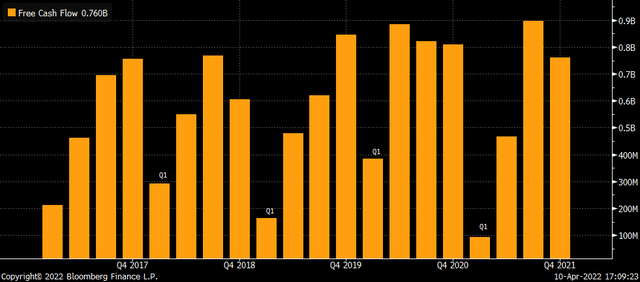

Seasonal Effect on Cognizant’s Operating Cash Flow

Having looked at Cognizant’s financial performance, we can consider a seasonality effect in the changes in its free cash flow to the firm (FCFF). As we can see below, the firm always has the lowest FCFE in its first quarter, but the highest ones in their 3rd/4th quarters. The steady free cash flow growth rate of Cognizant Tech Solution Company (annually 8.44% since Q1 2014) would even increase to the higher amounts if the firm overcomes this disturbing seasonal effect. In the first quarter of each year, CTSH uses high amounts of money on non-cash items (specifically non-current liabilities), leading to having the lowest free cash flow compared with other quarters. The main reason comes from the revenues, which have been made but not billed, and decrease the free cash flow of the firm.

In terms of cash flow, investors should pay attention to the Q1 report of Cognizant. There will be no surprise if the Q1 report of Cognizant shows a significant decrease in its free cash flow to the firm, due to the mentioned seasonality effect. However, if the firm can handle this problem, that would be a great sign to the market about this specific firm.

Valuation under the Worst-Case Scenario

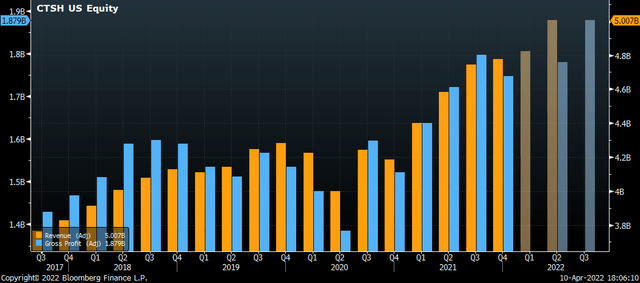

The worst case, here, would be if CTSH cannot handle the disturbing seasonal effect in their cash flow statements. Cognizant Tech Solution gains its revenue from different sources, all accumulating to have $18.5 billion in 2021. Having looked closely at the quarterly revenue of CTSH, there is a stable revenue stream with a steady growth rate of 1.45% quarterly (roughly 9% annually). Using the mentioned growth rates, it is expected to have $4.8 billion in revenue for the first quarter of 2022, $5.007 billion for the second quarter, and $19.8 billion in revenue for the whole year of 2022.

The above chart also shows the CTSH’s gross margin, which has been 37% on average during the past five years. That brings us to have an expected $1.78 billion in CTSH’s gross profit for Q1, 2022, and $7.3 billion in gross profit for the whole year of 2022. In this case, we can expect $3.2 billion in Cognizant’s earnings before interest and tax in 2022.

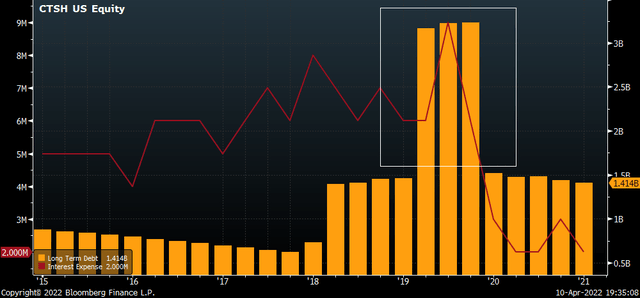

It’s worth mentioning some information about the financing structure of Cognizant, to better estimate the interest expenses, especially in this period of interest rate hikes. As we can see below, CTSH significantly increased its long-term liabilities, due to the potential acquisitions mentioned before. However, during the last year, we can see that the long-term liability has decreased by roughly 50%, which leads to having lower interest income.

According to the interest rate estimates done by economic analysts, the expected average interest rate for the year 2022 is 1.5%, which would increase the interest expense of Cognizant Solution Tech and other firms. For being conservative, the interest expense of the firm has been increased by 15%, to offset the interest rate hikes effects. Considering an average tax rate of 28% for this firm, we can expect a $4.24 in EPS for the year 2022. Let’s look at how EPS moves with the price of CTSH.

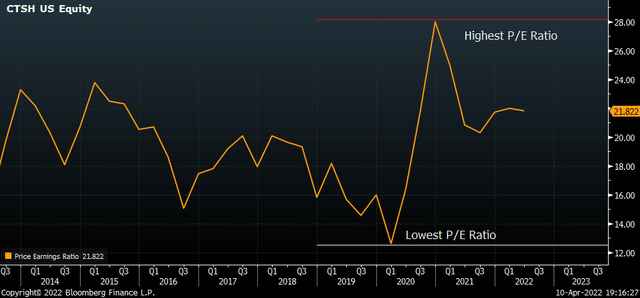

As the above chart shows, the P/E ratio is at the middle bound of its historical range, indicating that the stock is not overvalued nor undervalued, based on its current EPS. However, the valuation shows that EPS can be increased by 6%, compared to its 2021 value, which leads to having an expected price of $92 (in the most conservative way).

Risks

Looking at Cognizant’s risks sheds light on its valuation. The main activity of the firm is data warehousing using the newest data clouding and artificial intelligence. As we may expect from data clouding, the more the users have access to a shared cloud, the more the risk of getting hacked and losing the data. In the first quarter of 2020, cybercrime cases increased by 630%. As long as a tech firm spends enough budget for the R&D to find the latest technologies to secure their data warehouses, the company would not be vulnerable to the mentioned risk. Cognizant has not declared any cost as its R&D, but one of the acquired firms, Servian, is counted as an expert in data security.

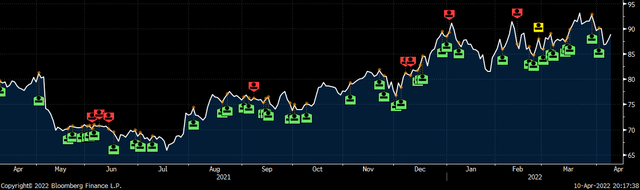

As another risk factor, we can look at insider trading as a signal to the market. During the past year, as shown below, insiders have been more active in buying CTSH stock than selling. In addition, having looked at the previous uptrend phases, we can figure out that the insiders have never bought before the recessions, which decreases this specific risk.

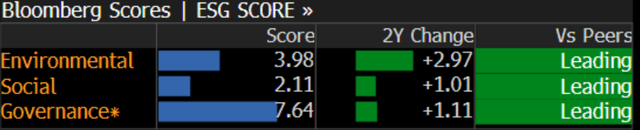

To end up, it is worth a lot to look at the ESG score of CTSH, compared to its peers. As mentioned before, by acquiring ESG mobility, Cognizant Tech Solutions turned out to be one of the data warehousing companies working directly with the green industry. That being said, the environment score of CTSH increased by 2.97, making them the leader among competitors. The overall comparison of CTSH’s ESG score with its competitors can be found below:

Conclusion

To sum up, Cognizant is a small company ($46.6 B) in the industry of data science, warehousing, and clouding. However, it has been dealing with a disturbing seasonal effect in its cash flow, which significantly decreases its operating cash flow in the first quarter of each year. Financially speaking, the valuation shows that even if CTSH cannot handle the seasonal effect, we can expect $4.24 in its EPS for the year 2022, which is roughly 6% more than its 2021’s value. This EPS number leads to an expected intrinsic value of $92.

Be the first to comment