Ben Gingell/iStock Editorial via Getty Images

Disney (NYSE:DIS) shares have been under pressure ever since the company got into a public spat with the state of Florida. It started as a question of individual rights but quickly morphed into the state threatening Disney’s tax-exempt quasi-sovereign Vaticanesque status over Disney World. Things got even worse after Netflix (NFLX) reported poor Q1 numbers that adjusted valuations for streaming peers, including Disney+.

Over the last few days, I believe Disney shares broke out of that declining wedge that they were stuck within since the start of the year. That wedge ended with a capitulatory bottom. Now, Disney has returned to a long-term trading range, where it is likely to stay for the remainder of 2022.

Disney daily candlestick chart (Finviz)

This terrible first half took Disney shares back to their pandemic lows. This level held and should be seen as incredible support. There also appears to be some significant resistance at about $120 per share, and I would be surprised if Disney can get over that value in the near term. Still, that leaves a significant amount of upside from here, and a reasonable range for accumulating and/or trading.

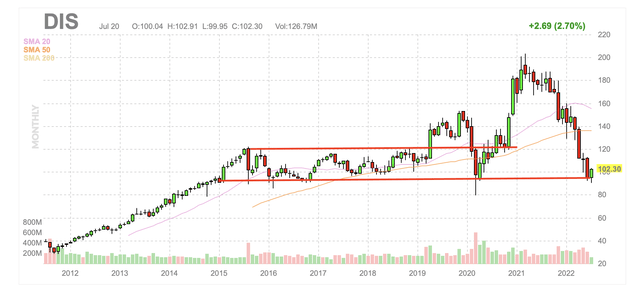

Disney monthly candlestick chart (Finviz with red lines by Zvi Bar)

As the above chart shows, Disney is back in what was a long-term trading range and basing period between 2015 and 2019. Further, Disney returned to it in 2020, before spiking to all-time highs later that year. Since then, Disney wholly round tripped that move and returned to its home base, much like a parent may threaten to do while road tripping with unruly kids.

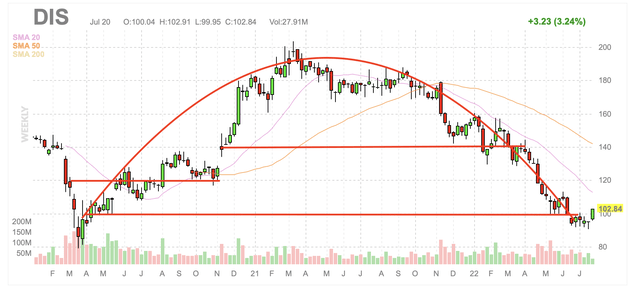

Disney weekly candlestick chart (Finviz with red lines by Zvi Bar)

Disney now seems to be back in a trading range where support exists around $100, as well as the low $90s, with little upside resistance until $120. It is reasonably possible, that Disney will test that level in the second half of 2022. Disney shares were rangebound around the $120 level for most of the second half of 2020.

Inflation is becoming a concern throughout the world. Cost increases are being accepted at the moment, but many companies may have difficulties pushing through further price increases. Disney is likely to have an above-average ability to raise pricing on its product due to their strong brands. There are few reasonable substitutes for a trip to Disney Park, or a Disney brand toy, which makes it easier to increase their costs.

Political risk could affect Disney in the second half, but that would likely be a buying opportunity. Disney is usually not a very politically charged equity, but it became embroiled in Florida legislation. It should have come as no real surprise that Disney selected the more liberal of the two choices, but the fallout from it was unexpectedly severe.

Such bipartisan matters may affect Disney shares in advance of mid-term elections in a manner that is not usually the case for Disney and generally reserved for industries such as pharmaceuticals, defense contractors, and maybe private prisons. Such weakness will likely be a strong buying opportunity.

Concerns over streaming growth rates are likely to persist, and competition is only heating up. Disney+ may have premium content and a decent number of subscribers, but the value of those subs to the market has diminished, and that may take some time to change.

Disney is likely to increase the cost of its various streaming services in the coming quarters. Recent reports indicate Disney is raising the price of ESPN+ from $6.99 to $9.99 per month, starting in late August. An increase to the Disney Bundle now seems reasonably probable in 2023, and there may also be forthcoming increases to the cost of UFC pay-per-view events.

Conclusion

Disney shares had a terrible first half of 2022, but long-term support held. Shares are breaking out of their recent descending wedge and capitulatory bottom. Disney’s capacity to institute price increases on branded goods, content, and its parks is a tremendous benefit that remains under-appreciated. Disney looks likely to remain between $100 and $120 in the second half of 2022, with a reasonable chance of testing upside resistance on a strong market rally.

Be the first to comment